Kohler's Week: The Budget, Bonds, Vita Group, Genetic Signatures

Last Night

Dow Jones, up 0.11%

S&P 500, up 0.09%

Nasdaq, down 0.06%

Aust dollar, US80.4c

The Budget

Two things get my goat about budgets in general, and this one in particular.

First, the forward estimates. Each Government budget provides estimates of revenues and expenditures for the year we are in, for the next financial year and three subsequent years, which is perfectly fair enough and desirable.

However, treasurers have got into the habit of adding up the effect of their “gifts” (expenditures or tax reductions) over four years and then announcing that gross number, as a fact.

For example, this year, on the first page of Statement No.1 is this declaration: “At the core of the Budget are a $5.5 billion Jobs and Small Business Package and a $4.4 billion Families Package.” Those numbers of course, refer to the addition over the next four years.

Two problems with this:

1. in other walks of life, finance managers are required to report the net present value of future cash flows and as investors we take no notice of future estimates that are not discounted back to present day values, and

2. do we really think that with a political cycle of roughly two years, and budget strategies changing even more rapidly, that four-year forecasts have any meaning at all?

And we learnt from the Prime Minister and the Treasurer as they marketed the budget the next day that small business was, indeed, the core of the budget, as they urged them repeatedly to “have a go”. All of which was politics as usual.

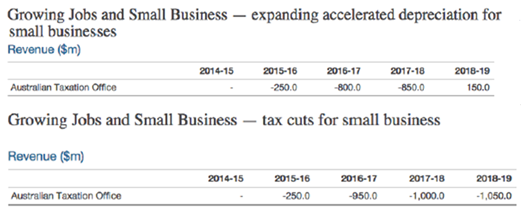

But here are the actual figures for the “Jobs and Small Business Package” copied and pasted from Statement no.2:

Apart from anything else, those small business measures presumably are meant to go much longer than four years.

In fact, there is no sunset clause on them so they can go forever – the present value of that small business tax cut, for example, extended for 20 years and assuming the current 10-year bond yield as the discount rate, is $14.8 billion. So Joe Hockey could have more accurately announced a “$20 billion small business package” on budget night.

No corporate treasurer would get away with adding the gross numbers up for four years and presenting the total to directors or shareholders (leaving aside the fact that the ones in the table above add up to $5 billion, not $5.5 billion).

All Treasurers do it, not just Joe Hockey, and it merely serves to widen the gap between what politicians say and what we all know to be true or realistic.

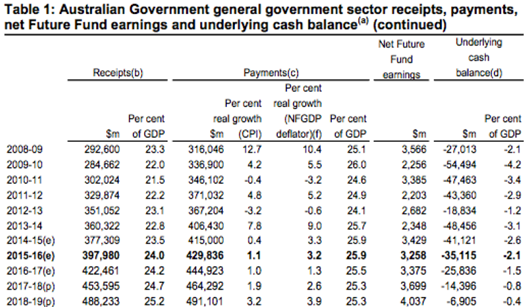

That gap becomes a chasm with some of Mr Hockey's more specific statements. Here's a quote from one of his many, many interviews: “we actually reduced the size of government by half a percentage of GDP every year. We're reducing government expenditure as a percentage of GDP, going down.” He has repeated this many times.

Here is a copy and paste of the relevant part of the main table at the back of Statement No.1:

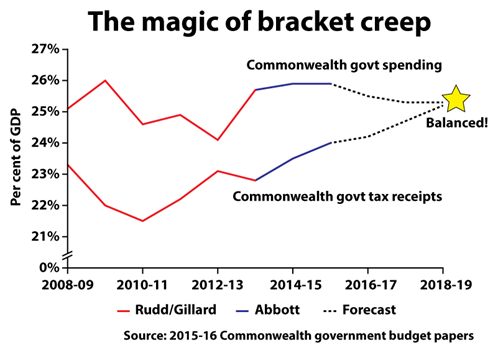

It can be seen that payments (the size of government) are higher every year after the 2013 election than for the previous five, apart from at the height of the GFC, when it was 0.1 per cent higher than 2015-16 at 26 per cent. Receipts (mainly tax) go above 24 per cent of GDP next year and then keep rising.

The reason the deficit is $6 billion less next year at $35.1 billion is that taxes go up by $20 billion and payments go up by $14 million.

