Kohler's Week: What commodity markets are telling us, Jeremy Grantham's 10 things, US Economy, Rent.com.au, XTD

Last Night

Dow Jones, down 0.32%

S&P 500, down 0.22%

Nasdaq, down 0.02%

Aust dollar, US73c

What commodities are telling us

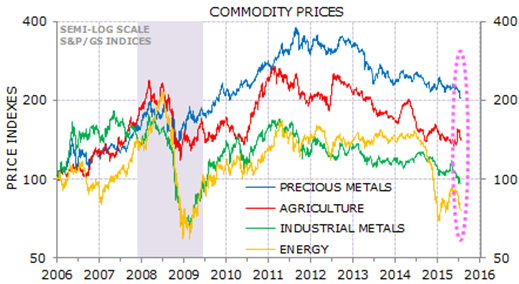

I think we need to start taking notice of what the commodity market is saying. Commodity prices have all dropped rather a lot in the past few months, and while that's in part technically a result of the strength of the US dollar, the commodity market is also saying that global GDP growth is slowing.

I'm not talking about the effect of the fall in commodity prices, which, on emerging and resources-based countries like Australia, is significant, but the cause of it, which is a deeper and more important topic.

What we are seeing is not some kind of speculative burst of short selling, but a genuine downturn across all commodity classes – oil, copper, gold, silver, bulks and foods. Moreover, world trade has been declining for some time. The global economy is cooling.

And why not? It's caused by the presence of loose monetary policy for six years, what Keynes called the “euthanasia of the rentier” in the last chapter of his General Theory of Employment Interest and Money. In the absence of any ability or willingness on the part of the political classes to stimulate their economies out of the Great Recession, central banks have been forced to remove wealth from the savers (rentiers) and give it to borrowers – speculators and producers – in the hope that production and employment might ensue.

But the effect has been to reduce real activity, not increase it. Monetary policy combined with tax policies has favoured short-term speculation at the expense of capital expenditure, and at the same time forced savers to save more and not spend, because their yields were so low.

As a result GDP per capita has been flat, income inequality has surged, labour force participation has dropped to its lowest level in 30 years and governments have been engaged in currency wars that have set false prices for credit and exchange rates.

The suppression of interest rates, the manipulation of exchange rates, increasing taxation and a drought of infrastructure investment (except in China) is having the inevitable result – slower growth rates.

On top of that Europe is now reaping the consequences of a straitjacket monetary system that rewards internal mercantilism at the expense of external trade: Charles Gave of GaveKal says that since 2000 Europe has “lost” half of its potential demand for imports because of the imposition of the euro.

Meanwhile Japan spent two decades trying to stimulate its economy through cheap credit and government spending and got nowhere, so the Abe Government resorted to competitive currency devaluation – a short-term fix that deadens trade and economic growth.

And China is reaping its own whirlwind from the debt-fuelled investment binge designed to maintain employment after exports dropped off following the GFC. Its infrastructure build is finished and the debt has to be paid back. China will be forced to slow internal growth significantly, and since it is also selling less stuff abroad, it will buy less as well.

Low inflation from falling commodity prices and technological advances is reducing long-term interest rates with the result that investment hurdle rates are too high, so that firms aren't investing and savers aren't saving – what Larry Summers calls “secular stagnation”. It could well mean that interest rates are staying low for a long time, and that if the Fed does increase rates in September it will only lift 10 basis points out of principle, and then nothing more for a year.

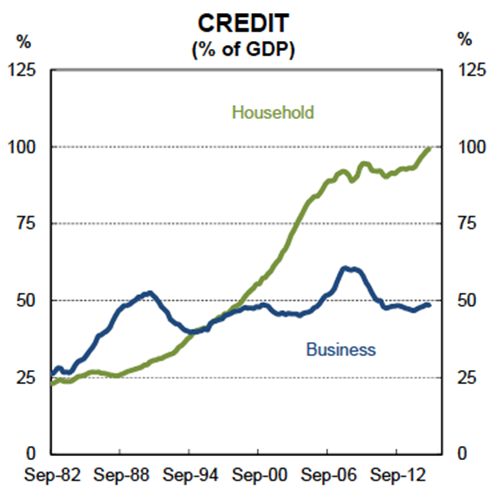

And yesterday we saw the problem in an Australian microcosm: business credit is weak – zero per cent growth in June, while housing credit is strong – up 7.3 per cent year on year (because of investor/speculator demand).

