Kohler's Week: Easing Galore, Central Banks Are Destroying the World, Part 2, Housing, Banks, SDI, IDT, Dyesol

Last Night

Dow Jones, up 0.9%

S&P 500, up 1.1%

Nasdaq, up 2.28%

Aust dollar, US72.1c

Easing Galore

Wall Street was already in a strong rally overnight because of great earnings from Microsoft, Alphabet (the new Google holding company) and Amazon and then they got an extra burst from, first, Mario Draghi producing another “whatever it takes” effort and then last night the People's Bank of China actually eased monetary policy quite a bit.

Here's what the PBoC did:

1. It cut the Reserve Requirement Ratio for banks by 50 basis points, with an extra 50 for “qualified banks”.

2. It cut the benchmark deposit and lending rates by 25bps.

3. More importantly, it fully liberalised deposit rates, allowing them to be determined by the market, and moved to a whole new set of policy rates. This does two things: it probably means deposit rates won't fall at all, despite the 25bp cut, and second, China's monetary policy just got a whole lot more complicated.

As I mentioned, Wall Street liked it all, of course, as it always does like central banks doing their thing of cutting rates and printing money, but it's completely wrong and any rally based on what's going on with the ECB and the PBoC is likely to be short lived. The rally based on earnings, on the other hand, is sound. Microsoft surged nearly 12 per cent, Alphabet 7.5 per cent and Amazon 7.2 per cent. The Nasdaq was up 2.3 per cent near the close.

On Thursday the European Central Bank was at it again, with President Mario Draghi saying after their latest meeting that the ECB would “re-examine” the “degree of monetary accommodation” at the December meeting. In other words, they will pull the lever on the money-printing machine a bit further. He even talked about the possibility of lowering the deposit rate to below zero. Good grief. The problem with this is that the euro promptly fell 1 per cent. That's bad for US earnings, not good: a higher US dollar versus the euro is a clear headwind for the US economy. Yes, it means it makes the Federal Reserve less likely to increase rates this year out of fear of pushing the dollar even higher, but a sharemarket rally based on low interest rates and higher valuations alone, and lower earnings because of a higher dollar, is a rubbish rally.

As for China, the PBoC is really just offsetting the capital outflow that has been causing it to run down foreign exchange reserves. Buying renminbi, which is what it has been doing, tightens domestic financial conditions, so cutting the RRR is simply a way to offset that.

And cutting interest rates is just another piece of madness by another central bank. China's big problem is that too much debt was channelled into unproductive investments. The statistics show that China is getting less and less bang for its buck/yuan; that GDP for each dollar of credit is falling. So more credit, encouraged by the rate cut, will make no difference and probably just make things worse.

But central banks and markets are doing their usual melancholy dance – the bell is rung and Pavlov's dogs salivate, to mix my metaphors.

Central Banks Are Destroying The World, Part 2

Last week I argued that the policies of central banks, with the possible exception of the RBA, are ruining both economic growth and retirement savings by fruitlessly trying to generate demand through monetary policy – zero interest rates and printing money.

During the week I came across a beautiful, but unintentional, explanation of the philosophical roots of Keynesian economics (for that's what we're talking about) in an essay on the 2016 US President election campaign, by Lewis Lapham in Harper's magazine. He refers to what Plato called the “noble falsehood” that “binds a society together in self-preserving myth”.

“In the American theater of operations the noble falsehood springs full-blown from the head of Abraham Lincoln declaring on the hallowed ground at Gettysburg in November 1863 ‘that government of the people, by the people, for the people, shall not perish from the earth'.

“Nowhere in the history of mankind does the record show a government so specified lasting longer than a few nasty, brutish, and short months; nor was such a government what the framers of the Constitution had in mind in Philadelphia in 1787. They envisioned a government in which a privileged few would arrange the distribution of law and property to and for the less fortunate many, an enlightened oligarchy that would nurture both the private and the public good, accommodating both the motions of the heart and the movements of a market.

“The balancing of the two sets of value they entrusted to a class of patrician overlords for whom, presumably, it was unnecessary to cheat and steal and lie, men like themselves, to whom Madison ascribed “most wisdom to discern, and most virtue to pursue, the common good of the society.”

