Kohler's Week: The bond/bank bull market, Recession, China, Praemium, Benitec

Last Night

Dow Jones, up 1.03%

S&P 500, up 1.08%

Nasdaq, up 1.29%

Aust dollar, US78.5c

End of the bond/bank bull market?

This week saw a pretty solid sell-off of global bonds, starting with German bunds, leading to a 5 per cent correction of Australian bank share prices.

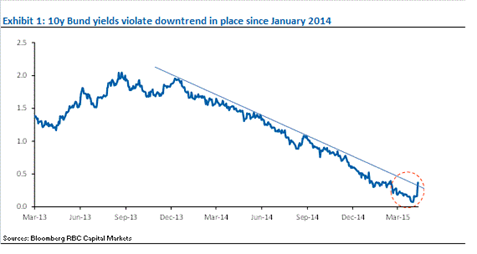

The rise in German bund yields was quite pronounced, and was definitely the key investment event of the week:

Here's the sequence of events:

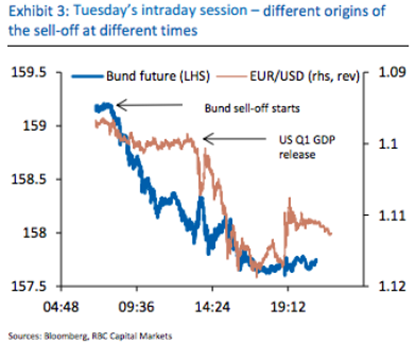

The sell-off in bunds began in the early hours of Tuesday:

The Aussie five-year bond yield started to move soon after:

And then the Australian bank share index headed south on Wednesday and Thursday morning, falling a total of 5 per cent in two days:

Depending on how you look at it the global bond bull market has been going on for 30 years (since the peak in US yields in the early 1980s), eight years (since the pre-GFC peak of July 2007), four years (since German bund yields started to collapse as a result of the Greek crisis) or 16 months (since yields unexpectedly turned down at the start of 2014, and as shown by today's first chart).

For most of us in Australia the relevant time frame appears to be four years: the beginning of the bull market in our banks coincided with the start of the fall in German yields in 2011, when the 10-year bund peaked at 3.7 per cent. It is now 0.37 per cent.

Needless to say a “10-bagger” in German bonds over four years, and the rapid decline since January 2014, is an astonishing turn of events and leads me to think that despite all the focus on the Fed and the US economy, the most significant factor in global markets for the past few years has been Europe.

In other words, concern about deflation in Europe has dragged down the global rate structure and led directly to a powerful bull market in Australian banks, as proxies for bonds in this country.

The question before the house is whether this week's action signals an end to the bond bull market, whenever it began.

The first thing to say is that the bund sell-off appears to have started all by itself, with no trigger – apart, perhaps, from Bill Gross, formerly of Pimco, declaring German bunds were the “short of lifetime”.

He was joined a day or two later by another “bond titan”, Jeffrey Gundlach of DoubleLine Capital, talking on Bloomberg on Wednesday.

As the first graph today shows, it began before the US GDP came out – at a fairly shocking 0.2 per cent for the March quarter.

This week's other key event was the removal of Finance Minister Yanis Varoufakis from the Greek negotiating team.

When I was in Athens last week he was the talk of the town, as he has been for a while, but not in a nice way. There was growing frustration with his posturing and rock-star behaviour, with a number of Greeks commenting that Varoufakis didn't appear to be very serious about solving the nation's problems with its creditors. He seemed to be more interested in his own profile.

A few days later – boom! – he's gone … as chief negotiator. The Athens share index lurched higher as credit fears eased. Could that have been behind the bund sell-off? Probably not: European peripheral bonds didn't move much, as they would have if that were true.

So it looks like it was simply profit-taking and position-squaring, possibly in response to Bill Gross' scare mongering.

Now, the reason to ask whether this might be the end of the bull market in bonds and bank shares is that that moment can't be too far off.