The reason taxes keep going up as a percentage of GDP, and the only reason the Government is able to forecast declining deficits, is because of fiscal drag – the natural movement of taxpayers into higher marginal brackets because of wage inflation.

The Coalition had promised to return fiscal drag, and not rely on it to manage the budget, and its Commission of Audit had assumed that would happen.

A few Eureka Report subscribers have written to me over the past few days complaining about my negative take on the budget, accusing me of bias.

Yes, I am very grumpy about the matters above – and don't get me started about the lack of genuine infrastructure investment despite the rhetoric to the contrary – but I am not biased.

Bonds (again)

There are two ways to look at the bond market at present:

1. that we are living in Nepal or the flood plains of Bangladesh, knowing that an earthquake or flood will inevitably strike – we just don't know when or how bad it will be (and the house is starting to shake)

2. that the return of interest rates to more normal levels will be an exciting rock climb during which a safety rope will be attached to us held by Janet Yellen and Mario Draghi at the top of the cliff, doing “whatever it takes” to make sure we don't fall.

Now, I should state up front that I am very wary these days of pronouncements of doom and gloom, or anything at all to be honest. Not that I needed reminding, but I was reminded of why by a subscriber this week, who wrote mainly to castigate me for my bias over the Budget and added the following:

“When you panicked my wife into turning my super fund into cash – I think last year in January, was it? I had to re-buy all those shares – it was only $2 million involved – so perception and confidence are extremely important to Joe public – and my wife, obviously! I think you should have taken a glass half full approach because I believe your opinion is extremely well respected and trusted throughout the nation.”

It was December 17, 2011, in fact, but it obviously seems like yesterday to this poor bloke and his wife.

I ate my own cooking at the time, and had to do a lot of re-buying as well, but more importantly it was a big lesson. What I got wrong was the willingness of the Federal Reserve, and then the ECB, to print any amount of money and to keep interest rates at zero for any amount of time – whatever it takes.

Moreover I didn't appreciate what an impact that behaviour would have on share prices and bond yields and therefore Australian bank stocks. The Fed-fuelled rally since, er, December 2011, has been ferocious.

With that in mind I attended a dinner with the senior executive team of one of our major banks this week. During the pre-dinner drinks and the meal itself, I spoke to most of them, one at a time.

The main topic on their minds was interest rates, and specifically the bond market. “We are heading into uncharted territory,” said one of them, echoing the others.

The issue they identified was that the markets are too sanguine about the process of returning interest rates to “normal”: they think it will happen slowly, but the Fed itself, and many bankers, think it will happen rather more quickly. As a result, these bankers believe the transition to higher interest rates will be disorderly – “there will be a lot of turmoil, in both bond and equity markets,” one of them concluded.

When? Don't know. One very senior executive who has been hanging around the bond markets for 35 years, said he didn't think this correction was “the one”… it just doesn't smell like it to him.

And anyway, won't the Fed and the ECB continue to do whatever it takes to prevent turmoil? Perhaps.

There have been three major bond bull markets in the past 150 years: 1865 to 1900, 1920 to 1946 and 1981 to the present.

Jim Grant of Grant's Interest Rate Observer notes that: “(bearing in mind the limited sample size) ending points are… marked by the metallic scraping sounds of conservative fiduciaries searching for suitable income-producing investments at the bottoms of barrels.”

He might have included SMSF trustees in the group of bottom scrapers. The hunt for yield among retired “conservative fiduciaries” seeking a reasonably comfortable life is truly heart-breaking.

“This particular bull bond market,” Jim Grant goes on, “the post-1981 episode, is unique.

“It owes its extreme valuations, in good part, to radical monetary policy. In no previous modern interest rate cycle did short-dated sovereign yields make their lows at less than zero or the 10-year Bund its low at just 5 basis points above zero.”

“The mispricing of biotech stocks or corn and soybeans is of no great consequence to finance at large. Interest rates are another matter. Universal prices, they discount future cash flows, calibrate risk and define investment hurdle rates. Interest rates are the traffic signals of a market economy. Ordinarily, some are amber, some are red and some are green. Since 2008, they have been mainly green.”

I should add that Jim was among those I quoted in December 2011 when warning of storms ahead. Unlike me, he has stuck with being wrong.

Well, perhaps incredulous might be a better way to put it than wrong: “Posterity, reading about this era in finance, may need some persuading that what is purported to have happened did actually happen, and to sentient beings at that. It seems implausible even now, when we are living through it.”