These days our “patrician overlords” are central bankers, benignly manipulating our behaviour (“aggregate demand” they call it) by adjusting the price and availability of the thing we all so crave – credit.

The question for this week is: what should they, and you, do instead? Bearing in mind the old joke that if you wanted to get to Dublin, you wouldn't start from here.

Well, there's no doubt in my mind that “they” – the Fed, ECB and Bank of Japan – need to start raising interest rates pronto, and stop worrying about inflation being too low. It's caused by technology reducing costs and debt suppressing consumption and investment – not by a shortage of demand that can be reversed by monetary policy. Specifically they should allow the market to set interest rates, just as the market sets most other prices. But these are not, to say the least, mainstream opinions.

As an old friend of mine, Steve Kates of RMIT University, wrote in his book “Free Market Economics”: “Today, there is no aspect of an economy's structure that governments do not believe themselves capable of making a positive contribution towards. … Such actions are not undertaken with a sense of dread at the possible unintended consequences. They are undertaken with a confidence that is simply unwarranted…”

“To believe that some central agency can plan ahead for entire economy is one of the major fallacies often associated with economic cranks. No single person, no central body, no government agency can ever know anything remotely like what needs to be known if an economy is to produce the goods and services the community wants, never mind being able to innovate or adjust to new circumstances.”

In my view, those “goods and services” include credit. Our patrician overlords at the central banks believe themselves capable of determining how much of it we need and at what price.

The Keynesian economic central planners went into hiding after the Berlin Wall came down in 1989 and the failure and corruption of Soviet style Marxism became evident. After that, and after the recession of 1991, the world had 10 years of spectacular growth due, in part, to interest rates being left to find their own level. However after the tech crash of 2000, the real Fed funds rate was taken negative – what Keynes called “the euthanasia of the rentier” – on the basis that wealth creation through rising assets prices would lead to economic growth.

Charles Gave of GaveKal Research calls this “one of the stupidest ideas ever put forward in economics”. It led to an explosion in debt and speculation on housing, which led, in turn, to the 2008 credit crisis, and Great Recession.

Instead of learning from this mistake, the central bankers then went all the way – reducing nominal rates to zero and keeping them there for six years.

To a large extent the current thinking is based on the proposition that we face “secular stagnation” a phrase rediscovered by former US Treasury Secretary Larry Summers (it was originally coined by Alvin Hansen in 1938, in a book called “Full Recovery or Stagnation?”).

Those promoting this idea today don't remember that it's the same incorrect argument that was floated towards the end of the 1930s, and they don't believe that if left to its own devices the economy would go back to normal. Instead they think the world's entrepreneurs, business people and consumers would somehow remain comatose if central bankers et al didn't poke at them to wake up. Central bankers have never run a business themselves but are totally confident in their ability to goad businesses and consumers into action and then distributing the proceeds.

These are the misguided vanities of what Lewis Lapham calls our patrician overlords. Economic growth is failing to recover because central bank actions have increased the stock of debt, which is weighing on the world's economy like a heavy blanket. It needs to be cleared, through being priced correctly and borrowers and lenders recognising their losses. In other words, the free market must apply.

As Steve Kates wrote: “The problem lies in the belief that that the natural state for an economy is for it to be growing with unemployment low, when the reality is that the natural state for an economy is that it is adjusting to new circumstances during every moment of every day.”

Or as Charles Gave wrote, the notion of secular stagnation “is simply the natural result of the policies followed by those whom Thomas Sowell calls the ‘anointed', that class of economic high priests who expect the rest of us to pay for their living while they dance round the fire in an attempt to summon rain. The reality is that growth is failing because we have abandoned rational thought in favor of economic myth, and as a result are execrably poorly managed.”

CBA and Westpac

An example of the free market trying to override the actions of central banks is the increase in home loan interest rates announced last week by Westpac and, this week, by Commonwealth Bank first and then NAB and ANZ yesterday (although of course, it's not exactly a free market since regulators are forcing the banks to increase capital ratios, which is leading to the mortgage rate hikes).

