Kohler's Week: New Eureka, Big trouble in little Oz, Smashed China, Iron ore, Greece, Risk and volatility

Last Night

Dow Jones, down 0.64%

S&P 500, down 0.65%

Nasdaq, down 0.55%

Aust dollar, US76.4c

New Eureka

It's our 10th anniversary in July. In 2005 James Kirby, daughter Phoebe and I sat with a couple of others around a table in a stuffy converted garage in Condell Street in Fitzroy and started producing a thrice-weekly online newsletter for investors. As Leonard Cohen said of his previous tour of Australia, when he was 63: “I was just a kid with a crazy dream”.

Anyway, we're still going and still loving it. It's our birthday, but you're getting the present – we're transforming Eureka Report and making it much better. Here are the extra things that we're doing from July 1:

1. Introducing a stream of live online events, either video or audio. I don't know of anyone doing anything like this, on any subject and especially not on investing. Most days, possibly more than once, we'll be bringing experts and corporate leaders to you, live, for video or “radio” talkback – that is we'll interview them and you get to ask questions too. We plan to get CEOs as they are available, professional investors and experts on things like tax and portfolio construction. If you can't listen in or watch at the time, you can lodge your question ahead of time and then watch or listen later. In effect, Eureka is becoming a dynamic, almost real-time service, where you get direct access to the experts and corporate leaders.

2. Listed Investment Company (LIC) research service. These are one of the most important vehicles for investors, but almost no one researches them properly because they have never paid commissions to financial planners and institutional investors don't use them and therefore don't pay brokerage on them. We don't care about those things of course, so from July 1 we'll be introducing a new, comprehensive LIC service, in which we will tell you their premiums and discounts to NTA and report on their investment strategies and performance.

3. Income investments. Up to now we have been focusing on growth stocks, but from July 1 we'll be adding specific research on income stocks. Our view is that good companies are neither all growth nor all income, but most are primarily one or the other. “Income First” stocks need to be looked at slightly differently to “Growth First” stocks – the key issues are the yield, the extent of franking and the sustainability of the dividend. Capital growth is a welcome bonus to the dividend.

4. Model portfolios. All of our investment research – growth stocks, income stocks and LICs – will also be put into model portfolios in which we'll tell you our recommended weightings to each and then track the performance of the portfolios. The stocks and the weightings will be updated constantly, with alerts and updates for you so you can match them if you want. There'll be domestic model portfolios for growth, income and LICs, as well as two international models run by the inestimable Clay Carter.

We haven't changed the price for a few years now, so from July 1, coinciding with the improvements, the price will be going up to $499 a year – but not for you, not yet anyway. If you renew before July 1, you'll get the current price ($435). I've also told the subs department to throw in a wine voucher for you so you can help us celebrate the birthday. I've done a bit of a video here talking about the changes some more if you want to watch.

I'm really looking forward to this. Eureka Report will be transformed in a way that will definitely help you become a more effective investor.

Big trouble in little Oz

Last week I wrote: "next week's second estimate of capital expenditure for 2015-16 will be crucial. If there isn't a decent uplift in services investment intentions, then the odds of a recession in Australia will rise dramatically.”

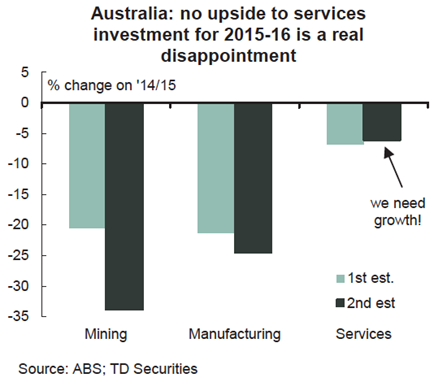

Well, there wasn't a decent upgrade. The estimate for capital investment in the services sector for 2015-16 was upgraded on Thursday from minus 7 per cent to minus 6 per cent – it's still being cut back. At the same time, investment in mining and manufacturing were downgraded even further. Here's a chart of it:

Not good. We can only really hope now that the unwillingness to invest by Australia's businesses turns out to be short-lived and that something happens to turn it around, or it turns around spontaneously. Otherwise we're facing a recession and domestic stocks – banks especially – will struggle.