That's the trouble with listening to old hands like Jim Grant and the 35-year bond market veteran I consulted over dinner the other night. What's happening now has never happened before, so they have no frame of reference and therefore don't find it comfortable.

Nor, for that matter, do Janet Yellen and Mario Draghi and their teams of boffins and geniuses have a frame of reference, although they do seem to be comfortable and relaxed.

But anyway, we are here now, and in the past few weeks bond markets have developed some cracks even as weak economic data out of both the US and Europe suggest they should be doing the opposite.

This time, however, the discretion that is the better part of my valour requires me to be cautious in my caution, as it were. I'll be taking out a little cash insurance and focusing even more intently than usual on the business models of the companies that I'm investing in.

Sure, their share prices might take a hit at some point, don't know when, don't know how much, but how secure are their profits? That is the question I'll be putting to my portfolio, and to the analysts at Eureka Report.

Talga Resources

I received this note from a subscriber (who wishes to remain anonymous) concerning my interview last week with the CEO of Talga Resources, Mark Thompson, which I republish here in full, with no comment (I should add that he says he's not an expert and these are just his views):

“I note your comments on Talga Resources. I have nothing specific to say about Talga per se but I am not convinced about the current merit of investing in companies starting out to mine graphite.

“Graphite is not a rare mineral. There are vast resources of reasonable quality in the world but not so many graphite mines. Some of the known graphite resources may be in politically unstable countries and so Talga's choice of Sweden may make sense from a political risk view.

“My view is the problem with spending substantial money to develop new graphite mines and of making money out of graphite mining is that its mine production is not scalable. Being an industrial mineral a producer can only sell the amount it has a market for and the market is dominated by very few major consumers.

“It is not like oil or gold where a producer can sell all that it produces at varying prices. With graphite it does not matter how much a company can develop and produce, it only makes sense to produce the amount for which it can obtain firm sales contracts.

“I think graphite had a share bubble last year which was extremely short lived, less than six months.

“Also even though graphene may be a miracle commodity with its extraordinary electrical conductance, to achieve this conductivity my understanding is that the graphene molecule only needs to be sprayed on to say plastic at a thickness of not much more than an atom. This means even if graphite has an explosive growth in its use not much tonnage in absolute terms may be needed.”

Vita Group

Another two interviews for you this week – one we know very well at Eureka Report, Vita Group (pronounced Veeta), and another I had never heard of before but have now developed a keen interest in – Genetic Signatures.

Vita Group was first picked as a “buy” by our analyst Simon Dumaresq in March 2014 when it was priced at 70c. It is now $1.74.

Here is his first note and here is his most recent one.

I don't have much to add to what Simon wrote, except that Maxine Horne, the CEO, is very impressive. She launched the business 20 years ago and still owns 36 per cent. Her management philosophy is both unique (staff come first, all else follows) and very effective, and her business strategy appears sound.

You can watch/read the interview with Maxine Horne here.

Genetic Signatures

John Melki, the CEO, has also been with this company for 20 years, but he didn't launch it – that was done by the late Geoff Grigg, a former CSIRO scientist.

Grigg discovered, or invented, not sure which, a new method of methylating DNA, which has now resulted in a series of global patents about tests for disease. Genetic Signatures' “Easyscreen” test for gastroenteritis has been selling for a couple of years and last year 40,800 were sold for between $12 and $50 a pop.

The company was listed in March this year at 40c and is now 39c, having been up to 48c and down to 36c. The company is burning $400,000 a month as it develops its molecular screening techniques into other diseases than gastro and markets its tests in Europe and the US.

I think it is well worth watching this video and/or reading the transcript, which you can do here.

Readings & Viewings

Interesting commentary from David Kotok of Cumberland Advisers on the bond market situation – he calls it the “schnitzel tantrum”.

And other good commentary on the bond market from Jared Dillian on the Mauldin Economics website.

Our friends at Clime: don't dump yield stocks in this bond correction.

The Bank of Switzerland has just announced a huge loss. Here's an interesting piece examining what it means.

My detailed analysis of the budget.

The magic of bracket creep (or fiscal drag).

Annabel Crabb on the budget.

A lecturer in linguistics on the budget: Hockey is the first Treasurer since 1981 not to mention GDP in his speech.

