Kohler's Week: US Jobs, Yield and Retirement, Dividends, Draghi, Australian GDP, Circadian, Ardent Leisure

Last Night

Dow Jones, up ~2.15%

S&P 500, up ~2.1%

Nasdaq, up ~2.1%

US Jobs

This morning's US employment report for November clears the last hurdle for a Fed rate hike on December 16. The figure of 211,000 new jobs, plus the revision to the October figure up from 271,000 to 298,000, confirms that the US economy is going strongly and the labour market has a lot of momentum.

In fact, so unanimous is the expectation for ‘lift-off' to happen this month that if, for some reason, the Fed doesn't do it, there will be utter chaos in the markets. But there won't be chaos because it will definitely happen – a 0.25 per cent rate hike, probably followed by another one in March. Will that drive the US dollar higher? Probably, but not necessarily.

The US dollar trade weighted index is up about 25 per cent since mid-2014 and a lot of analysts are saying that's it – that the US dollar often rises ahead of the first rate hike and then declines for a while, which is what happened in 2004 and 1994. Others (the minority I think) reckon the US dollar doesn't look stretched yet and has further to go. I guess we'll find out around Christmas time.

Wall Street stocks rallied strongly overnight after the November data came out because it provides certainly and also confirms that the US economy is going really well. Wages growth remains fairly weak – 2.3 per cent – but with unemployment likely to fall below 5 per cent soon, that should start rising.

All in all, a solid, unspectacular jobs report last night which should result in a decent run-up into the end of the year on the markets.

Yield, super and retirement

We're building to a crescendo on superannuation and tax reform, and as part of that build up, leaks – deliberate and accidental – are breaking out all over. Let me tie together a few different strands from the past week that add up to real difficulties for our retirement.

1. The Australian dollar went up.

2. The ECB cut interest rates (but left markets underwhelmed).

3. House prices in Sydney and Melbourne started falling.

4. The Productivity Commission issued a report called “Housing Decisions of Older Australians” which, among other things, highlighted the total lack of a decent equity release market here.

5. Scott Morrison made a speech in which he showed he really doesn't know what's going on, while at the same time foreshadowing big reforms.

Let's deal with the Morrison speech first.

It was actually last Friday, but I only got around to reading it this week, because my eye was caught by a story in the Sydney Morning Herald headed: “Treasurer Scott Morrison says to forget about relying on the age pension.”

That got my attention, which was the plan of course, but he didn't actually say that as far I can tell, or anything like it. The closest he came to something like that was: “On one hand, we might want to reduce reliance on the age pension but, on the other, this comes at a cost to Government by way of providing tax concessions as an incentive to lock money away in super.” So: beat up.

He certainly didn't say forget about relying on the age pension. He did reaffirm the Government's dreadful decision to force industry funds to have independent directors, which he says will improve their governance. Except that the retail funds that have independent directors produce much lower returns than the industry funds that don't. That probably doesn't worry too many Eureka Report subscribers, who have long since abandoned the lot of them, independent or not, but it's a further sign that the Government remains ideological on this subject, not practical.

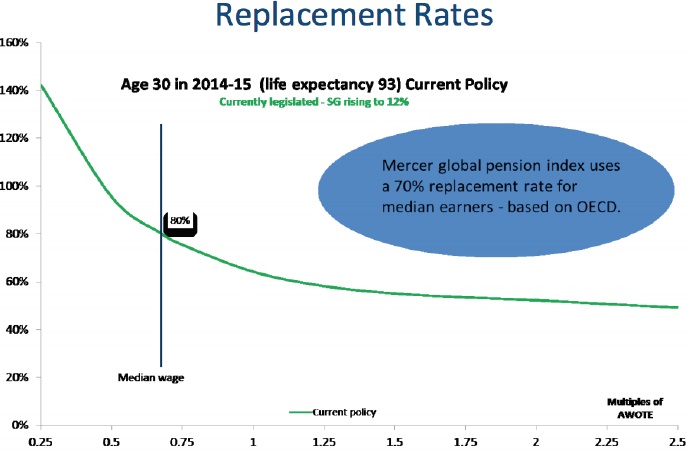

The main problem with Morrison's speech was the way he has fallen in with the industry's efforts to lower retirement income expectations. He referred to Mercer's suggestion that a benchmark of 70 per cent of pre-retirement income is suitable for a median earner. He then said that the median wage is $52,000, which was news to me since average weekly earnings, according to the ABS, are $1,541.50, which makes an average annual salary of $80,158 according to my calculator. I realise average and median are different things, but surely not that different! But using the median instead of the average brings the number down, and therefore allows taxes on superannuation to be increased without breaching it.

