Market Watch: Don’t worry about Canberra

The noise from post code 2600 this week has been one most of us can’t ignore. Interestingly however, it seems the local market has, for the most part, been able to disregard the chaos.

The fact Australia has its 30th Prime Minister as of Friday, and its seventh in the last 11 years has been of little consequence – meaning the impact of Australian fiscal policy on the overall performance of our equity market is negligible, and policy impacts are normally negated over time.

The Keys:

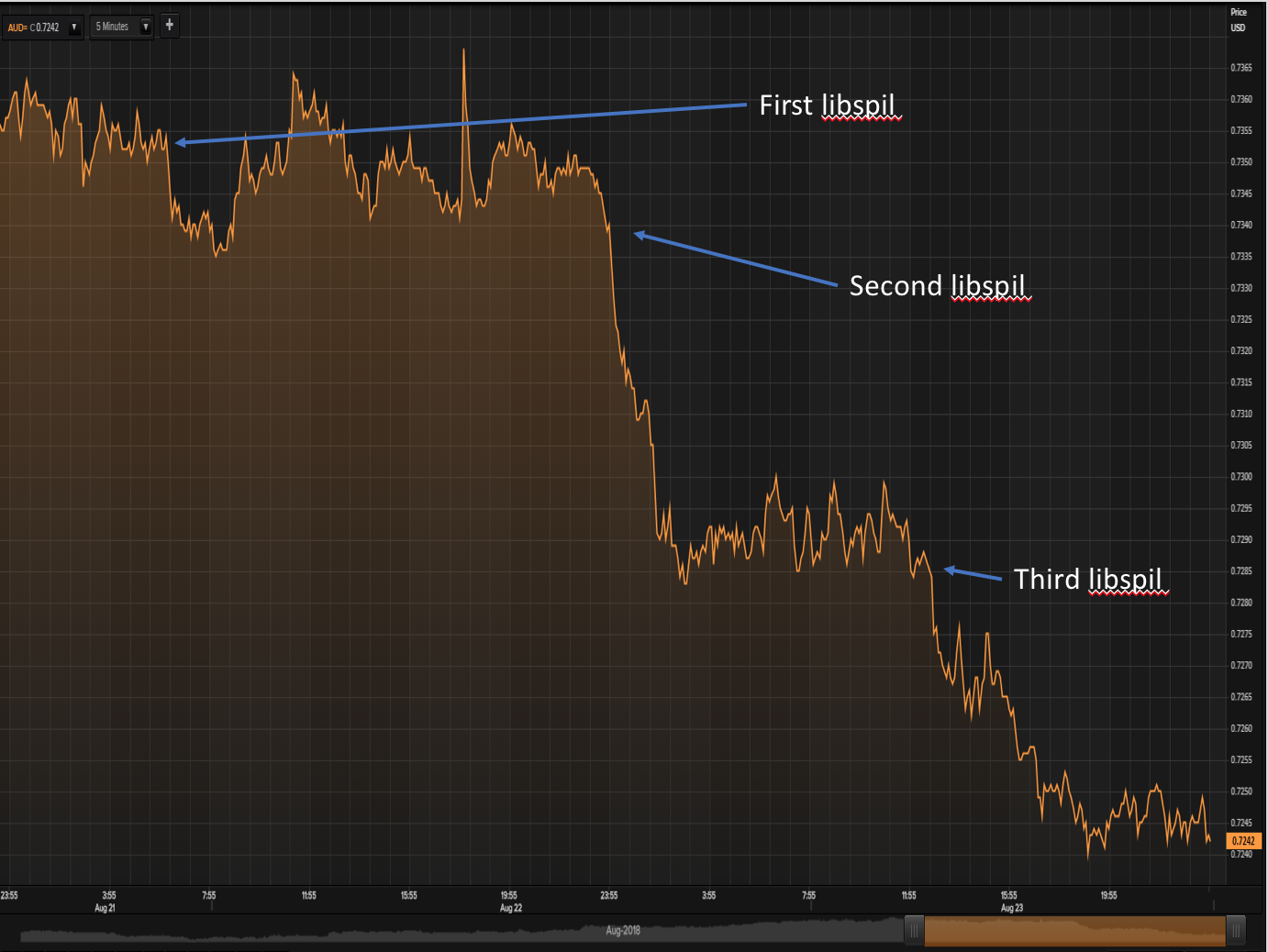

- The happenings of the week in Canberra did show in some markets, with the most notable and instantaneous being that of the AUD. The reaction of the currency to the three announced ‘libspils’ varied dramatically. However, the fall in the AUD over the three days was only 100 pips (one cent). The currency’s reaction to Deputy Governor Guy Dobelle’s speech on Thursday was a bigger mover on the currency. His speech stated that the RBA sees inflation falling away in the final two quarters of the year, meaning rate hike pressure is getting further and further away (Monetary and economic releases have and have had much larger impacts on the currency than what has happened in Canberra this week).