Interestingly we now have the full range of hikes: 15, 17,18 and 20 basis points. Bank competition lives!

The dollar dropped like a stone on Thursday after CBA announced its rate hike because it is believed that the RBA will now cut official rates to offset the rises in mortgage rates. Confusingly, the dollar surged after NAB's announcement and didn't do a thing after ANZ's. But none of it is a free market – not the banks, and not the dollar.

All of this, of course, begs the question of whether the capital is needed in the first place. I think the fact the big four banks are obviously too big to fail, and were deemed to be so in 2008 when the Government guaranteed all their liabilities to prop them up, means the demand for extra capital is a sham, or rather a “tax” imposed by the regulators for the privilege of actually being protected by taxpayers.

But that's another story.

And by the way, they're not there yet. Analysts reckon the big banks collectively still need another $15-20 billion in new capital to meet APRA's requirement to be “unquestionably strong”, whatever that means, but they should be able to get that through dividend reinvestment plans, so no more big capital raisings needed.

But more capital, however it's acquired, equals lower ROEs equals lower share prices.

What should we do?

In light of all of the above, how should we play it?

I think it's best to assume central banks don't come to their senses and will keep interest rates low for a long time. That means low growth for a long time as well and, probably, low commodity prices

Although, as an aside, are commodity prices actually low, or just lower than they used to be? What should a barrel of oil cost – $100 or $50? If iron ore costs BHP, say, $30 a tonne to get, what should it sell for? $33? (10 per cent profit margin) or $60? (100 per cent profit margin).

Anyway, assuming more of the same, it means doing nothing different to what you've been doing already, and if you've been taking any notice of us, that means ignoring the ‘market' and buying good companies, preferably ones that have their own source of profit growth, rather than just relying on GDP and employment growth.

Also, try to employ a diversified asset allocation strategy.

On Thursday I did a webcast for brightday about what the Future Fund can teach about asset allocation.

It's instructive to note that the Future Fund changed its asset allocations after the GFC because it was felt to be too illiquid – that is, not enough listed investments.

Listed equities went from 27.5 to 32.5 per cent, and cash from zero to 5 per cent, or at least the fund's benchmark did. In fact at September 30, the listed equities allocation was 33.1, of which only 6.4 per cent is in domestic, or Australian, equities.

I didn't, and don't suggest, that you reduce your exposure to Australian equities down to 6.4 per cent, but I think it's worth noting that the Future Fund's asset allocation has achieved a three-year return of 13.8 per cent pa and a five-year return of 11.1 per cent pa.

It has 12 per cent in private equity, 6.4 per cent in property, 7.7 per cent in infrastructure and timberland, 13.1 per cent in alternatives and 12.7 per cent in debt securities. At the moment its cash is well above benchmark at 15.1 per cent.

As I mentioned in the webcast, it's quite difficult for small investors to access the kind of investments that a $120 billion Future Fund can, particularly in private equity. Mind you, I have invested directly in a few start-ups, one of them with as little as $45,000, so it's not impossible. But most of the big wholesale fund managers and private equity funds have minimums that put them beyond reach.

One strategy might be to use stocks like Transurban and Sydney Airport as part of an infrastructure allocation. If you did that, you would only look at the price once a year, which is how often infrastructure is usually valued, and certainly not trade them like equities, trying to pick market ups and downs. Likewise property, through REITS. One of my direct start-up investments, as I may have mentioned, is in a residential real estate investment trust business called DomaCom, which might be worth a look as well.

As for alternatives, there aren't many alternatives, so to speak. As far as I can tell, there's just Blue Sky Alternative Investments, whose founder Mark Sowerby I interviewed for Eureka Interactive two weeks ago.

Housing

There's a fair bit of fear and loathing about Australian housing at the moment, in the misguided belief (I think!) that we're in for a crash. Building and housing-related stocks have fallen 17 per cent since February, underperforming the ASX 100 index by 12 per cent. In my view this represents a significant buying opportunity, since the anticipated crash will not occur.