Morrison produced this slide which is meant to show that the current system outperforms the Mercer benchmark – 80 per cent versus 70 per cent.

Presumably he's working up to cutting this figure back to the Mercer benchmark with a tax increase, and then declaring that everyone will still have enough to live on.

I think it's also fairly clear that the tax on super will change from a flat rate to a discount on personal income tax, so that lower income earners pay less on their contributions and high earners pay more. Net result: more tax.

As for whether the Government will keep superannuation tax-free for those over 60, he said this:

“Let me make one thing very clear though: while superannuation should ensure adequate retirement incomes, it should not be seen as an open-ended savings vehicle for wealthy Australians to accumulate large balances in a tax-preferred environment, well in excess of what is required for an adequate retirement.

It is not an estate planning vehicle nor was it ever intended to be.

When Australians see the Government supporting the accumulation of enormous superannuation fund balances in a tax preferred, and, in retirement, a tax-free environment, the confidence in the system is significantly undermined.”

Hmmm.

Then he said: “Retirees have saved for their retirement under the existing rules across their working lives.

The Government acknowledges these efforts and sacrifices.

And yet we must also balance all that with the goal of shaping the superannuation system so it provides opportunity to all Australians.”

Double hmmm. I'll leave that with you.

Back to the first two items on my list at the start – the rising Australian dollar and lower European interest rates.

It's clear that interest rates are going to be low for a long time to come. If the dollar rises in 2016, as this week's action seems to suggest, then the RBA will be more likely to cut rates again. And even though the US is likely to start raising rates this month, the trajectory will be very gradual indeed and in any case Europe is still cutting. The net pressure on interest rates globally is likely to remain downwards throughout 2016.

Which means the hunt for yield – for income on capital – will remain on, stay hard and probably get harder.

Pressure is going to come to release capital from the family home, either by downsizing or equity release. But house prices have peaked and started falling and in its report this week, the Productivity Commission highlighted the paucity of equity release products. There's a circular chicken and egg element to this: because demand is minimal, there is limited supply, which in turn leads to less demand.

As the PC put it:

“The market for ERPs is small and has stagnated in recent years — with 40 000 outstanding ERPs nationwide, they comprise just 0.4 per cent of the home equity of older Australians.

“This is due to both demand and supply side constraints.

“– Demand is impeded by consumer preferences affecting the family home and debt; negative perceptions of the products; poor financial literacy and information; high costs and risks; and disincentives arising from the tax and transfer treatment of the principal residence.

“– Providers and investors show little interest in the products due to the relatively small market size; the risks caused by the uncertain timing and value of returns; costly prudential and regulatory requirements; the lack of a consistent regulatory framework across ERPs; and the reputational risk inherent in offering the products.”

The Commission goes on to say that the situation is “unlikely to change”. End of story.

So what can be done? Not much. As I have written here before, retirees are being forced to take a pay cut to support the pointless and futile attempts by central banks to increase the rate of inflation.

The temptation – and, in fact, the only option available – is to increase risk. This is not only unwise, it's deeply unfair. When the last crisis hit seven years ago, relatively few retirees had risky portfolios and most escaped more or less unscathed. The impact of the next one, especially on retirees, will be deeper and wider.

Dividends

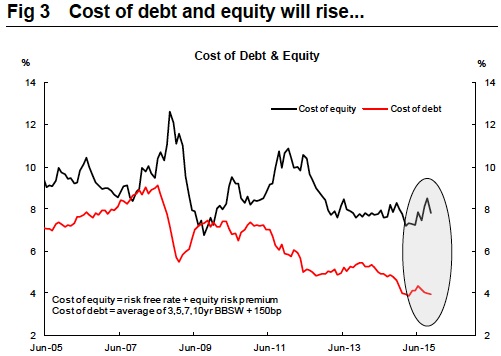

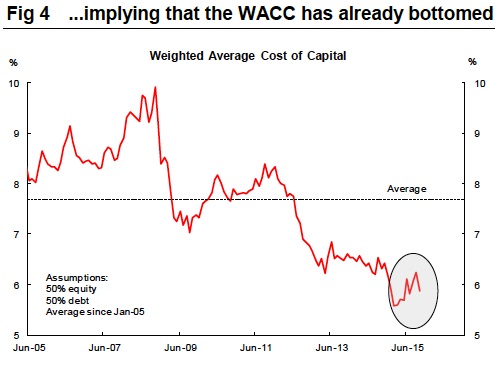

On the subject of dividends and yield, I stumbled on a couple of interesting graphs during the week that add to the evidence that some sort of reckoning on payout ratios is coming. They were in a note from Macquarie Equities on the subject of dividends:

