Market Watch

It’s a split week this week as we move into the final month of 2017 on Friday. The Australian data of note, and the one to round off an eventful November, is private capital expenditure – otherwise known as capex.

However, before diving into private firms’ future intentions for spending, we should take an important trip across the Pacific.

US GDP

US third quarter GDP is slated for release on Thursday AEDT, and the forecasted range is 2.6 per cent to 3.2 per cent for the year-on-year figure. The median consensus is 2.8 per cent. This would mark a slight decline from the previous quarter, however the US would remain the bright spot of the developed world even with a reading at this level.

Underscoring US GDP is likely to be a slight uptick in consumption. However, what I would be looking for is further upticks in private investment. Remember, the GDP equation is (C) consumption (I) private investment (G) government spending (Exports - Imports) net exports. Considering the growth of private firms’ earnings in 2017, private investment (I) might be the surprise of the release, and this would be a positive for growth equities.

Yellen’s testimony

The other big event taking place in the US this week is outgoing FOMC chair Janet Yellen’s testimony to the Houses. This, in fact, might be one of the more interesting testimonies in recent times. Yellen’s tenure officially wraps up in February and she will be completely removing stepping away from the Board then. There’s potential she will be more candid with her answers for that reason.

Even under normal circumstances, chair testimonies can be volatile events. We should potentially expect more volatility than usual at this event. Yellen is likely to defend the Board’s decision-making under her tenure and give forecasts, as well as shed a brighter light on current projections for the Fed’s funds rate.

It is this point, in particular, that Yellen might be pushed on. Republican senators are likely to ask if the current dot plot predictions are justified. Politics always adds spice. This has a double connotation:

- Has the current policy worked (over-accommodative)?

- Is the planned plotted path ‘too fast’, considering the economy is below pre-GFC levels?

Australia’s CAPEX

Looking to Australia and the biggest release of the week are the capex numbers, specifically, the forward-looking figures.

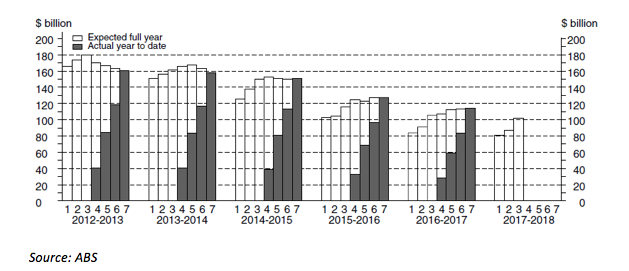

Since the peak of the mining boom in 2012, capex has been on a steady decline. It hit a decade-low on the first read for 2017-18 intentions last year.

However, as the chart above shows, the figure has steadily bounced off this low and future expenditure has been given a ramp up. More importantly, it’s the non-mining space that appears to be finally picking up the slack.

This brings last week’s speech by Reserve Bank governor Philip Lowe into the equation. As a service-based economy, and with expenditure expected to rise over the coming year, one area of spending should be employment.

Australia’s employment growth is experiencing its strongest year since 2005. If we look at the actual expenditure for 2016-17, it actually surpassed expectations, which should bode well. However, there’s a weak link on the wages front, and that’s wage increases. Will business pick up the slack in this area too? Lowe and Co. certainly hope so, but hope isn’t what it’s going to come down to. Capex could be a saving grace here.