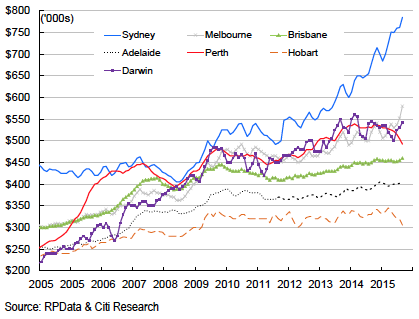

There has patently not been a housing bubble, and there won't be a crash. There has been a boom in Sydney, but that's it. Here's the chart:

Capital city dwelling prices

Sydney is bound by the sea on one side and the Blue Mountains on the other, so supply is limited. Demand has been boosted by Chinese buyers. As a result the median price is 42 per cent higher than the previous peak in 2010. Some people say “bubble”, I say boom, with a relatively modest correction already underway (only in Sydney).

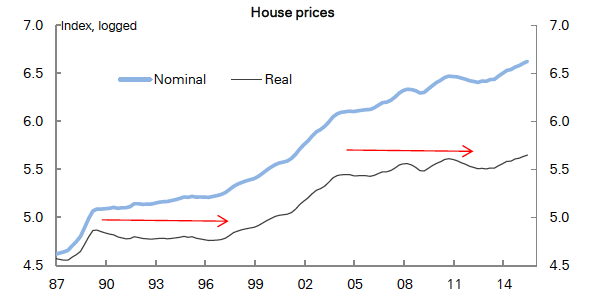

Here's another chart, this time of Australian house prices, nominal and real.

Source: Deutsche Bank

Obviously there is no such thing as the Australian real estate market – there's lots of different markets – but if there were, it's been flat in real terms for 15 years, following a boom between 1997 and 2004. Likewise in the 90s, real house prices were flat for eight years after a boom in the 80s.

In other words there is a case for Australian house prices to actually boom from here, God forbid. If that happened, we'd never get the kids to leave home – they simply couldn't afford it.

I'm not predicting that (I'm not predicting anything at all to be honest), but nor do I think we're in for a crash. And we're especially not in for a big drop in construction, certainly not one that justifies this year's bear market in building stocks.

As for investing in real estate itself, I'd suggest staying away from Sydney and new apartments in Melbourne and Sydney, although I doubt that you need me to tell you that. I've invested in a little Victorian terrace house in Melbourne, of which they're not making any more. Can't go wrong with that, I reckon.

Banks

In the light of all of the above – housing correction, more capital, low growth – what of the banks?

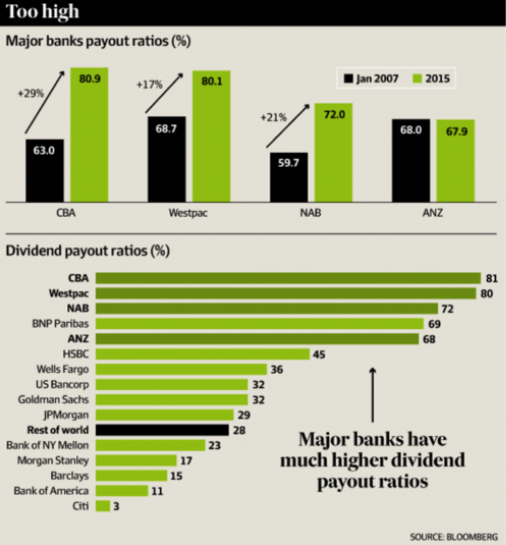

Well, these are all very good businesses that have arguably been paying out too much in dividends. My friend John Abernethy drew my attention to this graph from Bloomberg the other day:

John commented: "It is arguable that the major Australian banks have managed their capital with a primary focus on distributing the tax benefits of franking, and with less concern for the dilution effects of excessive payout ratios. It is clear that they have excessively geared their balance sheets in pursuit of this undertaking.”

And there was no better demonstration of this than when Westpac announced a $3.5 billion capital raising and at the same time increased the dividend! As John says: "Westpac's capital decisions in the face of hedge fund activities amplify the chaotic environment that exists in Australian financial markets at present.”