WACC stands for weighted average cost of capital. Over the past eight years, firms have had a tailwind from declining cost of capital, which has allowed dividend payouts to be pushed up. Macquarie's thesis that the WACC has bottomed implies that the tailwind is finished and a headwind will appear. Companies will be forced to retain more profits to fund capital expenditure.

“Overweight the past"

All of which brings me back to the banks – again – but so important are they to Australians' retirement portfolios I keep coming back to them. The Australian sharemarket is dominated by banks and mining and energy companies, but miners have only recently become yield stocks, and in any case they are likely to stop being seen as yield stocks pretty soon when they start cutting dividends.

Both the banks and the miners are at the end of what Gerard Minack, in a note this week, called their “super cycles”.

“There are reasons to be positive about the medium term outlook for Australia. But the problem for investors is that increasingly the equity market does not reflect the economy.

“Australia's listed market has a much larger exposure to financials and materials (which includes miners) than other markets – and these sectors' share of market capitalisation are much larger than their share of the domestic economy.

“Put simply, Australia's equity market is overweight two sectors at the end of their super-cycles; it is overweight the past and underweight the future.”

Overweight the past and underweight the future. That is a brilliantly descriptive but sobering phrase – similar to my aphorism: get on the train, don't lie on the tracks.

I'd go further than Gerard, especially about the banks. The miners' problems are clearly cyclical – the commodity super-cycle busted in 2011 and is down for a while – and while there is a cyclical element to the decline in the bank sector this year, with impairments starting to rise and house prices starting to fall, there is a bigger structural issue at work, in my view.

The trickle of change that's affecting the banks will soon turn into a flood. Banks will need to fundamentally change their business models and, as part of that, rethink what they are.

There are so many niche operators nibbling at the banks' limbs that the conglomerate model of banking, in which the bank houses savings, makes loans and conducts all financial transactions, may be coming to an end. Is a bank, at its core, a balance sheet or a distribution system? I suspect distribution profit margins will become so tight that banks will not be able to service their equity capital from their brand capital anymore; the bigger question is whether lending spreads based on their balance sheets will service the capital either.

Just about every week these days I talk to someone who's involved in a fintech startup. Last week it was another peer-to-peer lender, this week it was two fintechs, not one: an online lender (not peer-to-peer) named Prospa and a London-based international currency transfer business called TransferWise.

Prospa was started two years ago by a couple of young entrepreneurs and was named the fastest growing technology company in 2015 at the Deloitte Fast 50 awards a couple of weeks ago. It recently raised $60 million capital from The Carlyle Group and Ironbridge Capital. It's still quite small, and in many ways it just looks like a traditional high interest, short-term unsecured business lender, except its distribution and fulfilment are all online. Their main point of difference is fast turnaround – as fast as 24 hours – but they are definitely growing quickly and taking advantage of the banks' bureaucratic torpor and their unwillingness to lend unsecured because of the way capital risk-weightings push them towards needing security.

TransferWise was started in London three years ago by two young Estonian friends. One of them was transferring money from UK to Estonia, the other was moving money the other way. Both of them were paying the banks a fortune to do it, and they decided to simply shift the money between them, inside of between each country, to achieve the same result without bank fees and spreads.

From that idea was born a cloud-based platform that is now moving $1 billion a month around the world and seriously challenging the banking and Western Union money transfer cartel. TransferWise guarantees to use only the mid-point of the foreign exchange market rates, as opposed to the wide buy/sell spreads the banks use, and charge a fee of 0.7 per cent – about a third of what the banks are charging.

Yep, they're making $7 million a month revenue, and growing rapidly. They also have a few hundred staff, including 100 software developers improving the technology all the time, and a 200-person call centre, would you believe, so that phone queries are answered within 15 seconds and dealt with properly.

I mean, good grief … the banks simply can't compete with this. Too big, too cumbersome and too much capital to service. It's true that cloud computing and blockchain – the new settlement technology behind Bitcoin – could result in very big cost savings for banks, but these technologies are also levellers, available to competitors as well.

