Market Watch: Risks and returns

Chief Market Strategist Evan Lucas discusses why now is a very good time to be thinking about where to invest in 2019 and beyond.

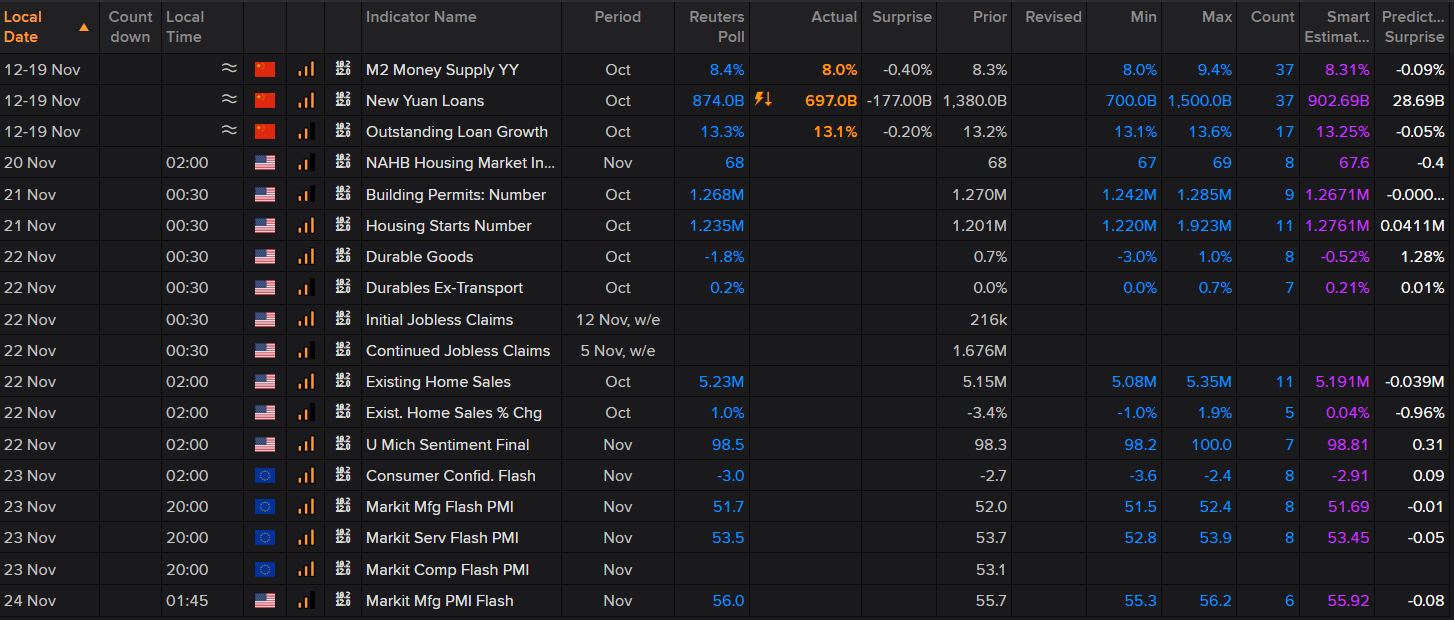

Upcoming events

The relationship between risk and return is one of the most widely recognised investment theories. Plenty of commentators out there are happily pointing out the risk in the market and the pullback it is creating. The ‘sell everything’ doom and gloom has pushed risk to the forefront of market concerns, and is blinding the public’s investment vision to the here and now.

However, with six weeks to go in the calendar year, should you really be thinking about how things may look on December 31, 2018 (the here and now)?

Or, should you be asking: what does December 31, 2025 look like?

We think it’s the latter.

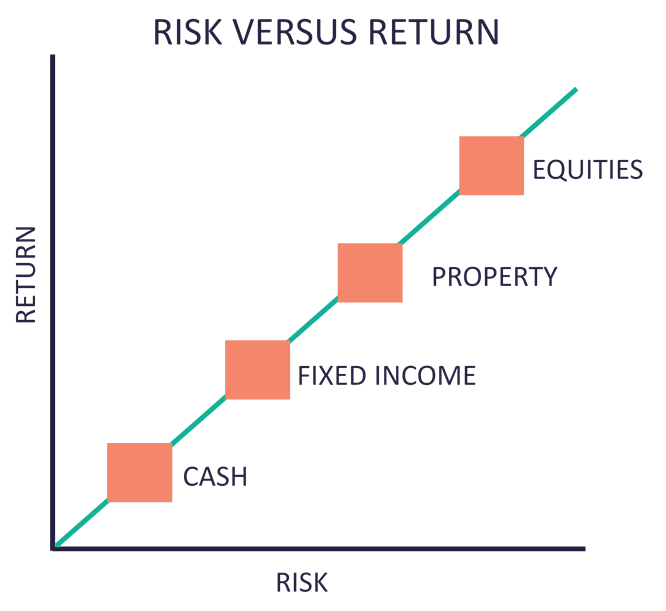

- Universities love to portray the risk and return relationship in a linear, timeless and variable-free manner, as demonstrated by the chart below.