Barrie Cassidy: Just as Labor refuses to accept any responsibility for the fiscal handicap the country now faces, the Government resolutely refuses to concede that its performance on debt and deficit is no better.

America's wholesale price index has its biggest drop in five years.

A good piece explaining in detail how the Conservatives won the UK election.

Veteran journalist, Seymour Hersh, created some waves this week with a 10,000 word essay on the killing of Osama bin Laden, and how the Obama Administration lied about it. Here's the piece.

And here is an interview with Hersh defending it.

Top CEOs in the US make 373 times the average worker.

China's economic weather report is mostly cloudy.

It is now increasingly clear that between the fourth and 12 centuries the influence of India in Asia was comparable to the influence of Greece in Aegean Turkey and Rome, and then in the rest of Europe in the early centuries BC.

Prince Charles's letters to the Government were released under FOI this week. Here's a very funny spoof on it.

What Tesla and Apple both know about entering new markets.

An interview takes an unexpected twist.

A poignant/funny story by Louis CK about his trip to Moscow.

Water is now the world's best-selling soft drink.

Amazing – a Chinese billionaire sent all of his 6,400 employees on a French vacation.

Anti-colonial revolutions led to fundamentalism, dogma and sexism. Why?

The US has a higher proportion of children in poverty than any other developed country except Romania. It also is the only major developed country that does not provide cash allowances to poor children.

Kenneth Rogoff says that restricting flows of people across international boundaries is morally indefensible. Hard to agree, perhaps, but interesting point of view.

A funny performance by a strong/piano quartet, sent in by a helpful subscriber.

By far the best thing on TV at the moment is Wolf Hall. Magnificent production from the BBC. I watched this scene last night: Anne Boleyn confronts Thomas Cromwell, as Henry loses interest in her and the infant Elizabeth. “Madam, nothing here is personal.”

BB King died yesterday, aged 89. I started listening to him close to 50 years ago and have always kept coming back to him. My favourite record was Live in Cook County Jail, which was a rollicking, boisterous performance, and heaps of fun – BB King at his best. Here he is doing How Blue Can You Get.

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

While the bond sell off continued over the past week it showed signs of stabilising and this helped shares a bit. In fact, while eurozone share fell slightly, US shares made it to a new record closing high and Australian, Japanese and Chinese shares also rose. Meanwhile, the US dollar continued to fall on mixed US data and this saw most commodity prices edge higher and the Australian dollar push back above $US0.80, which must be a concern for the RBA.

How far will the bond sell off go? In the short term it's too early to say that the bond sell off is over as positions that built up on the back of deflation fears earlier this year could continue to unwind. However, bond yields are unlikely to back up too far for several reasons. First, in Europe - which is the epicentre of the bond sell-off - the ECB bond buying program has a long way to go with ECB President Draghi reminding that “we will implement in full our (QE) purchase program”. In fact the ECB is likely to appreciate the fact that it can now buy bonds on more attractive yields and that there seems to be plenty of investors willing to now sell them to it. Second, global growth remains below trend and underlying inflation remains very low. Finally, flowing on from this central banks are unlikely to ratify the back up in bond yields with sharp rate hikes like occurred in the 1994 bond crash. Soft data in the US if anything is pushing out the timing of the Fed's first rate hike, rate hikes are not even on the horizon in Europe, Japan and Australia and in China rates are set to fall a lot further. So while it's hard to be bullish on bonds - because yields remain very low pointing to low medium term returns - it's hard to be too bearish either as the world remains awash in savings and spare capacity.

Similarly, the pull back in shares could have further to run if bond yields remain under short term pressure and as we proceed through a seasonally weak part of the year for shares. However, our view remains that in the absence of unambiguous and broad based share market overvaluation, investor euphoria in favour of shares and excessively tight monetary conditions that will drive bond yields rapidly higher or slow growth significantly, what we are seeing in shares is more likely to be a correction than the start of a new bear market. Corrections are quite normal and healthy for shares in that they help prevent markets from overheating and provide opportunities for investors. In anticipation of a correction in bonds and shares we have been running a higher than normal cash allocation and see recent moves as setting up investment opportunities.