On top of that there are macro challenges in the economy. Recession is not Gerard Minack's base case because the labour market has not cracked, but “recession or not Australia continues to face a long period of structural adjustment.

“First, trend GDP is falling. In fact, trend GDP growth has been falling for a decade. The bigger issue for business is that an even larger adjustment is likely for domestic spending, and that spending drives revenue growth.

“The commodity boom allowed Australia to enjoy an unprecedented period where trend growth in spending (gross national expenditure) exceeded trend growth in production (GDP). Rising export prices meant that a given volume of production could fund a higher volume of consumption. With the terms of trade falling, this income effect swings into reverse. After a decade where the trend growth in spending was above the trend growth in GDP, Australia will likely face a decade where spending has to rise less than GDP – and that GDP growth rate is itself falling.”

Draghi disappoints

European Central Bank President Mario Draghi announced a 10 basis point cut in euro interest rates on Thursday, plus a bunch of other measures, but it wasn't enough - the markets sold off around the world, especially in Europe (-3.5 per cent), but also the US (-1.4 per cent) and Australia (-1.6 per cent).

Disappointing the markets is a new experience for Draghi. He came to office in November 2011 with European interest rates at 1.5 per cent after his predecessor Jean-Claude Trichet mistakenly raised them in mid-2011. Draghi cut the benchmark rate immediately and then again in 2012, while coming out with his famous “whatever it takes” line: “We will do whatever it takes to preserve the euro. And believe me, it will be enough.”

That sparked a big global stockmarket rally that basically ran for two years non-stop, until China intervened last year. Earlier this year he announced an open-ended version of QE that was essentially another “whatever it takes” moment.

Expectations for Thursday's ECB meeting were high – too high. There were quite a few measures unveiled on Thursday and the disappointment seems to have been mainly caused by the lack of more of that “whatever it takes” rhetoric. In fact the ECB is now in “wait and see” mode. “Boring”, said the market. Here are the things that were announced after the meeting:

1. A 10bp cut to the deposit rate, bringing it to a new low of -0.30 per cent;

2. A confirmed extension of the asset purchase program (APP) to at least March 2017, or beyond, if necessary;

3. An extension of the eligible basket under the APP to include regional and local government debt;

4. Confirmation that the principal payments on securities purchased under the APP would be reinvested as they mature, for as long as necessary; and

5. An extension of the fixed rate/full allotment process under the regular refinancing operations until the last reserve maintenance period of 2017.

Looks pretty “whatever it takes” to me, but then I'm probably less demanding than the markets these days. Will it spark a significant correction? Don't know, but I'd say the September/November rally has run its course.

Australian GDP

There is only thing you need to know about the third quarter GDP expansion of 0.9 per cent, revealed by the ABS on Wednesday: 1.5 per cent of it came from net exports.

Two things flow from that: first, the domestic economy contracted 0.6 per cent, or close to 2.5 per cent annualised, which is the worst contraction since the GFC and suggests that Australia, internally, is in recession; second, the net exports figure was a flash in the pan.

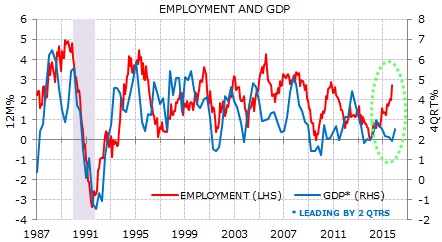

The trade data for October came out on Thursday. The trade deficit blew out by nearly a billion dollars, and it's very unlikely that trade will continue supporting output through 2016. That doesn't necessarily mean we're heading for recession in 2016 – as Gerard says, employment is not only holding up, it's growing strongly even as GDP has slowed. Long may it be so.

Facial recognition

This is not exactly about investing or finance, but I need to tell you about this. During the week I spent some time with the Australian sales director of NEC, Chris Korte, who has just signed a deal to sell facial recognition software to the Northern Territory police.

There are two things about this technology that I learnt from Chris that left me once again agog at the speed of change, what sort of world we are hurtling towards.

The first thing is that this technology is now so good that it can identify anybody, from a distance or among a crowd, no matter what changes have been made to their face. Beards are a piece of cake, likewise glasses, false noses, putting on or losing weight. It can also see through ageing – an adult can be identified from a childhood photo. It can even be used to identify skeletons! I found out about that because the press release mentioned cold cases. “How does facial recognition help cold cases?” I wondered. Chris said it's because they're digging up previously unidentified bodies and running the software over their faces! Can you believe it?