I'm not a bear yet and my own super fund is still 80 per cent invested (20 per cent cash), but I am seeing increasing reasons to be concerned, signalled by what's happening in the commodity markets.

Jeremy Grantham's 10 Things

As always Jeremy Grantham's quarterly letter this week was thoughtful and stimulating, and kind of backs up what I am on about in the above piece. This time, he says, he decided to summarise the ten things he is obsessing about at the moment. He admits they can all be viewed as problems, as potential threats, but as he points out: “surely it is more important to obsess about threats, which we often prefer to ignore. Good news, in contrast, will usually look after itself.”

Here they are:

1. Pressure on GDP growth in the US and the balance of the developed world: count on 1.5 per cent US growth, not the old 3 per cent

2. The age of plentiful, cheap resources is gone forever

3. Oil

4. Climate problems

5. Global food shortages

6. Income inequality

7. Trying to understand deficiencies in democracy and capitalism

8. Deficiencies in the Fed

9. Investment bubbles in a world that is, this time, interestingly different

10. Limitations of homo sapiens

I won't go into his explanations of all the topics – most are self-explanatory.

As for item no. 1, note the average first-half GDP growth of the US in the item below (1.45 per cent). Enough said.

Grantham lists what he sees as the factors limiting US growth, many of which apply to Australia (we also have our own issues, such as falling commodity prices and exports to China).

"Factors potentially slowing long-term growth:

a) Slowing growth rate of the working population

b) Aging of the working population

c) Resource constraints, especially the lack of cheap $20/barrel oil

d) Rising income inequality

e) Disappointing and sub-average capital spending, notably in the US

f) Loss of low-hanging fruit: Facebook is not the new steam engine

g) Steadily increasing climate difficulties

h) Partially dysfunctional government, particularly in economic matters that fail to maximise growth opportunities, especially in the EU and the US.

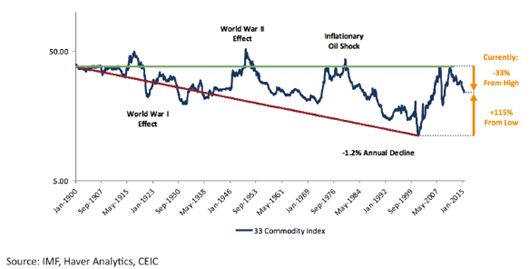

He has this interesting graph of commodity prices, which I showed on the ABC News the other night:

His comment on the graph: “You can see that although the average price has declined handsomely, it has only given back about one-third of the preceding great price surge.”

Under item no.7 – deficiencies in democracy and capitalism – there is this interesting comment that's worth quoting, if only because it reinforces what I'm saying:

“(The) near-perfect synergy between Fed policy and the stock option culture has, not surprisingly, resulted in most of the corporate cash flow of public companies being used for stock buybacks – a record $700 billion annualised rate this year at the expense of corporate investments in expansion. Thus, well into the seventh year of economic expansion, we have uniquely had no hint of a surge in capital spending, which remains well below average. And why should we be surprised? For how risky it is to build new factories and shake them down in a world where things can go wrong and corporate raiders lurk. How safe it is to buy your own stock and how likely that doing so will push prices higher, thus increasing option values (making it easier for CEOs to go from earning 40 times the average worker in 1965 to over 300 times today) and enlarging the Fed's wealth effect at the same time!”

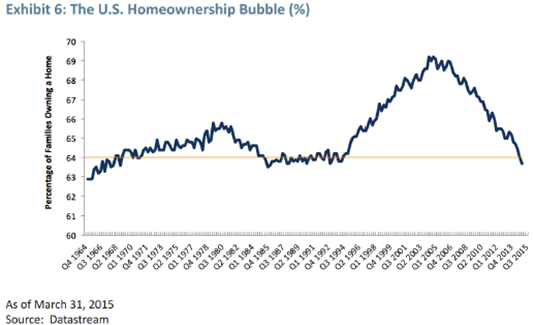

On a related subject, he has a remarkable graph headed: “the home ownership” bubble, which probably applies in Australia as well, although I haven't seen anything like it here.

And finally, what does he mean by No.10 – the limitations of homo sapiens?