Source: InvestSMART

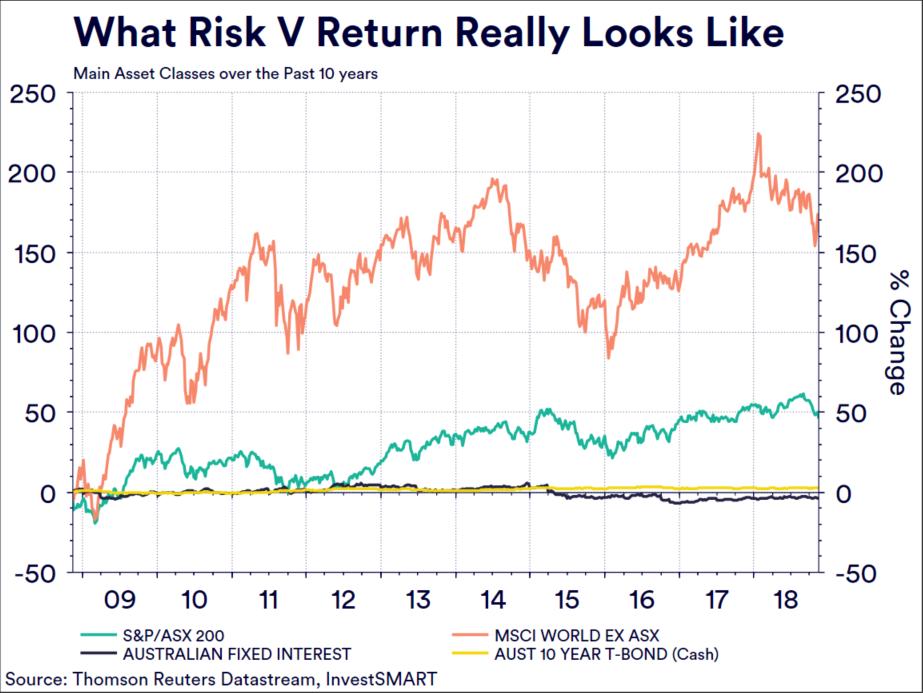

- However, this ignores one of the core variables when it comes to investing: time. Time allows risk and returns to amplify, to buffer against short-term volatility, and to smooth out market imperfections. Therefore, when we add time to the risk/return chart, the linear risk/return theory becomes anything but linear, as can be seen below.

- Over a 10-year period, equity returns have been significantly higher than those of its more defensive peers, and this chart only illustrates capital returns – not total returns. Adding the yield offered by the ASX (approximately 4.5 per cent) on top of the capital returns, the risk of a short-term pullback or correction is smoothed out further – giving the riskier assets an even greater ascendency.

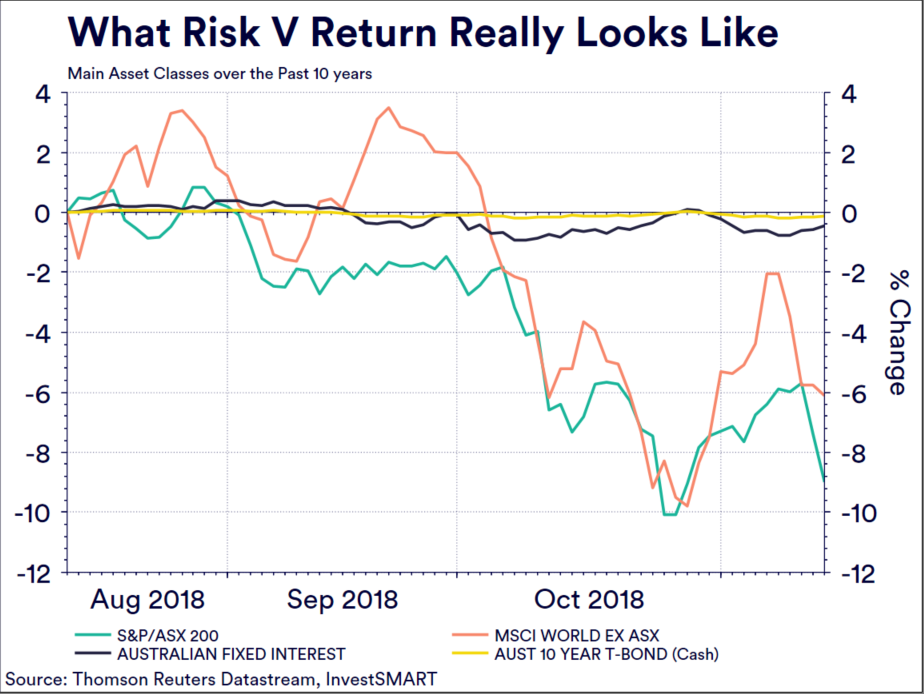

- Time also provides opportunity when risk creates fear. Over the past three months, the risk/return ratio in the markets has swung into negative territory for equities. Even cash and fixed incomes have declined slightly over this period, providing an example of why diversification is crucial.

- However, we would argue that this three-month period actually created opportunity when looking at a risk/return/time investment ratio. The decline in markets has provided an entry point for a longer-term investment strategy.

- The greater the required return, the more time is needed, which is why we are asking how December 2025 might look, as opposed to 2019 or even 2020. We choose to look seven years ahead, when total returns will have had time to accumulate and smooth out the current volatility, and when markets in general are likely to be significantly higher than they are currently.

(Further information about longer-term growth investment options can be found here)