Bonds globally are priced for perfection, which for this market means recession and continuing disinflation, if not deflation (bonds do best in bad economic times when inflation is falling). Clearly there has been logic to this as far as Europe goes, given the high risk of a catastrophic eurozone break-up and the underlying weakness of the economy.

In addition to that the European bond markets in particular have been showing all the signs of bubble behaviour, with many two-to-five-year yields going negative. As I've commented before, this can only be a game of ‘pass the parcel' – that bond investors are expecting to make a capital gain by selling at a higher price (lower yield) to some other mug later. They're certainly not looking to hold to maturity for the yield, of which there isn't any.

As Gundlach said: “The easiest thing in the world to not own is a negative interest bond.”

But as I have learnt over 45 years in the markets, this sort of thing can go on much longer than you expect and end for no obvious reason when you least expect it. The way Gundlach put it this week is that bull markets tend to end gradually, and then suddenly.

So it will be with bonds, and therefore Aussie banks.

In any case, the fact is that we have already seen very solid improvements in European economic data as a result of the weaker euro, lower energy prices, lower interest rates and more recently ECB quantitative easing.

And as I wrote last Saturday, there can be a growing suspicion that things with Greece might actually turn out OK.

I mean, think about it: no self-respecting negotiator does a deal till the last minute. While the media and markets wring their hands and wallow in fear and loathing over the lack of a deal between Greece and the IMF/ECB/EU, neither negotiating team will say ‘done' until five minutes before the deadline: to do otherwise means you have not got the best possible deal. It is what always happens in every difficult negotiation.

As always, the only tool that works in determining major market turning points is hindsight, but if my confidence about the Greek situation is well-founded, and as the lower exchange rate and cheaper energy and credit in Europe continue to do their work on economic growth, that turning point can't be a long way off.

So are Australian banks now a sell? Well, no, but the situation bears watching. The only reason their dividends WON'T be secure is if there is an Australian recession (which admittedly can't be ruled out); the relevance of what's happening in the German bund market is that it will determine the price that the market is prepared to pay for those dividends.

A week ago, the market was paying $38.50 for Westpac's dividend of $1.82 – a yield of 4.8 per cent. Yesterday it was paying $36.46 – a yield of 5 per cent.

Recession?

So, will there be an Australian recession? To cut to the chase, and as the pros say: it is not my investment “base case”.

The key adjustment going on in the Australian economy is a decline in national income: the mining boom was essentially an extended episode of national income, and therefore domestic demand, running well ahead of GDP growth.

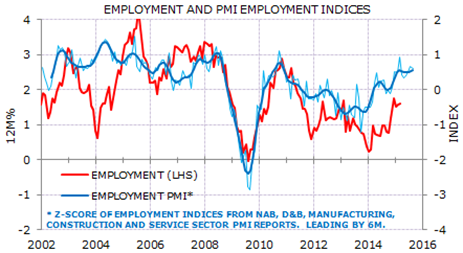

Now the reverse is happening: income and demand are running below GDP because of the decline in the terms of trade. The way to tell whether this is turning into a GDP recession is to watch employment, and so far there are no problems, as this graph from Gerard Minack shows:

(The employment PMI comes from the survey of employment intentions – Gerard puts together a few of them to get a more accurate reading).

Employment is strong, and on that basis there is no warning sign of recession.

What's more, there seems to be a consensus that the Reserve Bank of Australia will cut interest rates again next week, and that the Federal Budget in a couple of weeks will not detract from economic growth and employment through a big spending cut.

To get specific, and as Gerard says: “Until recession is an actionable risk, my view is that banks can continue to give reasonable performance relative to the overall domestic equity market.”

OK, so what about US recession?

US data has started to surprise on the downside, exemplified by this week's 0.2 per cent read for March quarter GDP (versus consensus forecast of 1 per cent).