The problem is that the low cash rate is not doing it – there needs to be a devaluation of at least 10 per cent, either internal or external, to bring down Australia's high cost structure, or else boards need to accept low hurdle rates for their investments, or both. There are other factors, such as a lack confidence caused by political incompetence and turmoil, as well as hurdle rates that are still too high. But I suspect costs are the main problem.

External devaluation you know about – it's just where the exchange rate falls. An “internal devaluation” is where real unit labour costs fall to produce the same improvement in competitiveness. Obviously it's much easier to do it with a currency devaluation than by cutting real wages (except if you're in the eurozone of course, where the currency is fixed), but the trouble is that foreign exchange markets are hard to manipulate. Most countries are engaged in “currency wars”, trying to painlessly lift their competitiveness, but it's in the lap of the gods … or more correctly, perhaps, in the lap of Janet Yellen, and what the Federal Reserve does with interest rates.

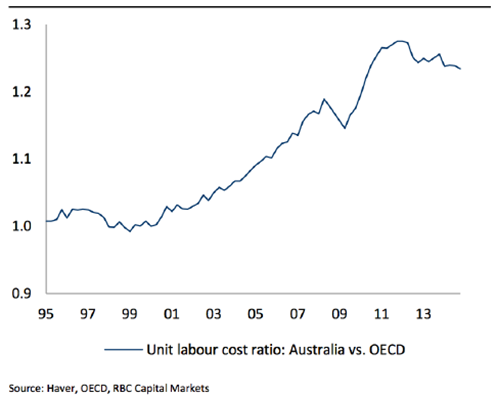

The real exchange rate, which is a combination of unit labour costs and the nominal exchange rate, has fallen by about 15 per cent since the peak of early 2013. What you might not be aware of is that this includes a decline in Australia's unit labour costs:

The problem is it's not enough in the context of the 25 per cent increase in our relative labour costs since 2000 (note – this is not the actual increase in labour costs, but how much ours rose more than the rest of the OECD).

Australia has become a high-cost country, which is a large part of the reason businesses are not investing. We either need an exchange rate with a 6 in front of it (that is, below US70c) or a big cut in real unit labour costs – which in reality can only be achieved through a lift in productivity. Australia's labour laws have the BOOT test (better off overall) which decrees that any change to labour agreements must leave workers better off – not even just the same as before, but better off overall. How do you engineer a massive lift in productivity? Very hard. The main requirement is better infrastructure, and the Government needs to get off its backside, in my view, and seriously invest in infrastructure – preferably by borrowing at the current low interest rates. But unhappily, that doesn't seem likely.

So with business investment falling everywhere we really, really need an exchange rate devaluation of 10-20 per cent to prevent a slide in economic growth and an increase in unemployment. How can we make that happen? Well, the RBA could intervene directly by selling Aussie dollars, but it probably won't. That carries a lot of cost, and risk, since forex is a very crowded marketplace with a lot of heavyweight players.

The only thing to do is cut the cash rate some more and bring down the interest rate differential. That's why most economists now expect another cash rate cut following Thursday's capex release – not because they think 0.25 per cent off the cash rate will encourage businesses to borrow and invest, but because it's the only way to bring down the exchange rate some more. Maybe.

What we really need is for the US dollar to go up, a lot. But so does everyone, and America doesn't want it to happen. Anyway, it's obviously something we can't control. Maybe the Fed will start raising rates this year, maybe not. And even if it does, it will probably be very slow progress.

The other way a country can lift its competitiveness is by having a recession – that is by sharply increasing unemployment to bring down labour costs. That's what Greece did, and Iceland (see below). Let's hope that doesn't have to happen here.

