Kohler's Week: Greece, China, Central banker fest, Peer-to-peer lending, Programmed, Magellan

Last Night

Dow Jones, down 0.19%

S&P 500, up 0.13%

Nasdaq, up 0.91%

Aust dollar, US73.7c

Greece

Didn't I tell you that they wouldn't do a deal till the last minute, but they would do it and there would be no default? All the rising media tension and volatility in the markets was manufactured to make money for brokers and hedge funds, for politicians to grandstand and to sell newspapers and get ratings (including, I must confess, by me on the ABC, just a tiny bit). The ‘last minute' turned out to be Monday morning at 8am (the absolute end of the weekend, and before the week started), and that's when Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel finally signed the agreement that was to be taken to Greece's parliament on Wednesday.

The story goes that they had given up on reaching a deal and were walking out of the room, when European Council President, Donald Tusk of Poland, told them they weren't allowed to leave the room until they finalised the deal. I don't really believe that – another story for the gallery.

The agreement was debated in parliament on Wednesday and, true to form, the media focus was on the protests and flag-burning outside while inside Tsipras got a standing ovation and the deal was passed 229 votes to 67.

The referendum the week before was nothing but a distraction. There's no doubt that if the question had been: “Do you want to stay in the EU and eurozone at all costs?” the answer would have been “YES”, which is what the vote in parliament on Wednesday reflected. Asking people if they want more austerity is like asking if they want to be kicked in the knee. Of course the answer was “No”, but of course it had to be ignored.

It doesn't actually matter much what the details of the deal are: Greece has no hope of complying with most of it anyway. But €86 billion in new debt will now be released – which basically represents the creditors repaying themselves – and €50 billion in privatisations and some much-needed economic reforms will go ahead. Greece will gradually recover, although there'll probably be some debt crises along the way.

The big four Greek banks will open next week, but there will have to be ongoing capital controls to stop the customers emptying them out. ECB President Mario Draghi tried to persuade everyone on Thursday night that Greek banks are solvent and just lack collateral (because Greek sovereign bonds have little value). Nobody is going to buy that.

It's going to be a long haul, one step at time, and this week was a big step.

China

China produces an economy the size of Greece every two weeks, so the Asian 4000-year-old civilisation is rather more important these days than the cradle of democracy in Europe.

To skip to the conclusion of this item: the stock market crash is probably over, China won't implode because of what's happened already, but GDP growth will slow significantly and the iron ore price looks likely to fall some more.

There have been seven trading sessions since the Shanghai Composite Index bottomed at 3373.5 on July 9, which was 34.8 per cent lower from the June 12 peak. Value worth about twice the Australian economy had been lost. Since then the SCI has rallied 17.3 per cent.

Obviously no one knows whether the correction has finished so that the bull market in China will now resume, or whether a bear market has begun, but I do know one thing: the Chinese authorities have sure given the capitalist world a lesson in how to intervene in markets. Whether it's a good thing to have done so is another matter.

At first the People's Bank of China announced big interest rate and reserve requirement cuts on June 27, which did nothing to stop the rout.

On July 1 and 2 a few other things were tried:

- Transfer fees were cut by 30 per cent.

- Investors were allowed to use real estate and other assets as collateral for margin trading.

- There was a sudden increase in share buybacks by major shareholders and directors of listed companies.

- The security ministry said it would investigate illegal short-selling and market manipulation.

- The official threshold on margin finance was removed and roll-overs were allowed.

That still didn't do the trick. Then on July 4, American Independence Day, the bazooka came out:

- 21 big brokers promised to spend no less than RMB120 billion ($26 billion) on exchange traded funds that track the performance of blue chip stocks. They bought them on July 6 and promised not to sell as long as the SCI is below 4,500.

- Central Huijin Investments announced that it would buy ETFs and would keep doing it.

- 25 domestic mutual funds announced plans to buy their own equity funds (and hold for at least a year).

