Kohler's Week: The RBA, Fed, Greece, China and everything

Last Night

Dow Jones, down ~1.2%

S&P 500, down ~1.1%

Nasdaq, down ~0.8%

Aust dollar, US77.8c

RBA

I had an interesting debate on Twitter the other day with a few economists about whether Terry McCrann gets leaks from the Reserve Bank. He wrote this week that the RBA will “almost certainly cut rates next Tuesday”. A lot of economists think he gets fed the information by the RBA and so they now think this means rates will be cut on Tuesday. I don't agree. Terry is not always right, and the idea that Glenn Stevens leaks to one journalist – any journalist – is ridiculous. If he does, he should leak to me!

And what's more, I doubt that the official cash rate will be cut on Tuesday. The language in the statement will change for sure after Wednesday's CPI, but I don't think underlying inflation of 2.25% justifies a rate cut yet. I think there will be a rate cut, probably in March depending on the data, just not next Tuesday.

But I could be wrong and McCrann right, and I definitely haven't got a hotline to the Governor.

Anyway, the market has got a February (next Tuesday) rate cut more than 50% priced in, so if it doesn't happen, as I expect, then the dollar will probably spike back to US80c for a while. But that would be only temporary. A March rate cut is almost 100% priced in by the market and a 2% cash rate is expected by year end. The dollar is going down baby.

US GDP

Stocks opened sharply lower on Wall Street last night after GDP for the fourth quarter came out weaker than expected – 2.6% annualised versus the median forecast of 3%. Better-than-expected consumer spending was offset by weak business investment, government spending and net exports. Interestingly, a big negative was government defence spending, down 12.5% for the quarter.

Is this a big deal? Not yet, especially with consumer spending still robust. The GDP number will probably be revised up and then not repeated in the current quarter – you can never base too much on one quarter's disappointment.

Nevertheless, if it's confirmed that the US economy is decelerating then the US market will correct. It's currently valued on strong growth and no rate hike in 2015. If growth disappoints again and/or there is a rate hike, or even an expectation of one, there will have to be an adjustment. Already the S&P 500 has fallen 2.4% in January, the biggest monthly loss in a year.

And by the way, St Louis Fed President, James Bullard last night told the market to stop being so complacent about interest rates this year. In an interview on Bloomberg he said (again) that zero interest rates weren't appropriate and we should expect a hike in June or July.

Yes, but he's not on the Federal Open Market Committee anymore, and those who are don't seem to agree with him.

The Fed

The Federal Open Market Committee held its much-anticipated meeting this week and nothing much happened. They were a bit more optimistic about the economy, saying that it is expanding at a “solid pace” instead of the “moderate pace” phrase they used last time, but they were a little less confident about inflation getting back up to 2%. As I've been suggesting for a while, there's no great pressure to start putting up interest rates in 2015 because growth and falling unemployment are no longer inflationary. Also, it's worth bearing in mind that the FOMC itself is less ‘hawkish', as they say, than it used to be, with Fisher and Plosser replaced by Williams and Lockhart.

The endless speculation about when there will be ‘lift off' in the US is getting boring and pointless. It might happen this year, but more likely next year. Nobody knows because the FOMC itself doesn't know, and therefore we shouldn't base any investment decisions on it. I don't think it will have much impact on the Aussie dollar, which is going to fall whatever the Fed does.

“Patience” and calm are the key words: the Fed won't do anything till it sees the whites of inflation's eyes.

Europe QE

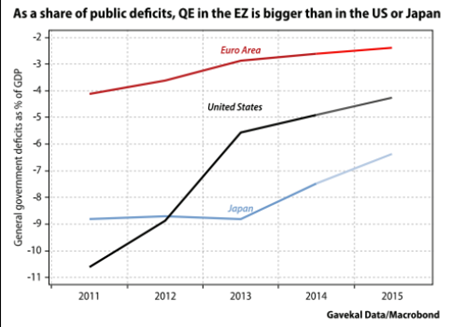

Last week I opined that the QE announced by the ECB won't be enough. Well, this chart from Gavekal might suggest otherwise:

While it's small in absolute terms and as a share of GDP, it is much larger than either the US or Japanese QE as a proportion of the fiscal deficit. Gavekal's analyst, François-Xavier Chauchat, says this suggests that the fiscal significance of the ECB's sovereign QE will be “very substantial”.