Smashed China

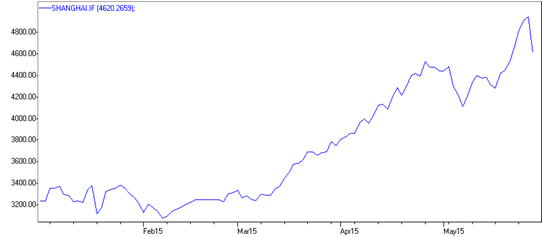

The Shanghai Composite index crashed 7 per cent on Thursday, although in the context of the 60 per cent rally since February it was not that big of a big deal.

The question is whether what caused it is serious. It was a report that the People's Bank of China had conducted some repo (repurchase) operations with commercial banks, draining about 100 billion renminbi from the banks. This led markets to think that monetary easing must be finished, if they're pulling money out of the system. The PBoC is not the most transparent of central banks, let's face it, and so markets were confused. Just the other day it had cut interest rates and the reserve requirement, which releases money into the system. Now they seem to be doing the opposite. What's going on? Delphic silence.

ANZ's excellent China economist Li-Gang Liu says it does not, in his opinion, point to a change in monetary policy but to the dilemma that the PBoC faces. He didn't say this, but it's the same one facing the Reserve Bank of Australia – that is, that monetary policy is not working, apart from inflating asset prices, because it cannot compensate for structural problems in the economy. In our case it's tight fiscal policy, lack of confidence, the high cost base and lack of infrastructure; in China it's too much local government debt and dire need of micro-economic reforms – what Li-Gang Liu refers to as “transmission effectiveness” (removing blockages from the economy).

The problem is that loose money has led to a speculative boom in the Chinese stockmarket, which has raised credit risks and made the commercial banks risk averse – so they're not lending. That means monetary policy doesn't work any more, and at the same time there is the growing risk of a damaging bubble burst.

Meanwhile the Chinese economy remains sluggish, with data this week suggesting that GDP growth will probably slip below 7 per cent this year. On top of the ineffectiveness on domestic demand of monetary easing, export growth is weakening – this week HSBC reduced its forecast for export growth from 7.1 to 4.2 per cent.

So the Australian economy is not going to be rescued by a Chinese rebound any time soon.

Iron ore

And don't expect the iron ore price to keep rising because of supply cutbacks by the majors, as opposed to demand increases from China, especially now that there'll be no inquiry into Andrew Forrest's claims of a conspiracy.

The thing is that all the iron ore miners, including Fortescue, are entirely focused on costs and efficiencies. That requires more throughput, not less. Vale, BHP Billiton, Rio Tinto and Fortescue are organising themselves for every day low prices, as the supermarkets would say, for a long time to come. That is the opposite strategy to cutting production to get the price up.

For long-term investors in these businesses, it's good news because they will end up being more efficient with fewer competitors. But in the short term, life will be tough – for shareholders and for the nation, because profits, national income and tax revenue will be down for a while.

Greece

The saga grinds on, with the temperature and rhetoric rising as the climax draws near.

That climax now seems to be a week off: Greece is due to pay €300m to the IMF by the end of next week, and can't and there seems little agreement about how default might be avoided. “It'll be OK,” says Mr Tsipras. “No it won't,” says Mr Schauble.

Dennis Gartman makes the point that there was a massive default by a European sovereign just a few years ago – Iceland – and that has turned out quite well. Iceland's unemployment rate is now lower – much lower – than the rest of Europe: 3.9 versus 11.3 per cent, and it has an actual inflation rate (of 1.4 per cent) whereas the rest of the continent is struggling with deflation.

Admittedly Iceland is a small country with only 330,000 souls on board versus Greece's 11 million. But the point is that default, even if it were to happen, does not necessarily mean destruction. It just means difficulties, and a jolt downwards in the national cost structure (see my comments above about Australia). In the case of Greece, wages have already come down a long way and a further step downwards as a result of default would make the place super-competitive.

Risk and volatility

I was prompted to reflect on this subject recently when a colleague suggested that a “high conviction” portfolio of small to medium sized stocks should represent only 10-20 per cent of a portfolio because it would be relatively more volatile than the index benchmarks. This, of course, is a conventional wisdom: most investors tend to cluster into large blue chip stocks because that provides low relative volatility. Where the market goes, you follow, and there is comfort in that to be sure.