- China Securities Finance Corp (CSFC) said it would raise through multiple channels and increase its scale to help stabilise the market. The PBoC said it would provide liquidity to the CSFC.

- China Financial Futures Exchange (CFFEX) announced plans to charge trading volume-based transaction fees to crack down on index futures speculation and monitor its top 50 accounts for illegal short-selling activities.

- Transactions of some accounts with short future positions were banned for violating management rules.

- A daily limit was placed on investors' purchases of CSI 500 index futures, to 1,200, on both long and short bases.

- 28 IPOs were postponed. IPOs were suspended for six months.

On July 6 the market rebounded, but then fell again the next day and the day after. After the market closed on July 8, the authorities announced another set of gob-smackers:

- Large shareholders (with 5 per cent or more), directors, supervisors and senior managers of listed companies were not allowed to sell any shares for six months, and were “encouraged” to increase their holdings.

- The PBoC said it would actively assist the CSFC through lending, issuing bonds, securitised financing and loan refinancing.

- On July 6, CSFC invested 60 billion yuan in 29 stocks, half of it in PetroChina.

- On July 8, CSFC invested 200 billion yuan in five active fund managers plus another 260 billion yuan to 21 brokers.

- CSFC spent another 200 billion yuan buying small and medium cap companies.

- Central Huijin Investment pledged not sell any shares.

- The Ministry of Finance said it would not sell any shares (it's the largest shareholder in listed financial institutions) and other ministries and state owned enterprises rallied to the call to buy back shares.

- The Ministry of Public Security announced that it will join the CSRC investigation of illegal stock/index short selling, market manipulation and insider dealings in equity and futures markets.

- Trading in 1000 stocks was suspended, and still is – which represents more than 30 per cent of total listed companies in Shanghai and Shenzhen.

- Overall, the Chinese state seems to have invested about a trillion yuan ($220 billion) in the stock market.

Kaboom! That did it. On July 9, after a final selloff in the morning, the market stopped falling and has now started going up. It fell on Tuesday and Wednesday this week, recovered somewhat on Thursday and then produced a 3.5 per cent jump yesterday.

Whatever you think of such interference in the free market, it worked – so far. But there are plenty of problems with what's happened (yes, more dot points I'm afraid):

- If the Government manipulates share prices, the market loses its function of pricing capital.

- By taking over risk from private investors, huge moral hazard issues have been created.

- The rescue has sucked liquidity from commodity and bond markets, increasing the risks there.

- Preventing the sale of shares is just like closing banks when there's a bank run – it makes people more worried and stores up trouble for later.

- In any case, the market is too big for the Government to fully control – China's stock market capitalisation now stands at 42 trillion yuan. Margin loan positions now stand at 2.3 trillion yuan.

On Wednesday this week the Government statisticians announced that GDP growth for the second quarter (which had ended two weeks before) was 7 per cent – better than the markets had expected and bang on the Government's target.

I'll bet my Essendon FC membership (admittedly not my most valuable asset at present) that this was another market stabilisation tactic – that is, the figure is entirely made up.

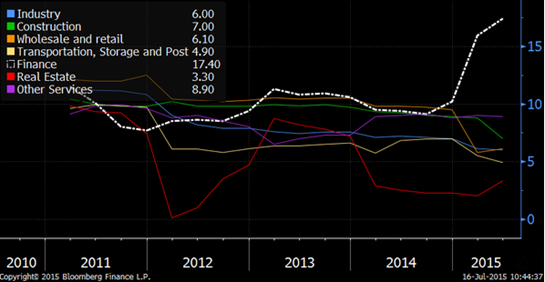

What's more, what GDP growth there was in the first two quarters (both 7 per cent) was due to the stock market bubble. Bloomberg's Tom Orlik tweeted this graph yesterday with the heading: China's equity surge provided unsustainable support for H1 GDP.

