Market Watch

The Reserve Bank of Australia (RBA) so desperately wants to be a hawk and follow its international peers down the ‘normalisation’ rate front, but it just can’t. Slack in our local economy, levels of debt, and consuemr confidence are all finely balanced.

A treble of events

The RBA cash rate

- Left on hold for the 19thconsecutive month at 1.5 per cent, it is also the 19thconsecutive month the neutral stance language was cut and pasted into the statement: “Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.”

- The statement was still positive. The Board’s assessment of the global environment, and its above-trend forecasts of GDP for this year and next, remain. However, it has lowered its 3.25 per cent forecast to “a bit above 3 per cent”.

- The Board remains evergreen on gradual inflation with: “A gradual pick-up in inflation is, however, expected as the economy strengthens. The central forecast is for CPI inflation to be a bit above 2 per cent in 2018”.

The Governor

RBA Governor Philip Lowe delivered an upbeat speech on the macro outlook of Australia. He alluded to possible tweaks to the RBA’s inflation targets (likely to the upside). Here are the key points:

- Growth in the Australian economy remains robust and above trend. Lowe reiterated that 2018 and 2019 GDP would be“a bit above 3 per cent”.

- Inflation forecasts for year-end 2018 are expected to be upgraded as inflation is expected to gradually increase “over the next couple of years towards 2.5 per cent”.

- Risks to the credit cycle. Lowe alluded to risks in short-term funding costs and the potential construction in global credit supplies. He also provided commentary on the medium-term impacts of “lending standards in Australia will be tightened further in the context of the current high level of public scrutiny”. The fallout from the banking Royal Commission will be far-reaching, and in the eyes of the RBA, will impact housing due to tighter lending standards going forward.

- Risks to global growth. Lowe also pointed out there are risks to Australia’s GDP renaissance which “lie largely in the international arena”. The interpretation is clear; US China trade wars, Chinese debt to GDP, and emerging markets peaking faster than expected, could all impact Australia’s future GDP.

The Statement of Monetary Policy (SoMP)

- As foretold early in the week, underlying inflation was upgraded to 2 per cent from 1.75 per cent for June and December. Considering trimmed mean inflation finally broke out of a four-quarter rut, from 1.8 per cent to 1.9 per cent, the June figure may be slightly optimistic.

- Australia GDP forecasts remained unchanged. Interestingly, the RBA is so confident in Australia’s economic growth that it is completely outstripping its closest central bank peers with the highest growth rates compared to the US, Europe, Japan, the UK, and Canada.

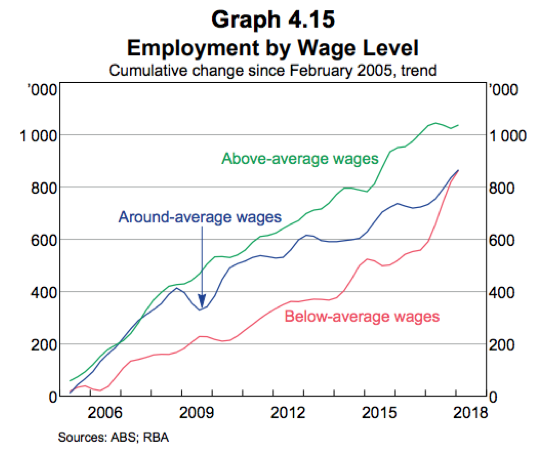

- Unemployment, however, was revised up to 5½ per cent from a forecasted 5¼ per cent for June and December 2018. Underutilisation remains the thorn in the side of the forecasts as the timescale for this slack to be picked up is drawn out. However, the positive is that the workforce believes employment is on the up. What is also interesting is most of the jobs and wages growth in 2017 came from low income brackets, which explains the underperformance in household income growth compared to the record year of employment growth.

These three events clearly show the Board wants to be hawkish and raise rates in the near future. However, the global environment, couple with domestic slack, is keeping the RBA firmly on the fence. The RBA is essentially a ‘wannabe hawk’.

This clip from the SoMP perfectly summarises where the RBA is at:

“If the economy continues to perform as expected, higher interest rates are, however, likely to be appropriate at some point. Notwithstanding this, the Board does not see a strong case for the near-term adjustment in the cash rate.”