Market Watch

A new month, quarter and new financial year. From a macro outlook, things are likely to be remain robust for the first few quarters of 2018-19, although the risks to this will be credit and geopolitical challenges.

FY19 presents as a year of ‘diversification’ as the risk underbelly of markets begins to surface, with one proven way of smoothing out volatility being through diversification.

As it is a new month the normal monthly macro events are back on the agenda. Forward looking PMIs from the US, Japan, Europe, the UK, China and Australia are all released this week.

Australia’s PMIs have been rather robust of late, particularly manufacturing, however considering manufacturing now only contributes about 12 per cent of overall output in Australia its effects are moot; services, on the other hand, dominates Australia’s output.

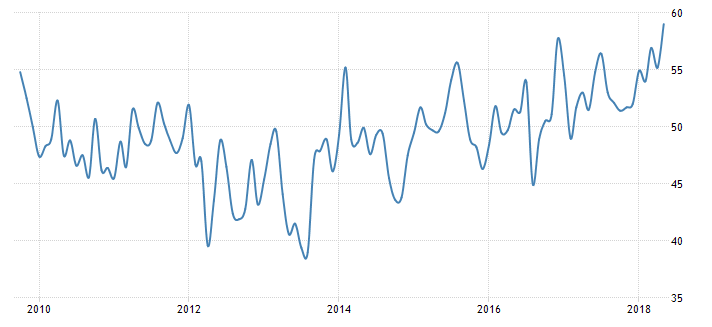

The previous month’s read of 59 is well and truly in expansionary territory and the strongest read of the past 10 years. Forecasts for Wednesday’s read are for it to ease to 56, which is still very solid by all measures. The momentum in economic output remains strong and should hold for the interim.

Chart 1: Australia Performance Services Index

(Source: Trading Economics)

Retail sales and the trade balance are also due on Wednesday, and represent a clear indication of the differences throughout the domestic economy. Retail sales have remained sluggish and, although they have bounced off the October 2017 low, the overall trend over the past 10 years is down. This shows that family finances and personal consumption remain strained.

Chart 2: Retail sales

Trade on the other hand is having a renaissance; net exports in the first quarter were the strongest nominal levels seen since the mining boom and have registered a net positive in 14 out of the previous 16 months. With oil having spiked in June and the price correlation with natural gas, one would expect a positive nominal return on Wednesday.

The final two events that will impact Australian markets this week will be the Reserve Bank meeting on Tuesday and the non-farm payrolls on Friday night.

Although the RBA remains welded on the neutral rates fence and will not be moving rates for the foreseeable future; there were a few changes in communications from the board during the four weeks since the June meeting. The most notable was the minutes omitting this line:

‘In the current circumstances, members agreed that it was more likely that the next move in the cash rate would be up, rather than down.’

Philip Lowe has also begun to change his language around employment: “Labour market conditions had eased a little in recent months” and some “spare capacity” remained. “Forward-looking indicators of labour demand had continued to point to employment growth increasing to above-average rates in coming months.’ “However, wage growth has remained below the average rate.”

Are we starting to see a ‘jawboning’ of the employment market? It’s very hard to do but it appears that the RBA has swung in behind employment and this could be its next point of interest over the coming year. The statement therefore will be key.

Finally, non-farm payrolls – the US employment statistics are strong, with unemployment at its lowest level since the late 1960s, at 3.8 per cent, and new jobs still averaging 200,000 per month.

The question is whether this strength will make the Fed steepen its forecasted rate hike trajectory. A faster pace means further tightening of the credit markets, something that will impact global investment over the medium term.