In effect the ECB has blurred the line between fiscal and monetary policy – something that has always been verboten in Europe – and in doing so has saved the euro.

Cash

I remain basically long-term bullish – largely because of what the ECB IS doing and what the Fed is NOT doing – but I've increased the cash in my portfolio to about 25% (from about 15%) just in case. It's possible that 2015 is normal – perhaps even more normal than 2014 was. What I mean is, there were share market corrections of varying severity in 2010, 2011, 2012, 2013 and 2014, the worst being in 2011 because of the euro crisis caused by Greece. Every year except 2014 the correction happened before June; last year it started on August 22nd, from when the broad index fell 8%.

Here's a chart of the ASX 200 over the past five years:

I'm no technical analyst, but I note that the index is not yet back to its August peak. This is entirely due to the persistent correction of resources, due the weak oil and iron ore prices. The resources index fell 26% from August to December and hasn't yet recovered. The banks and industrials are both back above their August peak. The banks have rallied hard since early October – they're up 10%, led by Commonwealth Bank hitting a new record on Thursday and then touching $90 on Friday. (It started December at $80).

That has happened because the 10-year bond yield started to fall again in November after a few months of sitting at around 3.3%. On Thursday it reached 2.48% and yesterday it eased further to 2.47% – below the cash rate for the first time in a couple of years. Here's a chart of the bond yield minus the cash rate:

CBA shares are probably the closest thing we've got to retail government bonds, so when the bond yield falls, CBA shares go up (and so do the other banks).

However, an inverse yield curve, which is what this is, normally foretells recession – except it didn't in 2008 or in 2012 (there was a global recession in 2008, but not in Australia) so it's not always a recession predictor.

Anyway, I think there's a fair chance markets will find some reason to freak out in the next few months, if only because they usually do – whether it's because the bond rate keeps falling, or because it doesn't and starts rising instead, or because Chinese growth disappoints (again) or there's a debt crisis in China (see below) or because US rates start rising, or because they don't (because the economy is weak). As you can tell, none of this is what you'd call a prediction, I just think corrections are normal and I want to have a little bit of dry powder if/when some of my favourites become a bit cheaper this year.

I actually think that in the current circumstances, it's rational to be quite open-minded – neither bullish nor bearish, but prepared to respond to the spinning vagaries of monetary policies, currency flows and political peccadilloes. Everything is changing so much, and so rapidly, it is very hard to hold fast to any point of view … apart from the fact that buying shares in excellent companies and employing high-quality investment managers is the only way to reliably grow wealth. That's especially true at the moment when market timing is so difficult (I suppose it always is) and real estate looks set for a period of softness.

So I've built up my cash a little because I think that, on balance, some of those excellent companies and high quality fund managers might get a bit cheaper in the months ahead. But I might be wrong.

Greece

One thing that might NOT cause a correction this year is another Greek crisis, even though all the ingredients seem to be in place for unpleasantness after the election, with the wilder predictions talking about a ‘Grexit' – Greece leaving the euro. The thing to note, however, is that Greece is actually doing better now. The economy is growing – third quarter GDP rose 1.9% year-on-year – the government is running a budget surplus of 2% of GDP, and although the absolute level of debt remains high, at 174% of GDP, the average interest rate is just 1.6%. In Greece, debt servicing costs are among the lowest in Europe now.

That means there is very little to be gained in budgetary terms by defaulting on the debt or negotiating debt forgiveness, and there's not much need for further bailouts. The new Syriza Government will be looking to fulfil its election promises to reduce the debt burden and to stop austerity (increase government spending), so there will have to be a negotiation with Brussels. Both sides will need to be pragmatic, but I'm sure they will be – there's no sign of destructive madness from any of them at this stage.