In fact, there is greater risk in low volatility, both absolute and relative. My experience over decades tells me that when markets are smooth, investors become complacent, which is when accidents occur. Volatility, on the other hand, keeps you alert and provides opportunities. The market in subprime mortgages was serene in 2006, and the buyers unquestioning. In 2007, when the subprime mortgage market started to acquire some volatility, it was the stockmarket's turn for serenity. It made new highs and the Vix index of volatility made new lows. It was the time to sell. The time to buy was 2009, when the Vix was at its highest.

As for eliminating relative volatility by hugging the index and keeping small caps to 10-20 per cent … well, yes, it's less upsetting, but you get the market return. The risk in that event is that you will not have enough cash in retirement because the long-term share market return is inadequate. Comfortable retirement is to be achieved through 15 per cent compound return, not 7.5 per cent.

In addition to looking for high quality, underpriced companies, our senior analyst, Simon Dumaresq, and his team are constantly trying to eliminate genuine risk – that is, the risk of losing your money – as opposed to the less relevant risk that you might briefly underperform the market.

Australian Dairy Farms (ASX:AHF)

A couple of very interesting interviews for you this week.

First Adrian Rowley of Australian Dairy Farms, which has begun aggregating dairy farms in south-west Victoria – around Warrnambool.

It started with two – one of them bought from an NZ syndicate that included a director Keith Jackson (at 30 per cent less than the syndicate paid, so no problem there) – and now has seven farms, including one just to grow feed and raise calves.

The company is now getting calls from dairy farmers trying to sell to them. The average age of dairy farmers is in the 50s these days and most of their kids don't want to do it so they need an exit. As a result Adrian Rowley and his colleagues are getting them cheap.

Adrian is not CEO – he's a non-executive director. They don't have a CEO yet. Naturally I asked him why not, and the answer was to save cost. They'll get one eventually, and for the moment they have an operations manager looking after the farms, but they don't currently need a CEO and are trying to save money. Last year the cost of running the business was $400,000! Good answer! That tipped me over the edge, and I bought a few AHF shares.

You can read, or watch, the interview here.

Nearmap (ASX:NEA)

This is another fascinating little business … well, not so little any more. It's now capitalised at $200 million, having risen 10-fold in two years, with $22 million in cash in the bank and no debt.

I came at this wondering how there's a business in mapping any more since Google does it for free. The answer is that nearmap takes pictures of entire cities on spec, and sells the content to subscribers who buy it for such things as measuring rooftops for solar panels without visiting the house, flood predictions, shadow analysis for councils looking at planning approvals, measuring sites and also elevations – in other words, lots of things that Google can't do, and probably never will. That word “probably” is the key risk with the business.

The growth opportunity is in the United States, where Simon's team sold their first subscriptions this week. Nearmap has “covered” about 160 million people in the US or about half the population (that is, they have taken pictures of their buildings etc).

You can find my interview with CEO Simon Crowther here.

Readings & Viewings

Last night the US Commerce Department revised first quarter GDP growth down to a contraction of 0.7 per cent, from its previous estimate of plus 0.2 per cent. It was expected. In fact, market consensus was for a fall of 0.9 per cent. Here's an analysis of why it happened.

Video of the Week: A baseball game somewhere in America. Batter loses the bat and it flies into the crowd, heading for a woman's head. Guy catches it calmly with one hand, while holding his beer. He didn't spill a drop.

A sped-up film of a 57-storey building in China going up in a record 19 days. Geez.

The assets test “black hole” – a really good (brief) analysis of how the budget affects pensions.

Is a reverse mortgage right for you? Three questions to ask before ringing a lender.

Scott Morrison says super isn't for building an inheritance for your children. I agree.

I was watching Wolf Hall the other night when Thomas Cromwell told Harry Percy who runs the world (bankers). It got me thinking about who runs the world today, and that resulted in this essay about who runs the world now – not bankers, but multinational corporations.