And secondly, Chris told me that all state governments are now working on legislation to allow police forces to access driving licence and passport photos, to build a full database of faces. This, obviously, is far more powerful than fingerprint identification because not many people actually have their fingerprints in the system. But just about every adult has a driving licence or passport, and those that don't probably have their picture on Facebook, which is also available to the police.

Add to this the fact that most places now have CCTV, and pretty soon 100 per cent of the population will be able to be identified at all times, anywhere in the world. Is this good or bad? It's fine with me, in fact I'm all in favour of it, but I suspect not everyone will agree.

Ardent and Circadian

A couple of fascinating female CEOs this week – Deborah Thomas of Ardent Leisure and Megan Baldwin of Circadian Technologies, soon to be renamed Opthea.

Deborah took over at Ardent from Greg Shaw in March and was greeted with a raspberry by a surprised market. The share price dropped from $2.43 to below $2 in a minute or two and the new CEO knew she was playing in the big league. She got the price back up to $2.80 in early November through lots of energetic and painstaking shareholder presentations and then suddenly it's back down to $2.26 because of disappointment about the quarterly earnings report, which wasn't too bad but apparently expectations had been raised. Answer: no more quarterly reports.

Also, Deborah is bringing a focus on customers rather than costs, which some flint-eyed analysts reckon means taking your eye off the ball. Deborah reckons the ball IS customers. Anyway this is her first big interview since taking over and well worth watching, or reading, although I would say that, wouldn't I?

Megan Baldwin did her PhD into the aspect of wet age-related macular degeneration (AMD) that Circadian/Opthea's molecule treats, so she understands the technology well. She says it works, and has application for diabetes-related problems. It's a $US7 billion market and Megan says they're about year off completing Phase 1 trials and being in a position to do a licensing deal with a big pharma. You can watch the video and read the transcript here.

Phoebe's Wedding

My eldest child, Phoebe, whom some of you might remember as Eureka Report's customer service operator for a few years, is getting married today to a fine young Essendon supporter. So for the first time, and I rather suspect not the last, I'll be walking a daughter down the aisle.

I must confess I'm both thrilled and surprised. In my day, big weddings seemed to be on the way out. Deb and I got married at the registry office in Exeter, England, with a couple of sub-editors from Yorkshire who we were working with at the Exeter Express and Echo, as our witnesses. Our reception involved getting noisily plastered at the White Hart hotel … on expenses! Our honeymoon was a three-month bicycle-ride to Greece, via France and Italy.

But big weddings are back: the wedding industry has produced the sort of fight back that newspapers need to pull off, and is now coining it. Not that I mind, of course. The suit is cleaned, the lapel rose is primped, the speech is honed and the elbow is crooked for the daughter's wrist to slip through. Should be a wonderful day.

Readings & Viewings

This is one of the most interesting things I've read for a while. This blogger reckons autonomous cars will have a near monopoly by 2030 and "the sweeping change they bring will eclipse every other innovation our society has experienced”.

Education is not an adequate defence against the rise of the robots.

Also interesting: the world has 118 million tonnes of coal it doesn't need.

Which is supported in typical emphatic fashion by Ambrose Evans-Pritchard in the Telegraph: the Paris climate deal spells the end of the fossil fuel era.

Short answers to hard questions about climate change.

The most fascinating thing about the Paris talks isn't that the result will be insufficient to avert potentially catastrophic climate change, but that people don't seem more bothered by the languid clip of progress. Yes, I agree.

Tim Flannery: what's at stake in Paris? Everything.

The other point of view: 12 reasons why the Paris climate talks are a total waste of time.

This is a troupe of very, very fine synchronised dancers. Amazing. Make sure you watch it to the end.

With Stephen Fry gracing our shores at the moment, it's worth revisiting Peter Hitchens's rather beautifully devastating piece on him, headed: "Stephen Fry - A Stupid Person's idea of What an Intelligent Person is Like”.

This emotional German Christmas ad went viral this week.

Guy Rundle's review of Paddy's Manning's biography of Malcolm Turnbull.

In case you missed it, Peter Hartcher's excellent five-part series on how Turnbull toppled Abbott.

Malcolm Turnbull will pay a high price if he keeps sticking by Mal Brough.

Quite weird Russian TV ad, showing elderly Barack Obama and John Kerry griping about President Snowden.

A guy stopped drinking alcohol and coffee for 12 months. This is his story.

