LNG exports: Confusing foreign profits with Australian benefits

The Grattan institute report 'Gas at the Crossroads' makes fascinating reading. Almost the entire report talks about how disastrous the export driven gas price rises will be for Australian manufacturing, business and consumers; but then concludes “but the economic benefits of the change will be overwhelmingly positive”.

Doubly confounding is that the report cited by the Grattan report to support this claim of an “overwhelmingly positive economic benefits” is the same report that just a couple of months ago captured headlines for pointing out that the gas price rises resulting from CSG exports would wipe a staggering $118 billion dollars off our manufacturing output by 2021, while providing an $81 billion dollar bonanza for the gas industry.

So how can something that's bad for just about everyone (except the gas industry) be called an economic benefit?

The answer lies in which measure you choose to claim a benefit, and which measures you choose to ignore.

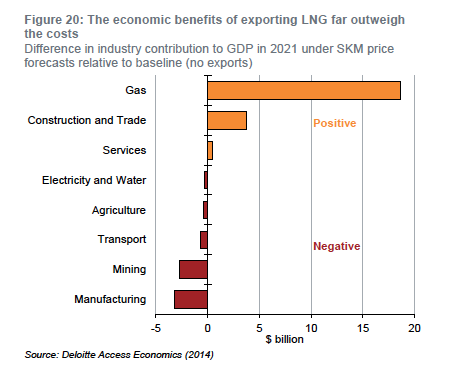

Tucked away on page 29 of the Grattan report there is a graph optimistically called 'The economic benefits of exporting LNG far outweigh the costs':

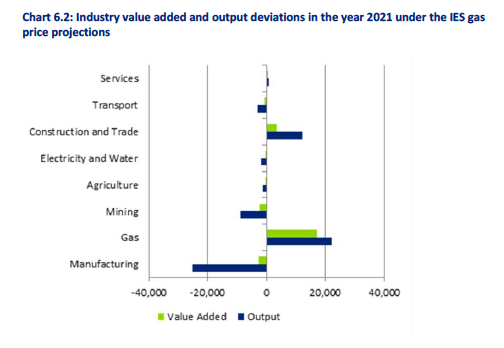

Its source is a Deloitte Access Economics report called 'Gas market transformations - Economic consequences for the manufacturing sector', and is very similar to a graph in that report more prosaically entitled 'Industry value added and output deviations in the year 2021 under the SKM gas price projections'.

The big difference between the two graphs is that the Grattan version removes the strikingly negative impact of the increasing gas prices on manufacturing output, and keeps the more positive measure of 'Gross value added'.

And there is no doubt that if you delete the 'output' bit, things look much rosier.

So what do the 'industry output' and 'Gross Value Added' (GVA) actually measure? And which is a better measure of economic benefits?

The odd thing is that the $22 billion that the gas exporters will make as a result of gas price rises in 2012 results in a booming $18.5 billion in GVA, while the devastating $25 billion loss of manufacturing output only results in around a $2 billion loss in GVA.

This is because industry output includes the cost of inputs, money being pumped back into the economy, whereas GVA subtracts this.

So the fact that the gas industry is so profitable, and has to spend far less on inputs in the rest of the economy to make those profits means that its GVA is far higher than manufacturing.

And where do the profits go? Eighty per cent go straight overseas to Exxon, Petronas, Sinopec, Shell and all the other foreign owned companies that dominate the gas exports, while the remaining 20% is split between Origin and Santos.

The bottom line is that is that GVA is not a good measure of 'economic benefit' because it excludes the value of the money being pumped back into the economy by manufacturing and says nothing about where the profits go.

Essentially, it's a transfer of wealth from Australian households and businesses to the foreign owners of the oil and gas majors with license to export Australian gas.

Interestingly, even the apparently positive contribution to GDP (the sum of GVA in all sectors of the economy) claimed by the Deloitte report is not uncontested. Credit Suisse recently estimated that gas exports would result in “a ~0.8 per cent drag on Australian GDP from every $2GJ rise in the domestic gas price”.

The other economic benefit claimed by the report is that the gas export industry will provide 17,000 jobs (after the brief construction phase).

The irony here is that the oil and gas industry is remarkable for how few people it employs. The entire industry in Australia employs around 24,000 people, less than a third of 1% of the Australian workforce, and by knocking out $118 billion in manufacturing output, is undoubtedly destroying a huge amount of jobs in the labour intensive manufacturing sector, which employs around one million people.

To the report's credit, it has some great analysis by Pitt and Sherry showing the huge savings households can make by switching from gas to efficient electrical systems.

But it then argues that governments should “remove barriers to gas supply” (read, allow more CSG mining) without any explanation of how this would help reduce prices, given that this gas will locked into oil-linked prices anyway.

Australian gas consumers are unlikely to get much comfort from the Grattan Institute's reassurance that it will be good for us because it increases GDP. The increase in their gas bills as a result of the dubious decision to open the CSG floodgates is counted as Australian GDP but largely flows to the foreign owners of the oil and gas majors exporting the gas.

The real value of the report is that it shows that governments can reduce the exposure of households and businesses to this inevitable price shock through energy efficiency and providing incentives to switch to electrical systems that are already cheaper. Let the rush from gas begin.

Mark Ogge is researcher and public engagement officer with The Australia Institute