Market Watch: Inflation, below the band

InvestSMART Chief Market Strategist Evan Lucas recaps inflation targets and bands, and precedes where we stand.

This week straddles the end of October and the start of November, meaning there is a rather large amount of data to cover globally before Friday.

The Bank of Japan (BoJ), the Bank of England (BoE) and the People’s Bank of China, all meet this week for either their October or November meetings, while inflation data for the month of September or the September quarter is due for release before the end of October from most G20 countries.

The three most notable events for Australia are as follows:

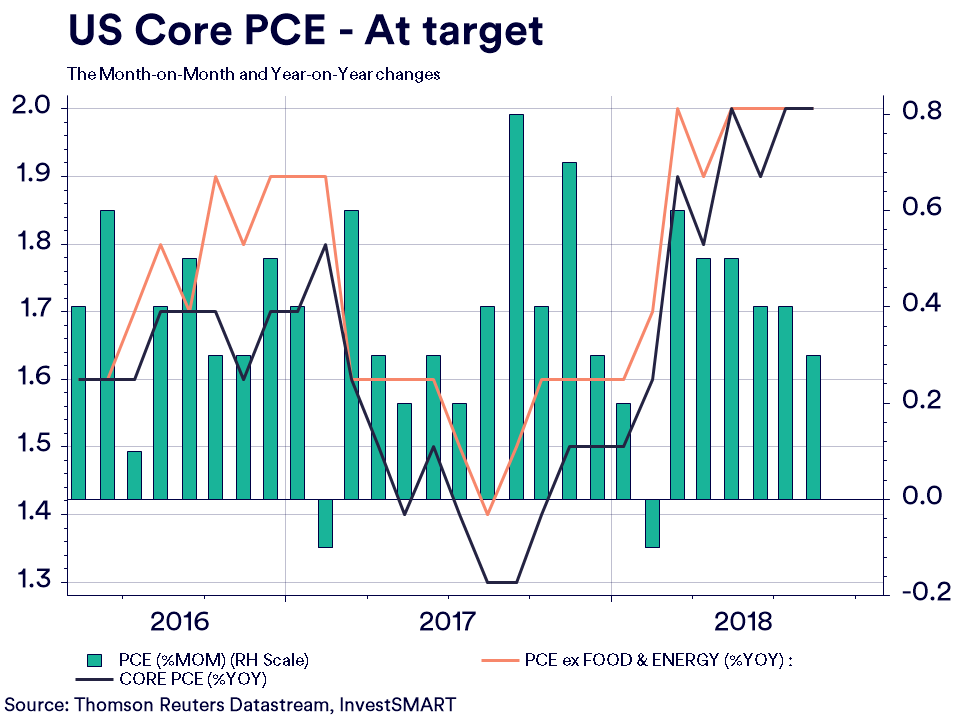

- US core Personal Consumption Expenditure (PCE), the US Federal Reserve’s preferred measure of inflation. The previous read from August was a surprise, seeing PCE slowing to its lowest level in 18 months. However, the 12-month blended figures show that US PCE is at or near the Fed’s target of 2 per cent. The consensus forecast is YoY to remain at 2 per cent, which will justify the Fed’s current policy path of raising rates.

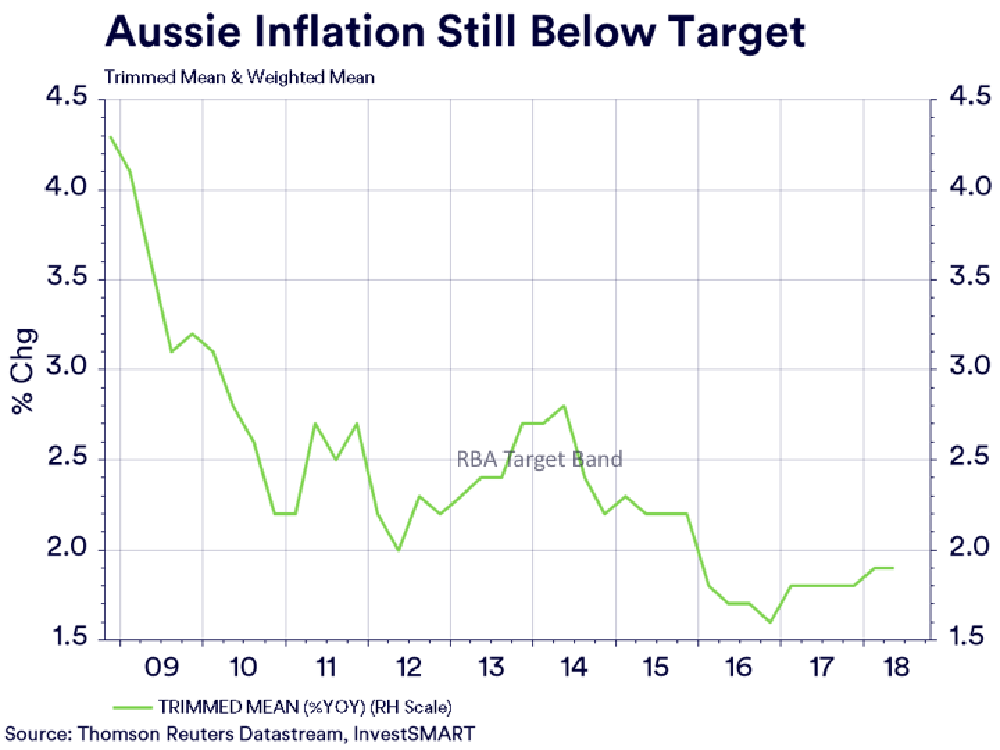

- Australia’s Consumer Price Index (CPI), our measure of inflation. Since the third quarter of 2015, the core measures of CPI (the RBA’s Trimmed Mean read) has been below the Reserve Bank of Australia’s (RBA) target band of 2-3 per cent. Until last quarter, core inflation had flatlined at 1.8 per cent for six consecutive reads. However, Q2 did provide some green shoot support to the idea that Australia is beginning to see some inflation to increase to 1.9 per cent. The reasoning? The employment boom had begun to eat into employment slack and wages were beginning to shift. However, the key driver was housing, and the change in housing in the third quarter is likely to be negative suggesting core inflation will spend another quarter below the target band. This could even suggest it’s moving away once more.

- Chinese Purchasing Managers Indices (PMIs). October appears to have been a ‘line in the sand’ moment for Beijing. With Chinese markets down 30 per cent for the year, and industrial production and GDP also declining, the ‘step in’ from President Xi stating Beijing will support its sectors is a poignant reminder that China will support itself. The PMIs are likely to confirm that momentum has bottomed out and is likely to show manufacturing is ‘neutral’ at around 50 points. This will likely change in November.