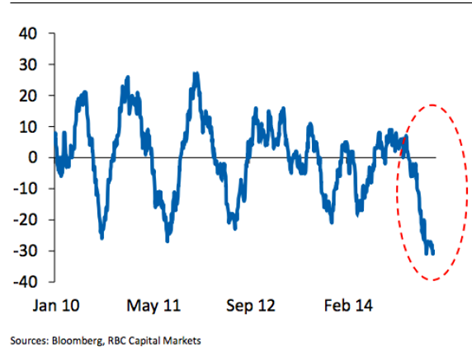

But that's far from the first one of those:

US data surprises (three-month rolling scorecard)

The big surprise, and the one that unnerved markets, was the 2.6 per cent drop in manufacturing sales in the March quarter, which predated GDP. That sort of thing has historically been associated with recession.

This time, however, it was entirely caused by lower prices – volumes grew 2.8 per cent. Lower prices have created the impression of an inventory build-up, because stock valuations take longer to adjust than selling prices. Inventory build-up is another sign of impending recession, but in this case it's false.

As I see it, the only problem in the US is that the competitiveness of its manufacturing industry is starting to be eroded by the strong US dollar.

That aside, the weakness in the data looks temporary and the US economy continues to have a lot of momentum.

China

This chart from Shane Oliver about sums it up:

Good message: the sharemarket is telling us the growth decline won't last long and an upturn in the economy is on the way.

Bad message: Chinese punters have gone mad and are betting borrowed money on a bubble that will end very badly.

Praemium

A couple of quite interesting interviews for you this week.

First, Michael Ohanessian of Praemium, which is the equities platform business. It began as a tool for accountants to do the tax returns for investment portfolios and became a platform for SMAs (separately managed accounts).

SMAs are now undergoing a boom because of the Future of Financial Advice reforms – financial planners, unable now to collect commissions from the producers of managed funds, are turning increasingly to these things to replace them. An SMA allows a planner to take what is, in effect, a trailing commission, but is actually just a share of the fee.

The fee is split three ways: the fund manager who provides the portfolio – the intellectual property, Praemium, which provides the administrative platform, and the financial planner who flogs it to the punter.

Now, as you can tell, I'm not all that enamoured with all of this, but the fact is a lot of people use financial advisers and those advisers have to make a living. An increasing number are sending bills for their time, but there's still a lot of resistance to paying a big financial advice bill. A lot of people, probably most, prefer to have the money taken quietly off their account.

That's where Praemium's business comes in. The company had a terrible time after the GFC when investors turned away from equities for a while and the share price fell from $1.20 to 7c in not very long, but it's definitely on the way back now and the price is now 37c.

You can watch, or read, my interview with Michael here.

Benitec

This a biotech that is based on technology that came out of CSIRO 20 years ago – a new way of turning off genes, known as RNA interference. It was discovered by Dr Michael Graham, who is now chief scientist of Benitec.

The CEO, who I interviewed this week, is Dr Peter French, who took over management in 2010 when it was basically out of money, had no staff and faced a serious challenge to its patent in the US Patent Office.

He beat the patent challenge, raised some money and rebuilt the company. He now has 10 US biohealth institutional investors on the register and trials underway for applying the technology to hepatitis B and C.

Peter, like most CEOs (all?) is an enthusiast for his company and believes it will change the world – by entirely curing viral diseases, and potentially cancer, with one injection.

If you'd like to hear him explain how, you can watch, or read, my interview with him here.

Readings & Viewings

Interesting video discussion between Yanis Varoufakis and Joseph Stiglitz, bearing in mind that YV is no longer on the negotiating team, and JS never was. But as a summary of the issues (for about an hour) it's useful.

The Centre for Independent Studies published a really thoughtful, thought-provoking, report this week on the problem of the pension and ageing, and how the family home needs to be used to help fund retirement. Rather than read media reports of it (even mine), you should have a look at the report itself.

Here's my piece on the CIS report (in the Drum, so it's free)

A record number of properties around the world are now commanding prices above $US100 million.

The Atlanta Federal Reserve Bank correctly predicted March quarter GDP growth for the US (0.2 per cent). It's now predicting not much more for the June quarter.

Martin Feldstein: America's risky recovery.

