Kohler's Week: Pi Day, Oil & the Euro, Ardent Leisure, Dollars, Europe, China

Last Night

Dow Jones, down 0.82%

S&P 500, down 0.63%

Nasdaq, down 0.44%

Aust dollar, US76.3c

Pi Day

According to the American way of expressing dates, today is Pi Day – 3/14/15 (the mathematical value of Pi is 3.1415 etc to infinity – it's been calculated to a trillion digits after the decimal point). There will never be another Pi day in any of our lifetimes, so I suggest that you get hold of a Four 'n Twenty and consume it for lunch, just to mark the occasion, although since it's the American date rather than the Australian order of 14/3/15, maybe it should be apple pie. I'll be spending the day at a traditional Catholic wedding so I might, at the end of it, have increased both my circumference and diameter, in the proportion of 3.1415 of course.

Oil & the Euro Keep Tumbling

Oil and the euro were both smashed again last night. Crude oil for delivery in April fell more than 4 per cent to just above $US45 per barrel and as I write this morning is set for a weekly loss of 9.2 per cent. The euro has fallen to a new 12-year low against the US dollar of 1.0475.

These two continuing bear markets are the most powerful forces in global investment markets. Alternatively you could express the euro's demise as a US dollar bull market, which it is since the US currency is rising against every other, but the exchange rate that matters most is the euro versus the US dollar.

Where all this stops no one can tell, but I note that a well-known oil oracle, Doug King of Merchant Commodity Fund, is sticking to his view that oil is heading below $US40 and as low as $US30. Those looking for a recovery in the price because of a drop in production are bound to be disappointed, he told Marketwatch this morning. “I look for facts,” he said. “I look for the reality of production decline, and, today, we're not seeing it.”

And the International Energy Agency backs that up in its monthly oil report issued last night: “US supply so far shows precious little sign of slowing down,” the report said. “Quite to the contrary, it continues to defy expectations.”

As for the US dollar, Dennis Gartman has been writing and saying on radio and TV for a while now that the US dollar bull market has a long way to run. He wrote yesterday: “Indeed, we've used the baseball metaphor noting that we are very probably only in the ‘fourth inning of a nine inning game' regarding the dollar's strength and we stand by that statement. The political and monetary confusion that reigns in Europe is not going to end anytime soon, and indeed almost certainly shall become uglier and more public rather than lesser and hidden.”

The US dollar is rising because of a combination of the American economy's obvious strength and the stated intention of the Federal Reserve to raise interest rates this year.

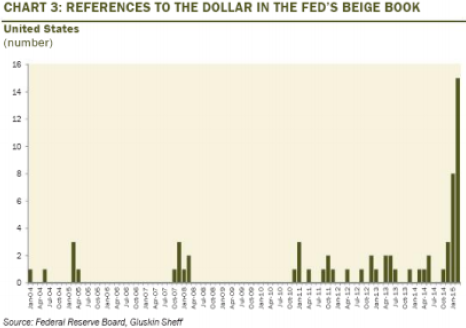

However, another much-followed newsletter writer, David Rosenberg of Gluskin Sheff, has produced an interesting graph of mentions of the dollar in the Fed's Beige Book, the monthly record of what's happening in the economy.

In the most recent Beige Book it was mentioned 15 times, which Rosenberg says is “off the charts!” In other words, the Fed is getting as worried about the dollar as the Reserve Bank of Australia has been about ours (and apparently still is).

This is hardly likely to lead to QE4, but as Gartman observed this morning: “The market has tightened for the Fed already, exonerating the Fed from that responsibility as the mere rumour of higher rates has been sufficient to send the dollar scurrying upward. Hence, perhaps the concerns that the Fed shall allow its o/n fed funds rate to ‘lift off' by mid-year may be misplaced and ill-advised?... Perhaps?”

The only other thing to observe about bull markets like the US dollar at present and bear markets like oil is, as an investor, that it's always best not to fight such powerful forces. These are times to sell commodity stocks on strength, not buy weakness. Don't forget that oil weakness and US dollar strength has an effect on all commodities, including iron ore, which fell yesterday to $US57 a tonne, where it still sits this morning.

Investors in Australia have to keep an eye on two balls in the air: currencies and commodities.

