Market Watch: Markets chaos explained

It’s the final week of what has been a ‘tale of two halves’ year: a strong bullish start and a volatile bearish end.

This week marks the final ‘full week’ of trading for 2018 and, as luck would have it, three of the top five largest central banks are meeting for the final time this year – the Bank of England, the Bank of Japan and the one that I believe will impact markets the most over the coming 12 months, the US Federal Reserve.

In the past nine to 10 weeks the “perma-bears” would have us believe something in the US and global economy has fundamentally changed – growth is ending a recession is coming.

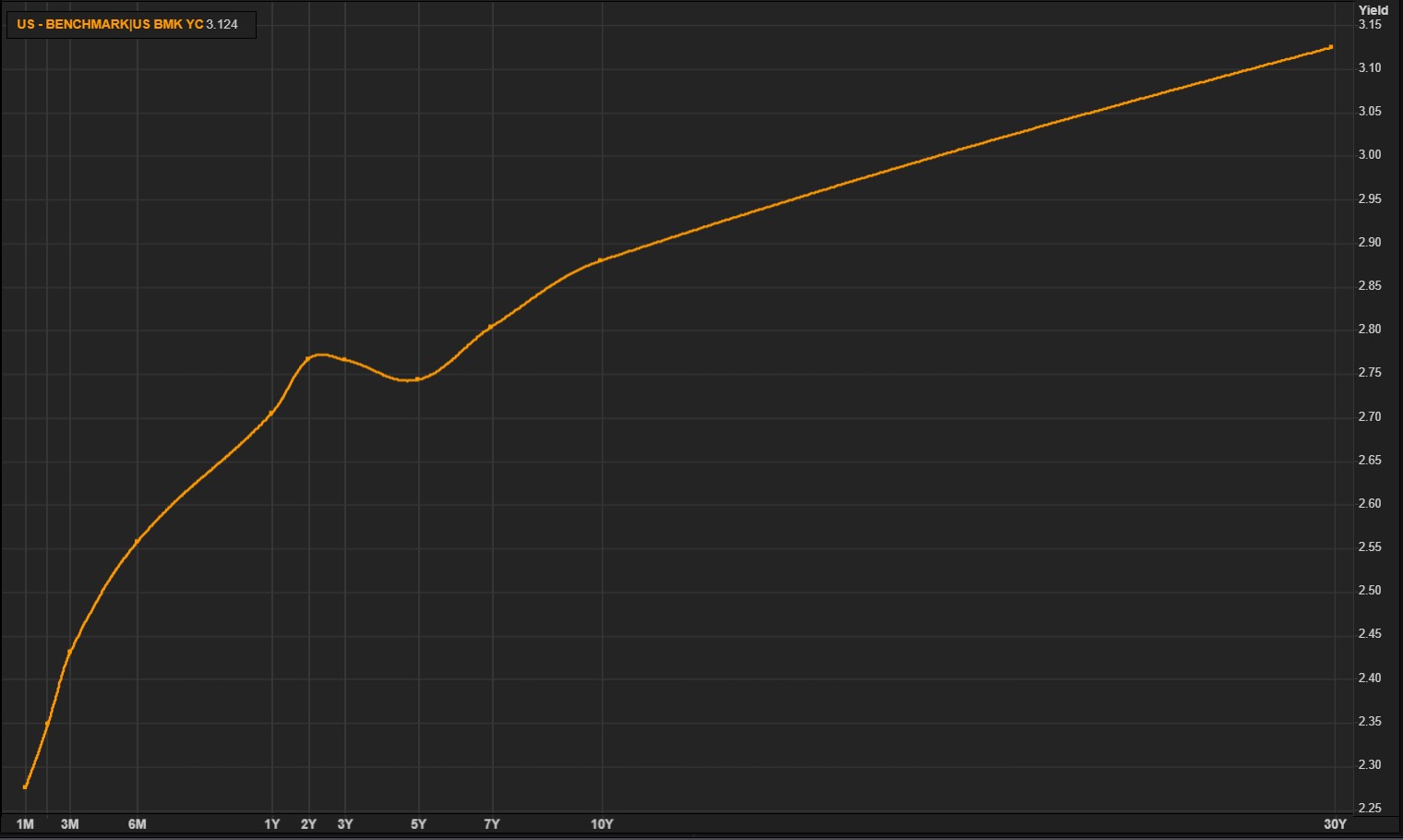

Their justification for this stance is reflected in this chart:

Chart: US Treasury Yield Curve

(Source: Reuters)

That ‘kink’ in the curve is the inversion between the 2-year and 5-year bond yield (this is where the 2-year yield is higher than the 5-year yield) - it is a strong warning sign for markets and recession watchers alike. For the first time in nearly six years, the 2-year-5-year spread has inverted – risk is coming.

However, the real recessions warning sign is the 2-year vs 10-year yield inversion. When this inverts, a recession is coming - history shows a 2-10 year inversion has predicted a US recession every time over the past 40 years. Note, however, that it hasn’t inverted yet but at 15 basis points (0.15%), it’s not far off at all.

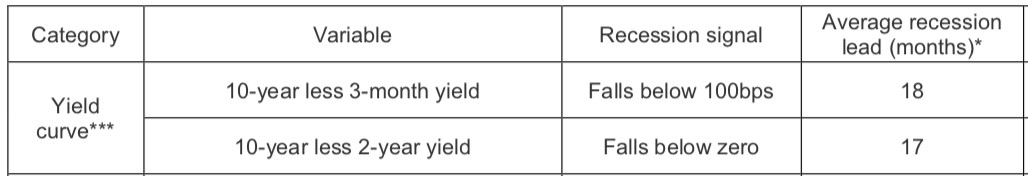

This table from Macquarie illustrates what the average time frame is for a US recession once the 2-year-10-year inverts.

(Source: Macquarie)

Thus, where does this leave the Fed, and its rate hike trajectory? Will the spreads in the bond and corporate debt markets make the ‘data dependent’ Fed pause?

I would argue that is unlikely and believe that this Thursday is still a lock for a 25-basis point rate rise.

Here is why:

- Chairman Jerome Powell (Neutral): “Interest rates are still low by historic standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy — that is, neither speeding up nor slowing down growth.” Speech on November 28

- Governor Lael Brainard (Traditional Dove): “The gradual path of increases in the federal funds rate has served us well by giving us time to assess the effects of policy as we have proceeded. That approach remains appropriate in the near term, although the policy path increasingly will depend on how the outlook evolves.” Speech on December 7

- Vice Chairman Richard Clarida (Perma-Dove): “What I want to emphasize... is, at least from my perspective, we’re at point now where we really need to be especially data dependent. The economy is doing well. We’re looking for signals from the labour market, from inflation, to get a sense of both the pace and the destination for policy.” Interview on CNBC on November 16

- Vice Chairman for Supervision Randal Quarles (Neutral): “There’s a range of views on the FOMC about… [the] spread of terminal rates … [which we believe is] somewhere between 2½ and 3½ percent – we are approaching that range. But it is a – it is a range. And where we will end up in that range will depend on the data that we receive and our assessment of the performance of the economy over the course of the next year.” Discussion on December 4

- New York Fed President John Williams (Hawk): “I do expect further gradual increases in interest rates will best sponsor a sustained economic expansion.” Press conference on December 4

All voting members are still of the same opinion. Data is strong, we are not at the neutral rate yet, and there isn’t any indication that rates have become restrictive. The market can be as chaotic as it wants; the data says hike.