The natural rate of interest does not exist. Hmm.

LinkedIn stock plunges 25 per cent, following Twitter and Yelp down the drain.

Whether it's outrage at Scott McIntyre's Anzac Day tweets or Samantha Armytage's on-air comments, camps are quickly divided into "left" and "right" and any chance of constructive discussion is lost.

How the Mayweather-Pacquiao fight became the richest boxing match in history. And it doesn't even have Muhammad Ali in it!

But it's going to be an extraordinarily overpriced dud. There will be disappointment, says the headline.

The UK election is next Thursday and it's going to be very close. Here's a prediction from the polling aggregator, Fivethirtyeight.

Speaking of which, here's a mash-up of the best moments of British MP, Jacob Rees-Mogg – quite entertaining.

Still on the UK: Paul Krugman wades into its austerity program – “the case for cuts was a lie: why does Britain still believe it?”

Krugman again: almost nobody admits they were wrong. We live in an age of unacknowledged error.

Is the Asian growth miracle over?

A comment on the Fed statement this week: all clues to when the Fed funds rate will be raised have been removed.

Highlights from the Fed statement from the Wall Street Journal's Real Time Economics.

Alfred Hitchcock, who died 35 years ago on Wednesday, had a simple secret for happiness.

The New York Times editorial on the Baltimore riots this week. Worth reading.

The moral case for inequality – it benefits the least well off.

Six investing ideas for the second half, from BlackRock.

The World Economic Forum's report on global entrepreneurialism. Interesting, but you'd have to be keen. (pdf)

Apparently Apple sold 30 per cent of its iPhone 6's in China, where sales rose 72 per cent.

Michelle Grattan: Australia's relationship with Indonesia will never be easy.

Joni Mitchell was reported to have gone into a coma this week, but then her website said she hadn't and was up and about. I suspect she's not well; it will be a big day when she dies – one of the 20th century's greatest geniuses (in my opinion). Here's one of my (many) favourite Joni songs: The Last Time I Saw Richard (live, from Miles of Aisles).

It's Brian Lara's birthday today (he's 46). Here's the last bit of his 400 against England in 2004.

And it's David Beckham's 40th birthday today. Here are his top 10 goals.

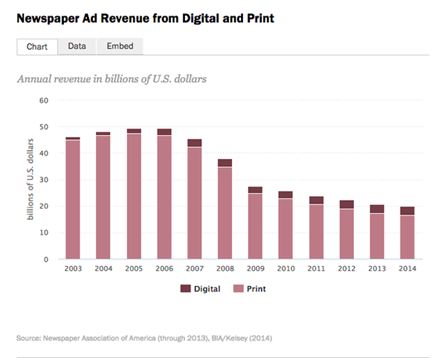

This chart shows why newspapers are worried, to say the least:

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

Shares had a soft weak reflecting a combination of somewhat messy economic data, uncertainty about the Fed and a backup in Eurozone bond yields. There is also an element of profit taking after recent strong gains, particularly in Europe and Japan. Reflecting the weak global lead Australian shares also fell, after failing to break through the 6000 level for the fourth time, not helped by a bounce in the Australian dollar, indications APRA may move faster to raise bank capital requirements and talk of Australia losing its AAA rating. Bond yields rose, but this was mainly led by Europe. The US dollar continued its correction and this saw most commodity prices gain and the Australian dollar briefly bounce above $US0.80.

The Fed is still in no hurry to raise rates. There were no real surprises from the Fed. While it's not too fussed about the weak start to the year in US economic growth, its post meeting Statement left the impression that a June hike is looking very unlikely. September remains my base case, but just bear in mind that the Fed is now in data dependent mode so a run of stronger economic data and more evidence of stronger wages growth could still bring its first rate hike forward again.

The Australian dollar briefly bounced above $US0.80 for the first time since January -- more bounce ahead? With the Australian dollar breaking resistance levels, it could have a bounce to around $US0.85. The RBA will need to be on guard against this though as it would further threaten the return to reasonable economic growth. The recent $A bounce adds to the case for another rate cut on Tuesday and a step up in efforts to jawbone it lower.

