Kohler's Week: Europe GDP, Yuan yawn, Currencies, Advertising, Death Cross, Population, CBA, Xero, CSL

Last Night

Dow Jones, up 0.39%

S&P 500, up 0.41%

Nasdaq, up 0.29%

Aust dollar, US73.8c

Europe GDP

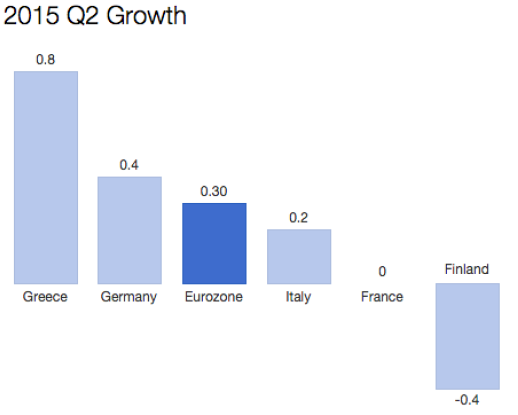

Here's a turn up: Greece's economy is doing better than Germany's, and a lot better than France's. Eurozone second quarter GDP numbers out this morning show that the European economy as a whole is weak and fragile, that France is stagnating, Germany is doing worse than expected and the only country with a spring in its GDP step is Europe's basket case, Greece.

Here's a chart from The Independent newspaper of a few of the notable ones:

The economies of central and northern Europe are losing momentum, despite the weaker euro, falling oil prices and the launch of the European Central Bank's quantitative easing program.

I mean, if France's economy can't grow at all with all that going on, then it's in trouble. And Greece? Well, it's off a low base but there's a lot of head-scratching among the experts: I haven't read an entirely convincing explanation of Greece's strong growth this morning.

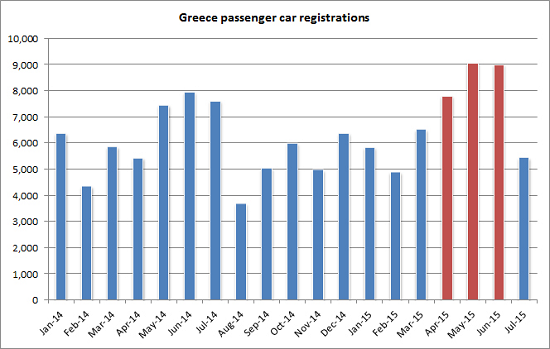

I wonder if it's because consumer spending rose as people took their money out of the banks in droves with the intention of putting it under the mattress, except that a lot got spent as well. There is some evidence of this in car registrations, which were quite a bit higher in Q2:

But the big worry in Europe is France – its wheels are spinning in the mud, with 10 per cent unemployment and no hope of getting it down without any GDP expansion at all.

Yuan yawn

The Chinese currency has now been depreciated by 4 per cent, which briefly tilted the earth's axis this week. The People's Bank of China's deputy governor, Yi Gang, held a press conference on Thursday to declare that talk that a 10 per cent devaluation was proposed was “groundless” – nothing to see here, move along.

His purpose also appears to have been to explain, as well as reassure, and if so that was a miserable failure. The world's financial markets are still swirling with uninformed speculation as to what the PBoC is doing and what the implications might be. Some say the PBoC's actions will derail the US Fed's progress towards interest rate 'normalisation'; some say it won't. Some say it's a big deal; some say it's not.

I say it's not. China is trying to liberalise its economy and the yuan must eventually be floated. This week's events were a small step along that journey. If it doesn't happen, then China's legendary foreign exchange reserves (which were $US4 trillion and are now $US3.69 trillion, and falling) will evaporate entirely and, more importantly, the Chinese currency will never be useable for trade and won't be allowed in the IMF's special drawing rights.

Pegging your currency to that of another country involves outsourcing your monetary policy: as America tightens so will China, which may not be a good idea for an economy that is struggling. Moreover, as the US dollar rises, the yuan becomes overvalued against other countries, particular the euro and the hated yen. As Dennis Gartman wrote the other day: “Those focusing their attention solely upon the renminbi/US dollar rate shall miss what is really going on: a veritable currency war between China and Japan. This ‘war' is only now a goodly sized skirmish. It very likely shall become much, much worse over time.”

