Market Watch: When politics and markets collide - oil

Chief Market Strategist Evan Lucas explains how fresh international tensions may affect the oil market.

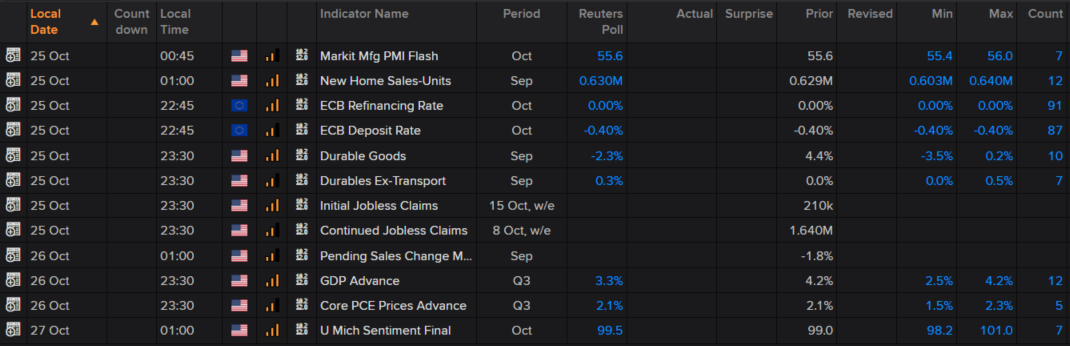

Upcoming economic events

Source: Reuters

- The price of oil has actually fallen over the past week, as US stockpiling of oil has surged. The latest oil inventory figures show that the US stockpiled 6.49 million barrels of oil in the second week of October – double the consensus estimate. Supply is always key to oil pricing, and clearly supply is ramping up. This is due to non-OPEC members (such as the US) soaking up the current elevated price levels, which should put a ceiling on oil over the medium-term.

US Rig Count (orange) versus WTI Crude (purple)

Source: Reuters

- However, oil is currently facing a geopolitical crisis not seen since the OPEC oil freeze of the 1970s. What transpired in the Saudi Arabian consulate in Turkey over two weeks ago to a prominent critic of the Saudi Royal family is appalling, and there is a clear need for an international response to this action. The pressure is on the White House.

- This could be Donald Trump’s biggest test since becoming President, as this has the potential to put the entire US-Saudi relationship at risk. President Trump’s language and views on the situation have veered from one side to the other as pressure mounts for action. He has personal and political links with the Royal Family and mid-term elections to win. Oil markets need to remain stable in his eyes, therefore we can expect him to move with the sentiment.

- However, the reaction from Republican Senators shows the US is demanding the truth and wants action. The UN, Europe and most of the international community are doing the same. The question the market is nervous about is: what is ‘action’? More importantly, what will be the Saudi response to said ‘action’?

- The market received a first-hand written warning on Thursday, when the Saudi Foreign Minister released these statements: “The kingdom affirms its total rejection of any threats and attempts to undermine it, whether through economic sanctions, political pressure or repeating false accusations…The kingdom also affirms that if it is [the target of] any action, it will respond with greater action.” The statement closed like this: “[Saudi Arabia] plays an effective and vital role in the world economy.” The inference is clear – Saudi Arabia will pull its oil supply, which is approximately 14 per cent of global supply. Put another way, that’s 10.2 million barrels of oil.

- This therefore has the potential to see oil prices skyrocket on an intra-week basis. How the White House, Brussels, The Hague and the rest of the international community approach Saudi Arabia is a question for the political pundits. Markets however, are facing an event they hate – the unknown. Oil could be anywhere between $US65 and $US85 a barrel over the coming month, depending on the ‘action’ taken. This means petrol at the bowser could reach $A1.80 per litre or more.