German 10-year bond yields up fivefold from two weeks ago. Admittedly that's not hard when you are coming from just 0.07 per cent so there is a danger in reading too much into it. But it is worth noting that signs of improved eurozone growth are continuing to mount, deflation fears are ebbing and a “reform for funding” deal looks closer for Greece. Higher eurozone bond yields partly explain why US and Australian bond yields are up.

It's coming up for budget time again and surprise, surprise there is another debate whether Australia will lose its AAA sovereign rating. While Australia's still low level of public debt has suggested that the risk is low, the Budget in a week's time will be the seventh in a row that has projected or implied a return to surplus within a reasonable time frame. One could be forgiven for starting to think that such projections/commitments are hollow. So the short answer is that if Canberra does not provide more confidence of a return to surplus within a reasonable time frame then the AAA rating will be at risk. While sovereign bond yields often don't go in the direction implied by sovereign rating changes its better not to take the risk, given the potential flow on to borrowing costs through the economy.

Major global economic events and implications

March quarter US GDP confirmed that the US has been going through another soft patch, but it would be wrong to read too much into it. GDP rose just 0.2 per cent annualised. Weather and the west coast port strike clearly played a role and a soft start to the year has been a pattern for years now -- with average annualised growth over the last 20 years being 3 per cent in December quarters, 1 per cent in March quarters and 3 per cent in June quarters -- pointing to a growth rebound in the current quarter. Other US economic data was mixed with weakness in consumer confidence and personal income but stronger home prices and home sales, a sharp fall in jobless claims and the employment cost index rose to 2.6 per cent year on year suggesting wages growth may be picking up, from a low base.

US March quarter profit reports continue to come in better than expected. We are now 70 per cent done and while only 48 per cent of companies so far have beaten sales expectations, 74 per cent have beaten on earnings and earnings growth for the year to the March quarter has improved to -0.2 per cent from -5.6 per cent six weeks ago. Yes, the strong $US is impacting but not as bad as feared.

Eurozone economic data was better than expected, with a smaller than expected fall in economic confidence and another improvement in lending growth. Unemployment was flat at 11.3 per cent in March, but deflation appears to be ebbing with rising oil prices now seeing CPI inflation return to flat over the year to April. But it and core inflation at 0.6 per cent year on year are still way too low for the ECB to think about curtailing QE.

Japanese data was a bit soft, with industrial production down in March albeit less than expected, a fall in small business confidence and Tokyo core inflation for the year to April running at zero, highlighting that the BoJ has more work to do. Employment data and household spending was positive though.

In China there was talk of a form of quantitative easing with the PBOC looking at ways to help smooth the local government debt swap. While pure QE is most unlikely and China is a long way from needing it - as interest rates are nowhere near zero - it is clear that the focus in China has now well and truly switched to maintaining growth via policy easing.

Australian economic events and implications

Australian economic data provided nothing new. Annual credit growth ticked up to 6.2 per cent in March but the monthly pace of 0.5 per cent is unchanged from that seen over the last few months. APRA still has its work cut out though as monthly housing investor credit bounced back to 0.9 per cent or 10.4 per cent year on year, which is above its threshold. Home prices continued to move up in April according to RP Data, but again it's driven mainly by Sydney with other capital cities averaging just 1.7 per cent year on year, with the divergence again highlighting the role for APRA in trying to bring Sydney under control rather than the RBA. Meanwhile, the goods terms of trade continued to fall in the March quarter and producer price inflation remains benign.

Next Week

By Craig James, Commsec

Key economic data and Reserve Bank Board meeting in the spotlight

In Australia a big week of economic events is scheduled including employment and retail data. In addition a Reserve Bank Board meeting and the quarterly Statement on Monetary Policy ensures that the central bank hogs the spotlight. ‘Top tier' indicators are also released in the US with employment statistics being the clear focus. Meanwhile in China, trade and inflation data are released.