“Not only does our species have a strong predisposition to be optimistic (or bullish) – it is probably a useful survival characteristic – but we are particularly good at listening to agreeable data and avoiding unpleasant data that does not jibe with our beliefs or philosophies. Facts, whether backed by 97 per cent of scientists as is the case with man-made climate change, or 99.9 per cent as is the case with evolution, do not count for nearly as much as we used to believe. For that matter, we do a terrible job of planning for the long term, particularly in postponing gratification, and we are wickedly bad at dealing with the implications of compound math. All of this makes it easy for us to forget about the previously painful market busts; facilitates our pushing stocks and markets on occasion to levels that make no mathematical sense; and allows us, regrettably, to ignore the logic of finite resources and a deteriorating climate until the consequences are pushed up our short-term noses.”

And he concludes:

“The good things in ‘The Race of our Lives'

In the interest of full disclosure, I do obsess also about the remarkable acceleration in helpful technologies – mainly in alternative energy but also in agriculture – that may just save our bacon.

It would be a shame, however, to spoil the uniform tone of this quarter's discussion, so I will wait a quarter to update the many positive developments.

Have a good summer.”

US Economy

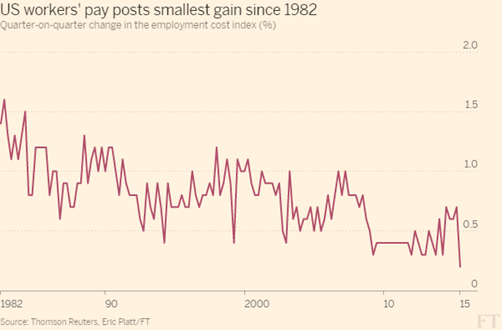

Last night the US Department of Labor reported that wage growth was the slowest in more than 30 years and on Thursday night the Commerce Department released second quarter GDP – growth was OK, basically as expected, but the surprise was a big revision to the first quarter.

The wages data – quarterly employment costs rose 0.2 per cent versus 0.6 per cent expected by the market (note that's for three months!) – sent the Aussie dollar spiking upwards at about 11pm last night, just as Australia was losing the third test at Edgbaston, because expectations of an interest rate hike took a hit. US bond yields fell, so did the US dollar and so did the stock market. The Australian dollar had been down at US72.4c and gapped up to US73.6c.

Why? Because as one economist quoted in the Financial Times said, the wages data is not “lift-off friendly”. Workers in America are doing very badly indeed, and the Fed is going to be cautious about raising interest rates – that is, growth data will need to be very strong to prompt a rate hike. It might happen, but I think probably not.

Actually, it was reported as being the slowest wage growth in 30 years, but look at this chart of it from the FT and you'll see that it's probably much longer – the data only goes back that long:

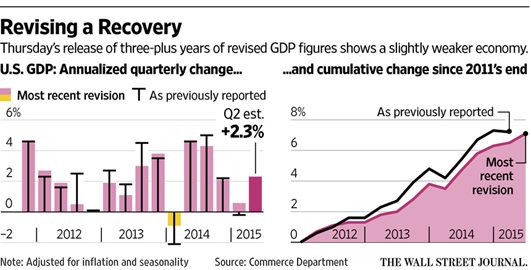

Meanwhile, the US economy grew 2.3 per cent, annualised, in the second quarter of 2015, but importantly the first quarter was revised up from a contraction of 0.2 per cent to growth of 0.6 per cent. As the chart below from the Wall Street Journal shows, revisions are often material, but they don't usually turn a contraction into an expansion.

It means the second quarter result would have been upwards of 3 per cent without the first quarter revision, since GDP growth rates are relative to the previous quarter. The average growth for the first half was 1.45 per cent, which is better than consensus market forecasts. Also Q1 consumption growth has been revised up, from 1.8 to 2.1 per cent.

So according to the GDP data, the US economy is doing better than the Federal Reserve thought, but according to the wages data, it's doing worse. Basically the economy is growing, but workers are missing out.

Monetary policy is all about dealing with the potential for inflation and therefore realised growth versus potential growth, and according to the economists at RBC Capital Markets, the latter took a significant hit in the GDP release.

"Despite the better activity more recently, growth between 2012 and 2014 was revised lower overall. If we take these new GDP outcomes and divide by aggregate hours worked in the economy, it implies MUCH weaker productivity growth during that span. What this also means is that potential growth (which is really just productivity growth labor force growth) was much lower than previously thought… The bottom line is that over the four quarters through Q1 2015 we "realised" 2.9 per cent growth in an environment where potential looks to have been less than 1.0 per cent.”