This probably can't go on, especially if profits come under pressure from rising provisions at some point.

And the other thing that I've become aware of lately is the disruptive effect of fintech, specifically bitcoin and “distributed ledgers”, which I wrote about last week (for those of you who aren't Business Spectator subscribers, write to me at alan.kohler@eurekareport.com.au and I'll send you the article by email – it's worth reading, even if I do say so myself!).

So if I owned bank shares for income, I wouldn't sell them, but I wouldn't buy any more. If I owned them for growth, I would sell at least some and have a look at the Eureka Report growth portfolio.

SDI

I interview Jeff Cheetham, the veteran CEO and largest shareholder (48 per cent) of what used to be called Southern Dental Industries and is now just SDI.

It was great to meet him after watching him from afar for 40 years, and he's a man who certainly knows fillings (so do I – my mouth is full of his products). SDI's revenue is still 40 per cent amalgam, but the growth is all in tooth-coloured fillings and whitening products. Sales of amalgam are declining gracefully.

SDI is in transition now – Jeff's eldest daughter, Samantha, has been appointed joint CEO with Jeff and he will retire next year (he's currently 73 – obviously been taking lessons from Bob Gottliebsen!). Four of Jeff's five children work in the business and Sam has been there for 25 years, having started at the bottom. Naturally I asked why she is the best person to take over from him and whether there was a proper search process. The answer is that there wasn't, but he's confident she's right for the job, but he would say that of course. Anyway, you don't invest in SDI, or News Corp for that matter, if you don't want to have your money in someone else's family business.

Watch the interview here.

IDT

This week's second interview is IDT – very similar business to SDI – 40-year-old local manufacturing operation selling mainly into the United States and Europe. IDT makes prescription drugs on contract in Boronia, SDI up the road in Bayswater. Paul MacLeman, CEO of IDT, and Jeff Cheetham are friends, and often swap notes. IDT also has a business in Adelaide managing clinical trials for pharmaceutical research companies.

Like SDI, IDT is also in transition. Paul MacLeman has been running it for two years and has quickly turned the business around, increasing sales 60 per cent without putting a dollar on the costs.

Now he's moving it into owning generic drugs itself, instead of manufacturing them for others only, having recently bought a portfolio of 23 generic prescription drugs for $18 million. It's a very interesting story, and well worth watching the video, here.

Dyesol

This is a solar power business that has been around for quite a while, still losing money. Richard Caldwell, who was my third interview this week, says they're now on the threshold of making headway. The technology involves a thin layer of photo-sensitive material on any surface – not photovoltaic cells, like the most common solar systems. Eventually, he says. The aim will be to have whole buildings coated with the stuff and completely self-sufficient for electricity.

Interesting business, or should I say, potential business. Watch, and read, the interview here.

Santos

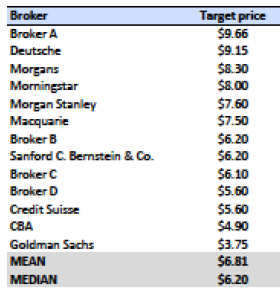

Here's an interesting table graph – it is broker price targets for Santos, as at October 22nd, that is, after it announced the rejection of the $6.88 per share offer from the rich-people-backed Scepter Partners, which is in turn backing former MD John Ellice-Flint.

I mean, goodness gracious – $3.75 to $9.66!

Readings & Viewings

I was sitting in the garden at lunchtime yesterday, mucking about with my phone, eating a sandwich. I stumbled on this video of Aretha Franklin singing A Natural Woman, which sent shivers up my spine and brought a tear to the eye.

And then I came upon this video of a French woman talking about her experience in a Nazi concentration camp, and giving chocolate to a baby, and before I knew it, tears were pouring down my face. Good grief – an emotional lunch, then back to work, writing about investing.

On that subject: this week the Prime Minister of Israel, Benjamin Netanyahu tried to blame the Palestinian Mufti for the Holocaust, saying that he told Hitler to “burn them” instead deporting the Jews. Here is the official record of the meeting between them. Netanyahu is wrong – that's not what he said. The document also sheds light on what really motivated Hitler, and the true origins of the Holocaust.

