Markets in Review: RBA game-changers

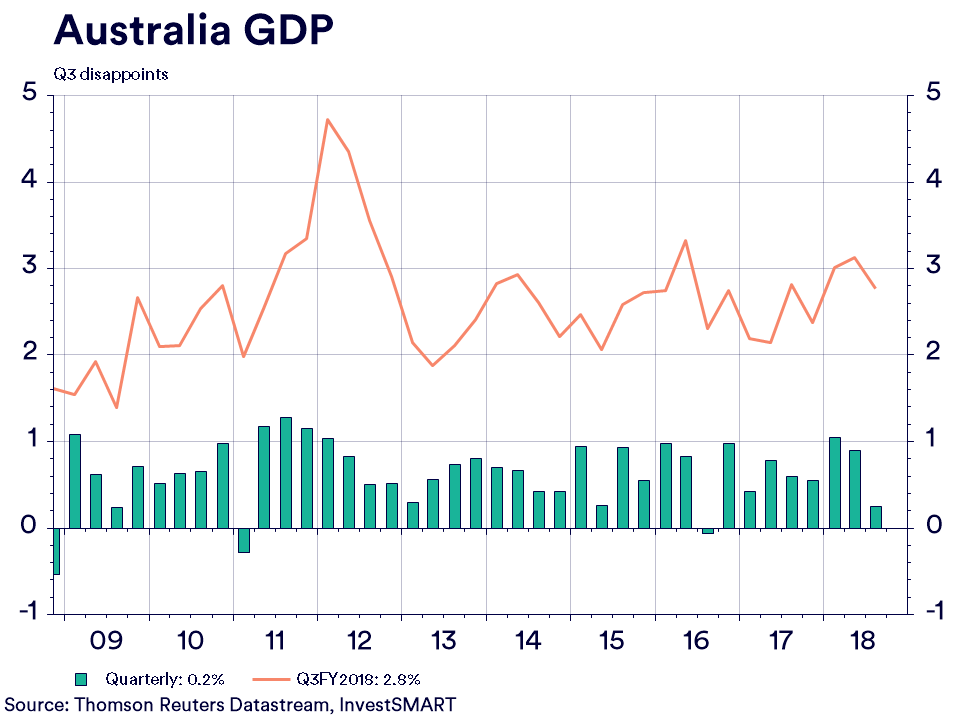

It was a week of disappointment on the economic front. The first two quarters of outperformance in Australian GDP had most suggesting Australia could – and should – come through the next part of the growth cycle reasonably well. However, that idea has dissipated after a weak third-quarter figure.

Australian GDP slowed to its lowest growth rate in six quarters, at 0.3 per cent quarter-on-quarter (qoq), leading to growth of only 2.8 per cent year-on-year (yoy). To say the result was disappointing would be putting it mildly.

The large miss on consensus was largely driven by consumer outcomes, which slowed to its lowest rate since mid-2012 (0.3 per cent qoq, 2.5 per cent yoy). Clearly, this is not ideal in a period of growing discontent.

Inventory de-stocking also dragged, however the retail sub-sector of inventories actually expanded. Government spending and net exports continued to support growth.

The warning signs come from household spending – which saw a sharp reduction in discretionary spend (0.0 per cent qoq), while ‘essentials’ (i.e. house repayments, health, education, energy and food) remained strong (0.7 per cent qoq). This is despite the fact price pressures fell for the likes of food and energy.

‘Cost of living’ is an issue which will be hotly debated over the coming months as we head to a Federal election – likely in May.

The consumer outcomes issue is consistent with impacts to the ‘wealth effect’ – falling house pricings.

Softness in wage growth (although the wage price index has wages growing at 2.3 per cent, the national account figure was only 2.1 per cent) saw the savings rate fall to 2.4 per cent, its lowest level since December 2007.

Construction of new housing slowed by 0.8 per cent qoq, but this was offset somewhat by an increase in renovations (4.5 per cent qoq).

The conclusion from Australia’s national accounts is that some of the weakness can be explained away by transitory issues. However, the weakness in consumer spending and household savings is an area needing close attention, as there is a clear run-off here from the housing slowdown. The RBA in particular needs to be on alert.

The RBA’s changing mindset

The RBA has had ‘rose-coloured glasses’ in recent times. I like to think of it as the RBA ‘seeing things as glass three-quarters full’.

However, it now appears near impossible that the RBA’s end of year GDP target (3.25 per cent) will be reached.

This brings us to the speech by Deputy Governor Guy Debelle’s around monetary policy’s reactions to the GFC.

When it comes to fiscal policy, he states it should be, “designed to take effect quickly”, highlighting Ken Henry’s ethos of, “‘go hard, go early, go to households’”.

However, he then extents this to monetary policy, saying, “the Reserve Bank has repeatedly said that our expectation is that the next move in monetary policy is more likely up than down, though it is some way off.

“But should that turn out not to be the case, there is still scope for further reductions in the policy rate.

“It is the level of interest rates that matters and they can still move lower.”

So, it appears rate cuts are not off the cards, and will be enacted if the situation deems them to be necessary. But, he went further than this:

“QE is a policy option in Australia, should it be required,” he said. “There are less government bonds here, which may make QE more effective…The RBA's balance sheet can also expand to help reduce upward pressure on funding, if necessary, as occurred in 2008.”

This is a game-changer, as there has always been a belief that the RBA hasn’t had the ability to explore this route. From the suggestions in the speech, quantitative easing (QE) may actually be as effective – if not more effective – in providing monetary accommodation.

It also shows that the RBA will not die wondering if the need arises. With eight weeks until the next RBA meeting, has this speech laid some groundwork for 2019 to be a cut year rather than a hike year?