In Australia, the Federal Government's Budget was a far a more boring and moderate affair than last year's austerity debacle. Reflecting this, it's likely to have a positive impact on confidence. The big positives are increased child care assistance and a tax cut & instant tax write off for capital spending items up to $20,000 for small business. Both the child care and small business packages look to have been received very well and the tax write off looks like providing a boost for retailers, car sales and capital goods providers. It would be dangerous to overstate the upside as the various "spending measures" are being fully offset by savings including the decision not proceed with the proposed Paid Parental Leave Scheme. However, the child care and small business measures look like generating a bigger bang for the buck than the expensive PPL would have. At the very least, this Budget looks like providing a boost to confidence in contrast to last year's confidence zapper. However, the downside is that the Government is still seeking to have the Senate pass many of last year's savings so there could be another fight with the Senate, the revenue assumptions being based on a return to 3.5 per cent growth from 2017-18 look at risk and the return to surplus looks as distant as ever.

Major global economic events and implications

US data was mixed but on balance suggests a soft start to June quarter growth. On the positive side small business optimism rose but remains below the highs of a few months ago, job openings remained solid, the quit rate improved and unemployment claims fell to around a 15 year low. Against this, retail sales disappointed in April indicating the soft patch in consumer spending seen since late last year is yet to pass. At the same time the strong US dollar is continuing to bear down on import prices and inflation. There is still no reason for the Fed to hurry in raising interest rates.

Eurozone growth picked up to its fastest pace since 2011 in the March quarter. GDP growth was 0.4 per cent quarter on quarter or 1 per cent year on year, with the pick-up led by Spain and Greece. And this occurred largely before the impact of quantitative easing which only started in March. A further acceleration in growth is likely ahead, but with inflation remaining well below target its way too early to consider a premature end to the ECB's QE program. Meanwhile, negotiations with Greece over a reform for funding deal continue to drag on, although some on both sides have indicated some progress.

Japan saw a further improvement in the Ecowatchers confidence survey and a sharp fall in bankruptcies both of which are positive for growth.

Weaker than expected Chinese economic indicators for April – retail sales, industrial production, fixed asset investment, money supply and credit – coming on the back of soft readings for trade and the HSBC PMI indicate that growth is still yet to pick up. With inflation remaining low further policy easing is likely with the benchmark 12 month lending rate likely to be cut to around 4 per cent this year, from 5.1 per cent.

Australian economic events and implications

Australian economic data was mixed. According to the NAB business survey confidence and conditions remain sub-par, and wages growth fell to the lowest level on record (since 1997) of just 2.3 per cent over the year to the March quarter. Weak wages growth is bad for household income and indicates no inflation threat from this source. Against this, growth in housing finance for investors remains way too strong highlighting the need for further APRA efforts to try and rein it in. The latter looks to be on the way with a speech by APRA Chairman Wayne Byres indicating it expects to see tougher lending standards evident in slower growth in investor lending through the second half of the year and if not lenders should expect more action by APRA. Maybe the RBNZ's exploration of a more targeted approach to macro prudential controls (focussed on Auckland versus the rest of NZ) is worth looking into given the concentration of housing market strength in Sydney.

Next Week

By Craig James, Commsec

A quiet week in prospect in Australia

In Australia, economic data or events will be in short supply in the coming week with minutes of the last Reserve Bank Board meeting and consumer sentiment data vying for attention. In the US, the minutes of the last central bank meeting are issued. And “flash” readings on manufacturing activity are expected on Friday across the globe.

In Australia, the week kicks off on Monday with a report from the Bureau of Statistics (ABS) on new car sales. The ABS recasts the industry data on new car sales, converting the original data into seasonally adjusted and trend estimates. The Federal Chamber of Automotive Industries has already reported that 81,656 new vehicles were sold in April, up 1.2 per cent on a year ago. Interestingly we may be seeing a mixed picture on consumer spending but the same cannot be said for sales of sports utility vehicles (or four-wheel drive vehicles). It is clear that demand for SUVs remains the main driver of the new vehicle market. In fact SUV sales are up 17 per cent on a year ago and now one in three new vehicles sold in Australia is a SUV.

Also on Monday Reserve Bank Deputy Governor Lowe delivers a morning address at the Corporate Finance Forum in Sydney.

On Tuesday the Reserve Bank releases minutes of the last Board meeting. This was the meeting held a fortnight ago that decided on another interest rate cut. The question is whether there is anything new to learn about the decision. The Reserve Bank released a statement after the rate decision and the quarterly Statement on Monetary Policy was issued last Friday. However investors will be hoping that policymakers provide more context on future interest rate movements – especially given that the Reserve Bank refrained from explicitly providing forward guidance on interest rates following the May rate cut.

