Kohler's Week: Euphoria and despair, Interest rates, Politics, Gerard and me, Middle East, MGM Wireless, Medibio, Knosys

Last Night

Dow Jones, down ~0.52%

S&P 500, down ~0.5%

Nasdaq, down ~0.4%

Aust Dollar, US71c

Euphoria and despair

What are we to make of a week in which Woolworths, Dick Smith and Capitol Health are brutally savaged, and NAB and ANZ are taken to the woodshed, and Blackmores hits $200? Euphoria and despair in equal measure. It's a weird time, that's for sure: the market is dangerous and full of potholes, but with pots of gold just waiting to be found.

The fact that we had, and still have, Dick Smith and Capitol Health as buy recommendations puts Eureka Report firmly in the despair camp; our buy on Flexigroup, which popped 17 per cent on Thursday, seemed little consolation.

Read James Samson's review of DSH published on Wednesday (Dick Smith disappoints, October 28) and CAJ will be reviewed on Monday, but there are bigger issues at play here – important lessons from the events of this week, both about modern investing and what's happening in the world.

First, management matters. As I have been saying for a while, this is a stock pickers' market. The ASX200 Accumulation Index is flat year to date, term deposits pay very little, and the only investment returns have come from investing in the right companies. Banks are uniformly down 5 per cent, resources down 17 per cent, but industrials are up 10 per cent, with big variations within that. Blackmores 500 per cent, Qantas 65 per cent, Domino's Pizza 84 per cent. Woolworths –20 per cent, Dick Smith –64 per cent, Seven West –50 per cent, Slater and Gordon –54 per cent.

Christine Holgate (Blackmores), Alan Joyce (Qantas) and Don Meij (Domino's) are outstanding CEOs. They don't have monopolies in their businesses and in fact each of them sells stuff that plenty of other companies sell – vitamin tablets, airline seats and pizzas. Woolworths, on the other hand, is in a duopoly and has fired the CEO, Grant O'Brien without a successor. Seven West has what used to be called a licence to print money.

In a market where the ONLY returns come from good stock picking – NOT from the index – there are zero buyers for dud stocks. That means there is no one buying the dips and therefore no price floor when some punters lose faith and decide to try something else. The market looks calm, but beneath the surface it's brutal.

Our analysts are still recommending and holding DSH and CAJ and believe they are now very cheap, which is fair enough. But these stocks, as well as SGH and WOW for that matter, won't be re-rated back to where they were until existing management regains credibility or someone new takes over and restores credibility. That's the ONLY way these stocks are coming back. Price-earnings ratios are now all about management credibility, not some kind of mathematical forecast of profit growth.

The final point about management is that it reinforces the need for portfolio diversity. It is impossible for a small investor, and even for a professional, to always, or even most of the time, pick dud manager from genius.

For example, I had a glass of sparkling water this week with the new CEO of Myer, Richard Umbers, and at the end of a pretty interesting hour-long rundown of all the changes he's making to turn the business around, I said this:

“Richard, I've been showing up at this building and before that the one up the road, for ten years to interview Bernie Brookes (Umbers' predecessor). He was always very convincing about the strategy and everyone thought he was a great retailer – a genius even. That's certainly how it seemed. Yet, now he's gone we find out that he was an idiot and the place needs to be fixed with radical surgery. What the hell?"

Naturally Umbers defended Bernie and said he's not an idiot (he's not) (they both came from Woolworths, by the way). He said times had changed; what used to work, no longer does. “Should the things I'm doing have been done two years ago? Yeah probably. But that's the extent of the difference.” Okay, fair enough. Whatever.

Second, success in investing and modern business is not just about digital disruption. It's true the world is being turned upside down by automation and digital cloud-based startups are sprouting like mushrooms after rain, but the big winners in 2015 are analogue businesses – airlines, pizzas, vitamins, wine (Treasury Wine Estates 55 per cent YOY), infrastructure (Sydney Airport 47 per cent) and packaging (Orora 33 per cent), to name a few.

Their costs are being brought down by technology, to be sure, but these are all traditional businesses, well managed. I still think technology and cloud-based, software as a service (SAAS) disruption is an important investment and business theme, but the lesson I've taken from this week is: don't focus on the new at the expense of the old. And perhaps one of the old businesses to focus on the most is food, that is: water, fertiliser, farming, food manufacturing and distribution. That's because food has one very important characteristic that digital technology definitely does not possess: scarcity.

