Making the most of a golden moment

Summary: Trends towards negative interest rates have sparked a global interest in gold, while closer to home our falling dollar continues to make the case for the precious metal. My preferred exposure to gold is through ownership of the metal, but there are a number of opportunities in Australian gold stocks – I've outlined these across four tiers according to market cap. |

Key take out: There are 19 listed companies with exposure to gold and market caps of more than $100 million, which I have profiled here. There are also a number of smaller exploratory projects waiting to be discovered. |

Key beneficiaries: General investors. Category: Commodities. |

Gold has retreated from last Thursday's all-time high in Australian dollars of $A1771 an ounce, but the case for continuing to watch the metal remains as strong as ever especially at a time when some international banks are charging (rather than paying) an interest rate on deposits.

Governments and some big companies, such as Switzerland's food giant Nestle, are getting in on the reverse rates trick. In Germany, government bond yields are negative to the year 2024.

Negative interest rates have become so pervasive that hundreds of billions of dollars are being invested not to generate a return but to simply be in a safe place – which has historically been the principal appeal of gold.

In this curious world created by central banks it is possible to argue, for the first time, that non-interest bearing gold generates a better return than some bank deposits or government bonds.

Negative interest rates, coupled with uncertainty about the international economic outlook, are among the forces generating a gold revival on a global level, helping lift the price in US dollars over the past few months to a high of $US1255/oz, before retreating to recent trading to $US1203/oz.

Closer to home there is another set of circumstances making the case for gold, which Eureka Report has been covering for some time (see Falling market opportunity 1: Gold investments in $AU, February 10, and Gold shines through in tough markets, January 20, 2016).

The first of the local factors is the Australian dollar, which has fallen by 35 per cent from a peak of $US1.10 in mid-2011 to its current US71c, a decline which magnifies the US dollar gold price on conversion and has a significant effect on the profits of Australian mining companies which sell their gold in US dollars while enjoying an Australian dollar cost base.

The dollar theme was picked up this week in the US investment magazine, Barron's, which tips two Australian gold stocks as buys, and one as a sell (read here: Which Australian gold stocks sparkle?).

Newcrest, according to Barron's, is the sell. Evolution and OZ Minerals the buys, with OZ a controversial choice as it is mainly a copper miner with gold as a by-product.

Another factor which has been overlooked by investors is that Australia remains one of the world's biggest gold producers with a successful group of goldminers which were once well-researched by stockbrokers and investment banks but which have been neglected in recent years.

From being a star sector of the stock market in the decade up to 2012, interest in gold stocks has faded in research departments to the point where most investors will struggle to find a report covering a sector which has “Australian natural advantage” written all over it.

Whatever the reason for brokers dropping their gold coverage and for the news media dismissing gold as one of yesterday's commodities the reality is that over the past 12 months gold has been regaining its gloss thanks to the currency changes and global financial jitters, which are best reflected in negative interest rates.

Changing market conditions mean that it's hard for an investment adviser to say gold is a bad investment because it doesn't pay interest when some alternative safe havens go one step further and charge a fee on savings.