The potential for inflation, however, took a big hit from the wages data.

All the political pressure these days is to do something about income inequality, so on balance I'd say the latter trumps the former – that the net result of the data is that interest rates are less likely to increase this year, and to be honest I don't know whether that's good or bad. When ‘lift off' happens, markets will be rocky, but it has to happen sometime.

Income portfolio

I introduced Eureka members to our new income stocks analyst, James Samson, on Wednesday and 1000 of you tuned in and peppered him with questions. James discussed the philosophy of income investing and explained how he will choose the stocks to analyse and include in his model portfolio. It was a lively, informative session and, as always, for those who were unable to watch at the time, you can have a look at it here.

CEO Interviews

Another couple of very interesting little businesses, and as usual these should not be taken as buy recommendations, since I haven't done any research on them – just interviewed the CEOs.

This week's companies are both start-ups, both out of Perth, still burning cash and capitalised at $12 million-$15 million. Both of them floated at 20c, six months apart, and are now 15c-17c a share.

1. Rent.com.au

This is an attempt to build an REA-type listings business focused entirely on rental properties. REA carries rental listings, but only from agents, which is apparently less than half the properties up for rent at any one time. Mark Woschnak, founder and CEO of rent.com.au, has got 6,100 agents on board, which is most of them, and 58,000 listings. Next step is to go after the private landlord properties, not managed by agents, which represent 46 per cent of the market.

The business model is to provide the basic listing for free and charge for a bigger ad and other services for the tenants. You can look at an investor presentation here and watch/read my interview with Mark here.

2. XTD

This is a digital “cross-track” advertising operation – that is, outdoor ads in (mostly underground) train stations on the other side of the tracks to the platform, so people see them while they're waiting for the train.

It might not seem like much of a business, but Steve Wildisen, founder and CEO, is going for a global market, not local. He has installed 32 screens in Melbourne's underground loop and 13 in Brisbane purely as a display for international buyers. His focus is on the US, where he is negotiating in seven cities. He says there is no competition – all the cross-track advertising at the moment is just paper posters and no one is offering a digital system.

He's also working on a system to link mobile phones to the screens through an app and Bluetooth, so customers can buy stuff that's advertised or keep watching content after they get on the train. The screens cost $100,000 and the revenue from each is $150,000 a year, so an interesting little business. Here's a preso from March and here's my interview.

Marketlend

Leo Tyndall of peer-to-peer lender Marketlend (who I interviewed two weeks ago) was a bit upset at my comments about his business last week in my note with the interview with Sunil Aranha of ThinCats. Here's his response:

Dear Alan,

In a recent article, you did make mention of Marketlend. We thought we would clarify what our offering consists of:

Protection against losses

We are the only peer-to-peer lender to provide the first loss protection which can be as high as 30 per cent in addition to a loss provision. This means we invest with the lenders and take the first loss in a situation where a borrower defaults.

There is a cost to this protection and it is taken into account in the fees paid by the borrower and not charged to the lender. In addition to the loss protection, we also have a provision for losses.

The only peer-to-peer lender in Australia with a provision for losses as well as Marketlend is Ratesetter, and based on their figures as of 29 July 2015, they have $444,372 in the provision, for loans outstanding of 6,034,957, equivalent to 7.36 per cent.

To date we have invested on average 12.44 per cent first loss protection and it is individual protection. This means that there is no depletion of the loan protection for one loan if another loan fails whereas Ratesetter does not offer the same.

We do offer insurance on our loans. It presently is only available for our debt finance product, that is, a policy where a failure by a borrower will result in an ability to make a claim on the borrower for 90 per cent of any invoices we purchased. Again we will invest the remaining 10 per cent.

We have closed in excess of 15 loans and we have had no defaults to date.

Fees

At Marketlend, all fees are paid by the borrower, and not from the loan proceeds other than the Loan Listing Fee (0.5 per cent). This is an important point as that if it is paid from the proceeds of the loan, it means the investor is funding the costs.

Marketlend is structured using trusts with independent trustees, back up servicer and bankruptcy remote funding vehicles, to further enhance the protection of the assets.

If there was one strong lesson learnt from the GFC, amongst many, and it goes to your argument of testing in a recession, it was that the issuers who had skin in the game during the GFC, that is invested in their own structures, were the ones that typically survived the GFC because they don't walk away when it is difficult because they are invested in it as well and they took on better risk because it was their money at risk as well.