- The ASX did indeed give back over the week, however it was only around 60 points, with the majority of that weakness coming on Tuesday against the backdrop of BHP’s FY18 numbers, which were solid, but forecasted a choppy FY19 due to Chinese growth concerns. If you look at ASX trading on Thursday and Friday – when the leadership issue came to a head – the market is neutral over the two trading days.

- The bond and money markets moved into a slightly more ‘dovish’ position on Thursday, however none of the moves were outside the normal global trading conditions. The interbank market (the market that prices rate movement risk) was unchanged at a 50 per cent chance of a 25 basis point rate rise by November 2019.

Conclusion: Canberra had little effect.

Looking ahead to likely future events, a Federal election will be called over the coming six months, as the mandate for the current sitting period is until March, 2019. However, it is likely to be earlier than this after the events of this week. Looking back at how markets move during election campaigns and then after Federal elections is interesting.

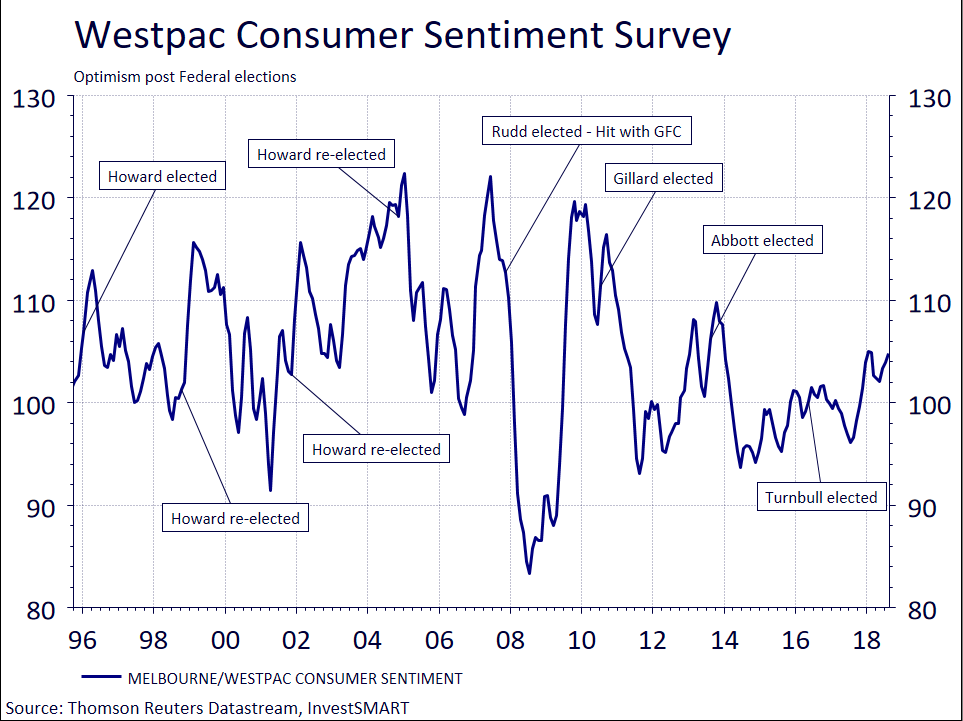

Since the 1996 election, consumer confidence has increased and moved into optimism for the first three months after every single election, barring Kevin Rudd’s win in 2007, which was hit by the GFC.

It shows that the general electorate sees ‘certainty’ and ‘stability’ after an election, even if the last three sitting Prime Ministers have been toppled by their own parties.

Remember, this survey measures people’s views on household finances, job prospects and the overall economy. Whatever happens as a result of Friday’s change, history suggests confidence will grow after the election.

The equity market is not as clear-cut as sentiment, as equities tend to drift leading up to and during the campaign period. However, for the most part, every Prime Minister since 1996 (again barring Rudd in 2007), has enjoyed some short-lived ‘honeymoon’ period post their election victories.

There will clearly be some policy announcements which will push-pull certain sectors and funds over the coming period, but over the longer-term, the market mostly looks through Canberra. That’s why it’s not always about Canberra – it’s about the state of the country’s economic and private output.