Market Watch: Bank Central

Diversification is one of the core pillars to investment and overall returns.

Over the past five years, international investment has been key to outperformance as growth markets took full advantage of the highly accommodative monetary policy from central banks around the world.

The money taps have been flowing, and although there is some tightening on the horizon, growth markets continue to outperform due to stagnate inflation leaving policy globally loose.

The keys

This split week (half July, half August) presents an interesting situation for data releases and central bank policy meetings.

The Bank of Japan will meet for its July meeting while the US Federal Reserve and the Bank of England will meet for their August meetings. The global data this week will be core to the underlying assumptions that central banks will take to their respective meetings. In Europe, Q2 GDP and June CPI reads will be releases, and in the US, core Private Consumption Expenditure (PCE) metrics and July Nonfarm Payrolls (NFP) will be published.

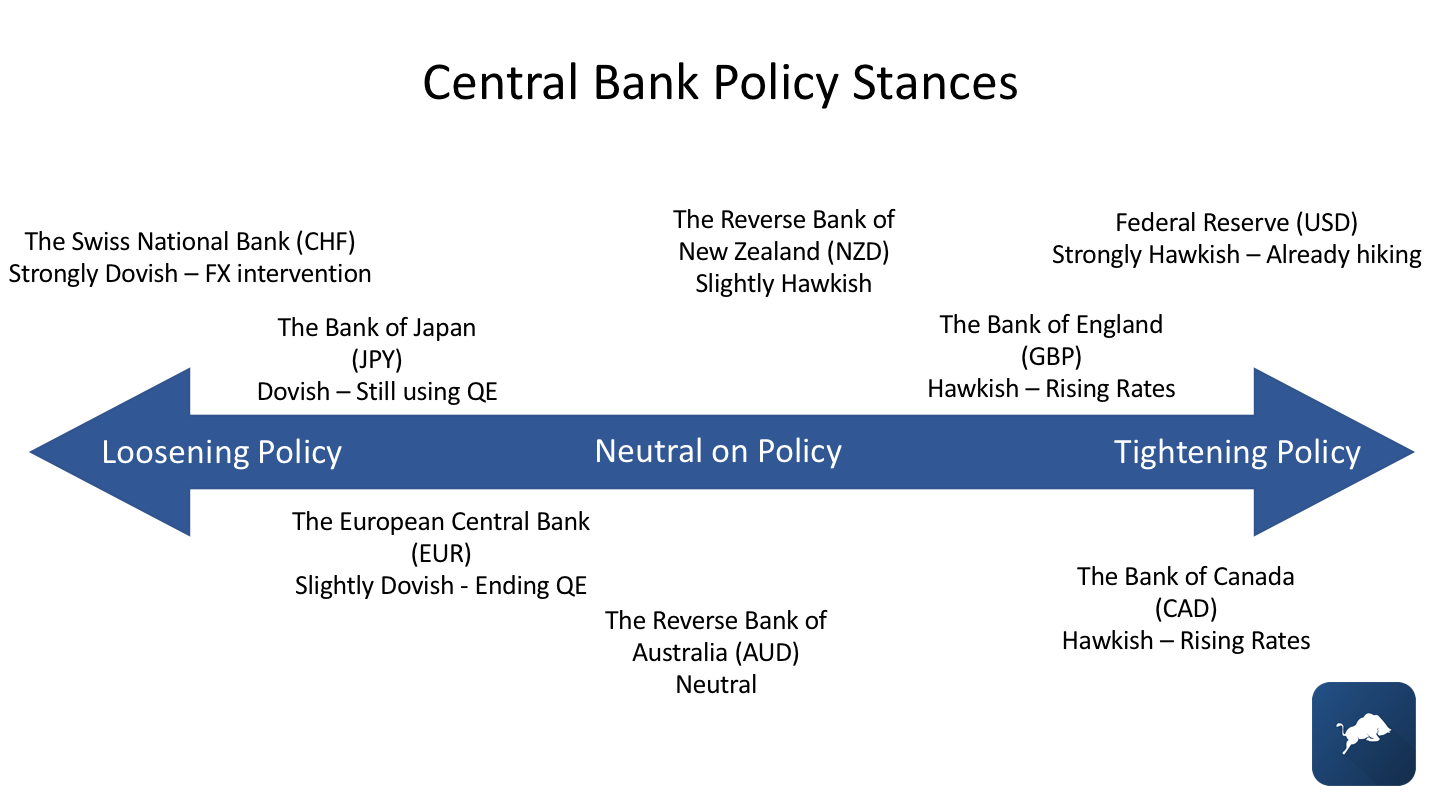

At least one thing is clear from consensus forecasts and retrospective actuals. Although economic growth has not seen inflation materialise as fast as theorised, it is causing central banks to shift their respective policy stances. A world with hawkish monetary policy will – over the longer term – slow international markets.

Hawkish bankers

