Market Watch: The latest on jobs

Australia continues to find itself in a downside ‘goldilocks’ scenario when it comes to employment.

It is robust and changing for the better, yet the overall quality of Australia’s employment market is benign. Unemployment continues to shift lower, however the amount of people looking for work and wanting to work more is increasing. It shows that employment is stuck in a loop.

The Keys:

The continued mismatching in employment can be seen when dissecting the two separate employment data releases of the week.

Labour force numbers:

- Total employment fell (-3.9k) in July, consensus was for ( 15k), however considering the June figures were 50.9k there is clearly run-off here. Overall annual growth fell slightly to 2.4 per cent year-on-year (yoy), down 40 basis points. If we smooth out the typically volatile employment change numbers the average monthly change is 22k over the past three months, compared to the 4K a month average from February through to April.

- The main drag on the employment change was part-time jobs falling 23.2k in July; full-time jobs increased 19.3k. Overall part-time growth is still outstripping full-time growth (up 2.7 per cent yoy versus 2.3 per cent yoy), which shows there is still slack in quality. Year-to-date however there has been a narrowing with the full-time net change up 62k; part-time 57k.

- Hours worked edged higher over the month; up 0.2 per cent for a growth rate of 2.3 per cent yoy. However, on trend terms, hours worked are actually edging lower – down 10 basis points to 1.9 per cent. This feeds into the issues in wages and underutilisation.

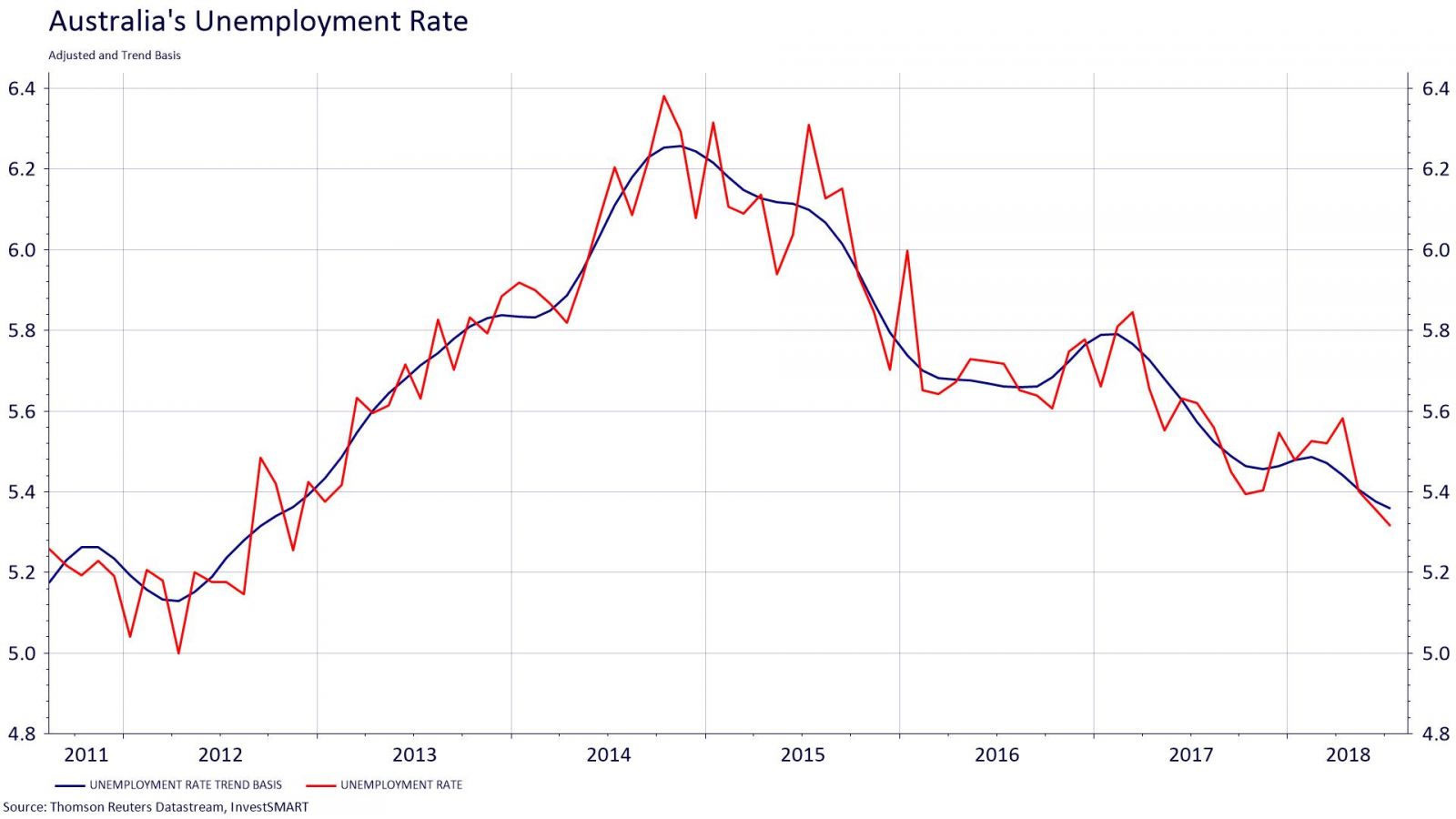

- The unemployment rate edged 10 basis points lower to 5.3 per cent, the lowest print since August 2012. However, the decline in the unemployment rates was driven by the participation rate falling 20 basis points to 65.5 per cent from 65.7 per cent. However, even with the decline in participants, overall participation is higher over the year and the unemployment rate is down 30 basis points over the same period. This explains why the Reserve Bank believes unemployment will grind lower to 5 per cent and that there are green shoots for wages.