The yuan certainly needs to float and it needs to come down by at least 10 per cent against the US dollar before it stops disrupting capital flows and hampering trade. This will take some time and there will be lots of weasel words from the Chinese authorities along the way, which is not a practice confined to China, by the way. Central banks generally prefer you to be looking the other way while they perform their magic tricks.

Currencies

Let's assume for a moment that the Chinese are, in fact, devaluing the yuan as part of a currency war with Japan and, more generally, to lift its export economy. The question: will it work?

A most interesting paper was put out this week by a London-based economist for UBS, Paul Donovan, headed: “The dollar – never in the history of economic thought were so many so wrong about so much.”

Donovan's point is that the floating exchange rate theory under which most economists still labour, is now defunct. Currency movements, he says, no longer influence trade flows.

“…there is a general tendency to assume that a strong dollar automatically and broadly weakens US exporters' market share, benefits European and Japanese exporters' market shares, lowers relative import product prices in the US and raises relative import product prices in Europe and Japan. These assumptions are, respectively, wrong, wrong, wrong and wrong.”

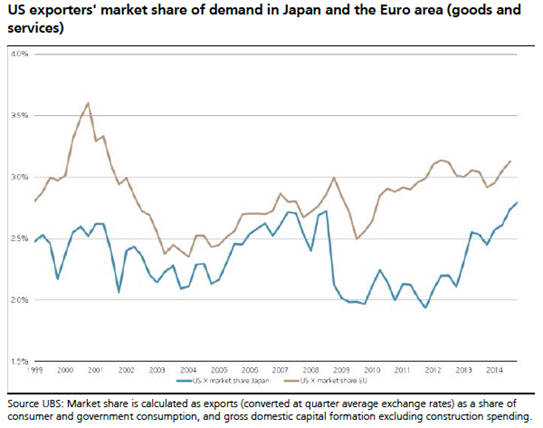

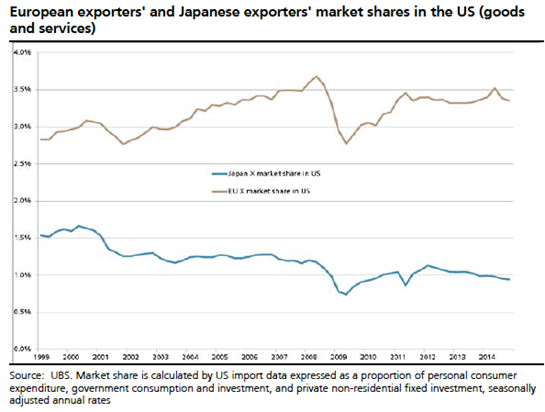

As evidence, Donovan shows two graphs:

These show, respectively, that despite a rising US dollar against both the yen and the euro, US exporters have been GAINING market share in Japan and Europe, and despite a move in the dollar yen of about 60 per cent from its lows, Japanese exporters have suffered a declining market share in the United States. The euro has fallen some 40 per cent against the US dollar since 2011 but the market share of European exporters has been flat. Says Donovan: "To blindly declare that competitiveness and economic activity are helpless victims of currency fluctuations is absurd.”

International companies set their prices according to local conditions; that is, according to the competition. With the exception of commodities, which are always priced in dollars so that exchange rate movements are relevant, a stronger or weaker currency does not, of itself, lower or raise inflation. Companies have to keep their prices constant relative to competitors and the effect of currency moves will be felt in their profit margins, for good or ill. “For an exporter to the US, a US competitor cutting their price is a reason to cut the dollar export price; a stronger dollar is no reason to do anything except count the increased profits.”

We know this intuitively to be true. Paul Donovan doesn't go into this, but I suspect that the reason floating exchange theory used to work, and doesn't any more, is that there is more competition now than there used to be. Countries everywhere, especially in Europe and including the United States and Australia, have been cracking down on cartels and anti-competitive behaviour. Monopolies are no longer allowed. And perhaps more important than that, the internet and smart phones now allow instant price comparison by consumers. These days very few companies can get away with anything in relation to their pricing, and importers thus have very little pricing power against local producers.

This applies equally to China. It suggests that a devaluation of even 10 per cent will have little or no impact on Chinese exports – except exports of money, of course. The capital outflow will step up.

Advertising

Another factor in all this is the waning power of brands, by which I really mean the power of advertising. The possession of a strong brand is all about pricing power: firms spend huge sums on marketing to establish a brand so that their margins may be enhanced by price premium over competitors whose brands are not as ‘strong', because they spent less on marketing. For marketers it is a straightforward ROI (return on investment) equation and that's how they refer to it.