Also on Tuesday Roy Morgan and ANZ release the weekly consumer sentiment survey. The recent lift in the Aussie dollar has supported sentiment, however the focus will shift to household views on the economic landscape in the context of the Federal Budget.

Similarly on Wednesday Westpac and the Melbourne Institute release the survey of consumer sentiment for May. Since the 2014 Federal Budget consumer sentiment has been in “pessimistic” territory – below a reading of 100 – for 11 out of the past 12 months. But given the 2015 Federal Budget contained few ‘nasties', the hope is that it provided some comfort for consumers.

Also issued on Wednesday is the latest survey of skilled job vacancies from the Department of Employment and Workplace Relations. Anything that could provide further clarity about the recent improvements in the job market was headed would be warmly viewed by investors and analysts.

The Reserve Bank will close out the week in Australia with a couple of further speeches. On Wednesday Deputy Governor Phillip Lowe will moderate a panel discussion at The Future of International Governance and the G20 conference. On Thursday Reserve Bank Assistant Governor Malcom Edey will deliver a morning address at the 20th annual Cards & Payments conference in Melbourne.

Federal Reserve minutes and housing indicators in focus

Turning attention to the US, the week kicks off on Monday with the release of the National Association of Home Builders index for May to be released. Economists expect the NAHB index to hold steady at 56.

On Tuesday, data on housing starts will be issued alongside building permits for April. The number of home starts rose by 2 per cent in March and given the improvement in weather conditions, economists tip a substantial lift in starts of around 9-10 per cent in April. Building starts are expected to have risen by 3 per cent in April. Also on Tuesday, Federal Reserve chair Janet Yellen fronts the Financial Stability Oversight Council.

On Wednesday minutes of the last Federal Reserve meeting are released and investors will look for clues on the timing of rate hikes. There will be particular focus on the Fed's views when it comes to the labour market. We expect the Fed to look to raise interest rates in the September quarter.

On Thursday, no less than five separate reports are released. The leading index is issued together with the influential Philadelphia Federal Reserve (Philly Fed) survey, existing home sales, Kansas City Federal Reserve index, and weekly data on jobless claims. In terms of data on existing home sales, economists expect that sales rose by 1.2 per cent in April. Across all other indicators economists expect improvement, potentially underpinning investor sentiment on the broader economy.

On Friday the Markit “flash” reading on the manufacturing purchasing manager's index (PMI) for May is released alongside the monthly inflation reading (consumer prices). Core prices (excludes food and energy) are up just 1.8 per cent over the year. Also on Friday, Markit issues “flash” PMIs for China, France, Germany and the eurozone.

Sharemarket, interest rates, currencies & commodities

The good news is that the global economy is doing better with the US jobless rate at 7-year lows and activity data in the euro zone showing signs of improvement.

The bad news is that the stronger growth has led to a lift in global bond yields, with the impact reverberating across other markets, such as equities.

In Australia, 10-year bond yields are back near 3 per cent, a gain of around 75 basis points from the all-time lows on April 14. Over the same period, US 10-year bond yields have lifted by around 40 basis points while German equivalent yields have lifted by around 60 basis points.

Shane Oliver adds:

Outlook for markets

Given the uncertainties around the bond sell off, the Fed's eventual move to tightening and Greece the next few months could remain volatile for shares. However, notwithstanding near term risks, the conditions for an end to the cyclical bull market in shares are still not in place: valuations against bonds remain good; economic growth is continuing at a not too cold but not too hot pace; and monetary conditions are set to remain easy. As such, share markets are likely to see another year of reasonable returns. My year-end target for Australian shares remains 6000. It's just that the market got ahead of itself with the surge earlier this year.

Still low bond yields point to soft medium term returns from bonds, but it's hard to get too bearish on bonds in a world of too much saving, spare capacity and deflation risk. Central banks won't be ratifying a bond crash like in 1994.

Despite the risk of a further short term bounce in the Australian dollar – possibly up to the 200 day moving average around $US0.83-84 - the broad trend is likely to remain down as the Fed is still likely to raise rates later this year whereas the RBA retains a mild easing bias (which is likely to turn into an easing if the Australian dollar doesn't soon head back down) and the long term trend in commodity prices remains down. We expect a fall to $US0.70 by year end, and a probable overshoot into the $US0.60s in the years ahead.