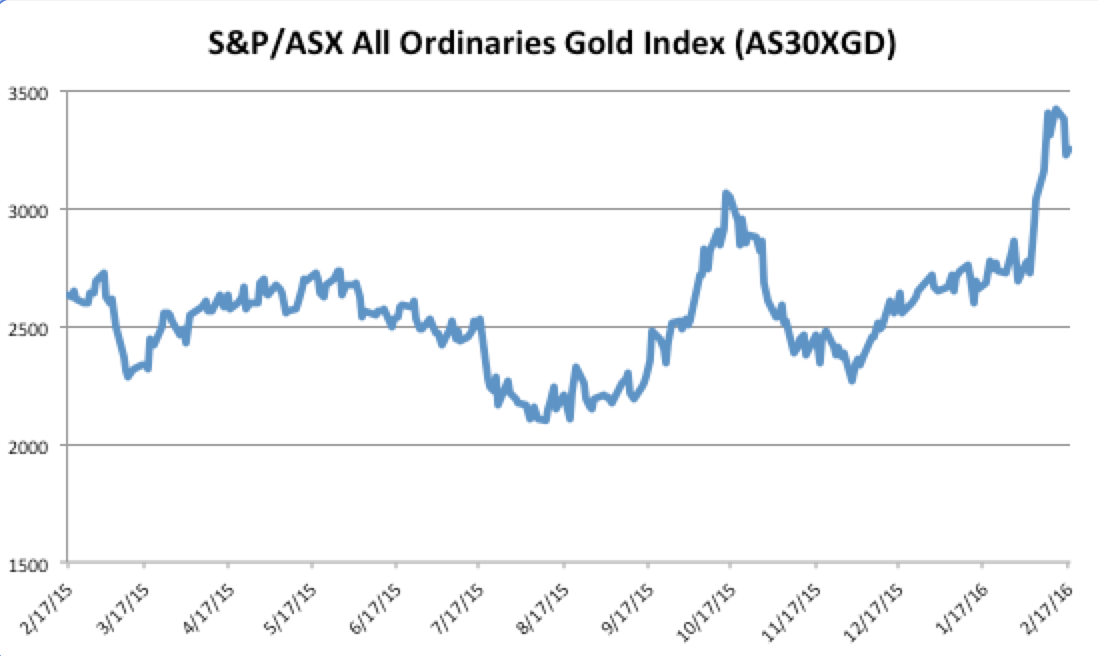

The appeal of gold can also be measured by the strong rise in the ASX gold index which is up over the past 12 months by 23 per cent compared with a 15 per cent call in the all ordinaries index.

My personal favorite when it comes to gold remains the metal itself because it eliminates the risk of human error in a mine, or a financial error in mistiming a forward selling program.

But, for most Australian investors there is the attraction of investing in locally-listed goldmining stocks where a smorgasbord of choice still exists even if very few professional advisers currently research the sector.

One way of looking at local gold stocks is to subject them to a “materiality” test which essentially means checking stock market values and daily trading volume to see whether it is as easy to get out as it is to get in.

In most of the 300 gold-exposed stocks on the ASX, the risk factors remain too high and the values too low to attract anyone other than a speculator seeking a quick trade.

However, there are 19 listed gold companies which pass a materiality test by having a market value of more than $100 million. Of that group five have a value of more than $1 billion, two are valued at more than $500m, three at more than $200m, and nine at more than $100m.

There are many other gold stocks flying below those test points, some with excellent credentials and exciting exploration programs, but for this exercise I'll look at the top 19, in four tiers.

Tier 1 (more than $1 billion)

Newcrest (NCM): capitalised at $11.7bn and easily the biggest gold stock listed on the ASX, is also a company with more detractors than supporters thanks to its poor profit record, mine site problems, and the cancellation of dividends three years ago. The consensus view of Newcrest is sell, even with talk of the dividend being reinstated. UBS has adopted the hardest line with Newcrest, tipping a 12 month share-price target of $8.66, down 43 per cent on its latest sales at $15.30. Big, it seems, is not always best.

Evolution (EVN): $2.8bn market cap and one of the ASX's gold stars of the past 12 months thanks to record gold production and a handsome profit margin of more than $650 per ounce. On the stock market Evolution shares have risen from a 12 month low of 68c to recent sales at $1.87.

OceanaGold (OGC): $2.2bn, once better known by the name of Macraes Mining after its namesake project near Dunedin in New Zealand's South Island, but more recently expanded to include a mine in the Philippines. Low costs drive investor interest in the stock which has risen from a low over the past 12-months of $1.99 to recent sales at $3.77.

Northern Star (NST): $2.1bn and a favorite among gold investors for the way it has leverage growth off a series of well-timed acquisitions from North American miners. Over the past 12-months the stock has doubled from a low of $1.80 to recent trades at $3.64.

Regis Resources (RRL): $1.2bn thanks to increasing production and a strong profit margin which was running at close to $800 an ounce in the December quarter. On the market Regis has risen from $1.07 to $2.49.

Tier 2 (more than $500 million)

St Barbara (SBM): $836m market cap, benefiting from production at two locations, Simberi in PNG and Sons of Gwalia in WA. A remarkable recovery story, St Barbara has overcome production problems at both locations to enjoy a share price rise from 16c to $1.70.

Saracen (SAR): $737m market cap, one of the best recent performer among the list of almost forgotten goldminers Saracen has enjoyed strong production from its mainstay mines (such as Carosue Dam) and is just bringing on line the redeveloped Thunderbox mine. Its share price is up from 33c to 86c.