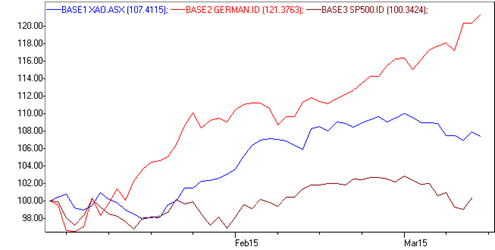

Here is a chart of the Australian All Ordinaries (blue), the German DAX index (red) and the US S&P 500 (brown), based to 100 at the beginning of this year.

So far this year the German market is up 21 per cent, the Australian market 7.4 per cent and the US market 0.3 per cent. The euro has depreciated 13.5 per cent this year against the US dollar and the Australian dollar has depreciated 6.7 per cent – half as much. The difference between the German market's performance and ours is the exchange rate.

Since the beginning of March, even though the Australian currency has continued to decline, the Australian share market has fallen because of the resumption of the commodity bear market in earnest, led by oil's fall to $US45.

Ardent Leisure

My first reaction to the 19 per cent drop in Ardent Leisure's share price to below $2 on Wednesday in response to the departure of Greg Shaw as CEO, on top of the 50c fall in February after the half-year results, was to go straight to the second stage of the Kubler-Ross five stages of grief: anger. Having interviewed Greg Shaw just two weeks ago, as well as last December, and having bought a few shares myself on the strength of how he presented, I was devastated – both for myself and for those of you who might also have bought into Ardent after my interviews.

So I rang the chairman Neil Balnaves to find out what was going on. He is a veteran of the media industry, having become managing director of Hanna Barbera Studios at 34 and then the Hamlyn Group, which started as the publishing division of James Hardie. Balnaves led a management buyout of that business in 1988, renamed it Southern Star and then floated it in 1996, making a lot of money.

He was in bed with the flu when I got hold of him on Thursday, but he managed to croak out the fact that he had spent $500,000 buying Ardent shares the previous day and that every other director had also been in the market buying at around $2, including the new CEO, Deborah Thomas, who has been a director for 15 months.

"So what happened with Greg Shaw?", I asked, possibly a little too aggressively. Well, said Balnaves, he's been CEO for 13 years and the board has been working on “renewal and succession” for a few years now. Shaw kept asking for “one more year” and they kept agreeing, but then over the past few months the board started to map out a 10-year plan for the business (Balnaves says they are not the sort of board that just shows up once a month for a meeting – they are “activists”).

As the directors developed the 10-year plan, they realised they needed a CEO who could potentially see them through the decade and that Shaw was not going to be that CEO – 23 years as CEO is way too long – so therefore it was best if he went now. Neil Balnaves didn't mention the problems with the gyms that Greg talked about when I interviewed him two weeks ago, and which had been behind the share price fall in February, but I presume that issue sealed his fate.

Also, the board wasn't happy with the lack of a marketing culture in the place: Greg Shaw was a good accountant, but didn't have a marketing bone in his body. That, it was felt, was what Ardent needs now, which is why they turned to Deborah Thomas, former editor of the Australian Women's Weekly, now owned by Bauer Media. She had dropped back to four days a week at Bauer so she could join some boards, including Ardent, but now is very definitely back to full time as CEO of the company, on $670,000 per annum, plus bonuses.

As it happens, I met a couple of guys in a similar business to Ardent just after I spoke to Neil Balnaves on Thursday, and asked them about Ardent's lack of marketing culture. They confirmed that this was well known around the traps, adding that the company's Main Event centres in the United States, which represent its key business now, are good and profitable operations but are “very daggy”. They do need to be fixed up and marketed properly.

I also rang Matthew Kidman, the fund manager who had recommended the stock so strongly at a couple of our events last year. He said, pithily, that Ardent had become expensive and was now less expensive, but still not exactly cheap.

I came away from the conversation with Neil Balnaves prepared to accept that the drop in the share price on Wednesday was an over-reaction. He says their gyms are now all moving to 24/7 operation (it was the competition from the all-night gyms that had so hurt that business), that the Main Event business in the US was “motoring along powerfully” and that the three other businesses – theme parks, bowling alleys in Australia and marinas – are all doing fine.

“The shares are well worth $3 each,” he spruiked. "Whether we can get them back to $3.50 [the AAD share price touched $3.49 for a few minutes last October] will depend on getting the gyms right, and I believe Deborah can do that.”

Good to hear, but I think I'll sit on my current small shareholding, thanks very much, acquired at an average price of $2.378, and glad I didn't sell in a panic this week.