Third, China is still important. It's a complex, paradoxical, almost unknowable country, with many, many problems – including, just for example, the ridiculous one-child policy that has now become the two-child policy – and the Communists could still do a lot of damage as they try to hang onto an old-style dictatorship in a modern world.

But having changed the world in the 2000s by massively increasing the supply of cheap labour, China is now changing the world again by massively increasing the supply of middle class consumers. That's what the Blackmores phenomenon is about and it's happening independently of what the Communist Party does.

Interest rates

There were two important developments on this subject during the week: Australian CPI and the Fed minutes. To cut to the chase, it looks like the probability of a rate cut in Australia and a rate hike in the US have both increased a little. Neither is a certainty, far from it, but the odds are up to something like 60-70 per cent. That's why the Aussie dollar is moving down toward US70c again – on top of the renewed weakness in commodities.

Australia has very little inflation, whether you look at the headline CPI (1.5 per cent) or underlying (2.1 per cent). One point of view is that if the RBA is going to cut in December, why wait? Do it now. Another is that there is no need to panic – the dollar is coming down and there's no need to pre-empt a December cut.

There are three reasons for the RBA to cut now, either next week or December: the low CPI, what the Fed is up to in the US, and the rate increases by all the banks to help pay for the extra capital. None of those things on its own would prompt a rate cut, but together they might.

The reaction to the Fed minutes was that they were “hawkish” and that “lift-off” in December is in play. Again, there are credible opinions both ways, for example (from The Wall Street Journal):

“Today's Fed statement further confirmed that the FOMC's finger is on the rate hike trigger. A major change in the FOMC statement included the following: ‘In determining whether it will be appropriate to raise the target range at its next meeting, the committee will assess progress – both realized and expected – toward its objectives of maximum employment and 2 per cent inflation.' In other words, the Fed is seriously considering a rate hike at its December 2015 meeting, although this statement also implies that the Fed will remain economic data-dependent.”

– Jason Schenker, Prestige Economics

“[I]n order to justify a rate increase, the first rate increase since 2006, the economy should be sending crystal-clear signals that it is ready and able to withstand a rising rate environment. However, with noticeable weakness across much of the economy, including the two key sectors determining monetary policy – the labor market and inflation – without a material reversal in the currently sluggish trends near-term, policy makers will have an increasingly difficult time justifying a rate increase come December.”

– Lindsey Piegza, Stifel Economics

Actually I think the Fed is all over the place and could do anything. The US economy looked stronger in June and even September, when it decided not to move, and now apparently, when weakness is noticeably starting to appear, they are apparently going to hike In December. I don't think so. In the context of how they think (bearing in mind my rants of the past two weeks, headed Central Banks Are Destroying The World and Central Banks Are Destroying The World, Part 2) they won't be hiking in December, in my humble opinion.

And that view was reinforced by this morning's data in the US – consumer spending edged up only 0.1 per cent in September, the smallest gain in eight months.

If the Fed doesn't hike, the RBA will definitely cut, in my view, maybe even next week.

Politics

A remarkable thing has happened in the past month: Australian politics has become quiet. It's a bit like having a noisy party, with heavy metal music, going next door – oontz, oontz oontz – for so long that you get used to it and don't really hear it and drift off to sleep despite the din, and then suddenly it stops, and at first you don't know really know what's happened.

For just about 10 years now Australian politics has been like a noisy party – constant screeching, loud media trying to scare us. I think it started with WorkChoices in 2006, then climate change, then stop the boats. There was the ascension of the frenetic Kevin Rudd, and the wildly incompetent Julia Gillard, then the scaremongering Tony Abbott. Both parties have been persuading themselves that their policies are fine, it's just the 24-hour media cycle that's been killing them.

We probably all thought that it was the media, desperately overblowing everything and trying to scare us to counter digital disruption, and feed the ravenous beast of 24-hour news channels and talkback radio.