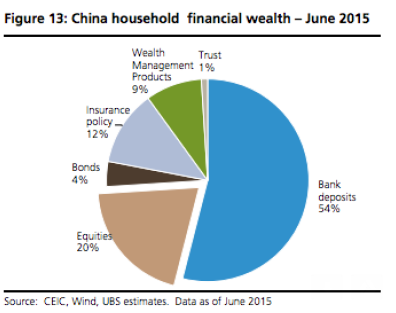

Will the market correction that's happened so far affect the economy in the opposite direction? Well, definitely to some extent it will – the opposite of that graph should occur. On the other hand, equities don't represent a very big proportion of household wealth. Here is a graph from UBS of where Chinese wealth resides:

China's banking system is about 180 trillion yuan. Even if all margin borrowers were wiped out, it wouldn't represent a systemic threat to the banks. (Real estate is another matter though).

And although it's fallen a lot, the Shanghai market is still up 20 per cent year to date and 90 per cent on a year ago, while the Shenzhen market is up 44 per cent YTD and 80 per cent on a year ago. Consumer confidence and consumption won't be affected much because the gains happened too quickly to be cashed out and spent – in other words, they were paper gains and paper losses.

But there are broader psychological issues than just the amount of money invested in equities. Diana Choyleva of Lombard Street Research wrote this week that Beijing's credibility has suffered a serious blow.

"Policymakers have focused their relief efforts on any part of the economy not plagued by past excesses, including mortgage lending and the stock market. But boosting share prices quickly backfired. The equity market collapse will reverberate throughout the economy in H2, likely leading to intensified capital flight as well as undermining the public's confidence in Beijing. Equities constitute no more than 13 per cent of Chinese household wealth, so no major income and wealth effects are likely. The worst outcome would be if Beijing backtracked on its plan to open up the economy and allow the market to determine interest and exchange rates."

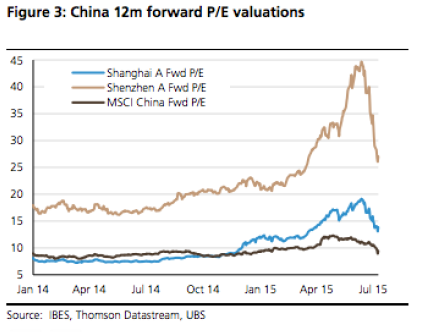

Are there more falls ahead? Possibly some: valuations still look a bit elevated:

The key number for Australia in all this is the iron ore price, which has fallen 30 per cent in the past month. Notwithstanding the (probably) fictional GDP result for the June quarter announced this week, the Chinese economy will have to slow down as part of the Government's "de-risking” strategy.

That is, while the direct impact of the stock market crash on the economy might be limited, the reason the bubble occurred in the first place was that the Government went for a risky debt-funded growth strategy to maintain GDP growth above 7 per cent, and despite all the measures to intervene and stabilise the market, the Communist Party has had a lesson in what happens when you play with fire – you get burnt.

I'd say the Government will now be forced to allow growth to decline back towards 6 per cent, and perhaps below.

Partly as a result of this, ANZ's commodity strategist, Mark Pervan, says a rebound in Chinese port inventories of iron ore now looks inevitable, “suggesting lower prices in the near term”.

"Increasing seaborne supply may not get enough Chinese buyers in the coming months. Chinese steel production normally dips mid-year during the hotter months and for the slower holiday period. We think this will be accentuated this year with historically low steel prices dragging most of the industry into loss-making territory. The latest reports suggest steel mills on average are losing between CNY200-CNY400 per tonne.”

Central banker fest

It was a big week for central bankers to emerge from their caves, sniff the air, scratch their bums and look around, say something wise and profound, before heading back in. Let's go through them all, one at a time.

Yellen

The chair of the US Fed spent two days boring the pants off members of Congress, saying what she'd said before, which is that if the economy goes along as expected it might be appropriate “at some point this year” to start raising interest rates. For some reason the markets found this surprising, and the US dollar did a bit of a jig as she spoke and rose from 96.6 to 97.6 on the trade weighted index. As a result the Aussie briefly fell below US74c.

