Lithium deal a win for Australia

Summary: US-based Albemarle’s decision to move into Australia represents a terrific opportunity for Australian lithium mining.

Key take-out: Despite this good news, the trade war and other economic indicators have caused the prices of commodities and lithium mining shares to fall.

Trade war fears are rubbing the gloss off commodity prices, as the economies of China and the US start to slow. However, there was a deal last week which could trigger a sector-wide re-rating, with US lithium leader Albemarle choosing Australia over Chile to expand production.

The significance of Albemarle agreeing to pay $1.6 billion for a half-share in the Wodgina lithium project being developed in Western Australia’s Pilbara region by ASX-listed Mineral Resources is not yet fully appreciated, but it could be the most significant event yet in the lithium rush.

Until recently, Chile and other South American countries which extract lithium from salt lakes were both the historic leaders in lithium, and seen as the future of a metal which has emerged as an important ingredient in the production of batteries.

Australia – with its hard-rock lithium mines – was seen as a temporary winner, able to snatch market share while South American producers tooled up to meet demand, with their brine pond systems widely believed to be the lowest-cost source of lithium.

Albemarle’s full-blooded entry into the Pilbara lithium sector is a big step in dispelling that belief, for several reasons.

Firstly, the US specialty chemical-maker has been a long-term producer of lithium in Chile and knows the brine production route, but it also knows that Chile can be a difficult country for business.

When the Chilean government banned a planned $US1 billion expansion of brine-sourced lithium by Albemarle, the investment was switched to Australia within a matter of days.

Albemarle is already half-owner of the big Greenbushes lithium mine in the south of Western Australia, and is also working on a number of expansion projects. It is more comfortable with Australia as an investment destination than Chile.

Secondly, Australian hard-rock lithium extracted from mines such as Wodgina, Greenbushes and the recently opened Pilgangoora ‘twin mines’ of Pilbara Minerals and Altura Mining might not be the second-rate material some critics claim it to be.

Hard-rock lithium appears to be easier and cheaper to convert to a semi-finished, battery-grade material called lithium hydroxide, as opposed to brine-sourced material which is generally sold as lithium carbonate.

In other words, battery makers are determining the future of lithium investment by specifying a preference for hydroxide – a change in customer preference which is expected to force the South American brine producers to invest in an additional processing step, which could remove their cost advantage.

Thirdly, Australian hard-rock lithium mines can be developed very quickly, and do not have the same environmental and weather-related problems as brine lakes, where lithium solutions can be hard to manage and rain events can delay production.

Albemarle CEO Luke Kissam said his company had stopped all engineering work on any expansion of lithium carbonate production in Chile.

“We are going to monitor our customers needs,” Kissam said. “What is changing is we’re seeing a significant acceleration in demand for lithium hydroxide, it’s clear we need to focus on lithium hydroxide.”

Albemarle’s investment switch from Chile to Australia was an enormous vote of confidence by an international producer of lithium, with other big producers expected to follow.

Unfortunately for current investors in Australian lithium-mining stocks, the benefit of the Wodgina deal was short-lived as bad economic news overpowered the deal.

Not much change is expected in the short term, even as the world’s political leaders head to Argentina for a meeting of the G20 group of the world’s biggest economies at the end of the week, featuring a potential one-to-one meeting of the Chinese and US Presidents.

Commodities crunch time

The prospect of no change in the trade war – except a possible increase in its severity – has seen the price of most minerals and metals continue a decline which started in April.

The latest victim of the sell-off is iron ore, which fell by 7 per cent on Monday night to $US64.45 a tonne for premium-grade material, its lowest point since July, and a drop which takes the November decline to 16.4 per cent.

Copper – long regarded as the bellwether metal because of its widespread industrial uses – staged a modest recovery to $US2.82 a pound, thanks largely to a five-year stockpile low, but the price is still well down on the $US3.30/lb of mid-year.

The depth of concern in commodity markets regarding demand for minerals and metals has been picked up in surveys of Chinese demand for steel and copper, which appears to have slipped into reverse as trade with the US struggles due to rising tariffs.