Marketlend is wholly owned Australian company and is here for the long term and testimony to that is that we invest with the lenders, and are charged fees for that investment similarly to the lenders.

Readings & Viewings

Indicting Varoufakis for doing exactly what he should have been doing.

The way I buy sausages could really hurt the banks – by me.

What's the outlook for marketplace lending.

A pdf from BlackRock: “a symphony of uncertainties”

As China's state funds buy stocks, individuals cash out.

Economic policy uncertainty on the rise.

In the US, it's the worst expansion since World War II

China wants to set the rules for the global internet.

Barrie Cassidy: What does it say about our country if this weekend Bronwyn Bishop is still in her job but Adam Goodes is not.

Stan Grant wrote a powerful piece on the Adam Goodes affair and then went on Radio National Drive to talk about it. Here's the article and here's a podcast of the interview.

How capitalism is breaking down India's caste system.

Jim Grant did an interview on Kitco about why he's bullish on gold. Here it is.

And here's a podcast about why gold is heading for $US850, from Savant Investment Partners.

Total collapse: Greece reverts to barter economy for the first time since Nazi occupation.

Then again … the optimist's guide to Greece.

And … Anatole Kaletsky: why the Greek deal will work.

Oxford economics professor, Kevin O'Rourke says the euro can't be made to work.

Janet Yellen's first 18 months running the Fed – the numbers, Vs Bernanke.

“I am an adjunct professor teaching five classes. I earn less than a pet sitter.”

What I learned at the weed dispensary – traditional health should copy the best elements of the medical marijuana industry.

Elon Musk, Stephen Hawking and a few others have warned us about the potential for robots to get out of control.

Happy Birthday Carl Jung. Here he is in a rare BBC interview.

Did you see that incredibly powerful magazine cover showing all the women who were raped by Bill Cosby? Here's a piece about how the empty chair has moved the discussion beyond Cosby.

The long lost story of the longest book ever written.

Here's an argument FOR a carbon tax – why it makes more sense than an emissions trading scheme.

Happy Birthday Robert Cray, 62 today. Here he is performing Old Love with Eric Clapton, one of my favourite Clapton songs, but I didn't know they wrote it together.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Share markets had a mixed ride over the last week not helped by renewed weakness in Chinese shares early in the week but this was offset to a greater or lesser degree depending on the market by good US earnings results, a benign Fed and good data in Europe. While Chinese shares fell, Japanese and eurozone shares were little changed and US and Australian shares rose. In fact the Australian share market is set for its best monthly gain since February, albeit this followed a bad June. Bond yields were largely flat except in Europe where they fell. Commodity prices and currencies were little changed with the Australian dollar remaining just below $US0.73.

Chinese shares had a bad week with their biggest one day fall in eight years, largely in response to a rumour that the China Securities Finance Corp was no longer committed to stabilising the share market. While this was subsequently denied volatility remained high. After very sharp share market falls like the 1987 share crash or through the tech wrecks and GFC it's quite normal to see a volatile period of base building around the bottom. So the same is likely to apply in relation to China. That said further policy stimulus is still needed in China.

Fed on track to hike but no clearer on whether the first move will come in September or December. While the Fed sounded reasonably, its description of the risks to the US economy being “nearly balanced” as opposed to “balanced” suggests it's not itching to hike just yet. A further improvement in growth and confidence that inflation will rise is needed and at this stage its 50/50 as to whether it kicks off in September or December. By the time the Fed does eventually hike it will be the most anticipated rate hike ever, which should mean it will hardly be a shock to financial markets.

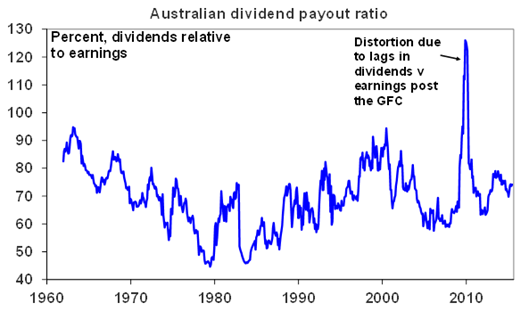

Are Australian companies really paying out too much in dividends? With the August profit reporting season the focus will no doubt return again to the high dividend payout ratios of Australian companies in response to yield hungry shareholders. Some allege that this is robbing future growth potential and risks a "doom loop" turning Australia into a "backwater." But is it really? First let's put it in perspective. The dividend payout ratio of Australian companies at around 75 per cent is not out of line with its long term range. See the next chart.