In Australia, the week kicks off on Monday with two key private sector reports alongside tourism and building approvals data. The first of the private sector reports is the TD Securities/Melbourne Institute monthly inflation gauge. This gauge is the only monthly measure of prices in the economy. And the report's authors are amongst the most accurate in forecasting the outcome of the “official” Consumer Price Index. At present inflation is well contained.

The other private sector report on Monday is the ANZ Job Advertisements series. In the past this was a good gauge on hiring activity but now social media and employment agencies are more actively used. Still, job advertisements have lifted for nine out of the ten past months, giving some sense that the job market is improving.

The building approvals data for March should a further retreat of around 4 per cent. Still, dwelling approvals are holding just shy of recent record highs, and given that this is effectively the first indicator of the home building pipeline, it is clear that actual residential building will remain strong over the coming year – supporting the broader growth story.

Also on Monday, the publication, “Overseas Arrivals and Departures” has information on tourist movements as well as longer-term migration trends. Tourist arrivals and departures are both near record highs.

On Tuesday the Reserve Bank Board will hand down its interest rate decision. While another rate cut is a line-ball decision (market pricing is 58 per cent for a 25 basis point cut), we would expect the Reserve Bank to commit to further stimulus. It all gets down to the relatively high value of the Australian dollar. A further rate cut would provide relief to export-orientated businesses. In addition inflation remains well contained.

Also on Tuesday the Bureau of Statistics (ABS) releases international trade data. Australia has notched up 11 consecutive trade deficits and another trade deficit is likely for March. Of more interest will be the breakdown in exports across countries. At present Australia's exports to the US are holding at a 6-year high.

On Wednesday retail trade data for the March month and for the quarter is expected. Based on the CBA Business Sales Index, we expect that sales rose by around 0.3 per cent in March. However note that there could be complications with the seasonally adjusted data given the timing of Easter. For the quarter we expect another solid 0.9 per cent increase in inflation-adjusted sales after the 1.5 per cent lift in the December quarter.

On Thursday the ABS will release the April labour market data. The employment figures have been rather upbeat in recent months. And we expect that hiring rose further in April with jobs up by 10,000 and the unemployment rate holding around 6.1 per cent. Given the recent improvements in the labour market, more focus will be paid to hours worked.

And on Friday the Reserve Bank releases its quarterly Statement on Monetary Policy. This should prove a very even-handed account of the state of the economy, but most interest will be in any commentary on the Australian dollar and the outlook for the labour market. Of note, if the Reserve Bank does alter interest rate setting, the Statement on Monetary Policy will give policymakers a further opportunity to flesh out their reasoning.

Overseas economic events: US employment and Chinese trade will attract most interest

There is the usual bevy of economic indicators for release in the US with employment statistics dominating the headlines later in the week. In addition, data on manufacturing activity in China is released on Monday (HSBC purchasing manager index), as well as inflation and trade data later in the week.

In the US on Monday, the regional ISM New York survey is released alongside factory orders for March. On Tuesday, trade data for March is released with the ISM services sector gauge.

On Wednesday, the ADP national employment index and weekly data on home loans (mortgage applications) are released. In terms of the ADP jobs report, economists tip a 189,000 lift in private jobs – a precursor to Friday's official job report. On Thursday, the Challenger job layoff data for March is released together with consumer credit and the usual weekly figures on claims for unemployment insurance.

And on Friday in the US, the pivotal non-farm payrolls or employment data is released. In recent speeches the Federal Reserve has said that the timing of any rate hike will be ‘data dependent.' Big data like employment will play a pivotal role as to when rates are lifted. Economists expect that around 190,000 jobs were created in April – a healthy result. The jobless rate is expected to ease from 5.5 per cent to 5.4 per cent.

In China, HSBC will release its manufacturing gauge on Monday and services gauge on Wednesday. And on Friday the National Bureau of Statistics will issue trade data. In addition inflation figures are expected on Saturday alongside a raft of financial figures including new Yuan loans, M2 money supply and aggregate financing.