It used to work very well and the media industry, especially television, is built on it. Gillette outspends Schick and gets to charge more for the same product, thereby making a bigger margin. The difference in profit is greater than the price of the marketing spend, and the advertising revenue is greater than the cost to the TV station of acquiring the audience. Everybody wins.

However, advertising no longer works. Let me repeat that: advertising no longer works. Viewers either fast forward over the ads, mute them or look at their phones instead. And overall, consumers are spending less and less time on traditional media that offers mass scale to brand advertisers, and more time on social media and streamed video via Netflix, with the result that the fastest growing type of marketing is targeted to niche audiences through Facebook and Google, where the advertisers are focused on customer acquisition rather than brand.

An advertising industry leader who I spoke to yesterday told me that the media and advertising peak was 2010 and the decline that has occurred since then is irreversible. TV networks are still managing to persuade some marketers that the large audiences they are capturing with reality programs and live sport still work for the creation and maintenance of brands, but that fiction is rapidly being exposed. Up to about five years ago, the advertising industry had barely changed since the days of Mad Men and Madison Avenue and much of it is still trying to preserve the illusion that what they do has value, and therefore are still pushing dollars into free-to-air TV.

But, in fact, it's over. Newspapers the world over are giving up on advertising and desperately trying to make up the revenue through subscriptions from readers, with varying degrees of success. Something similar is happening in television, with subscription services like Netflix leeching viewers away from free to air – the difference being that they are different businesses, unlike with the publishers, which are trying to preserve existing titles.

History will define the great brand advertising era as being about 60 years long, from 1950 to 2010, after which something new replaced it. I suspect that something new may be described with a single word: ‘data'. Mass brand advertising is characterised by almost complete ignorance about the audience, beyond the fact that there are (were) lot of them. The new advertising is characterised by detailed knowledge and segmentation, an entirely different matter.

Needless to say, this is a big deal and has implications for a lot of businesses.

Death Cross

I don't know if you follow charts and technical analysis, but if you do you'd be aware that the Dow Jones formed a ‘death cross' this week. That's where the 50-day moving average goes above the 200-day moving average. It supposedly heralds a bear market.

Michael Kahn in Barron's commented: “since the financial crisis and intervention by the Federal Reserve, death crosses and their inverse ‘golden crosses' have been less effective in predicting major trends. There have been several occasions when crosses are immediately reversed leaving investors with losses.”

Brett Arends in Marketwatch was pithier: “I call BS on the death cross. There was a death cross in 2011. Stocks went up. There was a death cross in 2010. Stocks went up. There was a death cross in 2004. Stocks went up that time too.”

The trend of the Dow, and the US market generally, remains up, despite some choppiness this week as a result of the Chinese devaluation.

The thing to watch, in my view, is the bond market, and specifically high yield bonds. This has become a very crowded trade due to the ‘hunt for yield' and at some point there may be a rush for the exits. Liquidity will be found wanting. Messiness would ensue.

With his usual charming turn of phrase, Jim Grant sums up the issue: “The credit cycle is a mass migration of the mind. It begins with the collective fear of losing money, Point A. It ends with the collective fear of not making money, Point B.

“Point A finds lenders and borrowers nursing the wounds of bust that followed the boom. The penitents resolve to be more careful if only the market will give them another chance.

“The passing years leech away memories of the bust. Bankruptcies become rarities as prosperity spreads its blessings ... For the professional investor generating gains takes precedence over avoiding losses. Point B is the apex of optimism.

“Point A of the present cycle was March 2009, the nadir of stocks and credit. Point B, we shall guess, has just passed. The crystallisation of boom-time optimism occurred on July 16. The oversubscribed sale of more than $1 billion of debt by the Ba-1 rated City of Chicago was the red letter event.”

Another red letter event perhaps was the recent panel discussion between Carl Icahn and BlackRock's Larry Fink, to which I pointed in last week's missive. Icahn accused Fink of fostering excessive investment in high yield bond ETFs, which would drive investors over the cliff when they try to sell at once. Liquidity would not be available.

Says Jim Grant: “Naturally, all cycles are different. Radical monetary experimentation is the stand out characteristic of this one. Zero-percent funding costs have pulled forward consumption and pushed back distress. They have reduced the returns to skepticism, securities analysis and due diligence.”