Dollars

On December 1 last year, the weighting of Chinese renminbi in the Australian dollar's trade weighted index was increased from 24.8 to 27.8 and the weightings of the euro, yen and British pound were correspondingly reduced. The weightings now go: China 27.87, Japan 12.51, US 9.76, Europe 9.22, South Korea 5.96, Singapore 5.15, New Zealand 3.94 and UK 3.53, and then so on.

I mention this because since those weightings were set, the Chinese currency has weakened against the US dollar. That, plus the steep declines of the yen and the euro, have resulted in a smaller depreciation of the Australian trade weighted index than the US dollar exchange rate – 11 per cent versus 18 per cent since this leg of the Aussie's downward journey began last September.

The significance of this, it seems to me, is that the psychological devaluation of the Australian currency is greater than the actual devaluation. Most people feel like there has been a greater devaluation than there has been. Also, the Reserve Bank watches the TWI, which is presumably why the head of economics there, Christopher Kent, said the other day that the dollar is still too high.

The key dynamic in the global currency belligerence (‘wars' is perhaps too strong a word) is that the euro and the yen are both still in bear markets (although the yen has stabilised these past three months) because their central banks are stimulating while the Federal Reserve is preparing to tighten. However, for us the fact that the renminbi is weakening is also relevant, given its very big, and increasing, weighting in the TWI.

Europe

There is a very significant development going on that those of you interested in international investing should take note of. First, the euro's decline appears to be accelerating: it opened March trading at $US1.12 and fell to a low this week of $US1.0495 in what seemed to be a bout of panic selling. The euro trade weighted index has declined 10 per cent this year.

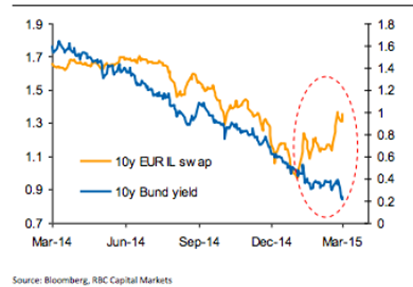

These are dramatic moves indeed, but behind it an even more important development is unfolding: nominal bond yields in Europe have also crashed, but inflation expectations have not fallen. The chart below from RBC Capital Markets shows the 10-year inflation swap rate and the 10-year German bund yield.

The divergence between inflation expectations as expressed in the yellow line, and the bund yield, was a direct result of the ECB's announcement of its QE program on January 22nd – after all the ECB is printing money to buy bonds therefore you would expect the price of the bonds to go up and inflation expectations to rise. This is all as expected, and intended.

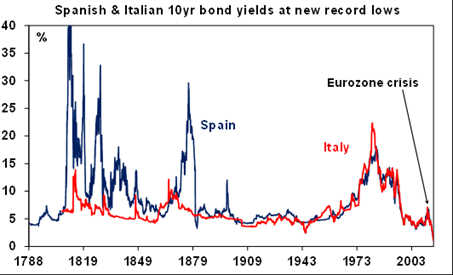

The important result is that real yields on southern European bonds have also collapsed. Real yields on Italian five-year bonds and 10-year bonds have even gone negative! This is a remarkable development and something you would never have predicted. Italy with negative real bond yields!! Goodness.

The thing to note is that the weak economies of southern Europe are not only now getting the benefit of a sharp currency devaluation, they are also finally getting the benefit of a very low real yield environment, something that Germany, the Netherlands and Belgium have been enjoying for a while but which Italy and Spain have found very elusive. This, plus the lower oil price, should see the economies of Italy and Spain, and therefore the whole of Europe, enjoy a solid turnaround this year.

As for Greece, well the place has to survive the next few months without defaulting first and then we'll see what happens. I'll be going to Athens in April for a few days to interview politicians, economists and business people, and before that to Germany to attend the Hanover Fair, so I will report back – including sending this missive to you from Hanover and Athens while I'm there.

China

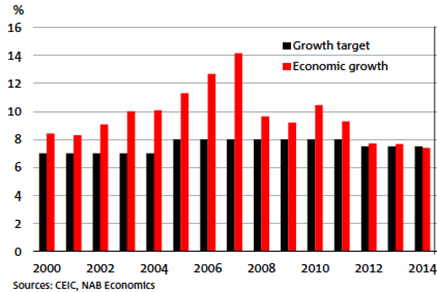

China's National People's Congress, their one meeting of Parliament per year, and usually the occasion for as much happy clapping as in a Pentecostal church, got underway this month and – bang! – the first thing to come out of it was a drop in the target growth rate from ‘about' 7.5 per cent to ‘about' 7 per cent. The first question is whether much notice should be taken of this, and the following chart suggests not:

The fact that growth has more or less matched the NPC target for the past three years is no doubt more an accident than anything else, and simply reflects the fact the economy is now matching the authorities' conservatism.