Why the Temple Mount is central to the latest violence between Israelis and Palestinians.

There have been big variations in recovery from the great recession of 2008 – a survey from the St Louis Fed.

"We are the pokies nation” – there is a test case is trying to have poker machines declared illegal.

We seem to be in a golden age of beer. The world is awash in ales, lagers and porters. So what's wrong with that?

Mark Steyn on the Canadian election result.

October 20th was my wife, Deb's birthday (we're going out for a posh yum cha today). It was also the day when Marty McFly and Doc visited 2015 from 1985. Here is a nice piece about the stocks they should have bought in 1985 – the best performer was Nike!

It was also Joe Hockey's second last day in Parliament. Here's his valedictory speech, if you're a glutton for punishment.

And here's a scintillating critique of it, and Joe generally, by Greg Jericho in The Guardian.

This chart goes a long way to explaining why crude oil is getting slammed.

This is a funny video of people acting as dogs and cats. Absolutely accurate!

The world's most dangerous road.

Did you watch Four Corners this week? With Kathy Jackson and Michael Lawler? If not you should – here's a link to the iView of it.

And a nice piece on it in Daily Review: there is no stranger – or greater – fiction.

This is the new Star Wars trailer. As my son said: it looks awesome!

China's plan to give every citizen a character score. That's an awful lot of character scores.

Britain's love affair with China comes at a price.

China's low retirement age can't last (in charts).

Anatole Kalestsky: China is not collapsing.

Amazing video of a guy playing with lions.

Five surprising facts about sleep.

The Obama administration plans to register drones.

Joe Biden didn't pull out of the Presidential race, he was passed over for Hillary Clinton.

What's the media's role in the leadership struggles?

It's Malcolm Turnbull's birthday today – he turns 61. Happy Birthday Malcolm – your first as PM! I don't have a video of him singing, but I do have one of Jon Anderson who turns 71 tomorrow (he's the hugely talented and influential lead singer and songwriter of Yes). Here he is at Montreux on 2003 doing a solo.

Last Week

By Shane Oliver, AMP

Shares got a strong boost from the ECB signalling further monetary easing ahead and from some better earnings reports in the US. As a result most share markets rose over the past week. While bond yields were little changed in the US and Australia they fell sharply in the Eurozone on the prospect of more ECB quantitative easing. Commodity prices fell slightly as the US dollar rose & this drove a slight fall in the value of the Australian dollar.

The ECB looks to be replacing the Fed as investors' best friend. As expected the ECB left its quantitative easing program unchanged, but ECB President Draghi signalled further easing in December unless the risks to the outlook fade. While Eurozone growth is heading in the right direction it's still slow with inflation way below target and it remains vulnerable to weaker emerging market growth. Further easing is likely to take the form of an extension of its quantitative easing program beyond September next year and another cut in the rate of interest banks “receive” on deposits they have with the ECB, eg from -0.2 per cent to -0.3 per cent. The ECB's strong easing bias is very supportive of Eurozone shares, but because it puts downwards pressure on the value of the euro it adds to pressure on the Bank of Japan to consider further easing and on the Fed to further delay rate hikes.

There is still a way to go for the US to avoid another debt ceiling/shutdown crisis. The debt ceiling will be reached early next month and finance for spending is only approved out to December 11. But with former vice presidential candidate Paul Ryan looking like he will be the next House Speaker, after securing support from “conservative” House Republicans, the risk of a crisis is now quite low. Ryan is in favour of increasing the debt ceiling and understands the negative impact that would flow from a default or shutdown. There could still be short term uncertainty though as there may still be a bit of brinkmanship and there is some chance that the debt ceiling might be suspended into December until another spending deal is worked out with President Obama (like the two year deal Ryan achieved in 2013).