Tier 3 (more than $200 million)

Resolute (RSG): $283m, active in African goldmining, up from 22c to 42c.

Gold Road (GOR): $311m, hot recent favorite thanks to plans to develop a new goldmine in WA, up from 29c to 44c.

Doray (DRM): $245m, solid cash flows from the Andy Well mine in WA soon to be complemented by the recently developed Deflector mine. Shares up from 39c to 78c.

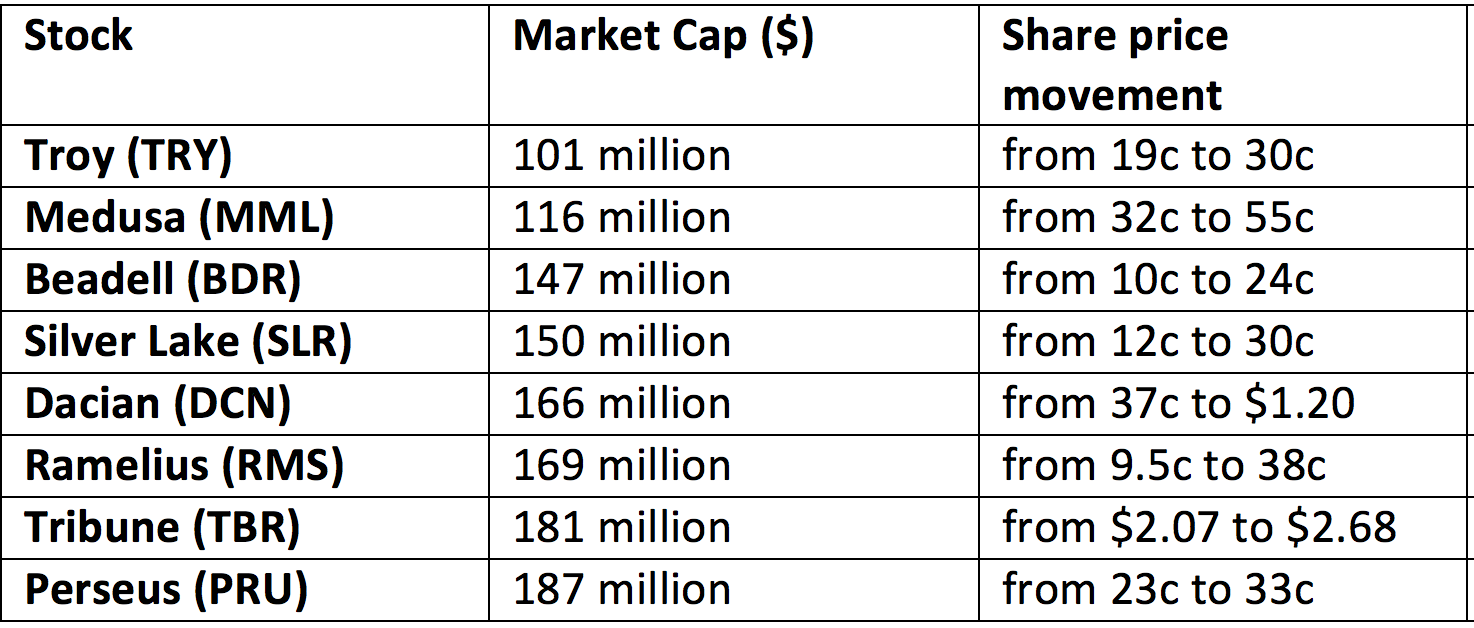

Tier 4 (more than $100 million):

Share price movement at time of writing.

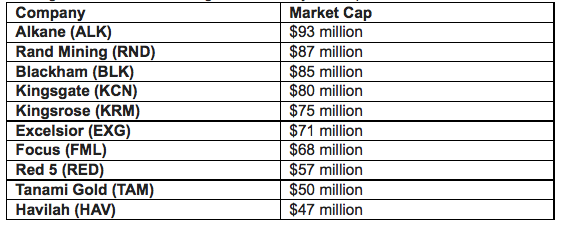

Other gold stocks worth noting because they are in production but often overlooked on a materiality (market value) basis:

Deeper down, if you want to keep digging, are a host of smaller exploration stocks waiting to be discovered – and hoping they can discover something.