But a short briefing on the state of the Chinese economy might be in order. Will growth even be as much as 7 per cent? Probably this year, but not next.

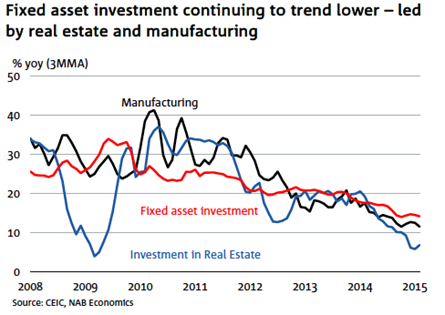

China's industrial sector is slowing very rapidly, and persistently, as this chart shows:

In February industrial output grew by 6.8 per cent, down from 7.9 per cent in December and the weakest since 2009. This follows the same pattern as in 2012, 2013 and 2014 – a sudden loss of momentum at the start of the year because of the Chinese new year plus the Chinese government's fiscal and planning cycle that backloads spending into the end of the year. If the usual pattern is followed, the Government will ease policy to get things moving again, and in fact has already started, cutting interest rates in November and then again in February, as well as the reserve requirement.

But in the medium term the Chinese economy is struggling to cope with the end of the housing boom and the appearance of very substantial produce price deflation (minus 4.8 per cent year-on-year in February), which is devastating profit margins. The headline CPI actually increased from 0.8 per cent to 1.4 per cent in February, so the threat of consumer price deflation seems to have eased, but wholesale price deflation is a serious problem.

Trade is improving because of the pick-up in the US and Europe, with exports up 21 per cent and 13 per cent respectively to those destinations, but in essence China has ceased to be an engine for global growth and more of a caboose. It will not be doing much this year or next to help the world come out of either deflation or slow growth, and if any commodity prices rise this year, it won't be because of China.

Readings & Viewings

Video of the Week: some Irish comedians have over-dubbed a Polish soap opera. Pretty funny (but very silly).

And John Oliver explains why daylight saving time makes no sense.

American mystery story: consumers aren't spending, even in a booming jobs market.

Interesting yarn about Fred Olsen, the Norwegian billionaire.

China's legislature: bigger, richer, still full of men.

The Economist magazine explains the fuss of Apple's smartwatch.

But this person says: I just don't get it – $500-$1000 so I don't have to take my phone out so much?

But Apple has a top secret lab where developers are making watch apps in secret.

A little-watched report is boosting estimates of US growth.

Joe Hockey's super debate, and why there is no debate.

And here's my contribution on this subject: that the question of whether it's better to have money in super or a house is immaterial, because super fund returns are so low, but that the supply of houses is so restricted that any extra demand would be very bad indeed (there's a video of me as well).

Tony Abbott's nice St Patrick's Day video – the one day it's safe to be green.

Pakistan's economic management gets a strong vote of confidence from the IMF, would you believe.

Twitter wars: How the US is fighting Islamic State propaganda through internet memes.

Barry Jones on the death penalty: Australia has been monumentally hypocritical on this subject.

Sometimes evil isn't banal, but incredibly calculated.

Why Warren Buffett's son isn't the heir apparent.

Why mums should get a salary of $260,000 per year.

How the sugar industry shaped government advice on cavities.

The 100 greatest blues songs of all time – one (anonymous) person's point of view. Not sure about this, but it's interesting.

This is a pretty cool music video – Skyscrapers by OK Go, sent in by Ian (thanks).

Ambrose Evans-Pritchard: Global finance faces a $9 trillion stress test.

Paul Krugman: he makes a good point.

Marc Faber – more bullish on stocks than usual. "Where are going to hide when disaster strikes? You will lose less money in blue chip stocks." I suppose that's kinda bullish…

The Age of Clive is nearing its end.

Cutting through the currency fog (a sharper focus on company exposures can help create a ‘natural' currency hedge in global equity portfolio).

Greek PM Alexis Tsipras' conciliatory tone.

Medical culture's hierarchical and autocratic nature harms not just patients and students but doctors too.

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

The past week was messy and volatile in financial markets as Fed worries waxed and waned, the $US surged to its highest since 2003, the ECB commenced quantitative easing and Chinese economic data was softer than expected. Against these cross currents, US and Australian shares fell, but European, Japanese and Chinese shares rose. Bond yields fell particularly in Europe as QE started. Commodity prices generally weakened as the $US rose and this weighed on the $A which fell below $US0.76 at one point.