She remains upbeat on the economy and still believes that the soft inflation data is a reflection of the decline in oil and non-energy import prices, so obviously no one has told her about the internet yet, which is the greatest deflationary force of our time.

As for what's going on in markets, er well, she's not sure. This is from an exchange with Rep. Scott Garrett: “So I think it's not clear what is happening in these markets and what, what is causing what”; “it's not clear where there is, or is not a problem here”; “by some metrics liquidity looks adequate by bid ask spread and trading volumes… but there are metrics that suggest there is a problem”; “this is something we need to study, we need to study further.”

Unimpressive.

Draghi

The ECB governing council had a meeting and decided not to do anything, and president Mario Draghi then had a press conference at which he didn't say anything.

He remains “cautiously optimistic” about Europe's economic recovery and he repeated the usual stuff about the full implementation of the QE program being needed to entrench the recovery and ensure inflation gets up to 2 per cent. He added that the ECB would be prepared to increase the QE if there was “unanticipated tightening in financial conditions”, which is code for currency appreciation. In other words he remains alert but not alarmed about currency wars.

The Q&A session, naturally, was dominated by questions about Greece, which he generally played like Chris Rogers rather than Dave Warner (for non-cricket fans they are the Australian openers – Rogers plays a straight bat while Warner likes to whack, and thus generally goes out before lunch, as he did on Thursday).

Draghi confirmed that the ECB had “substantially accommodated” the Bank of Greece's requests and had increased the emergency liquidity assistance cap by €900 million to €89.9 billion. He said capital controls would have to remain in place on the banks for some time and would only be released gradually. He said that is a decision for the Greek Government, which I presume no one believed for a moment. The ECB is in charge.

He added that the deal negotiated between Tsipras and Merkel was “impressive” and that debt relief in some form was both uncontroversial and necessary. They just had to work out how to do it “within our legal institutional framework”.

Carney

The Governor of the Bank of England gave a speech on Thursday at the Lincoln Cathedral entitled "From Lincoln to Lothbury: Magna Carta and the Bank of England”. It was, as the title suggests, a speech about the Magna Carta (Lincoln Cathedral held one of the four copies of it for centuries) and the link with central banking was that: "Forget royal infighting, wars or the whiff of revolution, it is inflation that really sets the pulses of central bankers racing. And for good reason because closer inspection suggests that inflation may have been a significant catalyst to Magna Carta.”

He eventually got onto present times, and like Yellen and Draghi, he wants to get inflation back to 2 per cent (although like them he didn't explain why). "What is clear is that to return inflation to target, growth in labour costs must pick up further from their current rate of less than 1 per cent.” He didn't offer an explanation as to why that's happened either.

Like Draghi and Yellen, Carney is “broadly positive” about economic developments, and as for UK interest rates: "the decision as to when to start such a process of adjustment will likely come into sharper relief around the turn of this year”, which was naturally reported as “Bank of England to raise rates at the end of this year”, which is not what he said.

Poloz

The Governor of the Bank of Canada, Stephen Poloz, actually said something and did something! Canadian interest rates (the overnight target) were cut 0.25 per cent to 0.5 per cent, which rather surprised the market and sent the Loonie (Canadian dollar) tumbling, and at his press conference, Poloz said: "Since … April, global economic developments have been quite disappointing, and these have led to a significant downgrade of our estimate of Canadian economic growth for 2015. There were three factors behind this downgrade:

"First, Canadian oil producers have lowered their long-term outlook for global oil prices, and have cut their plans for investment spending significantly more than previously announced. Second, China's economy is undergoing a structural transition to slower, domestic-driven growth, which is reducing Canadian exports of a range of other commodities. Third, Canada's non-resource exports have also faltered in recent months. While this is partly due to the first-quarter setback in the U.S. economy, it's still a puzzle that merits further study.”

