Market Watch

This week sees OPEC meeting in Vienna for their biannual meeting on supply. Over the past 20 months OPEC has managed to pull itself into line and work in a bipartisan way to freeze supply which has led to higher pricing in both Brent and West Texas Intermediate (WTI) crude.

However, recent communiques from Russia (a non-OPEC member) and Saudi Arabia look like the goalposts are moving again, and we could see supply freezes unwound into the latter half of the year.

Here is what is expected to occur come Saturday if the communiques turn into actual agreements:

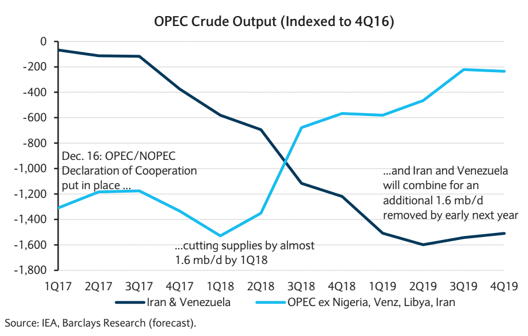

The chart shows that excluding Venezuela, which is seeing structural declines in output, and Iran, which is facing geopolitical issues around global sanctions as the US pulls out of the Iranian deal, OPEC is looking to increase output by around 700,000 to 800,000 barrels of oil per day over the coming six months. This would still see global supply in deficit to demand, however, it does bring it much closer to equilibrium.

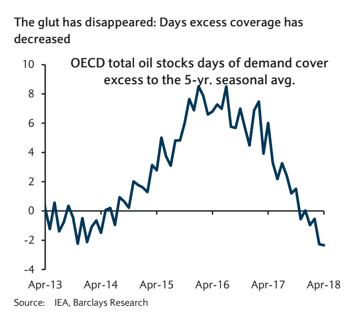

Interestingly, OPEC’s main aim over the past three to four years since the ‘oil crisis’ has been for ‘price stability’ and to intervene less. However, OPEC has intervened three times over that time period in attempts to rein in supply. Now, since the November 2016 supply cuts, the overhang in inventories has not only reduced, but also fallen into deficit. See right.

But supply cuts (aka intervention) are blunt policy tools. Their use as a medium-term stability mechanism against disruption is finally overrun by financial strain which does eventually hit home as seen by the collapse in Saudi Arabia’s debt-to-GDP ratio.

The supply deficit does give OPEC scope to move on output while still looking to push prices higher. The conclusion is, it appears OPEC is looking to soak up the higher prices of the past six months while trying to maintain price.

Here is the interesting part. Demand is clearly much more price sensitive than other commodities and products.