Market Watch: Crunching confidence and credit

In just eight weeks, we have seen quite a shocking change in views around Australia’s economy. It went from a place of quiet optimism to straight-up pessimism in just eight weeks.

Collapses in both consumer and business confidence even led the RBA to step away from its hiking bias to a very neutral stance with a dovish undertone. This is a position I am dubbing ‘dawkish’.

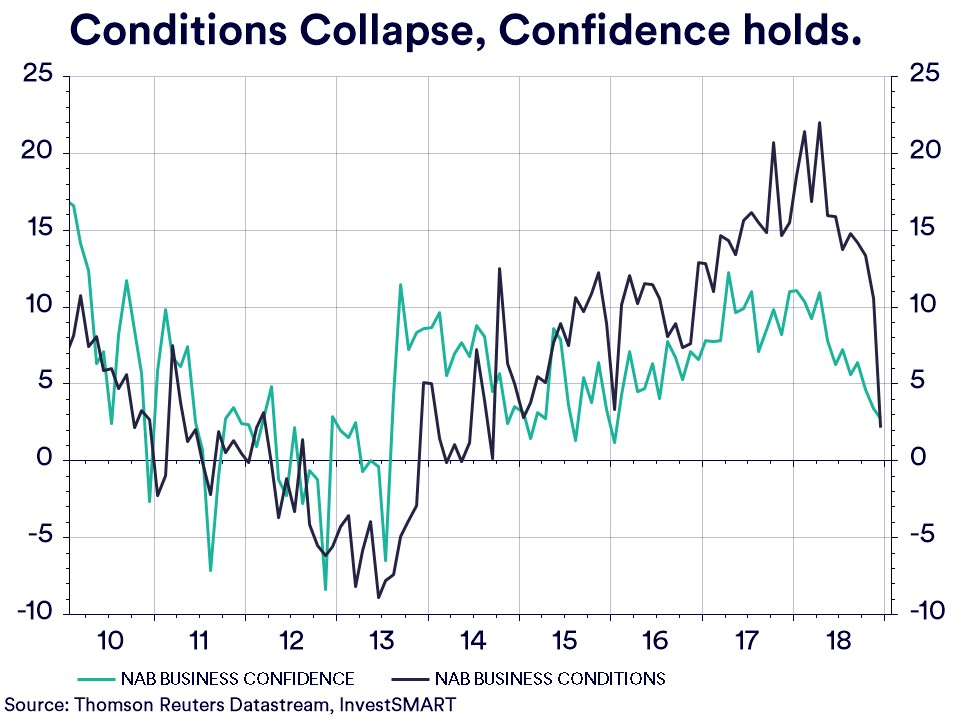

What was so concerning about the December business confidence numbers was the fact that conditions tumbled -9 points to measure at just 2 points. This was the biggest monthly fall since October 2008. That was the month after Lehmann Brothers collapsed.

But it’s more than that. It is the style in which it fell. The collapse in conditions wasn’t sector-specific, it was economy-wide. Trading conditions fell -8 points to 7 points, profitability fell -8 points to 0 points, and employment fell -5 points to 4 points. That all signals a sentiment issue.

If these subsectors hold or fall further in the January survey, released on Tuesday, it will not bode well for the RBA’s GDP forecasts of 3 per cent. It would mean business spending and investment is clearly reversing. That will lead to increases in unemployment, lower wages and lower business investment.

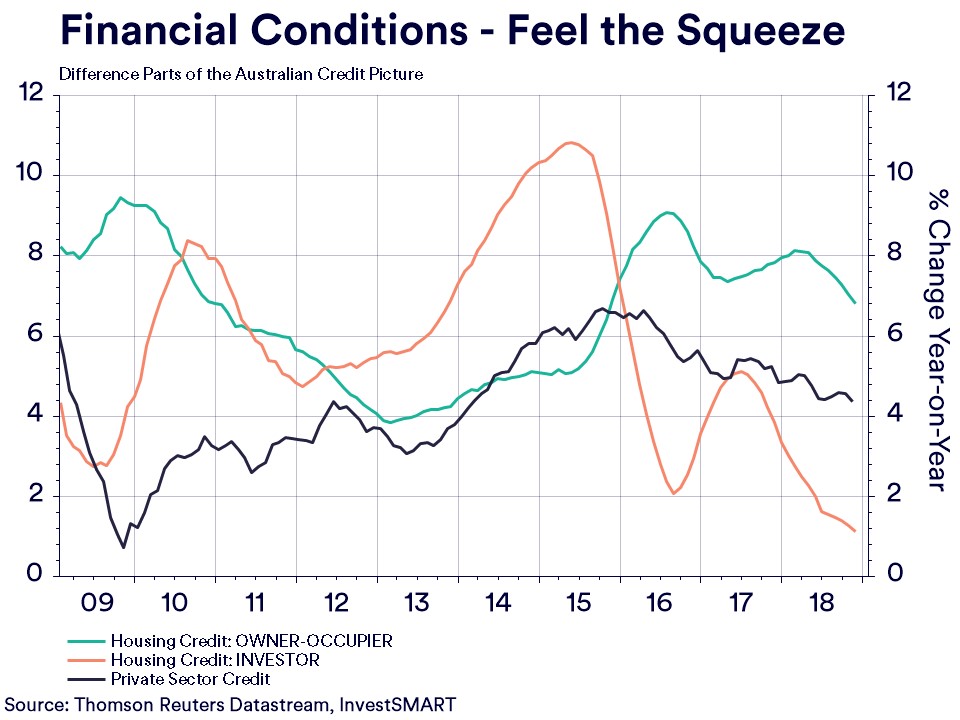

Further to business and consumer confidence figures is the release of private sector and housing sector credit numbers.

Over 2018, as financial conditions tightened, credit flows started to fall. Couple this with the increased ‘self-regulation’ from the banks due to the Royal Commission and all three metrics have been in decline. This is starting to drag on growth.

The December figures saw total private sector credit expand at 4.3 per cent year-on-year. This was the lowest read in 4.5 years, while total housing credit growth eased to 4.7% year-on-year, also the softest read in 4 years. Based the current estimates and market feedback, the January read is likely to be weaker still.

This all gives the RBA even more reason to ponder.