The Europeans (read: Germans) have already announced that an actual haircut on the debt is unacceptable and that is probably a line in the sand. The question is whether Prime Minister Alexis Tsipras and his Greek-Australian finance minister, Yanis Varoufakis, will accept a reduction in interest payments instead of an absolute debt haircut. And there is a lot that can be done to reduce interest payments, even though they are already fairly low, and the repayment schedule can also be extended, further reducing outgoings.

I doubt very much that Greece will exit the euro, which would promptly render its banks insolvent and require them to be nationalised. All of the progress Greece has made in the past couple of years would be wiped out, and the country would be set back for decades.

Nevertheless, staying in the eurozone will be difficult too, and require the sort of economic reforms that the Hawke/Keating government undertook in the 1980s. But those are the sorts of things that left-wing governments seem to be able to do.

As for the impact on markets, there will clearly be a lot of uncertainty for a while, especially up to the end of February when the current financial assistance program ends. If something is not negotiated by then, Greece won't qualify to be part of the ECB's new QE program and the banks won't be able to use Greek government bonds as collateral, which will put them under a lot of pressure, so brokers and traders looking for volatility will use this to talk up the prospect of a crisis. And then after February, there are some big bond redemptions due in July and August, so the uncertainty could drag on.

But with both sides of the negotiations having a lot to lose, they are likely to be pragmatic. In any case, Greece is quite isolated from financial markets, so any wider impact of this uncertainty is likely to be limited. Unless, of course, they storm out of the room, slam the door and blow their brains out by exiting the euro.

Zimbabwe

If you're wondering what happens to share markets when currencies collapse, you might remember what happened in Zimbabwe 10 years ago. Thanks to Robert Mugabe's hopeless economic management, the exchange rate went from $Z2 to $US1, to $Z100 trillion to the US dollar – probably the greatest hyperinflation and exchange rate move in history.

Well, Dennis Gartman reminds us that the Zimbabwe Industrial Share Index rose from 2,200 in 2005 to “...and we are not making this up… to 4,000,000 two years later! Yes, a foreign investor who bought Z$ to buy the Zimbabwe stock market lost more on his/her currency translation than he or she made on the stock price rise, but stock prices did rise… violently and relentlessly by a factor of 2000 x's.”

Now, I'm not suggesting for a moment that something similar is going to happen here, but it does remind us that while currency declines are bad for foreign investors, they are usually very good for domestic investors investing, and then spending, domestic dollars.

China

The twin dynamics to watch in China now are debt and deflation. The inflation rate is falling rapidly because of the collapse in the oil price: if oil doesn't recover quickly, and it seems that it won't, the Chinese CPI will soon be less than 1% and producer price inflation is expected to be minus 5%. China is the world's second largest consumer of petroleum products now, using more than 10 million barrels of oil every day, of which two-thirds is imported. That's going to give the monetary authorities a lot of room to move in loosening policy, which should put a floor under the decline in economic growth.

Separately, credit growth has outpaced economic growth for six years in a row, so total non-financial sector debt now stands at 230% of GDP, among the highest in the world. There have been many predictions of a financial crisis as the debt ballooned, but so far no crisis – undoubtedly because of the implicit government guarantee. Most of the creditors, and debtors, are related to the government, or are government-owned. That doesn't necessarily mean they are fully government-guaranteed and there are no problems, in fact since normal market dynamics don't apply, normal risk assessment processes probably don't either. Who knows what rubbish the banks have on their books?

Whether China can avoid a full-blown financial crisis, and therefore a big drop in economic activity, will depend on how firmly Xi Jinping's administration pushes on with reforms. Inefficient state enterprises need to be restructured so they can raise private capital to replace debt. Without that, things could get messy in China.

Interestingly, what China needs is very similar to what Greece, Italy and the rest of southern Europe needs, except that in China it's the government sector that needs reform, whereas in Europe it's the private sector. China's private sector is sharp and efficient -- the more it takes over what the State is doing, the better.

