Market Watch, Oct. 20

Having seen a snap out of pessimism in the consumer confidence survey due to ‘job security’ and employment makers in October, Thursday’s employment figures were either going to be confirmation of this fact or a headwind to current expectations.

However, before covering off on the employment figures – one needs to touch on the China data of the week.

The PPI figures on Monday certainly added weight to the expectations that full-year GDP in China is more likely than not to come in at 6.9 per cent for 2017. Although the Q3 figure reported on Thursday was 6.8 per cent - China is clearly looking to remain a powerhouse of growth and by default a powerhouse of bulk commodity demand, and this was illustrated in the PPI, industrial production and retail sales data of the week suggest a big push to finish the year.

However, the movements in commodity markets waned as the week progressed and the NPC took over – the question that will be answered, most likely next week, is what does the 2020 decade look like from a policy perspective? This will provide the clarity needed to understand what the next decade of the China story will look like and where Australia sits in this story.

Australian Jobs

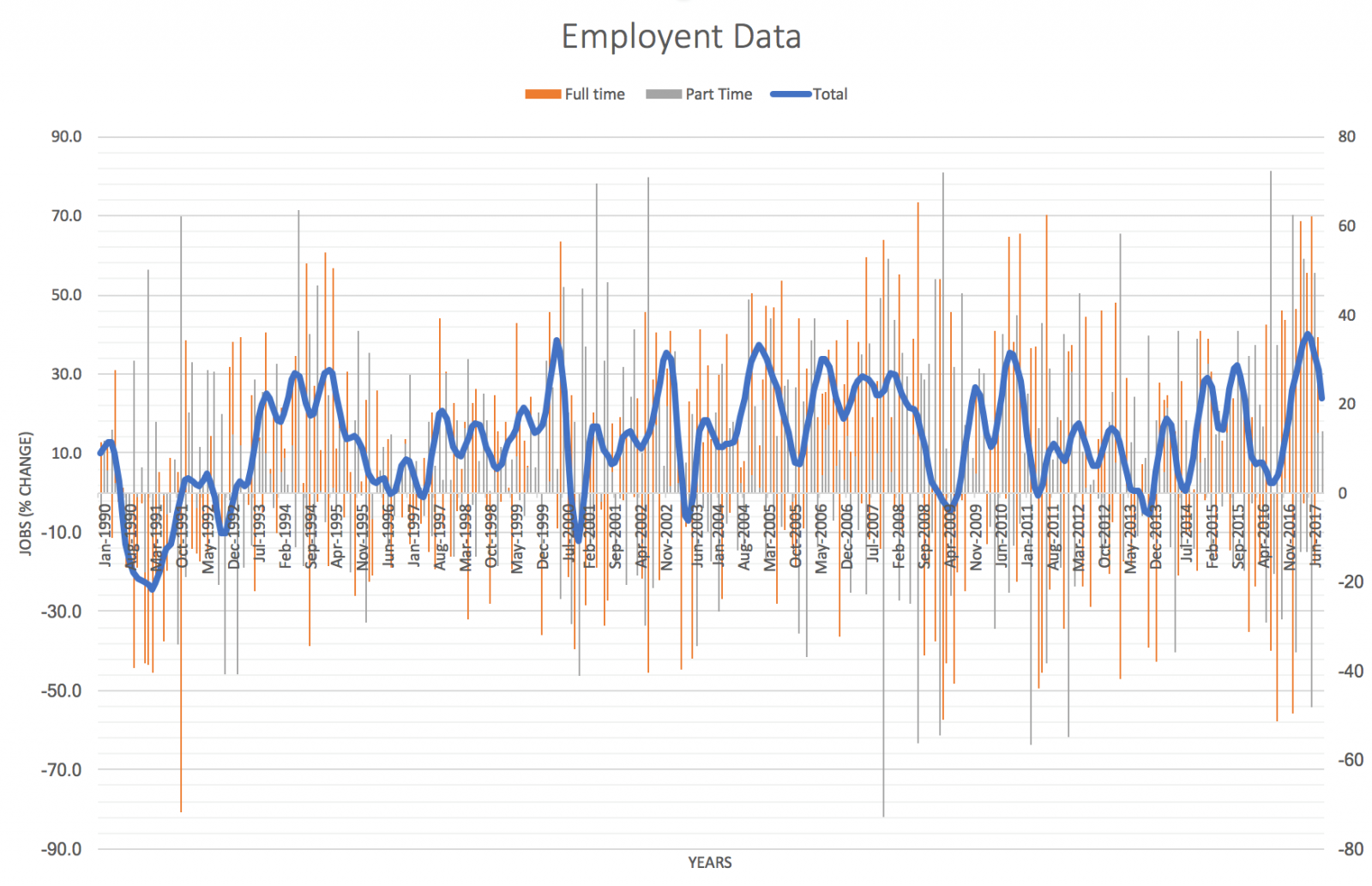

The healthy 2017 Australian jobs prints roll on. There has now been a 335,000 jobs added on a trend base in the past year alone and if current rates remain, this will be the best year of job creation since 2005. The annual rate is now 3.1 per cent, also well above average and in the post-GFC era this figure is a standout.

The employment change has now logged 13 consecutive months of job creation; not since September 2016 has there been a decline in employment, and with the unemployment figure at 5.5 per cent the outlook for employment in Australia is on the upside.

Over this time, it’s full-time creation that is the stand out and despite part-time outpacing full-time this month, the overall trend basis in 2017 is skewed to full-time. This adds further weight to the figures as seen in the chart below.

However, it’s not all roses. There is clearly still slack in the market, with underemployment at 8.6 per cent, participation lower month-on-month and year-on-year at 64 per cent, and hours worked up but not translating into wage growth.

This leads into expectations from the RBA. No doubt Lowe and Co. will have a wide smile on their faces from Thursday’s data. However, the board is unlikely to react to the employment data until it translates into wage growth as without this, its inflation targets are unlikely to be met.

Therefore - all eyes on next week’s CPI print on Wednesday for more colour.