Mark Zuckerberg announces the biggest tax avoidance scheme in history.

Giving away tens of billions of dollars is all very well, but wealthy philanthropists shouldn't impose their idea of the common good on everyone else. Interesting piece.

Roger Montgomery: chasing yield often overlooks growth. Yes, but isn't that the point?

Professor Rod Tucker: what will the NBN really cost?

The Republican primary has now become a free for all.

Whaaatt!!!??? Bananas may be headed for extinction.

The current El Nino is now the biggest ever recorded.

So here's a good question: How does matter make mind? More specifically, how does a physical object generate subjective experiences like those you are immersed in as you read this sentence? How does stuff become conscious?

A beautiful piece about the book lady of Kabul.

This amazing story on the ABC about Australia's bungled spying in East Timor seems to have sunk without trace.

It's 100 years since Einstein's theory of general relativity was published. Here's a marvellous little film explaining it simply, narrated by David Tennant.

Some Belgian physicists have calculated that everyone is lying about the downed Russian jet.

A hard look at the soft global economy.

What is pain, and how does it work?

In praise of pessimists. Maybe they're just right.

Happy Birthday Sonny Boy Williamson, the greatest harmonica player in history (he died in 1965). And his teeth perfectly match – half a mouthful on top and half on the bottom.

And happy birthday the very cool JJ Cale (he died in 2013). Here he is doing Cocaine.

Actually Eric Clapton has always done this song better than JJ Cale (just my opinion). He can certainly play the guitar better. And sing.

It's also the day on which a certain bloke named Wolfgang Amadeus Mozart died, in 1791, aged 35. At that age I was still stupid; he was a confirmed genius who had contributed more to the world than 10 normal people do in a long lifetime. Here is the sublime Symphony No. 40 in G minor, played by the Europe Chamber Orchestra in Vienna.

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

The past week was dominated by worries about the Fed hiking rates later this month against a background of mixed economic data and disappointment that the ECB did not ease by more. This saw falls in most share markets but particularly in Europe. The ECB's smaller than expected increase in its quantitative easing program saw bond yields rise, again particularly in Europe, but by reducing upwards pressure on the US dollar for now it perversely provided commodity prices with a bit of support. The weaker US dollar along with stronger than expected GDP growth in Australia saw the Australian dollar gain.

ECB easing disappoints, but it's still a further easing. The key moves by the ECB were to extend its €60/month bond buying or quantitative easing program by another six months out to March 2017 and to cut its deposit rate by another 10 basis points taking it to -0.3 per cent. The problem is that largely due to ultra-dovish comments by ECB President Mario Draghi over the last few months, markets were expecting more and this explains the negative reaction seen in share markets, the rise in bond yields and the bounce back in the value of the euro. As a result Draghi has arguably lost a bit of credibility in the short term.

However, there is a danger in getting too carried away here.

First, the ECB has still undertaken a very significant further easing with the quantitative easing program increasingly looking open ended until the ECB gets the pick-up in inflation that it wants.

Second, it's not that recent eurozone economic data has been bad. In fact, data for bank lending, business conditions PMIs and confidence have all been quite good.

Third, the ECB still has plenty of scope to do more. In fact, with Draghi known to look at share markets closely (he said a few years ago it was the first stat he looks at in the morning) and the value of the euro he is likely to have been disappointed by the initial 3.6 per cent fall in eurozone shares and the 3 per cent gain in the Euro and is likely to push back with dovish commentary in the period ahead.

Finally, the ECB's more muted than expected easing so far has taken some of the pressure off the Fed by lowering the value of the US dollar, which may take a bit of the pressure off emerging markets and commodity prices. So overall, the initial negative reaction to the ECB's easing looks to have been overly negative and likely to reverse in the months ahead. However, in the very short term, market volatility is likely to remain high ahead of the Fed's December 16 meeting.

The Fed is still on track for a mid-December rate hike, but it's likely to be a “dovish hike”.

While some at the Fed are feeling nervous about the Fed's December meeting, the clear messages from Fed chair Janet Yellen are that: the recent flow of information has been satisfying the conditions for a December hike; the hike when it comes will be a sign of how the US has recovered since the GFC; and that subsequent rate hikes will likely be gradual and tied to progress in lifting inflation back towards the Fed's target.