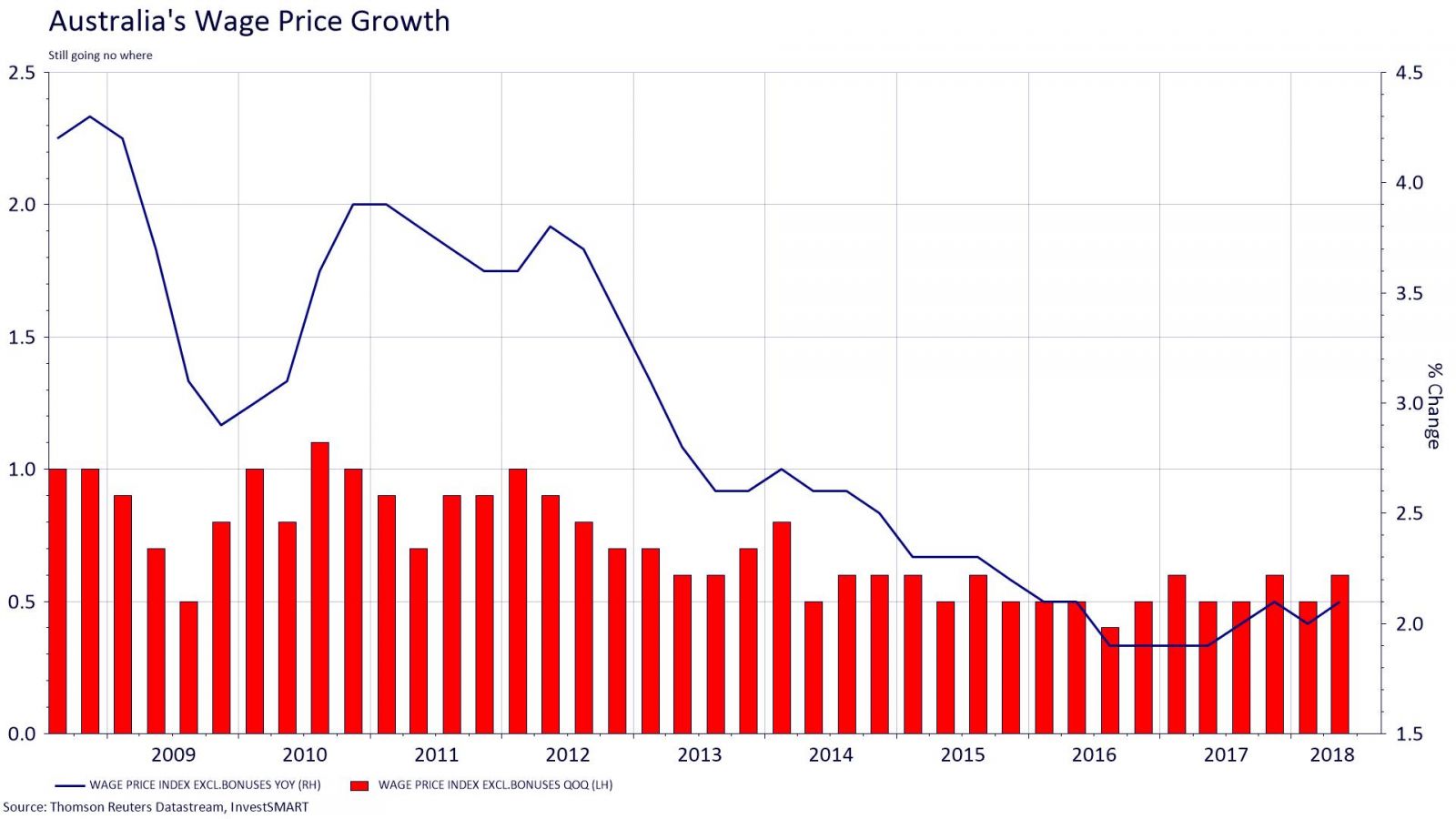

Wage Price Index

- Wage excluding bonuses growth increased 0.6 per cent quarter on quarter, over the June quarter, which was in line. There are signs of a gradual increase in wage pressure, but as seen in the employment change there is still plenty of slack in certain sectors and states. Year-on-year wages excluding bonuses grew by 2.1 per cent; on a real wages basis that is 0.1 per cent. There is no inflation pressure here at all.

- Looking at the release on a state basis there is clearly still slack coming through from the end of the mining boom, with Western Australia struggling to see any wage pressure at all while Queensland remains well below its East Coast peers.

- Looking at the breakdown of private to public sector wage growth and once again public sector growth is completely outstripping private, adding 2.4 per cent yoy, while private increased 2 per cent yoy. Victoria’s public sector wages grew at the fastest rate of any sector, up 3.3 per cent. Looking at wages including bonuses, interestingly annual growth in the private sector actually eased 10 basis points to 2.5 per cent; public sector wages including bonuses jumped 30 basis points to 2.7 per cent. Therefore, as predicted, the discretionary nature of bonuses is playing out.

- On an industry level, once again the strongest growth rate remains healthcare and social services, adding 2.7 per cent yoy followed by education adding 2.5 per cent yoy. On the other side of the spectrum mining and retail trade are the softest, up 1.3 per cent yoy and 1.5 per cent yoy respectively.

When taken together the overall conclusion from the employment data is that the ‘gradual’ rise in wages is still some time off and the RBA’s want for ‘demand driven’ inflation is just as far away. Australia is stuck in a neutral loop.