I love that – “reduced the returns to skepticism, analysis and due diligence”. Jim Grant has been on about this for years now and so far has been very wrong to worry so much.

Eventually he will probably be right, but perhaps not with this week's death cross.

Population

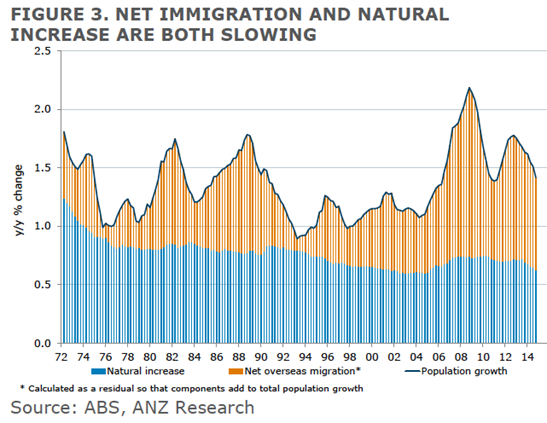

The census was announced this week as taking place in a year's time, so we'll find out for sure what's going with population then, but already it's clear that population growth is slowing very sharply – both from net immigration and natural (births minus deaths).

Justin Fabo, economist at ANZ, says the slowing of population growth largely reflects weaker economic activity and rising unemployment, and he also reckons that it's slower than the official figures suggest, so that the census next year will probably downgrade population growth even further.

There are two key implications of this:

1. Potential growth will be slower than previously expected, with somewhat weaker consumer demand and lower interest rates than otherwise would be the case

2. To the extent that population growth has raised demand for housing, and therefore residential real estate prices, that will be less so in future.

So, weaker population growth has two opposing effects on real estate values: lower demand, and lower interest rates. Maybe it's a ‘nil-all' draw in that respect.

CBA & Xero

Interesting juxtaposition of interviews with a pair of Kiwis this week. On Wednesday I spoke to Commonwealth Bank CEO Ian Narev (listen to it, or read it, here) and Thursday I did a long Eureka Interactive interview with Rod Drury, the CEO of Xero, the accounting software business (here). Both come from New Zealand: Rod still lives in Hawke's Bay, three hours out of Wellington, while Ian lives in Sydney.

Ian Narev is raising $5 billion to pay the dividend (well, it's actually to bolster capital in line with the Murray Committee's recommendations, but the effect of it is to provide the cash for the dividend). In my interview with him Narev made it clear that management and the board understand that their company is mainly seen by inverse as a provider of yield – an income security.

Rod Drury wouldn't dream of paying a dividend, not for years. Any cash he raises, either from share issues or selling subscriptions, goes into growing the business. Drury believes, rightly, that investors have bought Xero shares for growth, not income.

Which is better? Well, since the beginning of last year, CBA's share price has gone up $4, or 5 per cent, and the bank has paid $8.21 in dividends, for a total return of 9.4 per cent p.a. Xero's share price has halved over the same period. No dividends. Since March this year, CBA shares have fallen from $96 to $82 while Xero has fallen from $25 to $15, 10 per cent versus 40 per cent.

So, up to now it's a no brainer: get with the strength. The question is, what now? Xero or CBA? Listen to the interviews.

Peer-to-peer lending

Speaking of the Financial System Inquiry, we had one of David Murray's fellow panel members in the studio this week – Professor Kevin Davis of the University of Melbourne – to talk about peer-to-peer lending and provide an independent wrap up of my series on these things as a possible vehicle for investment yield.

He agrees that they're here to stay and will disrupt banking to some extent, and he provides a useful overview of the safety of them as investments. Well worth a listen. You can watch the video here.

CSL

My final interview this week was Gordon Naylor, the CFO of CSL.

What a wonderful company this has been, and still is. Since being privatised as Commonwealth Serum Laboratories in 1994, the share price has increased from just above a dollar to $93.30 yesterday, a compound annual growth rate in capital value of 25 per cent. On top of that CSL has paid $908.90 per share in dividends, taking the total return over 20 years to 40 per cent p.a. – far better than Warren Buffett's Berkshire Hathaway.

It is now the dominant global fractionator of blood (that is, extractor of plasma, albumin etc) and is still growing that business, and has now begun a move towards dominance in influenza vaccinations, through the acquisition of Novartis (which it picked up very cheaply, as Gordon Naylor explains).