This bloke needs to be careful – he'll get drummed out of the central bankers club for saying too much, saying something at all, for that matter.

Stevens

Our Governor didn't actually emerge in person – the RBA released its submission to the inquiry into home ownership by the House of Representatives Standing Committee on Economics (in response to a request from the committee to do it).

Towards the end of the submission was this passage: "The Bank believes that there is a case for reviewing negative gearing but not in isolation. Its interaction with other aspects of the tax system should be taken into account. The ability to deduct legitimate expenses incurred in the course of earning income is an important principle in Australia's taxation system, and interest payments are no exception to this.”

Aha! This led to a merry media flurry for 24 hours about negative gearing that had only a distant relationship with what was actually said (“RBA urges negative gearing rethink”; “RBA exposes Abbott's negative gearing folly”; “Hockey rejects RBA's negative gearing call”).

Less exciting was the fact that, under the heading of “Opportunities for Reform”, the RBA basically went round in circles and said nothing. One example: “There is … an argument for government policy to avoid creating unnecessary barriers to (housing) supply. However, there is no example in Australia or internationally where supply expansion on its own generated housing price declines.”

Peer-to-peer lending

Lots of well-attended live events online this week, which, as usual, are still available on the website for your perusal.

I did four, including two as part of my series on peer-to-peer lending, to inform and educate investors about whether this a potential source of decent yield. There are four operating peer-to-peer lenders in Australia: Society One, RateSetter, Marketlend and ThinCats, and each of them has a different model.

This week's interviews were with Daniel Foggo of Ratesetter, which you can watch here and Leo Tyndall of Marketlend, which you can watch here. Both companies take money from individual investors. RateSetter lends to individuals, usually to buy cars at the moment, and Marketlend lends to small and medium-sized businesses.

Programmed

My corporate CEO interview this week was Chris Sutherland of Programmed Maintenance Services (ASX: PRG), which is in the process of taking over Skilled Group for cash and scrip through a scheme of arrangement.

Sutherland first approached Skilled late last year and was knocked back. He redid his sums and improved it by 8 per cent – sharing more of the upside with Skilled shareholders – and the board accepted.

Here Sutherland talks about his strategy for the merged business and what he expects to achieve.

Magellan

I also thought I should catch up with Hamish Douglass about what's going on in Greece and China.

It happens that our new Listed Investment Company analyst, Mitchell Sneddon, has made Magellan Flagship Fund his first LIC recommendation but that's not one of Hamish's funds – it's run separately by his former partner Chris Mackay (he kept the Magellan name, and so did Hamish). I asked Chris to do an interview, but he never does them, so I thought – oh well, why not ask Hamish.

As always HD is knowledgeable and clear on global matters, and happily answered a lot of questions from those subscribers who managed to tune in at the time. If you weren't able to, you can watch it here.

Readings & Viewings

This is a couple of years old, but it is the first time I've seen it: a one-hour TV program called The Secret Bank Bailout, featuring a German investigative journalist talking about where all the European bailout money went. The interviews he gets are fantastic – Wolfgang Schauble and a whole lot of other finance ministers, among others. It's really worth giving it an hour and watching it.

This is an attempt to “crowdfund” Greece's debt. Good luck with that!

Mario Draghi faces tough questions about Greece.

A few (rough, preliminary) questions for Draghi today (at his press conference).

Here's my piece for Business Spectator ($, as they say on Twitter) on the debate in Greek parliament over the bailout deal.

No, the Greek agreement is not a coup and if you think it is, you're an idiot. (That's the headline of this piece from The Telegraph in London).

Here's another interpretation: it's all about Wolfgang Schauble, and his view that Germans shouldn't keep paying for the sins of their fathers and prostrating themselves before the European ideal.

Nine people who saw the Greek crisis coming years before anyone else. Don't you hate braggers?

But apparently the Eurogroup only figured it out a year ago.

Euclid Tsakalotos: We had no choice.