And now suddenly, it's gone quiet, and nothing has changed about the media. It turns out that it wasn't the media's fault at all that politics had become febrile: Malcolm Turnbull is not going on radio and TV every day – you don't see him that much at all. He's not constantly attacking the ALP and Bill Shorten and, God forbid, he sometimes doesn't bluster when asked a question he doesn't know the answer to. Politics is suddenly rational, with ministers not ruling things in or out and instead promising to examine all the options and make a careful decision.

As Guy Rundle wrote in Crikey this week, the Labor Party is sinking, and will sink further "if Turnbull can pull off what many Australians have been asking for, demanding: the chance to switch off politics not out of disgust or apathy, but out of a satisfaction that we are being sufficiently well-governed to allow attention to return to family, work, friends, life in general.”

It has been so long since we haven't been forced to pay attention to politics day in and day out, that we might not know what to do with ourselves. The ALP will probably provide us with some entertaining politics before long, but that will be merely the inconsequential convulsions of a peanut gallery.

Gerard & me

My friend Gerard Minack wrote following last week's Saturday email. It was such a good email, as you'd expect, and since it came from someone I respect enormously, a bit challenging. Here it is in full:

“Alan,

“Hope you're well.

“You know I always enjoy your Saturday missive, but I disagree with this one. I'm a card-carrying secular stagnationist, so here's a reply to some of your points:

“First – and least importantly – why call current central bank policy Keynesian? I know why the from-the-right nay-sayers do: ‘Keynesian' is the economic equivalent in the US of the political pejorative 'liberal'. The reality is that central bank policy now is Friedmanite. The right wing don't want to traduce one of their heroes, Milton Friedman, with the policy they don't like, but it's his, not Keynes'. The Fed, and other central banks, followed the roadmap set out by Ben Bernanke in his famous 2002 speech 'Making sure 'it' doesn't happen again'. 'It' was the Great Depression, and the speech was to celebrate Milton's 90th birthday. Ironically, we are in a period where the essence of Keynes again applies: fiscal can fix what monetary can't. I wish we were seeing Keynesian policy.

“Second – and also not that importantly – you reference Charles Gave's criticism of secular stagnation. Paraphrased Charles' argument is:

“Paul Krugman and Larry Summers are not nice people

“Krugman and Summers like secular stagnation

“Secular stagnation is not a nice idea. QED.

“That's playing the man, not the ball.

“Third, and most importantly, I think we are in a secularly stagnating world.

“What is the evidence that interest rates are 'too low'? If they were 'too low' then we should be seeing booming capex, demand pressures and inflation. We are not. Rates are exceptionally low because of market forces. If rates were low because of central bank manipulation we would see the interest rates not controlled by central banks much higher. They are not. Low rates are the new normal.

“For sure, low rates aren't doing much for the real economy, while the financial smarty-pants are doing their usual nonsense. But that's a by-product of financial deregulation. Oh, hold on, that's a policy approved by the anti-Keynesians. Markets know best, remember?

“The fact is we have never lived through an era that has seen such change in demographics, technology and global integration – or inequality and leverage. All these factors have worked to lower the so-called natural rate of interest for 25 years. The problem is we are near the point where natural rates should be below zero.

“That is the problem, not central banks.

“As an aside, for investors secular stagnation is a case of better to travel than arrive: interest rates falling is great for asset prices. But once they've fallen to near zero, we are stuffed.

“Sorry for the long email. Guzzling red in a restaurant in New York so clearly have too much time on my hands.

“Cheers Gerard”

Dear Gerard,

Fair point re Keynes and Friedman – you'd know more about that than me. By Keynesian I mean the focus on attempting to manipulate aggregate demand, either through monetary or fiscal policy, rather than focusing on production and letting demand take care of itself.

And I think you're a bit tough on old Charles Gave, although you're right that he probably doesn't think much of Krugman and Summers. But I've been reading Gave for a long time now and I think he's playing the ball.

With your third point, I think you're missing my main point, which is debt. It was too high in 2007 and has increased a lot since then. In my view that's the main reason low rates are not working and we're not seeing booming capex, demand pressures and inflation. With so much debt, that's impossible.

But I've been thinking: maybe we are getting to the same place by different routes. I agree that we may be in a secularly stagnating world (although I'm not carrying a card) – because of excessive debt, in turn caused by a combination of financial deregulation and low interest rates. I'm not quite sure what your reasons for thinking it are, but in my view the debt won't be cleared unless there's either much higher growth or higher interest rates are hiked enough to produce a recession and bankruptcies – that is a big, global margin call and liquidation.