Like CBA, this is rightly a core part of any Australian investment portfolio. You can view or read the interview here.

Readings & Viewings

Fabulous mashup involving Bronwyn Bishop.

This is a good video on wine – a sommelier debunks some common wine myths.

I've been listening to Eddie Berman a bit lately. Here he is doing a wonderful cover of Dylan's Like a Rolling Stone with Laura Marling. They turn it into something plaintive, rather than angry.

And while we're at it, here they are doing Bruce Springsteen's Dancing in the Dark, which is a great song, it turns out. Can't start a fire… can't start a fire without a spark.

Prof Kevin Davis: The banks are raising capital. What's going on?

Malcolm Farr: How Abbott uses consultation when he wants something to fail.

The Supreme Court has knocked back – as surreal – Dallas Buyers Club's attempt to get money off the people who pirated it. Now what?

The rise of the robo-advice machines – they're coming.

So are driverless cars. This is a fascinating podcast on the subject – “this is a better driver than I am”.

Computer hackers cut a Corvette's brakes wirelessly to prove it could happen to you.

This is a nice story, of a 6-year-old orphan who is giving away toys to make people smile. It'll make you smile too.

The curious case of China's currency.

China's devaluation can't be good news.

China joins the currency wars.

Five things to know about China's devaluation. OK, that's it.

Solar energy could save Greece.

Dear God – there is a Ned Flanders-themed metal band called Okilly Dokilly.

Why the rise of Donald Trump means death for the Republican Party.

Leo Babauta's thing on how to lose weight, using levels. It's good!

A solar-powered electric scooter for going to work.

Google's “Alphabet” looks a lot like a 21st century Berkshire Hathaway.

How energy companies and utilities use the internet of things to save billions.

And will the internet of things result in predictable people?

One billion lived in extreme poverty 200 years ago. One billion live in extreme poverty today (except 200 years ago it was almost the entire population of the planet.

A 7000-word cover story for The Atlantic magazine “The Coddling of the American Mind”. Basically about how political correctness is killing the education system.

We can only make excuses for you for so long Nick Kyrgios.

Armed with 10,000 more genes than humans: Scientists hail the intelligence of the octopus.

Happy Birthday Jimmy Webb, 69 today. Great songwriter (better songwriter than singer, that's for sure!) He wrote Galveston, that Glenn Campbell made famous. Here's Jimmy doing it the way he meant it.

Last Week

By Shane Oliver, AMP Capital

Investment markets and key developments over the past week

The past week was volatile as investment markets reacted to China's move to devalue the renminbi and make its determination more market oriented. The associated uncertainty saw shares, commodities, emerging market currencies and the Australian dollar fall. It was a bit like investors thinking “we don't know what's happening so we better sell”. Once the dust settled and investors came to the view that a large decline in the renminbi was unlikely, there was a bounce back or at least a bit of stabilisation. This saw most share markets still down for the week, including Australian shares which have not been helped much so far by the profit reporting season, but US shares rise modestly and Chinese shares put in good gains as they would be beneficiaries of the lower renminbi. Bond yields rose marginally in the US and Australia but fell elsewhere. Commodity prices were mixed with oil falling to a new low for the year with ongoing oversupply concerns. China related uncertainty also weighed on the Australian dollar a bit.

After years of the renminbi being tightly managed its 3 per cent decline and move to greater market determination came as a big of shock with global markets reacting to uncertainty about what it tells us about Chinese growth, how far the renminbi will fall, the implied disinflationary impact of cheaper Chinese goods and the risk of an intensified global currency war. It's tempting to go into hyperbole about all this, but since everyone else has I'll avoid the temptation. But several things are worth noting.

First, with the real trade weighted value of the renminbi up 30 per cent in the last five years and 80 per cent in the last 10 it's understandable China wanted it a bit lower.

Second, further renminbi depreciation is possible. But a big fall seems unlikely as China has a big trade surplus, is growing its share of global exports and the PBOC has indicated it only wanted to see a 3 per cent or so fall and described talk of a 10 per cent fall as "nonsense" and indicated it has the world's biggest reserves to prevent a free fall. Time will tell.