Golden Dawn will be strengthened by more austerity, warns Yanis Varoufakis from the peanut gallery.

An independent Scotland could easily have been the next Greece.

In future European countries won't bother negotiating, especially with Germany.

Phillip Adams had Yanis Varoufakis on his “little radio program” this week for half an hour. Very interesting.

I know, I know, a lot of stuff about Greece. It's just that I can't enough of it – find it very interesting.

What Donald Trump means to the 2016 US Presidential election.

The ABC had half a million visits to this story by Japan correspondent Matt Carney. It's about Japanese men who lock themselves in their bedrooms for years.

Madam Speaker is on her way…

How the RBA outsources its role to foreign bankers.

Something structural has changed with trade and growth.

Economists react to China's 7 per cent second quarter growth.

China defends its data. “The figures are real, really!”

Video interview by Tom Friedman of the New York Times with Barack Obama, about the Iran deal. It's probably all you need to watch to get his point of view, at least.

Abbott's difficult decision: the risk and reward of an early poll.

The battle for the BBC (a bit like the battle for the ABC).

The latest sign that coal is getting killed (it's bond markets).

Some guy singing “Pluto, you'll always be a planet to me” in his bedroom. Very cute.

Last week

By Shane Oliver, AMP

Investment markets and key developments over the past week

Share markets have had a good week reflecting good news regarding Greece, better than expected Chinese economic data, the nuclear agreement with Iran and benign comments from Fed Chair Janet Yellen. This has seen most share markets put in good gains led by Europe. Australian shares also saw good gains with the still falling $A also helping the profit outlook. Bond yields were flat to down, but with sharp falls in peripheral Eurozone countries as Grexit risk continues to recede. The $US continued to drift higher with the perception that the Fed is still on track to hike rates (now that global risks have faded a bit) and this saw the $A, euro and Yen fall. Commodity prices remained weak including oil on the back of the agreement with Iran.

The problem with going on holidays. It seems that whenever I go on leave (like three weeks ago) share markets take a tumble but to get them back up again all I have to do is return to work. Well maybe not quite, but it certainly feels that way!

Grexit off! - at least for now. Agreement was finally reached between Greece and its creditors on a path towards a new three year bailout program. It seems that Greece has met its commitment to pass various reforms through its parliament, the deal has already been approved by several Eurozone parliaments but with a few to go, €7bn in bridging finance has been arranged for Greece to make its near term debt payments and the ECB has increased its liquidity assistance for Greek banks. The next step is to agree the details of the three year program and this is not without risk, particularly given the unstable political environment in Greece with the Government having to rely on opposition parties for support and also given the IMF's view that Greece's debt needs to be put on a sustainable footing upfront. Given that the Greek economy will likely get worse before it gets better and debt relief is still a way off (after program reviews) another rebellion by Greece - reopening the prospect of a Grexit - remains a risk. But in the short term Greece is likely to fade as an issue.

The key for investors to bear in mind though is that the risk of contagion flowing from Greece to other Eurozone countries is now substantially reduced compared to several years ago - with other vulnerable countries now in much better shape and defence mechanisms much stronger. Through the recent turmoil the highest Italian and Spanish 10 year bond yields got to was just 2.4 per cent, a fraction of the 7 per cent plus seen in 2011-12.

More oil to hit an already oversupplied oil market. Agreement was also reached between Iran and the US to curb the former's nuclear program and remove sanctions. Assuming its finalised this is good news, in particular to the extent that it will see a boost to global oil supply ultimately of around 1 per cent pa, providing another dampener on the world oil price. Over the last year world oil production expanded 3.1 million barrels a day, but demand only rose by 1.4 mbd. It will also potentially open Iran up as a major investment destination. The potential negative to keep an eye on though is that a less constrained Iran may intensify the "cold war" between Sunni Saudi Arabia and Shia Iran in the Middle East (intensifying proxy wars in the region) that has arisen as US influence in the region has diminished.