Lithium – which is fully exposed to the battery-making industry and, in turn, demand for electric cars – is not immune to the commodity crunch.

However, of all the commodities in which Australia can claim to be a world leader, it is lithium which is showing the greatest growth potential – even at a time of slowing global growth.

Demand is strong as governments encourage a switch from fossil-fuelled vehicles; supply is plentiful thanks to Australia’s mineral-rich geology; and mining is encouraged in most states.

Investors, however, are rattled by the trade war and the potential for a global economic slowdown, which is why the benefit of the Albemarle deal was short-lived.

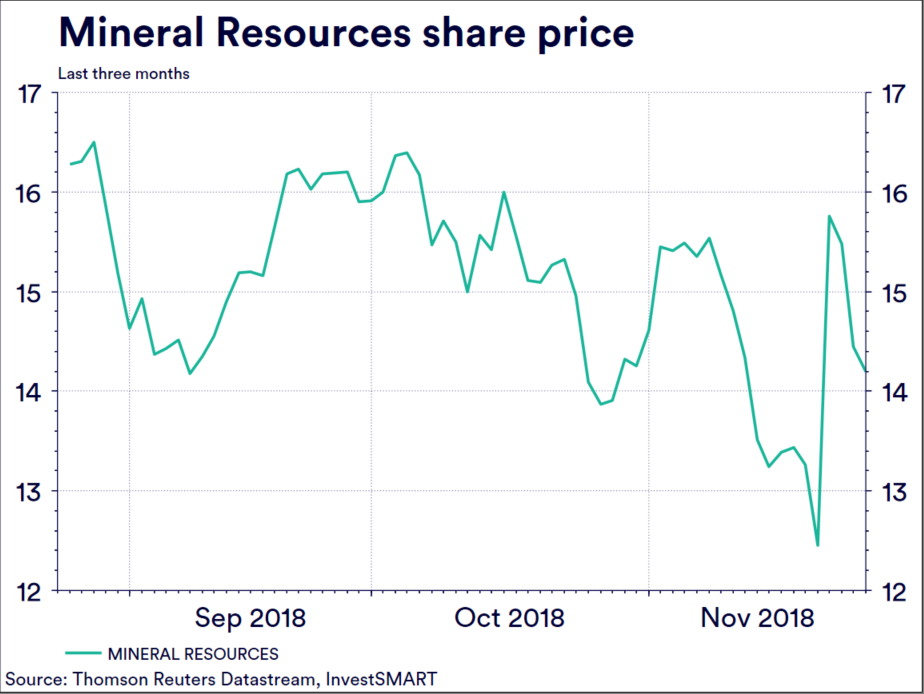

Mineral Resources – the biggest beneficiary of Albemarle’s Wodgina investment – initially saw its share price rocket up by $4 (32 per cent) to $16.50 before sliding away to $14.20 as at Tuesday's trading close.

Other lithium stocks enjoyed also enjoyed a short-term boost, especially those fully exposed to the Australian lithium sector.

