Market Watch: Very important, often forgotten

Why the opening of the wage price envelope on Wednesday matters more than you think.

“Wages growth remains low. This is likely to continue for a while yet, although the improvement in the economy should see some lift in wages growth over time. Consistent with this, the rate of wages growth appears to have troughed and there are increased reports of skills shortages in some areas.”

This comment from the RBA encapsulates everything that is dragging on the overall employment market. Participation has increased, the unemployment rate has fallen, and forward indicators such as vacancy rates are high, meaning, employment growth will continue to strengthen throughout 2018 even after the boon of 2017.

But wages are still lagging, because of the quality of the employment market. Slack (underemployment, underutilisation) remains an ever-present problem, and it’s leaving wages in the doldrums.

The Keys

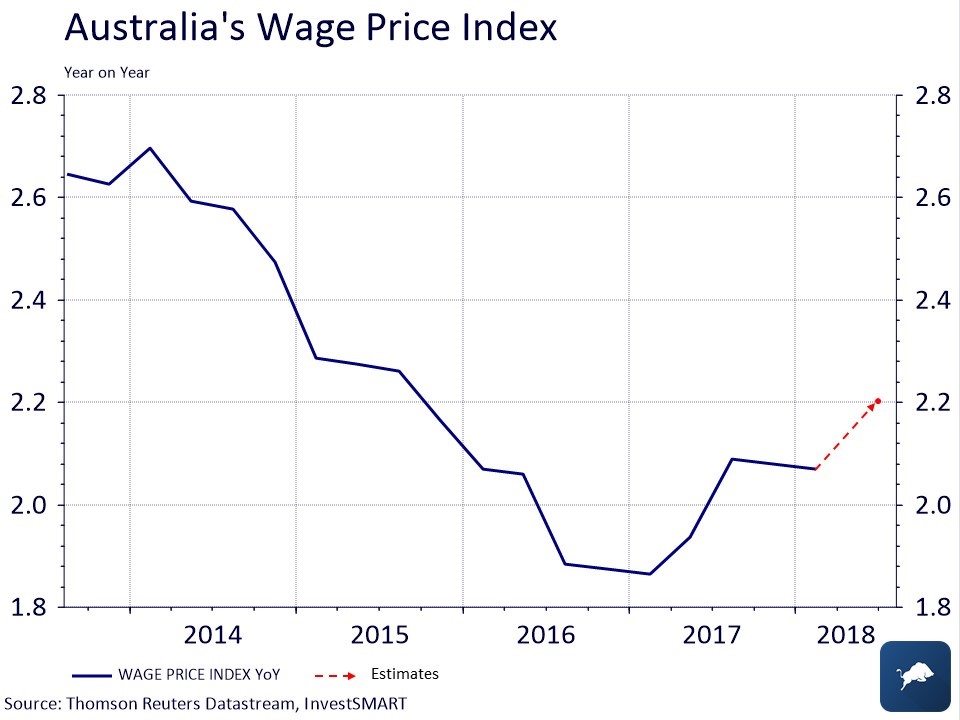

Consensus has year-on-year wage growth, excluding bonuses, growing by 2.2 per cent in the second quarter of 2018. The quarter-on-quarter consensus growth figure sits at 0.5 per cent.

Wage growth, including bonuses, is forecasted to come in at 2.6 per cent year-on-year. This would see a continued acceleration in the overall wages market which last kicked into gear in the final quarter of 2017.

The interesting pattern here is that people’s overall remuneration is becoming more and more aligned with returns rather than flat fee structures. Considering business confidence over the past year, bonuses should be stronger and that justifies the higher consensus figures. Earnings and overall profitability have been near records in economic indicators such as the manufacturing and services Purchasing Managers Indices (PMIs). However, bonuses are discretionary, and the benefit is not distributed evenly throughout the whole employment population – this will not positively impact all, again, producing a disjointed wage figure.

Using wages ex-bonuses and headline inflation to derive real wage growth, the problem in the employment market becomes even more apparent. Real wages are growing at just 0.2 per cent year-on-year. That explains why the RBA’s ability to increase the official cash rate is so constrained – wages are just not contributing to price pressures in the overall economy.

If there are continued signs that real wages are flatlining on Wednesday, then the RBA’s optimistic view of the Australian landscape will need to change.