In a broader sense - the events of the last few weeks with Greece, China's share market turmoil and the Iran deal - provide a reminder that the world is still being subject to deflationary shocks which are serving to keep economic growth uneven and constrained and ensuring that monetary conditions need to remain easy. Consistent with this the IMF (and other forecasters) is continuing to do the same as over the last few years in revising down current year global growth forecasts (to 3.3 per cent for this year) but anticipating an improvement in the new year (which will probably also get revised down again in time). The Bank of Canada's latest 0.25 per cent rate cut taking its cash rate to just 0.5 per cent on the back of weaker growth forecasts reinforces all this. For investors it means continued low (and in some cases lower interest rates) and an environment characterised by an ongoing "search for yield".

Major global economic events and implications

US economic data was a mixed bag. While data for industrial production and the New York regional manufacturing conditions survey improved more than expected and the Fed's Beige Book reported ongoing growth, June retail sales disappointed, the Philadelphia regional manufacturing conditions survey fell and small business confidence fell. Inflation readings were also mixed with producer prices up a bit more than expected but import prices remaining weak. So while Fed Chair Janet Yellen is still expecting to raise interest rates later this year, it's dependent on a further improvement in growth coming through and while the September Fed meeting is "live" for a hike it looks only 50/50 at this stage.

US June quarter company earnings are doing it again. Each quarter market expectations for US profits get guided too low and the actual outcome ends up being better. The same seems to be happening for the June quarter results, where the consensus started with a -5.3 per cent year on year decline, but after 73 per cent of results to date have beaten expectations has already been revised up to -3.7 per cent. It's likely to end up slightly positive. So yes the strong $US is impacting but not as much as feared.

There were no surprises from the ECB which left monetary policy unchanged, but it did signal a preparedness to ease further if there is an unwarranted tightening in monetary conditions. On the data front in Europe, a fall in May industrial production was disappointing, but the ECB's latest bank survey revealed no tightening in lending conditions and improving credit demand, which is good news given the background of the Greek turmoil.

The Bank of Japan left monetary policy unchanged but nudged down its growth and inflation forecasts a bit. Further easing is still possible though with inflation continuing to run well below target.

Chinese economic data was all a bit stronger than expected, confirming earlier signs that growth had improved somewhat. June quarter GDP growth held constant at 7 per cent year on year, but improved on a quarterly basis from 1.4 per cent to 1.7 per cent. This was helped along by improved or better than expected June data for exports, retail sales, industrial production, fixed asset investment, money supply growth and credit. A pick up in imports may also be reflective of stronger domestic demand and property sales have picked up. This is all consistent with policy easing possibly starting to get some traction. That said, with consumer price inflation well below target and producer prices deflating at 4.8 per cent year on year, real borrowing rates remain too high so further monetary easing is likely to be necessary.

Australian economic events and implications

Australian economic data remains all over the place with business confidence and conditions up according to the NAB survey and dwelling commencements at record highs but consumer confidence falling to last year's lows (with the noise around Greece and China not helping) and non-dwelling building starts falling sharply reflecting the capex slump. Continuing mixed and messy economic data in Australia highlights why another rate cut remains a 50/50 proposition. That said, having the lowest borrowing rates since the early 1950s and the continuing plunge in the $A to now around $0.74 is certainly helping the economy through this tough patch.

Next Week

By Craig James, Commsec

Inflation dominates the local calendar

One piece of economic data stands out in the coming week in Australia – inflation. And in the US, the focus is on housing market indicators. There are also “flash” readings on the health of manufacturing sectors across the globe.

In Australia, the week kicks off on Monday when CommSec releases its State of the States report. NSW led this quarterly assessment of economic performance in the April report. The question is whether NSW retained top spot in the latest July report.

On Tuesday the Reserve Bank releases minutes of the last Board meeting, held on July 7. At this meeting Reserve Bank Board members elected to both leave interest rate settings unchanged as well as the monetary policy stance. The RBA has a “neutral” stance, meaning that the next move in rates could go either way.