Neither of those things seems likely. Debt is suppressing growth, and the only solution from the geniuses in charge appears to be trying to encourage more debt, which obviously won't work. And I'm not hoping for a recession that's for sure!

But where I think you are dead right is that technology, globalisation and demographics have combined to reduce the natural rate of interest by reducing inflation and, more importantly, inflation expectations. This is the big change in the world, apart from excessive debt. That hasn't caused a deficiency in demand, but is the natural result of lower costs leading to lower prices leading to a reduction in the time value of money.

Interest rates should be allowed to find their correct level: central banks should stop trying to mend things.

As for your last comment: “we are stuffed”. Well geez. Tell that to the shareholders of Blackmores!

Middle East

Speaking of Charles Gave, he turned his attention this week to Middle East geopolitics, and what he said is worth passing on.

He says the deteriorating position of Syria's President Assad in the civil war demanded a response from Moscow and Tehran. America played into their hands by doing a deal with Iran over its nuclear programme, which gave Russia and Iran a clear run to clean up the "Saudi/Sunni Frankenstein that is ISIS”. "This could all be over in a matter of months with the result that the US army and its drones are made to look incredibly incompetent, or even worse, accomplices of the Saudis. American prestige in the region will take a huge hit.”

Leaving that aside, the question is what will it do to the Middle East map. Gave has long argued that Putin's main goal was to topple the Sunni monarchies, "thereby putting crude oil prices on a trajectory to $US200 a barrel and securing a controlled market for Russia's only real source of income”.

The current flood of refugees from the Middle East stems mainly from Sunni populations in Syria and Iraq fearing retribution, and the numbers seen so far are only a foretaste of what's to come. The eastern Arabian peninsula could come under Shiite control and a Sunni-Shiite civil war “tearing apart" Lebanon, is not out of the question. It would be imperative for Israel, Jordan and Egypt to form an alliance, followed by a concerted push to crush the Tehran-backed Hezbollah and Hamas groups.

"What does such a scenario mean for markets? Firstly the dollar would soar as dollars will be needed to pay for high-priced oil. After the 1973 Arab-Israeli War, the following year saw the dollar rise 35 per cent, while the price of oil went from $US4/bbl to $US11/bbl. World stock markets happily crashed by more than -75 per cent from their peak in this period. This time, I would expect the overall impact of an oil price super-spike to be a profoundly deflationary shock, so investors would be advised to carry a large position in medium-dated US bonds.

"In addition, the obvious trades would be to sell the Saudi equity market and short the Saudi riyal peg. The Egyptian pound would be an obvious sell as it is not clear that the military-backed regime in Cairo could survive without Saudi money. Russia would be a big winner and its assets would rally across the board. Among developed markets the Canadian loonie should rise on rocketing oil prices, while the Swiss franc would likely come under pressure due to the exit of Saudi money, although in this case the offset may be a flood of Russian money heading back to the Alps.”

MGM Wireless

I spoke to Mark Fortunatow of MGM Wireless on Monday. The company sells an attendance app to schools: it automatically checks the rolls and sees who's there and sends a text message to the parents, tailored for the occasion. That is, if it's the student's first absence, the message inquires after his health. If it's the 15th, it says it's time to come and see the Principal, and it's all done automatically.

Marvellous service, nice little business. It's capitalised at $11.5 million and in a PE of 11, with plenty of growth ahead.

Here's the interview and transcript.

Medibio

This company has an empirical diagnosis for depression, anxiety and PTSD. According to Kris Knauer, who I spoke to on Wednesday, they have 80 per cent accuracy – as measured against psychiatrist diagnosis. It measures the heart rate when you're asleep and uses patented algorithms to analyse the data.

Kris is selling to clinical psychiatrists and hospitals, but the main market for the service is companies, using “wellness” providers that are now providing health and stress services to big firms.

Another fascinating Australian business – capitalised at about $30m, but still losing money – not for long says Kris. He says they are close to getting FDA approval in the US.

The video and transcript may be found here.