Source: AMP Capital

Yes it's increased since 2012 but this has been driven by higher payouts for resources stocks and there is a good reason for this. After their huge investment in new mining capacity it makes sense to use excess cash flow now to return to investors via dividends. For the rest of the market the payout ratio has been going sideways! Second, it's far healthier for companies to pay strong dividends (provided they are not being paid using debt) because it signals sustainable cash flows, confidence in future earnings and helps prevent corporate hubris leading to wasteful investment. Finally, capex in Australia is now too low and needs to rise - but the reason its low has nothing to do with investors' desire for dividends. Miners would be crazy to ramp up in investment now and the reason industrial companies are reluctant to invest owes to the beating they got through the mining boom years and a lack of corporate confidence post the GFC which is a global phenomenon.

Major global economic events and implications

US economic data was a bit disappointing. June quarter GDP growth bounced back, but only to a 2.3 per cent annualised pace, the March quarter was revised up less than expected and previous years' growth was revised down. On top of this durable goods orders, consumer confidence, home prices and pending home sales all disappointed. Against this, the Markit services conditions index rose to a solid 55.2 and a surge in household formation to around 1.6 million a year suggests demand for housing will remain solid. Overall the US economy is continuing to grow but it's a long way from booming.

The US June quarter earnings reporting season continues to better expectations. We are now 70 per cent done and 74 per cent of companies have beat on earnings, 50 per cent have beat on sales and earnings growth expectations for the 12 months to the June quarter have improved from -5.3 per cent at the start of July to -0.5 per cent.

Eurozone economic confidence rose in July to a four year high, despite the noise around Greece, and is running around levels consistent with decent growth. On top of this bank lending is continuing to improve and the Spanish economy grew 1 per cent in the June quarter with annual growth at its fastest since before the GFC. Clearly Spain is not a Greece!

Japanese economic data was mixed with household spending down and unemployment up, but against this the jobs to applicants ratio held at its highest since 1992, industrial production rose more than expected in June with an improvement in the July PMI pointing to further gains and core inflation at least rose to 0.6 per cent year on year in June.

Finally, the messy picture in the emerging world is continuing with Brazil hiking rates for the 16th time since April 2013 as consumer confidence there continues to crash. Continue to be selective in investing in the emerging world. Asia - from India to China - looks best.

Australian economic events and implications

Australian data was weak with a sharper than expected fall in building approvals and another sharp decline in export prices in the June quarter. While the fall in building approvals is not really a concern being driven by normally volatile apartment approvals and with the trend remaining very strong, the continuing slump in export prices indicates a continuing fall in the terms of trade and national income. Credit growth also moderated with all components soft except lending to investors which at 10.7 per cent yoy is well above APRA's target. But with APRA now biting hard this is likely to be a last gasp for lending to property investors.

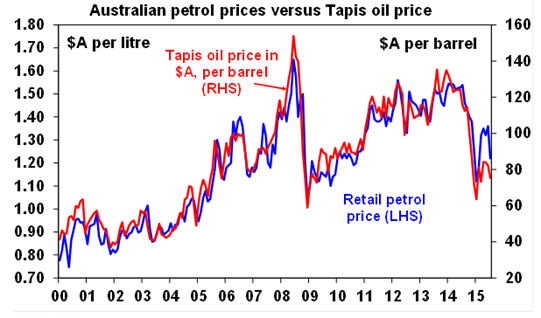

It's interesting to note that we are starting to see some petrol stations selling petrol for around $1.22/litre. Maybe petrol prices are at last starting to fall back into the line with their normal relationship with global oil prices adjusted for the lower Australian dollar.

Source: Bloomberg, AMP Capital.

Next Week

Craig James, Commsec

A big week for economic events

The start of a new month ushers in a barrage of fresh economic data, with something of interest for investors virtually each day in the coming week.

The week kicks off on Monday with CoreLogic RP Data releasing data on home prices. ANZ also publishes its series on job advertisements; TD Securities and Melbourne Institute issue its monthly inflation gauge; the Performance of Manufacturing index from Australian Industry Group is released; and the Housing Industry Association will release new home sales data.