I went on the radio with Alan Jones this week, talking about free trade and the Trans Pacific Partnership. You can listen to our (rather one-sided) discussion here if you want.

Hey, here's a company that wants to make Melbourne's trams solar powered. What a good idea.

Macro is not the markets – they do things differently.

Does our fear of dying drive almost everything we do?

Really interesting column by Paul Krugman on US productivity.

The case for truly free trade.

John Hussman: the new era is an old story.

What we've learned from Yellen and Fischer

Bond traders know stuff that the Fed doesn't.

Washington is not the Game of Thrones.

FIFA made a mistake messing with the US.

Why Sepp Blatter will survive.

Speaking of fraud, which we were (FIFA), China's richest man may have been running a massive one.

McDonald's has simply stopped publishing its monthly sales numbers, because they are so bad.

Conrad Black's review of a new 1000-page biography of Napoleon: "It is almost inconceivable that there could be a more densely detailed book about Napoleon than this.” Sounds exhausting.

Venezuela says it's working on a way to kill Google and Firefox so no one knows about their currency crash.

The cost of bad threat intelligence.

Suncorp's life insurer, Asteron, breaks the industry's silence over life insurance commissions – they're heading for fee for service, a revolution.

There's a lot of status anxiety going about these days. People live suspended between the anxiety of being deluged in communication and the agony of receiving none.

Scientists in South Korea have developed a graphene supercapacitor that stores as much energy per kilogram as a lithium-ion battery and can be recharged in under four minutes. But it also highlights the problem with graphene – you don't need much.

Self-drive cars and the trolley problem.

Please wear a seat belt in the back of a taxi (this is about the deaths of John Nash and his wife, killed in the back of a taxi while not wearing seat belts).

What was it like to glimpse John Nash's beautiful mind?

John Nash's astonishing geometry.

You might not want to look at this: it's a calculator that tells you how rich you'd be if you'd invested the money you spent on your wedding.

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

Shares had a mixed week with US and European shares down on worries about Greece and the Fed and Chinese shares undergoing another correction, but Japanese and Australian shares seeing good gains. The US dollar rose on the back of stronger US economic data and this weighed on commodity prices and the Australian dollar. Bond yields also fell – they've been moving inversely to the US dollar lately - adding to confidence that the April-May bond sell off has run its course.

Chinese shares had a sharp one day fall of 6.5 per cent on Thursday, supposedly in response to tougher margin requirements and a PBOC effort to drain liquidity, prompting some to wonder whether its bull market is over. However, this is unlikely. First, a 6.5 per cent one day fall is not unusual for China – there was 7.7 per cent decline January 15. It needs to be seen in the context of a 43 per cent gain year to date and a 126 per cent rise over the last year. Second, the huge gain in Chinese shares over the last year has only unwound dirt cheap valuations with the forward price to earnings ratio rising from around 8 times to around 17 times which is around Australian and US levels but below its long term average. Chinese shares are a long way from being overvalued. Finally, the PBOC moves in the last weekly look like normal liquidity management with further monetary easing likely. So all up we see this as just another correction in an ongoing Chinese bull market.

It's now getting close to crunch time for Greece which needs a funding release to cover payments due in June. While a €1.6bn payment is due to the IMF on June 5, this and other June IMF payments can likely be delayed till the end of June so there is still a bit more time to reach an agreement than commonly feared. Our base case remains that a funding deal will be reached in time allowing Greece to head of a payment default, or “Graccident”. However, while there has been some progress the two sides are still apart on some issues and even if a deal is reached a missed payment may still occur if the deal needs to be passed by the Greek parliament or put to a referendum. A Graccident won't necessarily lead to a “Grexit” (or Greek exit) from the euro though and it could just force the Greek Government to see common sense or be replaced by a more sensible government. This all has the potential to cause more volatility. But whichever way it goes the threat of contagion to other peripheral countries is low compared to the 2010-12 period as they are in far better shape now and the ECB is buying bonds across Europe as part of its QE program.