Recent mixed US economic data, bouts of turmoil in share markets and ongoing weakness in commodity prices suggests a hike could still be delayed again but our base case (with 70 per cent probability) is that the Fed will move on December 16 (taking the Fed Funds rate to a range of 0.25-0.5 per cent) but that the accompanying Fed commentary will be dovish emphasising that it anticipates future hikes to be gradual. Yellen's restatement of her view that there is still additional slack in the US labour market underlines her assessment that rate hikes will be gradual.

The Reserve Bank of Australia remained on hold as widely expected with Governor Steven's justifiably pleased with the September quarter's solid GDP growth. However, our assessment is that the economy will likely need more help next year as mining investment continues to fall, commodity price weakness continues to flow through and housing cools. As a result I see it as still likely that the RBA will have to act on its easing bias early in 2016 and cut the cash rate below 2 per cent.

Iron ore price heading below $US40/tonne as the global oversupply of steel continues to hit. The past week has seen the iron ore price continue to fall to a new eight year low. It's near 80 per cent plunge from its 2011 high has largely wiped out the price boom seen last decade. For Australia this means an ongoing loss of national income and a further blow out in the budget deficit as each $US1/tonne fall in the iron ore price knocks $250 million off annual Federal tax revenue, with the latter likely to be confirmed by another blow out in deficit projections in the Mid-Year Economic and Fiscal Outlook due mid-December. Fortunately, a lower Australian dollar provides an offset, but it will need to resume falling. This is likely over the year ahead with the Australian dollar heading to around US60c.

Major global economic events and implications

US data was mixed, but still consistent with the Fed hiking interest rates on December 16. Data for pending home sales and a sharp fall in the ISM manufacturing conditions index were disappointing with the latter highlighting the pressure the US manufacturing sector is facing from the rise in the US dollar. However, the broader Markit manufacturing conditions PMI is holding up much better, services sector conditions PMIs remain stronger, although they have slowed a bit too, and labour market indicators remain strong.

Eurozone unemployment fell in October, but only to a still high 10.7 per cent highlighting the extent of spare capacity in the Eurozone economy. This along with a fall in core inflation to just 0.9 per cent year on year in November supports the case for the ECB's additional monetary easing.

Japanese capital spending data for September quarter accelerated much more than expected, pointing to an upwards revision to initial September quarter GDP data showing a contraction.

China's manufacturing conditions PMIs provided mixed signals for November by moving in opposite directions, but remain soft. Services conditions PMIs remain reasonable.

Replace BRICs with ICs. The irrelevance of the BRICs concept was highlighted in the last week by September quarter Indian growth surprising on the upside to 7.4 per cent year on year at a time when Brazil's recession deepened with September quarter GDP down 4.5 per cent yoy, which is deeper than its recession at the time of the GFC. While at some point the bad news in Brazil will be “so bad that its good”, its plunging manufacturing conditions PMI to 43.8 at a time when President Dilma Rousseff is to be impeached suggest we aren't at that point yet. With Russia also in a structural recession it remains a time to be selective when investing in emerging markets.

Australian economic events and implications

The rebound in September quarter GDP growth is good news and indicates the economy is continuing to find ways to sustain growth as other sectors help fill the gap left by mining investment and as the third and final stage of the resources boom drives stronger export volumes. However, before breaking out the champagne it's worth noting that the 1.5 percentage point contribution to growth from net exports won't be repeated this quarter, with the October trade balance already showing a renewed deterioration, and more importantly it masked very weak domestic demand. The risk for next year is that with mining investment still falling, demand in the economy could slow further as the contribution to growth from dwelling investment and wealth gains from rising home prices fades and as further bank mortgage rate hikes in response to increasing capital requirements cut into household spending power.

While retail sales growth was solid in October, the slowdown in the housing sector was clearly evident over the last week with Sydney's auction clearance rate now around 2011-12 cycle lows, building approvals continuing to show signs of peaking, new home sales rolling over, lending to investors continuing to slow and home prices starting to soften. At the same time the TD Securities Inflation Gauge for November shows inflation being very weak.

But will home prices crash? Is this it? Sure the plunge in Core Logic RP Data home price series in November is quite dramatic, but it's noteworthy that we have seen similar sharp falls before which have proven temporary and we may have seen a knee jerk reaction from buyers to recent bank rate hikes that may not prove lasting. Our assessment remains that the property cycle has now turned down but in the absence of generalised oversupply, a recession or a sharp rise in interest rates a house price crash is unlikely.

Next Week

By Savanth Sebastian, CommSec

Jobs, jobs, jobs

The last major Australian economic indicators for 2015 are released in the coming week. In Australia the focus will be on the labour market. In China, trade, inflation and broader economic activity indicators are released throughout the week. In the US, data on retail sales and producer prices are the highlights.