At the margin China's move is disinflationary globally and puts pressure on competing countries to depreciate and on developed countries to maintain or accelerate easy monetary policies and could, at the margin, delay the Fed from tightening. But with a 3 per cent fall so far, this is all marginal.

For Australia, a lower renminbi should be seen as good news ultimately. Cheaper Chinese exports will boost demand for them which in turn will boost demand for our raw materials. But again this is marginal.

It's early days in the Australian June half profit reporting season, but so far the results have been rather mixed. Fifty-one per cent of results have beaten expectations and 61 per cent have seen their profits rise from a year ago which is good, but good results often come out early on and at the same point in the February reporting season these numbers were 60 per cent and 76 per cent respectively. Despite this dividends are continuing to surge with 68 per cent of companies so far raising their dividends and only 8 per cent cutting them. Other key themes are ongoing weakness amongst resources and mining services companies, slowing profit growth for the banks at the same time they are raising more capital and ongoing cost control.

For motorists the fall in the petrol price to around $1.25/litre has taken it closer to what is suggested by the collapse in oil prices & the level of the Australian dollar, but there is still a bit further to go.

Major global economic events and implications

US economic activity data was a bit stronger with a rise in small business optimism, solid labour market indicators and strong July retail sales. So in terms of the Fed raising rates in September economic activity data gets a tick. But with falling commodity and import prices confidence around inflation is still weak. So a September move is probably still 50/50 and if it does move it might be a “one and done” for a while.

Chinese economic data was on the soft side with weaker than expected readings for exports, imports, credit, industrial production and retail sales. Overall growth looks to have slowed again in July and it's clear that further monetary easing is likely. With non-food inflation of just 1.1 per cent and producer prices down 5.4 per cent year on year, interest rates remain too high and a decline in the benchmark lending rate from 4.85 per cent to below 4 per cent is still necessary and likely. Further bank reserve ratio cuts and fiscal stimulus are also likely.

Indian economic data is looking better with industrial production up and inflation continuing to fall, highlighting the malaise affecting many emerging markets is not affecting India.

Australian economic events and implications

Australian confidence data was mixed with consumer confidence up and business confidence down. This partly reflects last month's Chinese and Greek turmoil but the message is that consumer confidence remains subdued and business confidence is around its long term average. With wages growth remaining at record lows of just 2.3 per cent over the year to the June quarter it's no surprise that consumer confidence is subdued. Fortunately wealth gains and low interest rates are helping drive reasonable retail sales growth.

It's hard to disagree with RBA Deputy Governor Phillip Lowe's observation that ever rising land values won't do much to make us better off as a nation and that economic reform is needed to drive economic growth. Of course the key to solve ever rising land prices is to increase the supply of it, but we seem to struggle in achieving that on a sustained basis.

What to watch over the next week?

In the US, the minutes from the Fed's last meeting (Wednesday) are expected to confirm that it remains on track for a rate hike later this year. On the data front, expect to see continued strength in home builders' conditions (Monday) and housing starts (Tuesday) but a slight fall in existing home sales (Thursday). Core CPI inflation (Wednesday) is expected to remain low at 1.8 per cent year on year. New York and Philadelphia regional Fed manufacturing surveys will also be released and the Markit manufacturing PMI (Friday) for August is likely to remain solid at around 53.8.

Japanese June quarter GDP (Monday) is expected to show a decline after two quarters of growth.

In Australia, the minutes from the last RBA Board meeting (Tuesday) are likely to confirm that the RBA is happily on hold for now. Data for car sales, the Westpac leading index and skilled vacancies will also be released.

The June half profit reporting season for Australian will really ramp up with around 80 major companies reporting results, including QBE, Qantas, Wesfarmers, Stockland and AMP. Profit growth for 2014-15 is likely to be around -1 per cent as resource sector profits slump 28 per cent thanks to the hit from lower commodity prices, but with the rest of the market seeing profit growth of around 9 per cent as industrials ex financials benefit from low interest rates, the lower Australian dollar and cost cutting.

Next Week

By Craig James, Commsec

Feast to famine

The flow of domestic economic data dries up in the coming week. And that is probably a good thing given that we are in the middle of earnings season – the time when listed companies release their latest profit results. So if you want to assess what shape the economy is in, the best bet is to review the commentary provided by the companies when they release their results.