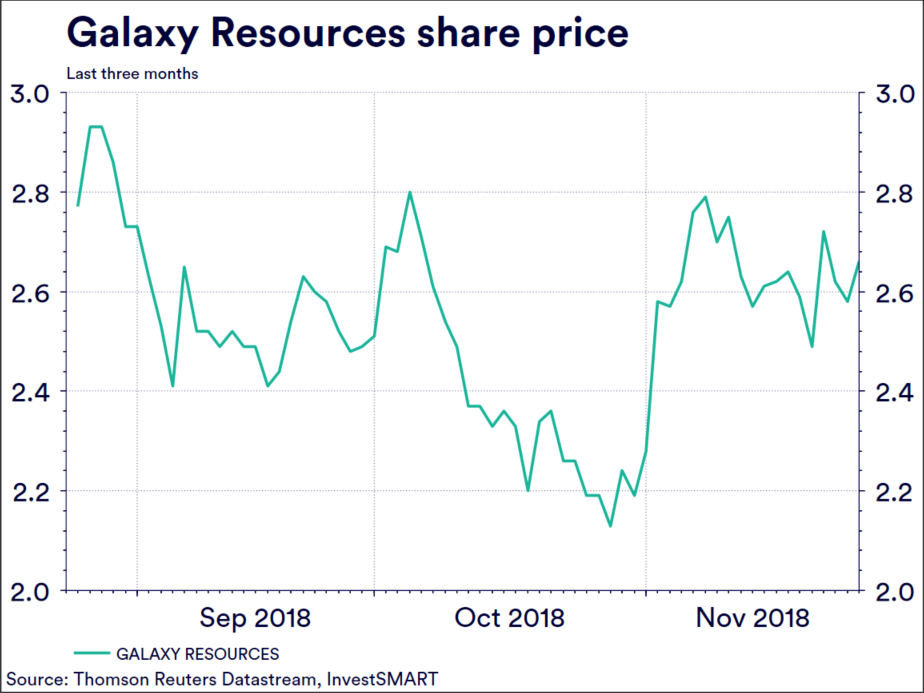

Pilbara Minerals added 6c (7.5 per cent) immediately after the Wodgina deal was reported, but is now back to roughly where it was beforehand at 83c as at yesterday's close. Galaxy added 20c to rise to $2.70, but is now back to $2.66 as at yesterday's close.

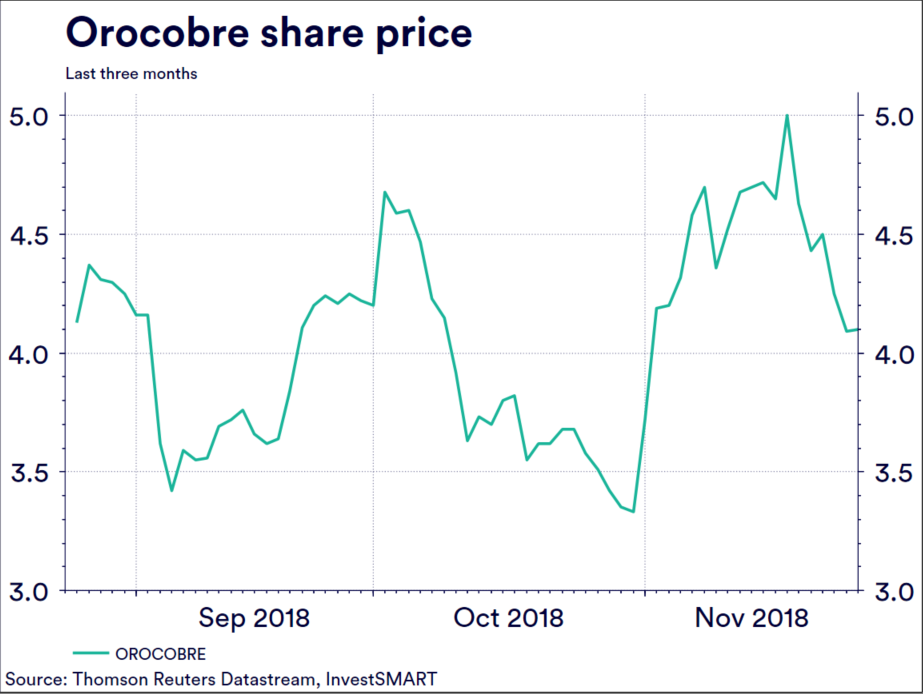

Orocobre – one of the Australian lithium producers with deep South American exposure – enjoyed a short-term post-Wodgina lift, but is now trading at around $4.10 as at yesterday's close, lower than before Albemarle opted for an Australian investment rather than continue arguing with Chilean mining regulators.

The most important aspect of Albemarle’s Wodgina deal is the vote of confidence in Australian lithium that it represents. Also promising is the willingness of the big American company to plough more capital into value-added lithium processing to meet customer demand for lithium hydroxide over lithium carbonate.

In time – assuming China and the US call a truce in their trade war – the broader Australian lithium industry can expect to be re-rated in a delayed reaction to a very significant deal between Albemarle and Mineral Resources.