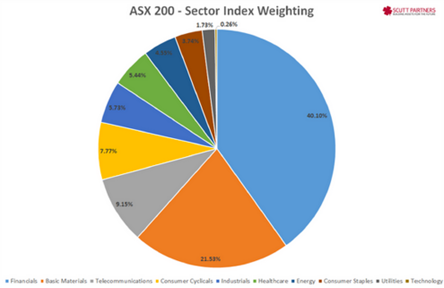

Sector weightings

By the way, the recent rise in the banks and fall in resources has taken the financials sector to 40% of the market, and materials to 21%. It used to be the other way around.

Politics

Speaking of political peccadilloes, was the knighting of Prince Philip a political turning point for Australia? Possibly. It was certainly bitterly disappointing. What Australia needs is consistent, stable administration with a focus on economic management and reform, not distractions like knighthoods … at all, and especially not bestowing one on a foreign prince, thus producing a national discussion on the competence of the Prime Minister. It can only damage business and consumer confidence just as they are tentatively recovering. But there it is: our PM is human, which means he makes mistakes. Just not too many, we hope. The last thing the Liberal Party will want to do is sack him, and we can only agree that that would not be ideal.

Apple

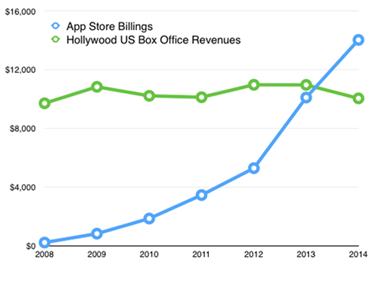

This week, Apple announced the biggest quarterly profit by any company in history – $US18 billion. It has enough cash to buy Microsoft outright. Its market cap is up to $US672 billion and the PE ratio is 6.8, according to Marketwatch. Its app store billings now exceed all of Hollywood box office revenues.

In the past month the stock has outperformed the S&P 500 by 10%, while Amazon, Google and Facebook have basically matched it. It really is a phenomenal company.

When he reviewed the company in September, Clay Carter said he wouldn't be buying it at the moment because he thought there were better opportunities elsewhere, but he did write: "there is the possibility of a third leg of outperformance in the future and that's based on the long-term potential of Apple Pay and the development of the Apple ecosystem which will essentially keep millions of Apple users ‘in the system' and is available for any new device, app, software or service the company devises. This third leg will not be hardware driven and it may take time to develop. Its current software and services category, which includes iTunes, the Apple retail stores, warranties, etc., generated $US16 billion in 2013.”

It looks like that third leg is already happening.

National Storage

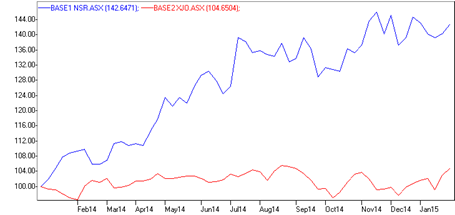

This week's CEO interview is Andrew Catsoulis, of National Storage which listed in December 2013. Here's a chart of its share price versus the ASX 200 since it came on at $1 – the outperformance has been about 40%.

The storage industry has been booming because everyone's got far too many possessions now, especially baby boomers who want to declutter their houses but can't bear to throw anything out, and also who have kids that have moved out to rental share places and want to store their belongings (both apply to me).

Since listing the company in December 2013, Andrew Catsoulis has made 20 acquisitions – basically National Storage is a roll-up play, with Catsoulis as the driver of consolidation in a very fragmented industry. It's similar to what John Conidi is doing with Capitol Health.

The key to National Storage is that self-storage is a real estate play that yields 8%-10%, and its cost of capital, according to Andrew Catsoulis, is less than 5%, so each acquisition is instantly accretive.

As we discovered last week, the fact that I interviewed Andrew should not be taken as a recommendation to buy the stock, but I do think this one is worth further investigation -- but only as a growth stock for the moment. It should be a good income provider, since its property assets throw off 8-10% yields, but it's a corporate structure rather than a trust, and until it stops making takeovers the dividends probably won't be franked. At the moment the franking is zero.