Clearly, however, if rates were to move in the next six months, it would be most likely be down. But if the economy continues to stabilise, the longer that rates stay unchanged, the greater the chance that the next move in rates is up – but not until well into 2016.

Also on Tuesday, Roy Morgan and ANZ release their weekly reading on consumer confidence. Over the last two weeks consumer confidence has slumped 8 per cent from 18-month highs. In short, whatever could have gone wrong over that period did go wrong. But if Greece and Iran retreat from the headlines and both the Aussie dollar and iron ore prices stabilise, then confidence may rebound just as smartly.

On Wednesday, the Bureau of Statistics (ABS) releases the quarterly inflation data, that is, the Consumer Price Index. The big mover over the last quarter has been the price of petrol. Using our daily national estimates of petrol prices, CommSec has calculated that petrol lifted around 14 per cent in the June quarter, putting it on track to the largest quarterly increase in 25 years.

Overall the CBA Group expects that the headline CPI rose by 0.9 per cent in the quarter with annual growth at 1.7 per cent. Stripping out volatile factors like petrol, ‘underlying inflation' probably lifted 0.7 per cent in the quarter or by 2.4 per cent over the year.

In the June quarter, the CPI would have been boosted by the annual price increases by health insurance firms. There were also likely to have been seasonal price increases in international travel costs although offset to some extent by falls in domestic holiday travel and accommodation prices. The cost of ‘new dwelling purchase by owner-occupiers' also likely rose in the quarter reflecting the high demand for home building services.

Also on Wednesday the Reserve Bank Governor delivers his annual luncheon speech in support of the Anika Foundation. There has been a fair bit happening of late, so it will be useful to hear the Governor's views, including hus views on home prices.

Overseas: US housing market data

There are no real standouts on either the US or Chinese economic calendars in the coming week.

On Tuesday, the usual weekly data on chain-store sales is released.

On Wednesday, the monthly home price index from the Federal Housing Finance Agency is released. There isn't the same hype on home price changes in the US as in Australia. Prices are rising at a sustainable rate despite super-low interest rates. In April, home prices lifted 0.3 per cent to be up 5.3 per cent over the year

Also on Wednesday, data on existing home sales are issued. Economists estimate that sales lifted by around 1 per cent in June to a 5.4 million annual rate after a solid 5.1 per cent gain in May. The weekly data on mortgage activity is also issued – new lending and refinancing data.

On Thursday, the National Activity index is issued for the month of June as well as the June leading index and July survey of activity by the Kansas City Federal Reserve. Economists tip a 0.1 per cent lift in the leading index after a 0.7 per cent gain in May.

And on Friday in the US, the June data on new home sales is issued. After a solid 2.2 per cent lift in May, new home sales likely plateaued at a 543,000 annual rate in June.

Also on Friday, the “flash” July readings on manufacturing activity in the US, Europe and China are released.

The only other indicator of note will actually be released a day before the start of this weekly rundown – Chinese home price data is scheduled for Saturday June 18.

Sharemarket, interest rates, currencies & commodities

The US earnings season cranks up another notch in the coming week.

On Monday, Morgan Stanley is amongst a small number of companies releasing earnings results.

On Tuesday, there are 20 firms from the S&P 500 index scheduled to be releasing earnings including Yahoo! Inc, Verizon Communications, Apple, Microsoft, Baker Hughes and Bank of New York Mellon.

On Wednesday, around 25 companies from the S&P 500 index report earnings results. Amongst those are Coca Cola, Texas Instruments, American Express, Boeing, and Newmont Mining.

On Thursday, around 50 companies from the S&P 500 index are expected to issue earnings results. Amongst those are Amazon, Caterpillar, E*TRADE Financial, 3M Co, Starbucks, General Motors, NASDAQ, Kimberley Clark and Eli Lilly.

And on Friday there are 12 companies listed to report earnings including State Street, Xerox and Moody's.