Made in Cannabis

In January 1958, the Hula Hoop detonated into a worldwide craze. The toy's manufacturer, Wham-O, sold over 40 million units before the fad cooled off that October, earning the fledgling company tens of millions of dollars in revenue. You can imagine the thrilled directors poring over the books at the end of the year.

Wham-O ended 1958 with a net loss of $10,000. It was broke.

Key Points

-

Canadian supply rapidly growing

-

Short-term price rise likely to give way to falls

-

Excess capacity will hurt Aussie producers

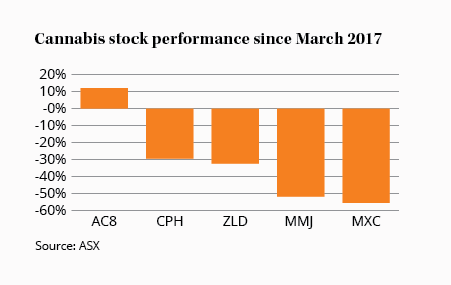

We'll untangle that tale in a moment but first we need to introduce our stars. In early 2017 we reported on the marijuana craze sweeping the Australian stock market: several companies had recently listed, targeting either cultivation, production, or medical research. These included AusCann, MMJ Group, Creso Pharma, Zelda Therapeutics, and MGC Pharmaceuticals.

With all but one of those stocks down 20-60% since then, you may be wondering if now is the right time to invest.

It's natural to assume that demand is always a blessing - that more media attention and sales can only enrich a company's shareholders. Where Wham-O went wrong was in failing to anticipate the market's response: the company ramped up manufacturing so quickly that by the end of 1958, as the craze lost its footing, millions of plastic hoops were piled up in warehouses.

The other thing piling up was competitors: by November 1958, Wham-O already had 40 opponents offering copy-cat Hula Hoops. The founders didn't receive a patent for the toy until 1963, long after the mania ended. When competing products are indistinguishable, companies are faced with a tough choice: (1) lower prices to encourage sales and, in doing so, kill your profit margin; or (2) keep prices steady and inevitably lose customers to a competitor willing to accept Option 1.

O Canada

Competition is growing rapidly in the cannabis industry. At the time of publication, there were 123 listed cannabis-related companies worldwide and over 1,500 unlisted ones, ranging from mega-greenhouses to online stores manufacturing golf tees that double as pipes: 'A perfect accessory for the golfer who loves to discreetly par-tee while on the course,' as the maker put it.

A chart of global production capacity resembles a hockey stick and, fittingly, Canada is winning the game.

In October 2018, Canada became the largest country in the world to legalise cannabis use. Statistics Canada says 5.4 million people bought cannabis from dispensaries in 2018 - around 15% of the population. Including black market sales, the industry is twice as large as the market for chocolate.

When an industry that large suddenly opens its doors, funny things start to happen. Four days after legalisation, Canada's dispensaries couldn't get enough inventory to meet demand, so orders were only partially filled.

Legalisation had a major effect on prices, too - Statistics Canada says that the average price per gram is currently C$8.02, 17% higher than the pre-legalisation price. The average price for legally bought cannabis is nearly 50% higher than that bought from illegal suppliers.

Capacity boom

Demand exceeding supply? Rising prices? If you're currently invested in cannabis stocks, your first thought might be 'you beauty!'. But beware the Hula Hoop salesman - the business opportunity hasn't been lost on budding entrepreneurs.

The Canadian government has a backlog of over 500 commercial grower licence applications and existing suppliers are rapidly increasing capacity.

The world's largest producer, Aurora Cannabis, is building a new greenhouse in Medicine Hat, Alberta. At 21 football fields in size, it will increase annual production capacity from 280 tonnes to over 430 tonnes when it completes later this year. Management expects production costs to be 'well below C$1 per gram' at full capacity, down from C$1.70 in 2018 and C$1.90 in 2017.

Here's the thing: Aurora is working on another 15 greenhouses like this. All growers are. Crop yields typically range from 70-120 tonnes per million square feet. Adding up the top 10 producers worldwide, there's at least 20 million square feet of greenhouses - 347 football fields - in the works.

In 2018, legal cultivators produced around 350 tonnes of cannabis. Canadian demand is roughly 1,000 tonnes per year currently, and that excess demand is what caused the spike in prices following legalisation. However, cultivation capacity is likely to top 2,000 tonnes a year by around 2020, while Canadian consumption is expected to be stable at just over 1,000 tonnes per year.

The scale is about to tip heavily towards excess supply - and with production costs falling below C$1 per gram, we firmly expect a collapse of cannabis prices over the next two years.

Exporting a flood

The only way for Canadian producers to offload their stock will be to sell it internationally, where medical use is legal. That doesn't bode well for Australian cultivators - Cann Group, MMJ Group, Althea, and AusCann among others - where growing costs range from $0.90-1.50 per gram (roughly C$0.86-1.44) according to a 2016 Deloitte study.

With a commodity-type product, few barriers to entry and no established brands, we think the industry is closer to lettuce farming than big tobacco. Those growers that rapidly increase their scale have a shot at surviving because they should be able to lower production costs as quickly as the Canadians. However, like most agricultural products, cannabis production is capital intensive and generates little free cash flow. Even the most lucrative crop producers rarely earn returns on capital of more than a few per cent. Survival is just a different way to lose.

There will probably be a few big names that evolve over the years, most likely in healthcare, where niche, patentable therapies and minor competitive advantages can be built. Unfortunately, it's too early in the game to assess the sustainability of those advantages and how products will perform in the market. Most are still in clinical trials. Predicting revenue, let alone profitability, is impossible.

As for whether or not you should invest in cannabis growers, our advice is crisp and simple: you're better off buying Hula Hoops.