Knosys

I love the look of this business. They have a piece of cloud-based technology – software as a service – that sits over the top of companies' existing various computer systems and “virtualises” the data and presents it in a useable form, tailored to each employee that needs it. The programme doesn't change the data or interfere with the systems, it just reads the data and presents in a consolidated form in a single screen. Gavin Campion, who I interviewed on Wednesday, explains that the data is ghosted and surrounded with analytic tools. He says it always produces double digit improvements in productivity. You can also use Knosys to enter data into the legacy system.

It started as a bespoke project for ANZ and they have “productised” it, with ANZ as the first client. They sell it for $29 per seat per month (that's per employee). ANZ has bought 12,000 (probably not for the full price, since they are the first customer).

This is well worth watching/reading – really interesting. You can watch/read it here.

Readings & Viewings

Every hit song uses just four chords. Here's a medley of them.

This was an incredible and horrifying story on the Religion and Ethics Report on Radio National this week – forced organ harvesting in China.

Ethics in the news – why it's OK to block ads.

Robots are becoming self-aware!

And on the subject of whatever happened to … the disintegration of Europe.

In the US there was a guy who famously gave his employees a $70,000 minimum wage. Here's what happened next.

Richard Feynman explains fire.

Testing the Tesla Model S autopilot.

Automation comes to construction.

The best and worst countries to run a business, according to the World Bank.

The real story about bacon and cancer.

A spoof on Tony Abbott's London speech this week – quite funny.

A sensible version of Donald Trump would be quite good.

A great article on the technological revolution – it has its own momentum, and will never end.

Woolworths has cut its prices by an average of 1.8 per cent over the last three months.

I read this book about Hitler coming back as a stand-up comedian. A film of the book has topped the box office in Germany this week.

A Muslim and an atheist on the need to reform Islam.

NAB's sale of 80 per cent of its life insurance business is the first of many – banks can't own life insurance because of its capital demands. NAB has got an early mover advantage.

Deutsche Bank: we can already see how London's insane property bubble will end.

This is an excellent rundown of who's who in Malcolm Turnbull's PM's office.

Australia proposes to eliminate passports. There's just one problem…

Why Jack Dorsey may not be able to fix Twitter.

She ran a marathon – and didn't talk about it. The first woman (or man I'd say) ever to run a marathon and not tell a soul.

Some Saturday morning music – London Grammar with Wasting My Young Years. I love this song.

Last Week

By Shane Oliver, AMP

Shares were mixed over the last week with US shares boosted by a more upbeat Fed and some good earnings and Japanese shares up, but Chinese, Asian, emerging market and Australian shares down not helped by concerns that a December Fed tightening will reignite worries about a strong $US pressuring emerging market currencies and commodity prices. Worries about an oversupply of steel saw the iron ore price fall back below $US50/tonne which weighed on Australian miners. The global steel and iron ore glut looks like it will push the iron ore price to around $US40 in the year ahead. Bond yields rose in the US on the Fed. Soft commodity prices and heightened expectations of an RBA rate cut saw the $A fall.

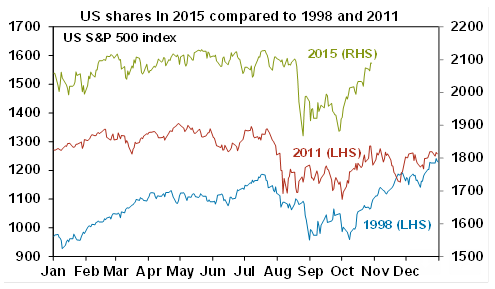

It's clearly been a strong October though with US, Eurozone and Japanese shares up around 9-10 per cent, Chinese shares up around 11 per cent and Australian shares up about 4 per cent. After the sharp share market falls in the September quarter, October has lived up to its reputation as a “bear killer” (at least so far!). However, November is unlikely to be as strong as after rising 10 per cent from their September lows global shares are a bit overbought and due for a correction particularly with concerns around the Fed and the emerging world remaining. The 2011 analogy which the US share market has been following reasonably well also points to the risk of a correction in November. This is likely to impact Australian shares. But after a pull back or consolidation expect shares to resume their run up into year-end as the typical Santa Claus rally sets in.