A poor showing by Spain's Governing Popular Party (PP) in local government elections has raised fears that Spain will go the way of Greece at a general election due later this year. However, this is unlikely as: apart from a win in Barcelona the anti-austerity party Podemos didn't do that well and has been seeing declining support; the rise of the more pro-business and liberal Citizen's party is drawing support away from Podemos; the Governing Popular Party still receives the most support; and Spain's improving economy may see support for the Government improve over the next six months.

In Australia, I can't help think we have become a country for silly debates - allowing access to super to buy a home, an inquiry into low iron ore prices, removing GST from tampons. What's next? The tampon question provided a perfect opportunity to explain that we should be removing exemptions from the GST to simplify it, reduce distortions and to fund broader tax reform. Unfortunately the opportunity was missed.

Major global economic events and implications

US economic data saw a welcome return to strength, with stronger than expected gains in core durable goods orders, home sales and home prices, a rising trend in mortgage applications and continued strength in services sector conditions. Growth may be starting to pick up after the March quarter soft patch at last. The immediate reaction was a return to fear about the Fed. But it's premature to get too excited as the June quarter growth rebound still looks soft compared to last year's June quarter bounce back and the Fed has on numerous occasions noted that it will allow for the dampening impact on the US economy of a strong US dollar, which rebounded over the last week. Our base remains that the first hike will be in September, and that the process of returning monetary policy to normal will be very gradual. This is not 1994!

Eurozone confidence held up in May – with a rise in business confidence offsetting a small fall in consumer confidence - defying expectations for a fall and providing confidence that the pick-up in the pace of growth has continued.

Japanese economic data showed a welcome improvement with gains in small business confidence, retail sales, industrial production and continued labour market strength. However, with the impact of last year's sales tax hike dropping out core inflation has fallen back to just 0.4 per cent year on year. The BoJ likely has more work to do, so further monetary easing/QE expansion still looks likely later this year.

Australian economic events and implications

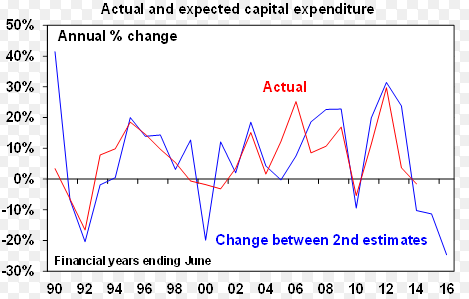

In Australia the outlook for business investment seems to be going from bleak to bleaker. March quarter construction and capital expenditure data were worse than expected. Dwelling investment is rising nicely but this is being more than offset by the ongoing slump in mining investment and poor non-mining investment. What is more concerning though is the further slump in the outlook for investment. Capex intentions for 2015-16 are 25 per cent below plans made a year ago for 2014-15. See the next chart. There is no surprise that this is being driven by mining (-35 per cent), but the real disappointment is that non-mining investment plans are also down (-10 per cent). While the capex survey does not cover all sectors of the economy and tends to exaggerate, it nevertheless points to a further deterioration in the investment outlook for 2015-16, with current plans pointing to a roughly 23 to 25 per cent fall in 2015-16 down from a 12 to 16 per cent decline based on plans in the December quarter survey.

Source: ABS, AMP Capital

The RBA won't be rushing to cut rates again in the week ahead, but just as the bleak capex outlook in the December quarter survey saw the RBA downgrade its growth forecasts in the May Statement of Monetary Policy and hence justify a May rate cut, the even bleaker capex outlook now could well prompt another downgrade in the growth outlook in the next SOMP to be released in August and hence another rate cut at the same time. The latest capex intentions also highlight the need for the Australian dollar to fall further. My view is that the probability another rate cut is now 50/50, with the August RBA meeting the one to watch.

In other data, April new home sales edged higher according to the HIA and credit growth slowed across the board in April. Annual growth in property investor credit remained at 10.4 per cent though, which is above APRA's cap, but with banks seemingly only tightening lending conditions now a slowing may not be apparent for a few months yet.

