Market Watch

Although it’s a shortened trading week due to Easter it is still the end of the month and end of the quarter.

Therefore, we need to review where markets stand and where to from here.

Let’s be honest, Q1 2018 has been poor – it’s the worst start to a year since 2016.

The ASX is approximately 3.9 per cent lower for the quarter, most of which comes down to a 3.1 per cent decline in the month of March.

US markets have actually corrected twice in the March quarter; the S&P has lost 5.2 per cent in March and the Dow Jones index 6.1 per cent. However, for the quarter both are down approximately 3.6 per cent, which is somewhat impressive when you factor in the fact a correction is a 10 per cent decline or more.

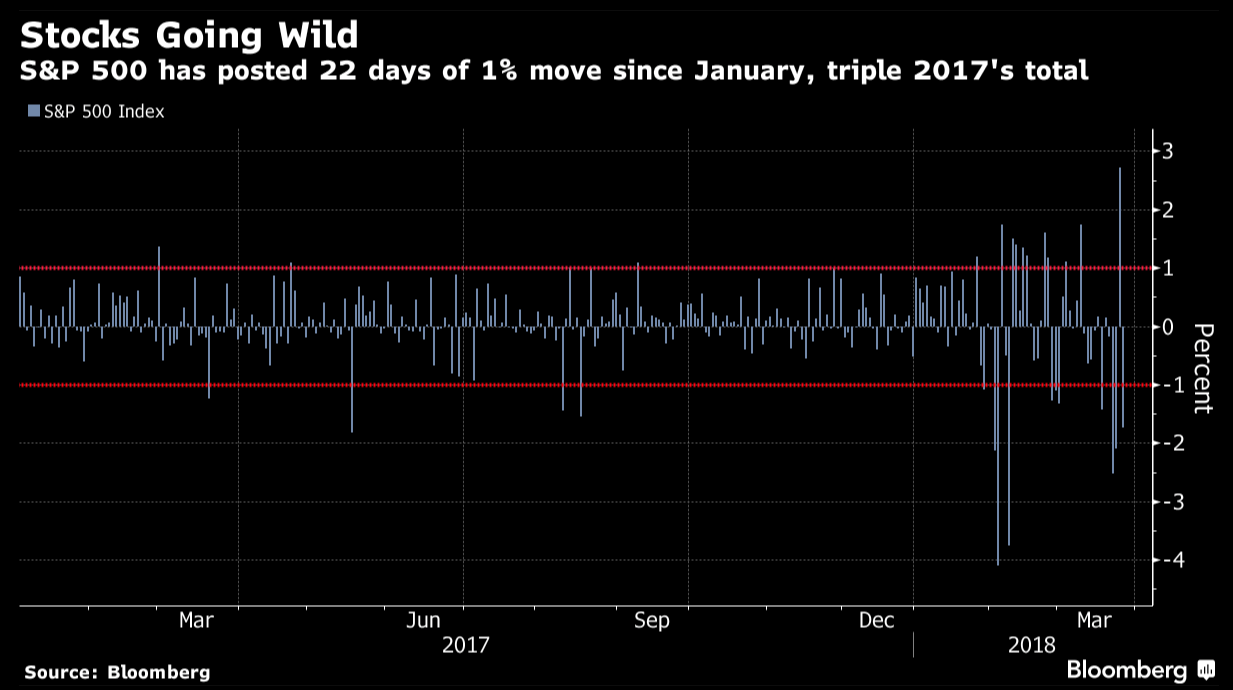

(This chart perfectly illustrates how macro and political risk has infiltrated global markets.)

Since the February 5 market collapse, volatility and geopolitical risk has taken pride of place in markets. This is unfortunate, as 2018 is still on track to be the best year of global growth in the post-GFC world.

This statement is backed by the Organisation for Economic Co-operation and Development (OECD), which earlier this week upgraded its forecasts for global growth to 3.9 per cent from 3.6 per cent for 2018, and to 4 per cent from 3.7 per cent for 2019.

Economists are in the same mood, with the likes of Macquarie, Goldman Sachs and UBS also updating their outlooks on global growth to the upside this week.

The consensus figure for global GDP in 2018 from the 26 economists surveyed by Bloomberg stood at 3.89 per cent (at time of writing). In short – economically, things are good.

‘Synchronised global growth’ clearly remains the macro-economic thematic of 2018.

The underperformance in the first quarter of the year can be attributed to some structural reasoning i.e. the NASDAQ – with Facebook’s legal issues being a core reason.

However, the overarching risk thematic that is drowning out the core macro thematic is ‘Washington risk’. Whether it be from Capitol Hill or Constitution Avenue, the White House and the Fed have contributed to the March quarter’s poor return and are likely to continue to create some investment hesitation.

The Fed has a clearer agenda than Capitol Hill, with US employment and to some extent US inflation moving to levels that need to be regulated through rate rises. However, it’s the risk that has come from the White House that has caught markets offside.

Using tariffs as a bargaining tool and threating the largest growth market in China with intellectual property ‘theft’ is clearly impeding investment mandates and capital allocation.

However, the current market conditions and reactions in Q1 must sharpen the focus. US ‘negotiations’ will dissipate, the northern hemisphere seasonality and weather distortions will also fade in the coming months and should allow earnings and economic actuals to underpin that 2018 remains one of the best growth profile years of the past decade.