You can find the video interview and transcript here.

International stock screener

You may remember Eureka Report owns half of a stock screening tool with Clime Asset Management, called Stocks in Value. Well they have just launched a global version, with valuations that cover companies from more than 15 international indices and can help investors navigate and value major household names such as Microsoft, Google, Samsung, and many others. You might want to sign up for a trial and have a look at what it has to offer.

Readings & Viewings

The markets' verdict on central bank policies is that they are failing on inflation and growth.

The best thing I've read yet on what's wrong with Europe.

Sharp column by The Spectator's Rod Liddle on the demonstrations around the Muslim world … against free speech.

Excellent piece by Michelle Grattan on this week's Abbott/knighthood fiasco, and where it might lead (not that she knows).

Alternatively: Abbott needs backing, not the boot.

It's the Queensland election tonight. The LNP holds 73 of the 89 seats in Parliament, yet there's talk that it will lose. How extraordinary.

A midsummer disinflation nightmare for the Fed.

The Governor of the Bank of England has attacked eurozone austerity.

How Greece magically made its debt disappear before joining the euro.

Mohamed A. El-Erian on what Syriza's election victory means for Greece and Europe.

What next for Greece – an explainer.

Stiglitz: the politics of economic stupidity.

John Mauldin: the Swiss release the Kraken.

This week was the 70th anniversary of the liberation of the Auschwitz concentration camp. This is an excellent website that Google has created on the subject.

More big data: the US Justice Department has been tracking number plates – storing hundreds of millions of car movements from licence plate readers.

The Big Mac index of currency relativities. Does this still work?

Artificial Intelligence won't kill us, says Microsoft Research chief. But would he know?

A spectacular skiing video, worth watching to the end.

Cato Institute's misery index: Venezuela tops the charts (again) and Australia is no.78 out of 108. Come on Oz, that's not good enough!

I subscribe to a newsletter called “Zen Habits” by an American buddhist called Leo Babauta. The other day he wrote a good item called “A gradual approach to healthy eating”, which I think is worth reading.

John Menadue on why health reform is needed.

Interesting blog by a conservative pro-gun person on the subject of America's gun laws. The US is 111th on the league of murders per capita, he says: "How tragically disappointing that must be for our moral superiors.”

On a related matter: the US campaign finance system means that its politicians come “pre-corrupted”.

This bloke has done a lot of research on suicide and come to 10 conclusions. It's worth reading. (No.1 - we don't have the right to suicide).

A fascinating email exchange about how a venture capitalist missed Airbnb, the accommodation start-up.

A history of global economics – in football shirts.

Top ten amazing libraries – these are great, especially Nigella Lawson's, containing more than 6000 cookbooks.

Happy Birthday Mario Lanza, born Alfred Arnold Cocozza, who would have turned 94 today if he hadn't died at 48. Was his Nessun Dorma better than Pavarotti's? You decide. In any case, it's truly magnificent.

Happy Birthday, too, to Philip Glass. Here's one of his beautiful piano etudes.

And finally, birthday greetings to Marcus Mumford, lead singer of my current favourite band, Mumford and Sons. I might have linked to this before, but if so – here it is again: Babel.

Quote of the Week:

Bull markets are born on pessimism, grow on scepticism, mature on optimism and die of euphoria.”

- John Templeton

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

Share markets have had a mixed week with messy US earnings results and worries about the Fed and Greece weighing on US and European shares, Chinese stocks continuing to go through a bit of a correction but Japanese and Australian shares seeing gains. Bond yields were also mixed with falls in the US and Australia but increases in some eurozone countries after their recent sharp falls. Commodity prices remained under pressure, including the oil price, and this along with heightened talk of an RBA rate cut pushed the $A below $US0.78 for the first time since 2009.