Source: Bloomberg, AMP Capital

Fed on hold as expected, but still thinking of hiking in December. The Fed's post meeting statement was a bit more hawkish with US consumer spending and investment seen as “solid”, less concern about global economic and financial developments and a clear statement that it will decide in December whether to raise the Fed Funds rate. However, while the Fed wants to keep its options open for a December move it's doubtful that it has really told us anything new as 13 of 17 Fed officials wanted to hike in September by year end anyway and in deciding whether to hike or not the Fed will remain “data dependent”. The latest talk of a December hike has also put renewed upwards pressure on the $US which in turn is bad news for commodities, emerging countries and threatens to further slow US inflation. So given this and recent concerns about softer US growth a December hike is arguably no more than a 50/50 proposition.

Meanwhile, the risk of a US debt default next month or government shutdown in December has been all but eliminated by a bipartisan deal that will suspend the debt ceiling to March 2017 and fund the government for two years. US Congressional politics remains low risk for financial markets.

Not much to get excited from China's 5th Plenum beyond the shift from a one child to a two child policy. Allowing all couples to have two children is a big move for China, but it won't impact the labour force for 15-20 years and will still see the population decline as two per couple is still below replacement and it's doubtful that all urban residents want to have more anyway. So it's hard to see much economic impact. In terms of growth, a target to double per capita income by 2020 implies a 6.5 per cent pa GDP growth target for the next five years which is in line with expectations and reflects China's slowing population and productivity growth as the focus shifts from investment to consumption. Commitments to focus on innovation, increase consumption, accelerate urbanisation, improve social welfare, reform the financial system and protect the environment are all welcome but in line with the direction of existing policy anyway and so don't really change the growth outlook. In terms of the recovery in the Chinese shares we continue to see good medium term return potential in Chinese shares, particularly Chinese companies listed in HK where the H share market is trading on a forward PE of 7.6 times.

Lower than expected September quarter inflation in Australia adds to the case for another RBA rate cut. Despite a 20 per cent plus fall in the value of the $A over the last year there is little evidence of this flowing through to higher consumer prices, apart from higher prices for overseas travel. Rather, evidence of weak pricing power is widespread consistent with ongoing demand softness in the economy. While the inflation rate is not low enough to guarantee a rate cut it adds to the case for a cut that has already been made by sub-par economic growth and the de facto monetary tightening that will otherwise flow from big bank mortgage rate hikes.

Major global economic events and implications

US economic data was on the soft side, with falls in new and pending home sales, durable goods orders, consumer confidence and the Markit services conditions PMI contradicting the Fed's somewhat more upbeat view on the US economy. September quarter GDP growth fell back to 1.5 per cent annualised after 3.9 per cent in the June quarter. While this was due to a negative contribution to growth from inventories with final demand (ie consumption and investment) remaining strong at 3 per cent recent indicators suggest that demand is slowing in the current quarter. More broadly real GDP growth is running at 2 per cent year on year which is in line with average growth since the GFC and well below what would normally be seen after a major recession. What's more nominal growth (real GDP growth and inflation) is just 2.9 per cent yoy. US growth is not bad but it's a long way from booming and so the Fed needs to be cautious.

US September quarter earnings results were somewhat better. With 64 per cent of S&P 500 companies having reported 76 per cent have beaten earnings expectations. Revenues remain under pressure though with only 44 per cent beating on sales as the strong $US continues to weigh. Consensus earnings expectations for the year to the September quarter have improved though from -6.3 per cent two weeks ago to -3.9 per cent.

Eurozone economic confidence improved further in October, pointing to okay growth, but a slowing in private lending growth in August would be concerning the ECB.

Japanese economic data was a bit more upbeat. September household spending was weak, but gains were seen in retail sales and industrial production, the unemployment rate remains low and the jobs to applicants ratio is now at its highest since 1992. There was also good news on the inflation front: while headline inflation is zero, core inflation rose to 0.9 per cent year on year which is its highest since 1994. There is still a way to go to reach the 2 per cent inflation target though and so while the Bank of Japan made no change to its monetary stimulus program at its October meeting, the pressure remains for further easing.

Australian economic events and implications

Apart from lower than expected consumer price inflation, producer price inflation remains benign, September quarter prices for exports and imports point to a further fall in the terms of trade and credit growth data showed a further slowing in lending growth to investors. Rolling three months annualised growth in lending to property investors slowed to 7.9 per cent in the September quarter down from a peak of 11.1 per cent in the three months to November last year. Slowing lending to investors along with a 4 per cent fall in new home sales and weakness in auction clearance rates adds to evidence that the housing market is cooling down.

