Market Watch: The market loves bad news

There is a clear disconnect developing between the ASX 200 and Australia’s gloomy economic picture. In fact, you could go as far to say, the market is almost relishing the bad economic news.

So, with growth slowing and household consumption at its weakest point in several years, why is the market rallying? Quite simply, it’s because of the sheer likelihood of the Reserve Bank of Australia cutting the cash rate.

One by one, 10 economists trotted out their revised forecasts for the Australian cash rate this week. All of them moved to a dovish stance, specifically, a 50-basis point cut to the cash rate. All in all, by the end of the week, most economists believed by December 2019 the RBA will have moved the official cash rate to 1 per cent – a new record low.

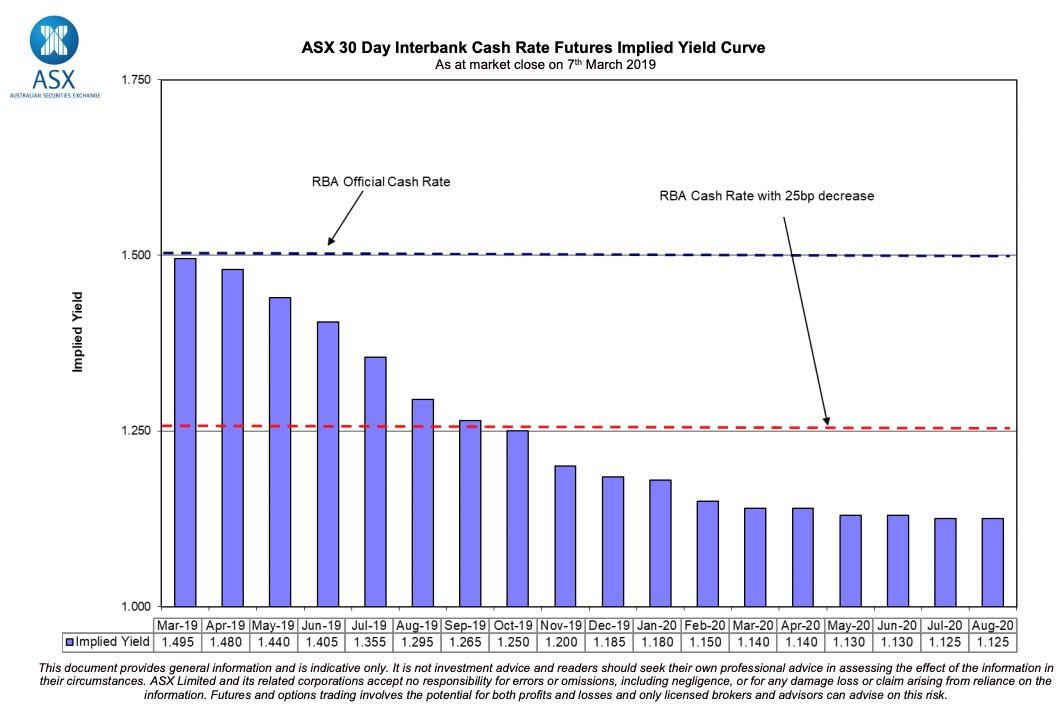

The market clearly believes this too. Interbank cash rate futures are now fully pricing in a 25-basis point rate cut come December and a 50 per cent chance of a second 25-basis point cut in the same period.

This is illustrated by the chart below:

The ASX 200 jumped on this idea, disregarding the declines in global markets to finish the week higher. The reason why it shifted higher on Wednesday is worth considering at a deeper level.

The sector driving Wednesday’s outperformance was financial services. The banks drove the market higher because a falling cash rate is often a good thing for them:

- Lower funding costs

- Looser financial conditions

- A booster for credit demand

- An asset price supporter (particularly housing)

All of this would filter into cash earnings, net interest margins (the feeling is the banks may not pass down the full cut to borrowers) and asset valuations. With the banks being over 25 per cent of the ASX 200, these points are all investment drivers.

However, something was missed by the market this week. Some of the data points were downright astounding. Take the January trade balance, which came in as the second-largest surplus on record at $4.5 billion, only beaten by the December 2016 read of $4.7 billion. It was so big that it beat the October and November 2019 trade balances combined.

This is important because it takes pressure off other things like the currency account. That means Australia can continue to rely on itself rather than foreign capital. It also shows that GDP growth, while moderating, is not collapsing.

Furthermore, the RBA is hesitant to cut rates unless it absolutely must. Its dual mandate of employment and inflation has not yet shown signs that it should act. If we look inside the GDP read from Wednesday, it was ‘labour compensation’ grew 4.3 per cent year-on-year, and although inflation has been anaemic for almost four years, it certainly is not contracting. Tick and tick on the mandates.

So, yes, the market loved the bad news this week and the prospect of cuts to the cash rate. However, things would likely have to get worse still to push the RBA to act, meaning, there is a possible divergence in market pricing to the actual environment.