Home prices may have posted a solid gain of 2.8 per cent in July with Sydney prices up 3.3 per cent. So that data may hog the limelight. But job ads have also been trending higher for 15 of the past 17 months and are now up almost 11 per cent over the year. So there will be interest in whether the job market continues to rise.

Turning to the inflation gauge, the headline index was up just 0.1 per cent in June to be up 1.5 per cent on a year ago. And annual growth of the underlying rate (trimmed mean) held steady at 1.3 per cent. The bottom line being that inflation remains well contained.

On Tuesday the focus shifts to the Reserve Bank Board meeting. However before that we get the retail trade figures and the trade data released by the Australian Bureau of Statistics (ABS) at 11.30am AEST.

Retail trade rose by 0.3 per cent in May and was up a healthy 4.7 per cent over the year (5-year average, 3.6 per cent). We expect that sales rose another 0.6 per cent in June. Excluding inflation, sales may have risen 0.4 per cent in the June quarter. And we expect another large trade deficit in June, around $2.9 billion.

The Reserve Bank Board meeting will certainly draw investor interest on Tuesday afternoon (2.30pm AEST). The majority of economists expect no change to interest rates although the accompanying statement will be looked at very closely to garner clues about future rate moves. It will be interesting to see if policymakers discuss the recent moves by a number of banks to lift interest rates on investor loans.

On Thursday, the July employment figures are due. There is no doubt that there has been a credible lift in employment over 2015 with over 120,000 jobs being added in the first six months of the year – marking the best start to a calendar year in seven years. At face value there does seem to be a shift from part-time to full-time jobs, which makes sense given that over the past year business profitability has improved, and now employers are seemingly adding more full-time staff.

However employment growth hasn't been enough to offset the lift in the work force. Given the better economic conditions more people are looking for work and as a result the unemployment rate has held near 6.0 per cent. CommSec expects employment rose by 15,000 in July with the unemployment rate flat at 6.0 per cent.

On Friday home loan data for June is released. In May, loans to build homes recorded the sharpest slide in more than five years, sliding by 8.3 per cent. Tighter lending regulations may be starting to take some of the exuberance out of the property market and resulting in potential home buyers being more circumspect about purchases.

Overall, we expect that home loans rose 6 per cent in June after falling 6.1 per cent in May. But we will be keeping a close eye on the number of construction loans – a precursor to further housing supply. There is a close correlation between home construction loans, building approvals and housing work – the latter driving the fortunes of residential developers and building material suppliers.

Data on tourist arrivals and departures is also released on Friday.

Also on Friday, the Reserve Bank releases its quarterly Statement on Monetary Policy. Little change in economic growth and inflation forecasts is expected, confirming that interest rates are on hold for the rest of the year.

Key Chinese and US data released over the week

The week kicks off on Saturday (August 1) with China's National Bureau of Statistics releasing Purchasing Managers index (PMI) gauges for both the services and manufacturing sectors. The private sector Caixin manufacturing PMI is released on Monday with the services index on Wednesday.

In the US the week kicks off on Monday with data on personal income and spending, construction spending, auto sales and the ISM manufacturing index. A 0.4 per cent lift in income is expected to have out-paced a 0.2 per cent lift in spending. And the manufacturing index was probably unchanged at 53.5 in July.

On Tuesday, data on factory orders is released together with the usual weekly data on chain store sales.

On Wednesday, the ADP data on private sector payrolls is issued together with the ISM services index and international trade (exports and imports).

On Thursday the usual weekly figures on jobless claims – new claims for unemployment insurance – are issued. And the Challenger series on job layoffs is released the same day.

On Friday, the pivotal non-farm payrolls or monthly employment report is released. Economists expect that 218,000 jobs were created with the unemployment rate unchanged at 5.3 per cent. A result in line with the forecast should keep the Federal Reserve on track to lift rates by the end of 2015.

On Saturday (August 8), Chinese trade data is released while data on producer and consumer prices is issued on Sunday.

Sharemarket, interest rates, currencies & commodities

The focus shifts from the US profit reporting season to the start of the equivalent Australian version. While a spattering of ASX 200 companies have already reported, in the coming week Suncorp issues its earnings result on Tuesday with BWP Trust on Wednesday, Rio Tinto and Downer EDI on Thursday and Virgin Australia and Flexigroup on Friday.