Next Week

By Craig James, CommSec

Data, data, data

A bevy of key indicators are generally released at the start of each month and November is no exception. Around half a dozen indicators are released in Australia in addition to key speeches, reports and an interest rate decision from the Reserve Bank.

The week kicks off in Australia on Monday with key home loan figures from Core Logic/RP Data together with the Performance of Manufacturing index and data on building approvals from the Australian Bureau of Statistics (ABS).

On Tuesday the Reserve Bank meets to decide interest rate settings. And for the first time in six months, a decision to cut rates is being seriously entertained.

Major banks have been forced to recoup some of the cost of raising additional capital by lifting interest rates. If the Reserve Bank determines that this could harm the economy, then it will cut rates. But this is by no means certain. Around 80 per cent of existing home loan customers are ahead with their loan repayments, in effect watering down the negative impact of the recent rate increases on the broader economy. And the Reserve Bank won't be too disappointed with less irrational exuberance in Sydney and Melbourne home markets.

But on the other side of the equation, the economy is increasingly dependent on housing to maintain growth and there clearly hasn't been a housing boom outside the key Sydney and Melbourne markets.

On Wednesday the ABS releases September figures for both international trade (exports and imports) and retail trade (spending).

On Thursday the Reserve Bank Governor, Glenn Stevens, delivers a speech to the Melbourne Institute 2015 Economic and Social Outlook Conference in Melbourne. Investors are looking for clarity on a number of fronts at present, so the speech will be keenly awaited.

The speech by Glenn Stevens is at 9.15am. And at 12pm on the same day there will be panel participation by Philip Lowe, Deputy Governor, at FINSIA's Regulators Panel Discussion in Sydney.

And on Friday the Reserve Bank will issue its quarterly Statement on Monetary Policy. By the time this comes around there may be less interest – explanations for the rate decision coming from Reserve Bank officials on Thursday. But the latest forecasts on economic growth and inflation will be produced and that will indicate whether there is any monetary policy leaning – implicit or otherwise.

Plenty to monitor on overseas markets

There are ‘top shelf' indicators to watch in both China and the United States over the coming week. The highlight is likely to be the employment report (non-farm payrolls) in the US on Friday.

The week kicks off on Sunday (November 1) in China when the official statistician (National Bureau of Statistics) releases the purchasing manager indexes for both manufacturing and the services sectors. The data is effectively ancient history following stimulus measures employed by the central bank.

On Monday, the private sector variant of China's manufacturing purchasing manager's index – from Caixin – will be issued. And on Wednesday Caixin will issue its services purchasing managers index.

In the US, the week kicks off on Monday with the release of the ISM manufacturing index. Economists expect that the index eased from 50.2 to 49.7. Interesting the final reading of the competing Markit purchasing managers index for October is also issued and the preliminary reading was a lot higher than the ISM index at 54.0.

Also released on Monday in the US is data on construction spending.

On Tuesday, the ISM survey for the New York region is issued together with data on new vehicle sales and factory orders. Economists expect that sales fell from a 17.17 million annual rate to 17.6 million in October. Also on Tuesday is the usual weekly data on chain store sales.

On Wednesday the ADP survey of private sector employment is issued with international trade data (exports and imports) and the ISM services report. Private sector jobs are tipped to have lifted by 172,000 in October, down from the 200,000 gain in September. The trade deficit may have narrowed from $US48.4 billion to $US46 billion. The services gauge may have lifted from 56.9 to 57.2. And also on Wednesday the usual weekly report on mortgage transactions – purchases and refinancing – is scheduled.

Also on Thursday in the US weekly data on claims for unemployment insurance is issued together with the Challenger job layoffs series and preliminary data on both labour costs and productivity.

And on Friday the highlight of the week – the non-farm payrolls or employment report is released. In September, job growth disappointed, only lifting by 142,000. Economists tip a stronger result in October with jobs up 189,000. The unemployment rate is tipped to be steady at 5.1 per cent while earnings may have lifted by 0.3 per cent.

Stronger-than-expected results – particularly on earnings (wages) and the jobless rate would boost chances of a December rate hike.