Market Watch

The third week of March was always going to frame the macro-economic environment for 2018, however it has done more than that: it has framed the coming 36 months as well.

Firstly, to the Australian domestic data of the week – employment.

The term ‘jobs and growth’ may be the political buzz phase currently – the reality is more jobs growth with no other growth in the employment market.

Australian employment growth is booming, that much is clear,

- The 17th consecutive month of employment growth extending the record that started in January. One has to go back to the early 2000s to see a similar growth period.

- Employment growth saw 17,500 jobs added taking the 12-month change to 390,000.

- Full-time employment continues to boom, surging by 64,900, and has seen over 294,000 full-time jobs added in the past 12 months.

However:

- Unemployment ticked up to 5.6 per cent on seasonally adjusted terms on the back of the participation rate jumping – which means more people are returning to the market looking for work but haven’t found work yet.

- Part-time employment fell by 47,400 – however, a lot of this would be part time work turning into full time work

- Under-utilisation and underemployment both rose in the first quarter.

This last point particularly is a warning sign for wage pressures and therefore wage growth. The space capacity in the Australian employment market is disappointing and keeps some suggesting cutting interest rates further, or that fiscal policy needs to change in the assentation.

Without wage growth inflation will remain elusive and it will see consumption slowing as well.

Returning to the bigger and more pressing issue – funding squeezes.

As expected the Federal Open Market Committee (FOMC) increased the Federal Funds Target Rate by 25 basis points (bps) to 1.75 per cent. However, what the market had being looking for was the possibility of four rate rises in the 2018 and therefore all attention was on the dot plots – the plots showed that forecasted three rises for this year remained – some saw this as a dovish view and reacted accordingly by buying bonds, which saw yields ease.

Although the initial fall in yields was down to the Fed’s slightly light hawkish stance for 2018, the major reason was geopolitical risk and the Trump administration’s new set of tariffs squarely aimed at China.

I will discuss this in more detail in the coming week, however the White House remains in my view the single largest risk factor facing markets.

The initial reaction misses the changes in the forecasts for 2019 and 2020 – which are clearly hawkish.

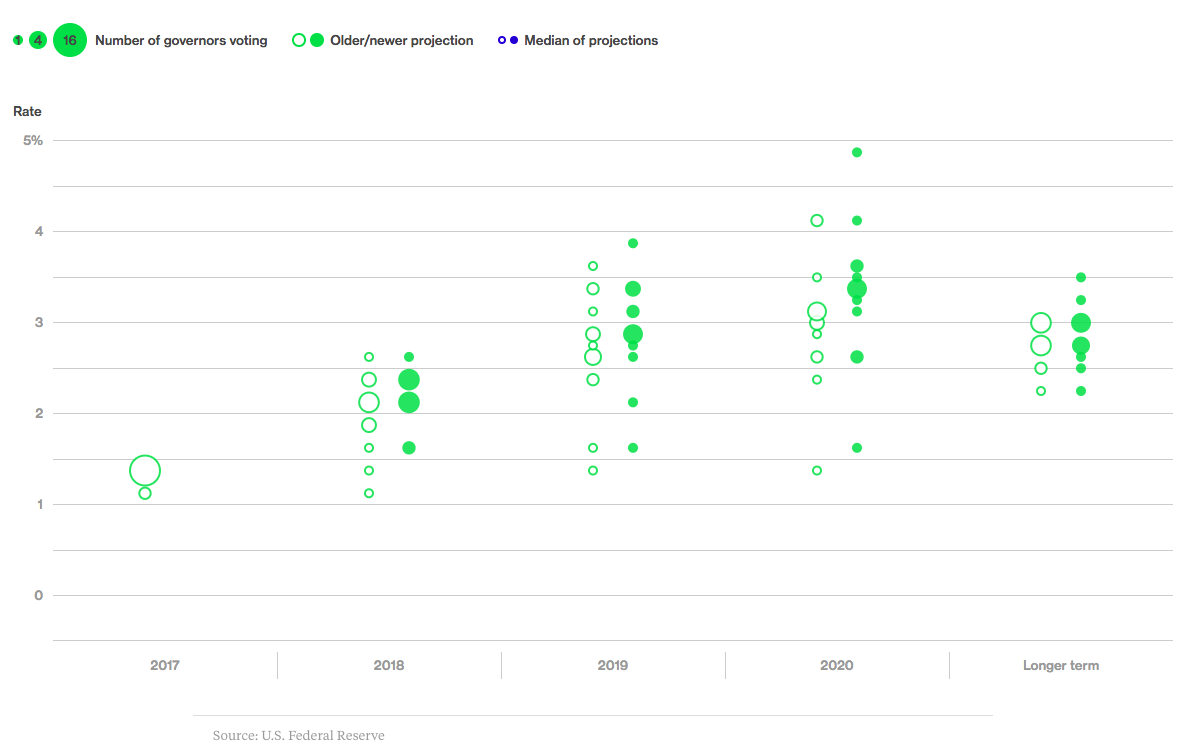

This chart shows the December projections versus the March projections.

Source: Bloomberg)

The steepening in the 2019 and 2020 projections are clear signs of a more hawkish Fed; it also gives the board latitude to bring rate rises forward and to be even steeper in terms of basis point rises.

There is clearly still a case for four rate rises in 2018 and the dot plots suggest that an increase in 2019 could be brought into this year.

The reason for highlighting the plight of the US interest rate market is the effect it's having on Australian funding.

The increasing US money market rates is causing short-dated Australian rates to skyrocket. As the chart illustrates the 3-month bank bill swaps rate is at its highest level since mid-2016.

The 50bps of cuts the Reserve Bank brought announced in May and August of 2016 are now being completely negated by the US rise.

This will impact net interest margins over the coming 18 to 36 months, and if the FOMC raises rates as forecasted there is every chance short-term rates will be north of 2.5 per cent.

This cost impact will hit earnings of the banks and those firms with debt obligations.

It is also likely that these cost pressures from higher funding cost will filter through to the consumer (mortgage holders, margin lending and the like) this will be a major theme for the coming years.