Market Watch, Nov. 3

The biggest economic data this week came out of Europe. Markets and the media concentrated on the Eurozone’s GDP, which is materialising for the first time in the post Eurocrisis-era.

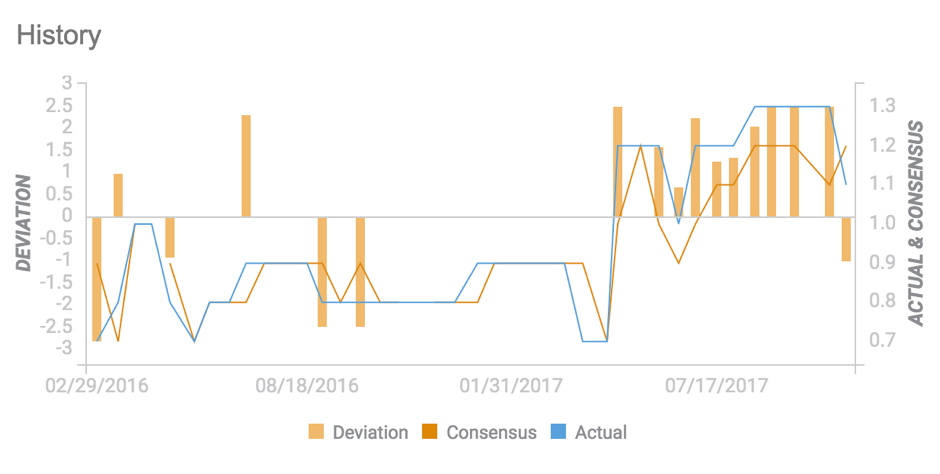

From an Australian perspective, the European data of note was inflation – or should I say, disinflation. Like Australia, Europe is struggling to ‘grow’ inflation. Although it is moving towards levels the European Central Bank (ECB) wants on a blended basis, core inflation fell back to 1.1 per cent from 1.3 per cent in the previous quarter.

Source: FXStreet

Inflation missed the consensus target for the first time in over a year. It is the lowest core inflation read for Europe since March.

Global growth, employment and consumption have finally taken off and will be a global phenomenon in 2018. However, across the globe, wage growth is not materialising: variable inflation sectors like energy and food are either flat or in a deflationary cycle, and core inflation is being propped up by sectors such as housing and large consumables, which is unsustainable.

The investment thesis for a low inflation environment is that ‘growth’ markets will outperform ‘value’ markets. Across the world, this thesis has already proven true, with growth markets such as the NASDAQ, Hang Seng, DAX, and even the Dow, well and truly accelerating ahead of value markets such as the ASX and the Singaporean Strait Times (STI) in 2017.

With inflation remaining elusive on a forward basis, will the growth vs value thesis flow through in 2018? Growth seems priced at a possible premium, but time will tell.

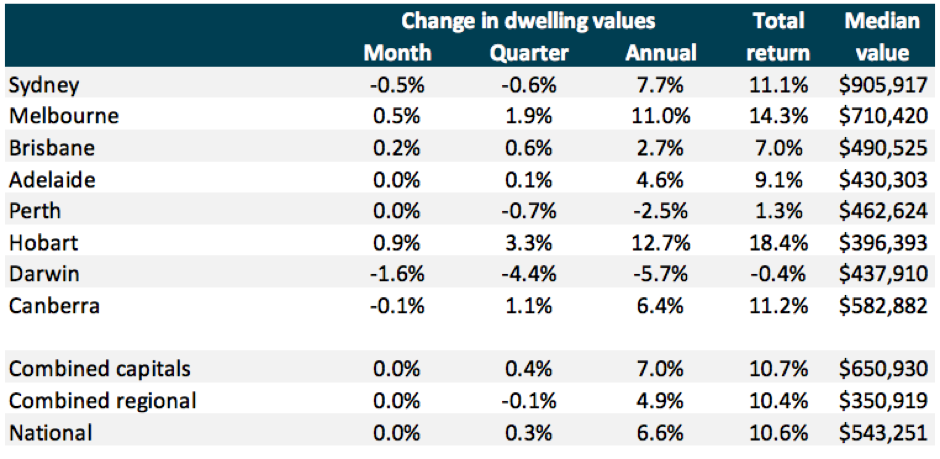

Meanwhile, housing is beginning to sigh of exhaustion. Sydney house prices have slowed for two consecutive rolling quarters for the first time since May 2016. Sydney just suffered its largest month-on-month decline for 2017.

Source: CoreLogic

Australia, as a whole, is experiencing a flat-lining of dwelling values. Melbourne and Hobart remain the standout capitals, but even Melbourne had its lowest quarter-on-quarter and month-on-month rise since June 2016. The slowdown can be attributed to:

- Macro-prudential policies

- Credit tightening

- Transference from interest-only loans (IO) to principle and interest loans (P&I)

- Investor loans facing premium price increases

- Loan-to-value ratio (LVR) rules tightening

The cracks in housing should come as no surprise. Many, including the Reserrve Bank and private banks, have been waiting for some heat to come off the housing market. The catch from a market and economic point of view is the loss of the ‘wealth effect’.

This wealth effect, driven by home ownership, has propped up consumption for at least the past few years – just look at the share price journey of discretionary stocks Harvey Norman and JB Hi-Fi since 2013. A decline in housing will impact consumer sentiment.

Secondly, core inflation in Australia has been backstopped of late by housing. If house prices begin to decline, the RBA’s core mandate will face further pressure, adding more speculation it will have to turn dovish.