While negotiations in Europe with Greece aimed at unlocking funding are dragging on, it's clear that the uncertainty around Greece is still having no flow on effect to other peripheral countries in the eurozone. In fact bond yields in Spain, Italy and Portugal have fallen to new record lows – with 10 year yields now at just 1.1 per cent in Italy and Spain and just 1.6 per cent in Portugal. Clearly the start-up of the ECB's QE program and the better shape peripheral countries find themselves in is having an impact. This also means that Greece's bargaining power is a lot lower than what Syriza was hoping as the threat of a Grexit ain't what it used to be. Meanwhile, reflecting the flow of better news, ECB President Draghi has reiterated things are “pointing in the right direction”. All of this reinforces our positive view on eurozone shares.

Source: Global Financial Data, AMP Capital

Major global economic events and implications

US economic data was mixed yet again with another month of soft retail sales but solid labour market indicators and a slight rise in small business optimism. I wouldn't be too worried about US retail sales as the February figures look weather related and 5 per cent-plus growth in real household income growth and high levels of consumer confidence point to a bounce back soon.

While Japanese GDP growth in the December quarter was revised down, economic sentiment, machine orders and tertiary activity data were all better than expected.

Chinese economic activity data for the January-February period was soft with industrial production, fixed asset investment, retail sales and imports all weaker than expected. Chinese data at the start of the year should always be treated with some caution due to Lunar New Year distortions and strong export growth will provide an offset for GDP growth. Money supply and lending growth did perk up in February but allowing for New Year distortions and averaging across January and February they were still weaker than seen through last year. Overall the Chinese economy does appear to have started the year on a soft note – probably below the comfort zone of the Chinese Government and this is likely to support the case for more monetary easing. While Chinese CPI inflation rose to 1.4 per cent in February this looks more like an aberration with soft domestic demand and an acceleration in producer price deflation pointing to lower inflation ahead.

Finally, the global monetary easing cycle is continuing with Thailand and Korea cutting rates over the past week. So far this year there has been more than twenty easing moves by central banks. This all helps add to confidence that deflation will recede as a threat.

Should first home buyers get access to their super to buy a home? Absolutely not. Like first home buyer grants it will just push up house prices only benefiting existing home owners like me and worsening affordability. And it will deny young workers some of the power of compound interest when it's most beneficial and lead to lower retirement savings for them. I can't see we have to keep having this silly debate!

Australian economic events and implications

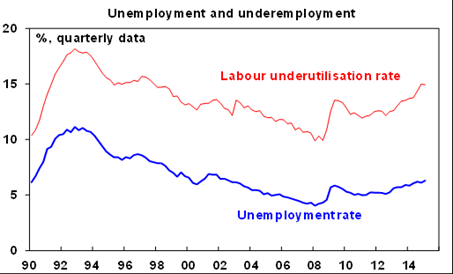

Good jobs data but soft confidence readings in Australia. While the February jobs report was a bit better than expected with employment up and unemployment down slightly and ANZ job ads are continuing to rise, the reality is that employment growth is still not strong enough to stop unemployment from continuing to trend up. Labour force underutilisation remains around its highest since 1997 at 14.9 per cent which points to ongoing softness in wages.

Source: Global Financial Data, AMP Capital

Meanwhile, both consumer and business confidence are running at fairly mediocre levels reflecting the poor news flow of late. While the slight fall in housing finance in February is not really a problem because it followed a strong rise in December, what does remain a concern is that the flow of finance is getting even more skewed towards investors.

The overall impression is that economic growth is continuing at a sub-par pace. This is not a disaster but it continues to highlight the need for lower interest and a lower Australian dollar.

Still no investor euphoria in shares. While Australian shares have benefitted from retail buying – mainly of high yield shares – it's interesting to note that scepticism regarding shares more generally remains high with less than 8 per cent of Australian's nominating them as the “wisest place for savings” according to the Westpac/Melbourne Institute consumer survey. This is well down from the peak of 34 per cent seen in 2000 suggesting that shares are a long way from the euphoria often seen before major market tops. Bank deposits, paying of debt and real estate (a worry) remain far more popular.

Source: Westpac/MI, AMP Capital

Next Week

By Craig James, Commsec

Variety of economic indicators, but Reserve Bank in focus

So-called ‘top shelf' economic indicators will be virtually non-existent in Australia in the coming week. The highlights are the minutes of the last Reserve Bank Board meeting and two speeches by Reserve Bank officials on Monday and Friday. In the US, a Federal Reserve meeting and housing data are the highlights.

