Market Watch

Geopolitical risk is on the up again, and The White House continues to be the single largest threat to markets.

The decision to include Mexico and Canada along with the European Union in the next wave of tariffs on steel and aluminium exports shows The White House is looking to pick a fight with allies and foes alike and is happy to completely disregard international trade laws and signed treaties under the guise of ‘national security’.

The impacts on global trade, growth and relations are playing out live on intraday trading screens. Washington’s relationship with the globe will continue to ebb and flow and that leaves markets with no other option but to price in risk discounts.

The question is whether the current discounts consider the inability of the ‘Big 5’ at The White House to see eye-to-eye. Peter Navarro, John Bolton, Robert Lighthizer, Wilbur Ross and Steve Mnuchin clearly cannot agree how to proceed with their current ‘strategy’ on trade policy. They appear at odds on which nations to target, time frames for their policies, and even their desired outcomes.

It seems that President Trump’s policy setting on global trade realistically comes down to which of the five has the ear of the President at any given moment. The current announcement could completely reverse in days or weeks.

In short, risk and short-term volatility are omnipresent.

CAPEX

With regards to Australia’s capital expenditure (CAPEX), headline figures were up 0.4 per cent quarter-on-quarter (QoQ), a touch below consensus of 0.7 per cent.

Looking at the composition of the release, the data reflected both an upward revision to growth in the last quarter of 2017, and strength in the machinery & equipment component ( 2.5 per cent QoQ) offset the first quarter declines seen in building and structures (-1.3 per cent QoQ). This data will feed through to next week’s GDP release and suggest GDP will be around trend.

Turning to the 2018-19 forecasting there is no way around the fact it was weaker than expected. Mining continues to weigh heavily in the post-mining boom era, off 23.6 per cent, and manufacturing has also been sliding consistently for two decades now (-12.2 per cent). However, it’s the ‘other selected industries’ (aka services) which declined 1.3 per cent that was a slightly disappointing read.

A caveat here, much of the strength in the ‘non-mining’ space isn’t actually captured by the CAPEX survey. These are things like public infrastructure, health, and education services. Private spending may still surprise.

Credit

The headline figures reveal that private sector credit rose by 0.4 per cent MoM to April, and 5.1 per cent YoY, to meet consensus expectations.

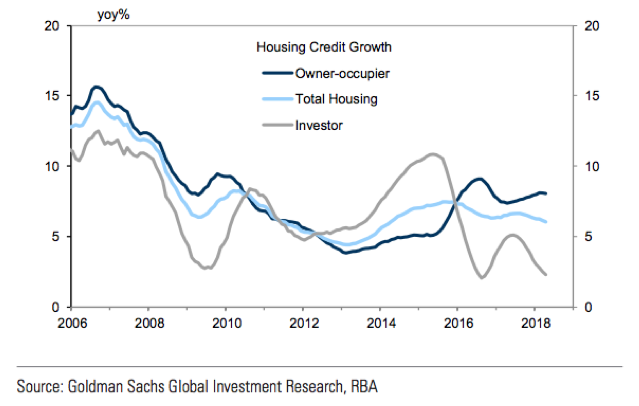

Compositionally, investor credit continues to slow housing credit growth, a trend we expect to continue over the coming months as the Sydney and Melbourne housing market continues to cool. Despite this, housing increased 0.4 per cent as owner-occupier credit holds firm, and underlying demand and supply in the Australian market remains balanced.

Investor credit is slowing, increasing only 0.1 per cent MoM, continuing to weigh on overall housing credit growth, while business credit ( 0.5 per cent MoM) showed signs of improvement.

Business credit was solid, building on the rise in March. Annually, business credit growth is up 4.3 per cent, bringing this measure back in line with the 5-year average.

However, the disappointing part of the release was personal credit falling by 0.3 per cent. This is the largest monthly fall since late 2012. There is an acceleration in the decline in personal credit, which is now down 1.2 per cent YoY.

The credit data clearly reflects what has been seen in confidence surveys where business confidence is on the up while consumer confidence remains subdued.