This evolving ‘hawkishness’ of global central banks is core to international allocations in 2019.

The US Federal Reserve is on track to hike rates a further six times in the next 18 months. The August meeting will not see rates move a further 25 basis points, but the central bank is expected to reiterate that we will see US interest rates rise in September.

Furthermore, if the current trend in US employment continues, the trajectory to increase rates will only accelerate. NFP data will be released on Friday; employment is at its strongest levels since the 1950s. Further confirmation that PCE is reaching its 2 per cent target will only add to the haste.

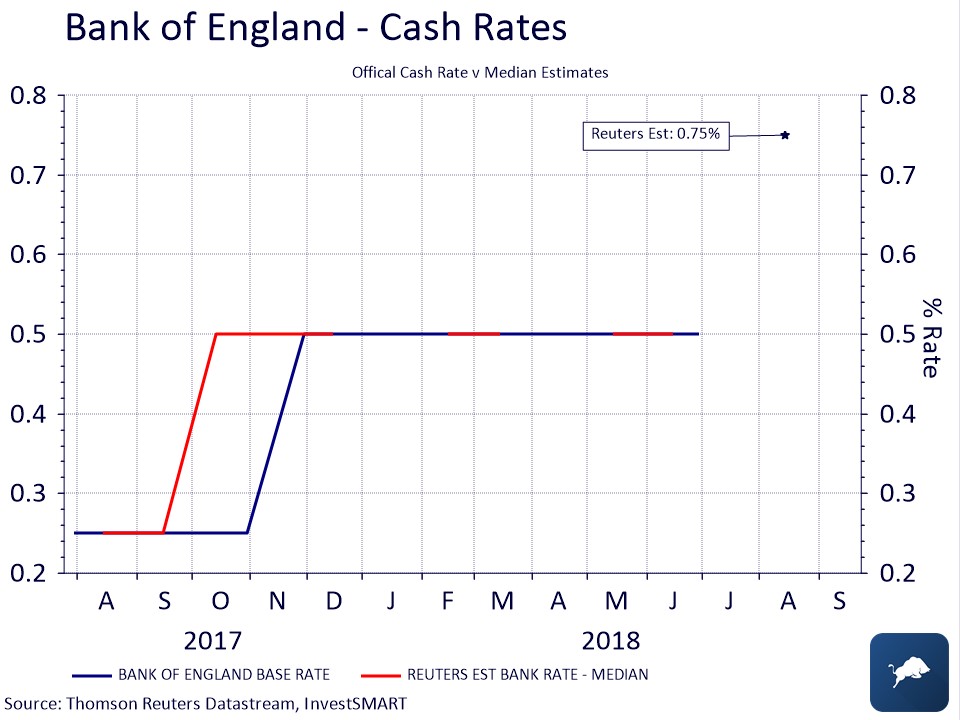

The most actionable release of the week is the Bank of England meeting on Thursday. The Reuters consensus for the Bank of England live event sees a 25 basis point rise to 0.75 per cent, up from 0.5 per cent. This is despite the ongoing issues with Brexit.

The UK economy has been solid, without being stellar, and housing outside of London has been rather mixed. However, the Bank of England has wanted to move out of its highly accommodative policy stance now for over four years. This would make for a second rate rise in the post-Brexit environment.

We continue to see growth assets and international allocation as core. However, we are aware that the tightening of funds is inevitable and will slow outperformance in the medium term.