Market Watch

Once again, the macro environment dominated this week. A week forecasted to be quiet, considering how light it was on the economic data front, quickly became a dramatic week in geopolitics which filtered into equity markets.

The Dow moved through a 1 per cent-plus range every single trading day this week. On Monday and Tuesday, the Dow moved through a 2 per cent range.

The environmental triggers varied greatly. The horrible events in Syria led to tweets and counter-tweets of possible US intervention, and the US-China trade war fluctuated between full-blown retaliation to conciliatory to status-quo from a week ago. US-Russia relations also soured further as Russia vetoed an investigation into the Syrian attacks and the US accused Russia of collusion. All this risk is equal to a lot of volatility.

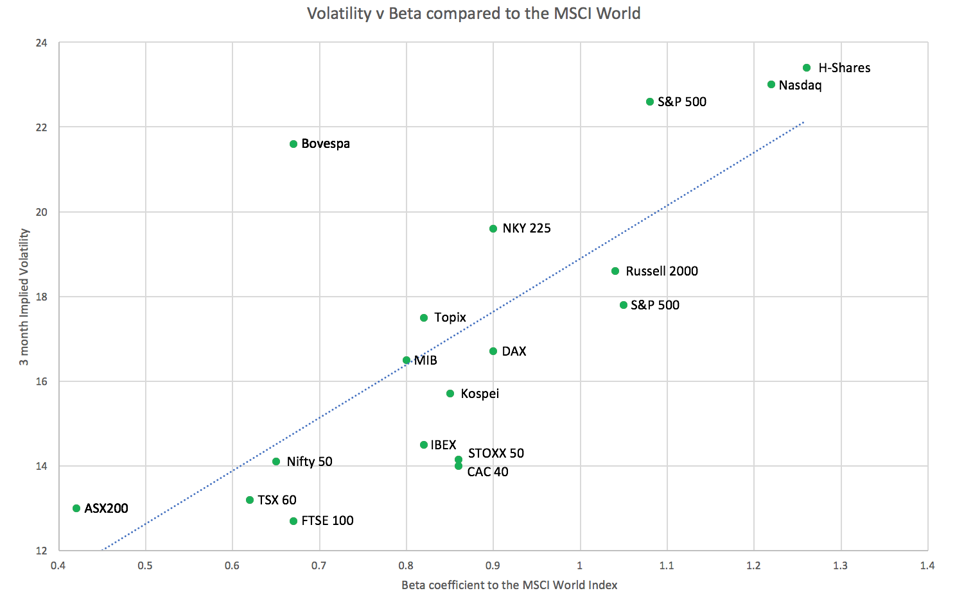

However, interestingly, the volatility that is coming through in global markets is not having as much of an impact on the ASX as one would expect. That’s shown in the chart below, which has the ASX 200 sitting in the corner at the bottom left.

The chart illustrates the 3-month blended implied volatility of global indices versus the risk arising from exposure to general global market movements. That risk is told through the Beta coefficient.

The ASX is currently the best performer, in this respect.

However, despite being the index most insulated from volatility, the ASX has, and continues to, underperform. Year-to-date the ASX is down 4.12 per cent – compare that to the S&P 500, off 0.36 per cent, and the Dow, down 0.96 per cent.

This underperformance becomes even more dramatic when the date range is extended to the last five years. Growth-skewed markets have consistently been preferred over value-skewed markets – the ASX being the latter.

From a top-down thematic perspective, the underperformance of the ASX is starting to become an interesting long-term prospect. The binary nature of choosing growth over value is now a little more complicated than it was before because of the price premiums in growth markets. There is a case for a more diverse and value-driven investment thematic as this outperformance in growth is likely to narrow over the coming years.

Secondly, if volatility does indeed continue in overseas markets, and losses increase dramatically, the ASX’s insulation from geopolitics may also attract investment looking to mitigate risk in the short-term. A theme that is certainly catching my attention.

Australian data of the week

NAB’s Business Confidence and Conditions Survey

Conditions, as expected, eased from the all-time high printed in February. However, on 3-month average terms, conditions are weighing in at around a decade-high.

Confidence also eased. As NAB suggested, this may connect back to the volatility seen in equity markets during the month of March.

We need to highlight the forward-looking subsectors, such as employment, which remain very strong. The survey remains positive for profitability, growth and economic output.

Westpac’s Consumer Confidence Survey

Sentiment declined 0.6 per cent on a month-on-month (mom) basis for April to 102.4 points. However, that is still in ‘optimistic’ territory – and makes April the fifth consecutive month where sentiment was sitting above the 100 point-mark.

Sentiment is also up over 3.4 per cent on a year-on-year (yoy) basis. The decline in sentiment was driven by family finances over the coming 52 weeks. This was most pronounced in the mining states (WA and QLD), with the US-China trade issue the likely impactor.

Australian Housing Finance

Owner occupiers fell slightly in February, down 0.2 per cent mom and 0.8 per cent yoy. This met consensus expectations. The overall data was consistent with the ongoing ‘soft-landing’ of the Australian housing market. In theory, this should put a smile on board member faces at the RBA.