Is the negative January in US shares (-1.8% month to date) a bad sign for the year as a whole? While the January barometer, "as goes January, so goes the year", has sent a bad signal, it's worth noting that it's not that reliable when it comes to negative January's going on to negative years. In fact, since 1980 the hit rate of a negative January going on to a negative year has only been 38% in the US. The most recent failure on this front was last year when US shares fell 3.6% in January but rose 11.4% in 2014 as a whole. So a negative January in US shares doesn't mean much for the rest of the year as a whole. It's not an issue for Australian shares of course which have had a positive January (up around 3% month to date), and where since 1980 positive January's have 75% of the time seen positive gains for the year as a whole.

In Europe, its early days in terms of the new Greek Government and the Troika (of the IMF, EU and ECB) reaching an agreement on the Greek austerity and reform program. While the rest of Europe looks prepared to grant Greece a bit of relief it's unlikely at this stage to include another debt write down, except in maybe extending the term or further lowering the interest rate. Rather most of the pressure will be on the Syriza led Greek Government to back down. Faced with the economic chaos that would result from no deal – as Troika funding would immediately end and ECB funding for Greek banks would end leading to an immediate banking crisis, capital flight and a return to depression – the Greek Government is likely to back down. However, this could take months and there is likely to be several hair-raising moments along the way. The better state of other Eurozone peripheral countries and the ECB's quantitative easing program should help prevent much contagion to the rest of Europe during the negotiation period and beyond if Greece does end up on a path to exit the Euro.

In the US the Fed continues to indicate that it can be patient in raising rates. However, while it has clearly become a bit more sensitive to international developments it also upgraded its assessment of the US economy to “solid” and job gains to “strong” and sees the fall in inflation as largely transitory leaving the overall impression that it sees itself on track to raise interest rate around June. Markets – which are factoring in a later tightening – were clearly hoping for something more dovish. For what's it's worth, our view remains for a June first tightening by the Fed, but the risks are that a further fall in core inflation towards 1% year on year in the US will see this delayed and the Fed's reference to monitoring international developments have given it an off ramp if it decides to delay.

Outside the US the predominant trend globally is still towards easing and this is putting massive pressure on the RBA to do the same. Singapore is the latest country to ease in the face of massive quantitative easing programs in Europe and Japan that are forcing other smaller countries to ease unless they want to see their currencies go higher. This should really be characterised as “easing wars” as opposed to “currency wars” and to the extent it is forcing monetary easing around the world it adds to confidence that sustained deflation can be avoided. Australia is not immune. If the RBA wants to see a continued broad based decline in the value of the $A it will have to join the easing party lest the $A rebounds again on the back of our still relatively high interest rates.

December quarter inflation data in Australia was not low enough to provide a smoking gun to justify an RBA rate cut. However, it was benign enough to provide plenty of scope for the RBA to cut in order to provide a boost to the economy. Headline inflation has fallen below the 2-3% target and is likely to fall to just 0.9% year on year in the current quarter, underlying inflation is low at 2.2% year on year and there are plenty of signs of price discounting in areas like clothing, furniture, household equipment and motor vehicles.

Major global economic events and implications

US data was mostly strong with consumer confidence at a seven year high, jobless claims down sharply and strong readings for new home sales, home prices and the Markit services PMI. However, durable goods orders were disappointingly soft for the fourth month in a row. Falling energy company capex may be weighing here, but it highlights that while the US economy is strong it's not taking off.

US December quarter earnings are a bit messy. So far 79% of companies have beaten on earnings and 56% have beaten on sales, but there have been some high profile misses indicating that the strong $A is impacting and earnings growth for the year to the December quarter is running at just 2.7%.

In the eurozone there was some good news, with consumer and business sentiment up in January, credit growth continuing to improve and German unemployment down.

Japanese data for December was mixed with a fall in unemployment, a rise in job vacancies to applicants, stronger industrial production but by less than expected and falling household spending. Core inflation remains weak once the impact of the sales tax hike is removed.