In Australia, the week kicks off on Monday with a report from the Bureau of Statistics (ABS) on new car sales. The ABS recasts the industry data on new car sales, converting the original data into seasonally adjusted and trend estimates. The Federal Chamber of Automotive Industries has already reported that 90,424 new cars were sold in February, up 4.2 per cent on a year ago. Interestingly we may be seeing a mixed picture on consumer spending but the same cannot be said for sales of sports utility vehicles (or four-wheel drive vehicles). Despite the slide in passenger vehicle sales in the month of February it was clear that demand for SUVs was the main driver, scaling new heights in February. In fact just over one in three new vehicles sold in Australia is a SUV.

Also on Monday, Reserve Bank Assistant Governor Debelle gives a morning address (9am AEDT) at the KangaNews DCM Summit in Sydney.

On Tuesday the Reserve Bank releases minutes of the Board meeting held on March 3. Given the decision to keep rates on hold – one month after cutting rates to record lows – investors will certainly be hoping to get a better sense of central bank thinking. We expect the minutes to focus on soft confidence levels and similarly soft labour market conditions.

And on that note the weekly consumer sentiment reading will be released on the same day. It is pretty clear that rate cuts are certainly not having the same desired impact on confidence, with confidence levels having fallen since the February rate cut.

On Thursday the ABS will issue more detailed statistics on the job market. This publication will also include the quarterly break-up of data on employment by industry as well as trends in participation rates for demographic groups. Of particular interest will be the data on employment across industry groups so investors can identify the key sectors that are hiring and firing across the economy.

Also on Thursday the Reserve Bank will release its quarterly Bulletin, a publication that contains topical articles on the economy.

On Friday the ABS will also issue data on imports for the month of February. Given the importance of foreign goods in consumer and business purchases, the data on imports will provide a timely guide on economic activity.

In addition the Reserve Bank Governor, Glenn Stevens, provides an address to the American Chamber of Commerce lunch in Melbourne. The topic of the speech has not been revealed as yet.

US Federal Reserve meeting will dominate headlines

Turning attention to the US, the week kicks off on Monday with the release of the influential New York Empire State manufacturing survey. Also on the same day the National Association of Home Builders index for March is to be released along with capital flows and the monthly industrial production figures. Economists tip a modest 0.3 per cent lift in industrial production while the NAHB index is expected to lift from 55 to 56.

On Tuesday, data on housing starts will be issued alongside building permits for February. In addition the Federal Reserve also commences a two-day meeting (announcement on Thursday morning Sydney time 5.00am AEDT). The number of home starts fell by 2.0 per cent in January dampened by the colder weather and snow storms. And despite an improvement in weather conditions, economists tip a fall in starts of around 2 per cent in February. Building starts are expected to have risen by 0.5 per cent.

The Federal Reserve meeting will be important because new forecasts will be released and the Fed chair, Janet Yellen, will hold a news conference. She will have the opportunity to address the broad array of views amongst Fed members about the timing of future rate hikes. We expect the Fed to change its rhetoric in April and look to raise interest rates by around mid-year.

On Thursday, the only data of note is the current account deficit for the December quarter as well as the regular US weekly data on new claims for unemployment insurance (jobless claims).

On Friday, the leading index is issued together with the influential Philadelphia Federal Reserve (Philly Fed) survey. Economists expect improvement in all the indicators, potentially underpinning investor sentiment on the broader economy.

Sharemarket, interest rates, currencies & commodities

Over the latter part of 2014 and through the early part of 2015 commodity prices have taken a hit. The biggest losses have occurred in iron ore (down 18 per cent in 2015) followed by wheat (down 16 per cent), sugar (down 10.3 per cent) and copper (down 9.1 per cent).

Interestingly one of the few gains in commodity prices in 2015 has been recorded by wool (up 2.5 per cent).

Despite the substantial slide in prices, it may surprise investors to know that the Commodity Research Bureau index is only down only 6 per cent in US dollar terms. And interestingly in Aussie dollar terms the CRB index is actually up almost 1 per cent courtesy of the lower Aussie dollar – which hit a six-year low in recent days.

Essentially the slide in the Australian dollar has been on the Reserve Bank's wish list for some time. The lower currency will be crucial in driving export growth and incomes in a sluggish domestic environment. CBA currency strategists expect the Aussie dollar to fall further, getting down towards US73c by mid-year.