In Australia, the week kicks off on Monday with November data on job advertisements to be released by ANZ. Job ads have been trending higher for 15 of the past 17 months and are now up almost 13 per cent over the year. The latest Reserve Bank interest rate decision and minutes of the last Board meeting commented on the improvement in labour market conditions.

On Tuesday the National Australia Bank business survey is released. The business survey covers key business indicators, a reading on business confidence as well as gauges on prices, wages and finance. The indicators of confidence and conditions have showed encouraging improvement since the Budget, with a particular focus on a lift in profitability.

Also on Tuesday the ANZ/Roy Morgan weekly consumer sentiment survey is released. Sentiment levels have softened in the past three weeks although that should hardly be a surprise. Currency, commodity and sharemarkets have proved volatile and that has affected consumer sentiment -- not just in Australia, but across the globe. In addition, the weaker Aussie dollar is causing consumers to worry about the higher cost of overseas travel and dearer imported goods.

On Wednesday two indicators of note are released: The monthly Westpac/Melbourne Institute consumer confidence survey is released alongside housing finance data. For the most part the monthly confidence reading should mirror the more timely weekly survey released each Tuesday by ANZ/Roy Morgan.

The main value of the monthly sentiment survey now is the additional survey questions that are posed each quarter. And the upcoming December survey includes these extra questions, notably consumer views on the wisest places for savings. Interestingly last quarter real estate surpassed banks as the wisest place to put new savings -- the first time since September 2007. It is very likely given tighter lending standards and the pullback in property prices that Banks take the ascendancy once again.

The housing finance data will focus on new commitments made by lenders for the purchase or building of homes and renovations. We expect that the number of loans made to owner-occupiers (those who want to live in the homes) rose by 0.5 per cent in October after a 2 per cent lift in September. Clearly housing remains the growth driver for the broader economy.

On Thursday the ABS releases the monthly employment figures. Overall we expect that the number of jobs fell by around 10,000 in in November. And while the participation rate may have eased from 65.0 per cent to 64.9 per cent, it is unlikely to stop the unemployment rate lifting modestly from 5.9 per cent to 6.0 per cent.

Closing out the week on Friday, the Bureau of Statistics will release lending finance figures, which includes housing, personal, business and lease loans. The September lending statistics showed a sizeable 6.4 per cent lift to $75.3 billion -- a 7½-year high, encouragingly driven by the strength in commercial finance.

Chinese economic data in the spotlight

There are sparse helpings of ‘top shelf' US economic data in the coming week with the main interest in retail sales on Friday. But all the key monthly Chinese indicators are issued.

The week kicks off on Monday with the release of US consumer credit figures are released, with analysts expecting a result near $US17.5bn. The JOLTS job openings index is also released.

On Tuesday, the focus shifts to the Chinese trade (exports and imports) figures for November. The trade surplus is significant at present at $US61.6bn, suggesting there are still healthy global markets for Chinese goods. At the same time imports continue to slow.

On Wednesday the monthly US wholesale sales and inventories figures are released alongside the usual weekly data on mortgage finance commitments. Meanwhile in China, the National Bureau of Statistics issues inflation figures -- the data on producer and consumer prices. Producer prices are still in decline, down 5.9 per cent over the year. And consumer prices are rising at a modest 1.3 per cent annual rate. Further tame inflation readings would leave the door open to another round of stimulatory measures.

On Thursday in the US the usual weekly data on claims for unemployment insurance (jobless claims) is issued together with the import price index for November.

And then on Friday retail sales data is released together with US business inflation figures -- the producer price index -- and consumer sentiment data. There has been much debate about the strength of sales around Thanksgiving Day -- some suggesting that Black Friday sales were soft due to more online shopping taking place and less consumers heading to stores. So the data will end some of the debate.

On Saturday the monthly batch of Chinese economic indicators are released -- retail sales, production and investment. Chinese economic activity is decidedly mixed. Production and investment growth are slowing while retail sales growth is firm. Expect annual retail sales growth near 11 per cent (the highest reading in nearly a year) with production near 5.7 per cent and investment near 10.2 per cent. The risk is that the results print on the weaker side of expectations over the next couple of months -- especially given that air pollution levels in Beijing and North China are the most severe in a year. As a result main iron ore ports have been closed while the government has ordered over 2,000 industrial enterprises to limit or halt production.