Australian economic events and implications

Apart from the December quarter inflation data, other Australian data over the past week was mostly soft with a slight fall in business conditions and business confidence remaining subdued according to the December NAB survey, skilled vacancies falling for the third month in a row in December and the terms of trading falling further although by less than expected. Private credit growth remained around the same modest 6% annualised pace seen through most of last year, with investor housing credit still growing around 10% pa, personal credit remaining weak and business credit perking up a bit. It's too early to expect APRA's macro prudential measures aimed a capping investor housing credit at 10% growth to have much impact. Producer price inflation also remains weak.

Next Week

By Craig James, Commsec

Reserve Bank in the spotlight

A raft of economic data will be released in the coming week together with a number of private sector surveys. But most investors and analysts are focussed on one thing: the first Reserve Bank Board meeting for 2015.

The Reserve Bank Board meets on Tuesday and much has changed in the past two months. Oil prices have plunged; the Aussie dollar has also weakened; and the European Central Bank has unveiled its own bond-buying program.

While we can't totally rule out a rate cut from the Reserve Bank, it is almost certain that there will be a shift in rhetoric. That is, rather than indicating that monetary policy is stuck in neutral, the Reserve Bank will shift to an ‘easing bias' – suggesting rates could fall in coming months.

The spotlight on the Reserve Bank doesn't stop with the Board meeting – the quarterly Statement on Monetary Policy will also be released on Friday. Not only does this report assess economic developments over the past quarter, it includes the latest economic growth and inflation forecasts.

In terms of economic data, the CoreLogic RP Data home value index is released on Monday with the monthly inflation gauge and Performance of Manufacturing index.

On Tuesday data on international trade is issued with the monthly building approvals publication.

On Wednesday the January new car sales figures are released with the Performance of Services index and alternate inflation for demographic groups.

And on Thursday the December retail trade figures are released. Not only will the report cover the Christmas and Boxing Day clearance sales period but it will also contain quarterly estimates of real or price-adjusted sales for the December quarter.

US employment figures dominate attention

The ‘star' of the US monthly economic data calendar is the non-farm payrolls (employment) figures. And those jobs figures are released in the coming week on Friday.

Economists expect that the good run of results continued in January with 230,000 jobs created. Apart from the jobless rate, the other indicator in the report that will be scrutinised will be the measure of wages. If wages are starting to lift, the Federal Reserve will be more likely to lift interest rates.

In terms of the other indicators, the procession starts on Monday with data on personal income and spending, construction spending and the ISM manufacturing index.

On Tuesday, data on factory orders is expected with the usual weekly data on chain store sales and auto sales. Sales of new vehicles may have edged down from a 16.92 million annual rate to 16.9 million in January.

On Wednesday, the ADP survey of private sector jobs is released together with the ISM services index. And on Thursday, international trade figures are released with the usual weekly data on claims for unemployment insurance and the Challenger job layoff series.

In China, the focus is on the various activity measures covering the manufacturing and services sectors. The official statistician – the National Bureau of Statistics – and the private sector HSBC Bank, both have purchasing manager surveys for the two key sectors of the economy. Overall the various surveys create more confusion than illumination. The NBS PMIs are released on Sunday while the HSBC measures are issued on Monday and Wednesday.

Sharemarket, interest rates, currencies & commodities

Financial market pricing suggests that there is a 50:50 chance that the Reserve Bank will cut rates on Tuesday but participants are more certain about a potential rate cut in future months.

The overnight index swap market has priced in a 50% chance that the Reserve Bank will cut rates on Tuesday. Financial market participants believe that a quarter percent rate cut in four months' time is almost certain (100% chance) while the cash rate is projected at 2.11% in nine months' time.

The US profit-reporting season continues in the coming week while at the same time the Australian earnings season also kicks off. The “confessional” period has been skewed to earnings downgrades rather than upgrades but it has been by no means one-way traffic.

On Monday, earnings results are expected from JB Hi-Fi while Echo Entertainment is amongst those to report on Tuesday. On Thursday, earnings include those from Downer EDI, Flexigroup, REA Group and Tabcorp. And on Friday, earnings are expected from Royal Wolf Holdings.