Markets in Review: The Fed and oil

The Federal Reserve

-

There were very subdued market reactions to the US Federal Open Market Committee’s (FOMC) 25-basis-point (bps) rate rise on Thursday – just how the Fed likes it. However, there have been some moves that caught our attention. US bank securities fell sharply (funding costs), while the US 10-year saw buying seeing yields falling 3.1 per cent to 3.05 per cent (dovish?) and the US dollar moved lower on the initial statement.

-

A lot was made of the fact ‘accommodative’ was removed from the Statement, some suggesting this was a dovish move as the Board could be backing away from rises. Chairman Jerome Powell smashed that idea on its head in his press conference by stating the policy was no longer ‘accommodative’ and the Fed’s rate course is clear – “[it’s on] gradual return to the neutral cash rate”. The US dollar snapped back and the longer term trading views retuned post the press conference.

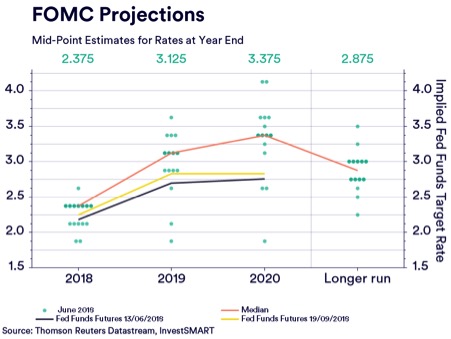

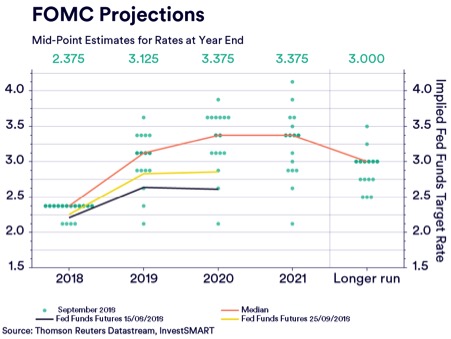

- The new dot plots are also interesting – it’s the first time we got to see the Board’s view of rates in 2021 and an increase in the ‘longer run estimate’. Board consensus for December 2018 has already been reached, meaning, December will see another 25bps rate rise. Next year, 2019, is slight different though, with a perfectly even split between two, three or four 25bps hikes. My opinion remains that four is the likely outcome.

- FOMC forecast changes were, in the main, to the upside: Median GDP growth estimate for 2018 increase to 3.1 per cent from 2.8 per cent, and in 2019 up to 2.5 per cent from 2.4 per cent. For 2020, the FOMC sees growth unchanged at 2 per cent. Median estimates of PCE, core PCE inflation were left unchanged.

- US President Donald Trump remains livid with the Fed’s current course and has made it clear that if it was up to him, rates would be lower. The push-pull between the White House and the Fed is one area that keeps the interest piqued. Will fiscal policy stimulate while monetary policy tightens? It looks this way.

- The Australian-centric view of all of this, once again, is that the cost of credit is getting more and more expense. That will mean over the coming years as funding cost increases, lending rates will go with it – the average home loan rate over the coming three years will move independently of the RBA cash rate.

Oil markets

- Brent hit $US81.69 a barrel this week as the President upped his rhetoric around Iran and powered ahead of the proposed sanction on Tehran, which will come into effect mid-November. Iran is the 6th or 7th largest oil producer in the world, so taking out this much supply through sanctions can only lead to one thing – higher prices.

- Secondly, OPEC is refusing to increase supply. Back in 2015, shortly after the oil crash of 2014, OPEC for the first time in decades agreed unilaterally to freeze supply. This move has drained world inventories over the past 3.5 years and returned the supply-demand equation back to equilibrium. Taking Iran out with sanctions pushes supply into ‘undersupply’ territory, therefore, meaning higher crude pricing in the near future.

- The Australian-centric point of view is the AUD has fallen some 12 per cent this year, while oil is up 20 per cent. In Australian dollar terms, Brent per barrel hit $A109.20, and in Tapis, it hit $A111. This has translated to $A1.67 to $A1.70 per litre at the pump. This will hurt discretionary spending in the interim.