The week kicks off on Tuesday when the Reserve Bank releases minutes of the last Board meeting – that is, the Bank releases details about what the Board members discussed. And the commentary could prove interesting given that at the July meeting Board members changed their views on the currency. Before the July meeting, members believed that further depreciation of the Australian dollar was “likely and necessary”. But at the latest meeting those key few words were omitted. Essentially the Reserve Bank board members seemed to suggest that they were happy about where the Aussie dollar had settled, that is, around US73-74 cents.

Other areas of interest in the Board minutes include the discussion about the new “speed limit” for the economy and the implications that this poses for retail spending, home building and the job market.

Also on Tuesday the Australian Bureau of Statistics (ABS) releases data on new car sales while ANZ and Roy Morgan release the weekly consumer confidence survey.

The industry group – the Federal Chamber of Automotive Industries – has already released new vehicle sales figures in original terms. That is, the data hasn't been adjusted for seasonal effects. In July, new vehicle sales were at record highs for any July month. This shouldn't be a surprise given the fact that car affordability is at the best levels in almost 40 years. The ABS will recast these sales figures and express them in seasonally adjusted and trend terms.

The consumer confidence figures are unlikely to provide many surprises. Confidence amongst consumers is reasonable at present with fewer global “flashpoints” and recent comments by the Reserve Bank that the job market should prove stable over the next year. The main worry for consumers is that they would like a stronger Aussie dollar to boost their purchasing power over foreign goods and give them greater scope to travel abroad.

On Wednesday, the Skilled Vacancies index is released from the Department of Employment. The data provides another perspective on the state of the job market.

China and the US trade places

The past week was dominated by Chinese economic data including trade, inflation, retail sales, production and investment. In the coming week, the US takes the lead in providing economic indicators.

The week kicks off on Monday with the release of the New York Federal Reserve manufacturing index, the housing market activity index from the National Association of Home Builders and data on capital flows.

The New York Fed index is tipped to lift from 3.86 to 4.6; and the NAHB housing market index is tipped to have remained stable at a reading of 60.

On Tuesday, data on housing starts and building permits are slated for release together with the usual weekly chain store sales figures. The building permits data is the leading gauge on home building. Economists expect that permits fell by 10 per cent in July. But housing starts may have remained stable at a 1.17 million annual rate in the month.

On Wednesday, the July consumer price index (CPI) is issued. Federal Reserve policymakers would prefer to see some evidence that inflationary pressures are picking up before they decide to lift interest rates. Economists expect that the core CPI (excludes food and energy) lifted 0.2 per cent in July, taking the annual rate to 1.9 per cent in the month from 1.8 per cent.

Also on Wednesday, the Federal Reserve releases minutes of the last policy-making meeting. Economists are trying to divine whether the Fed starts lifting rates in September or whether policy-makers wait until December. So analysts will be scouring for clues from the latest meeting transcript. The weekly reading of housing finance is also issued on Wednesday.

On Thursday the leading index is released together with data on existing home sales, the pivotal Philadelphia Federal Reserve business survey and the regular weekly data on claims for unemployment insurance.

Economists expect that existing home sales eased 1.3 per cent in July to a 5.42 million annual rate. Analysts are also tipping a modest 0.2 per cent lift in the leading index in July and a lift in the Philly Fed index from 5.7 to 6.2 in August.

Sharemarket, interest rates, currencies & commodities

The Australian profit-reporting season moves into top gear in coming week. So far there have been the usual fair share of stand-outs and disappointments, but companies continue to rack up the profits with balance sheets generally in strong shape.

On Monday, earnings results include Newcrest Mining, Aurizon, Charter Hall Retail and Flexigroup.

On Tuesday, earnings are scheduled from QBE Insurance Group Ltd, Iluka Resources, Sonic Healthcare, GPT Group, Challenger, Sydney Airport, Invocare and Asciano.

On Wednesday, amongst those scheduled to issue their profit results are Woodside Petroleum, Stockland, iiNET, Alumina, Treasury Wine Estates, Recall Holdings and Seven West Media.

On Thursday, earnings are expected from Origin Energy, APN News & Media, Qantas, ASX, Western Areas, IRESS, AMP, Wesfarmers, Tatts Group, Adelaide Brighton, Qube, Lifestyle Communities, Mount Gibson Iron, Investa Office Fund, NRW Holdings and RCR Tomlinson.

On Friday, scheduled earnings results include those from Medibank Private, Coca-Cola Amatil, DUET Group, Insurance Australia and Santos.