Next Week

By Craig James, CommSec

Business spending dominates attention

The start of a new month ushers in a barrage of economic data, with a Reserve Bank Board meeting thrown in for good measure. Over the past week, parts of the economic growth jigsaw puzzle were released and on Wednesday the official economic growth figures for the March quarter are issued and will take centre stage. In the US the spotlight shines strongly on Friday's employment data (non-farm payrolls). Meanwhile in China, key manufacturing data is released on Monday, with services sector data on Wednesday.

In Australia, the week kicks off on Monday when no fewer than five indicators are set for release. The Bureau of Statistics releases a publication entitled Business Indicators, containing figures on sales, profits, inventories and wages. While the profits data attracts most attention, the other data is useful in gauging the health of the broader economy.

Also on Monday, TD Securities and the Melbourne Institute release the monthly inflation gauge for May. And while there are no signs of inflationary pressures at present, the ongoing lift in the petrol price bears close monitoring. So far in the June quarter (since April 1) petrol has lifted 11.7 per cent. If prices are sustained, petrol may add 0.4 percentage points to June quarter inflation.

Alongside the business indicators release, the ABS releases data on building approvals on Monday, while the CoreLogic/RP Data home value index is also released. We tip a 3 per cent fall in April approvals while house price growth is likely to be focused on Sydney and Melbourne. The performance of manufacturing survey is also issued.

On Tuesday the Reserve Bank board hands down its latest monetary policy decision. Given that rates were cut at the start of May, policymakers will be hard pressed to provide further stimulus. Rather the focus will be on how the economic recovery will pan out post-budget.

Confidence levels have lifted and the Aussie dollar has depreciated. It will be interestingly to see if there is any discussion by board members on the capital expenditure -- or business investment data. The likelihood of any further interest rate cuts will be dependent on how the business investment landscape evolves over the coming year. We expect the Reserve Bank to stay on the interest rate sidelines and attempt to gauge how the economy tracks over coming months.

Also on Tuesday the current account data for the March quarter is issued with plenty of interest in the extent to which net exports (exports less imports) boosted economic growth in the quarter.

On Wednesday the ABS issues March quarter gross domestic product (GDP) or economic growth data. On current indications the economy recorded strong growth of around 0.7 per cent in the quarter, with annual economic growth holding around 2.0 per cent – well below longer-term averages.

Also on Wednesday the performance of services gauge and new car sales data are released.

And on Thursday the monthly trade figures are issued. Trade deficits have been the norm over the past year, highlighting the effect the slide in commodity prices is having on our external accounts. A trade deficit of $1.8 billion is tipped for April. In addition the ABS releases retail trade figures for the April. Activity levels have been healthy and we expect retail trade to have lifted for the tenth consecutive month, up by 0.4 per cent in April.

Overseas: US employment data & global manufacturing figures in the spotlight

China will hold the interest of investors in the early part of the week, when the official manufacturing gauge and equivalent HSBC measures are released on Monday and the services gauge on Thursday.

In the US, the week kicks off on Monday with the ISM manufacturing gauge, alongside new figures on construction spending. Economists tip a lift in the ISM gauge to 52.0, in expansion territory, above the 50 line that separates expansion from contraction. The April data on construction spending is released the same day with a 0.9 per cent lift expected.

On Tuesday, new vehicle sales data is released together with factory orders and weekly chain store sales.

On Wednesday the usual weekly data on housing finance activity is released alongside the ADP employment index, trade data and the ISM services index. A trade deficit of $43bn is expected for April, while the service sector index should post a reading around 57.0.

Also on Wednesday the Federal Reserve issues its Beige Book, a summary of conditions across the 12 Fed districts. If there are signs of both stronger activity and inflation, Fed members will become more confident to lift rates.

On Thursday the weekly data on jobless claims is issued together with the Challenger job layoff series and March quarter productivity.

And on Friday in the US, the pivotal non-farm payrolls or employment data is released. If the Federal Reserve policymakers decide to start lifting interest rates in the second half of 2015, one key metric that will give them confidence will be ongoing improvement in the labour market. Economists expect that 215,000 jobs were created in May, although the unemployment rate is expected to hold steady at 5.4 per cent.