The moves by the Commonwealth Bank & the National Australia Bank to hike their variable mortgage rates, following Westpac, add further pressure on the RBA to cut its official cash rate to offset the flow on to households with mortgages. While the RBA looks like it doesn't want to have to cut interest rates again, it won't want to see households with a mortgage paying higher rates just now either given the risk this will pose to consumer spending at a time when economic growth is still weak. So we remain of the view that the RBA should and ultimately will cut rates again to ensure that this does not happen. We have pencilled in the November meeting for a cut, but the RBA may need more convincing and so there is a risk it could be delayed into early next year.

While the Australian economy is doing a lot better than many have feared there are five reasons why the RBA will likely cut rates again: to stop big bank mortgage rate increases flowing to households with mortgages; the contribution to growth from home construction will likely peak next year; the non-mining capital spending outlook remains poor; El Nino related drought risks pose an additional threat to growth next year; and the Australian dollar is at risk of drifting back higher if the Fed continues to delay rate hikes.

Another El Nino on the way. Over the years I have heard so many false warnings about a new El Nino weather phenomenon that I am sceptical about getting too worried about it. However, the latest indications are getting more concerning.

An El Nino sees trade winds that normally blow across the Pacific to the west weaken or reverse causing more rain in the east Pacific and less rain/drought in the west, ie Asia and Australia. It is commonly measured by the Southern Oscillation Index which measures sea surface pressures across the Pacific and it is now approaching levels seen around the last major El Nino of 1997-98 and so warning of drought in Asia and the east coast of Australia, pointing to lower farm production and higher food prices.

For Australia, the link from El Nino to farm production varies, eg farm production was little effected by the severe 1997-98 El Nino but was more affected by weaker El Nino's last decade. And swings in farm production don't have the impact they used to on the economy as it is now only just above 2 per cent of GDP.

That said a severe El Nino drought induced slump in Australian farm production at a time when growth is already sub-par due to the unwind of the mining investment boom would not be good. For example a 20 per cent slump in far production (which is what occurred in the 1982-83 severe El Nino would knock around 0.45 percentage points off GDP growth. While food prices may see some upwards pressure, the hit to growth would likely dominate the RBA's thinking and so is another reason why the RBA is likely to be under pressure to cut interest rates further. An El Nino could be good news for soft commodity price indexes though, particularly for wheat.

Major global economic events and implications

While there are concerns that US economic growth may be losing some momentum, housing related indicators remain strong with housing starts and existing home sales up solidly in September and further strength in the NAHB home builders' conditions index pointing to more gains ahead. Home construction remains well below long term averages in the US and with household formation rising is likely to be a solid contributor to US growth going forward. Meanwhile US September quarter earnings results came in a bit better over the last week with impressive results from Dow Chemical, McDonalds, eBay, Google and Amazon. Of the 33 per cent of S&P 500 companies to have reported so far 75 per cent have beaten earnings expectations but only 45 per cent have beaten on revenue. Fortunately the big drags on US earnings over the last year from the collapse in the oil price and the surge in the US dollar have faded.

The ECB's latest bank lending survey pointed to a further recovery in credit demand and easing in lending standards which is a positive sign for growth but clearly not enough to ease the ECB's concerns.

Chinese economic data was mixed with September quarter GDP growth coming in slightly better than expected at 6.9 per cent year on year and retail sales growth showing a further improvement but industrial production and investment slowing further. The weakness in industrial production likely reflects Beijing area event shutdowns and more broadly the GDP data, helped by strength in retail sales and services sector activity, suggest growth may be stabilising. Improving credit growth, a gain in the MNI China business sentiment index and further gains in home prices in September are consistent with a stabilisation in Chinese growth. Chinese hard landing risks appear to be receding but then again it's hard to see a strong growth rebound either.

Australian economic events and implications

The minutes from the RBA's last meeting added nothing new and confirmed that the RBA was content with current interest rate settings. However, with the big banks hiking their variable mortgage rates, resulting in a de facto monetary tightening, the minutes are now a bit dated. Economic data was light on over the last week but it painted a mixed picture with another strong reading for skilled vacancies but a slight fall in weekly consumer confidence and a soft Westpac leading index.

Next Week

By Craig James, CommSec

Inflation dominates the domestic calendar

There are few stand-out economic events scheduled in Australia in the coming week. No doubt inflation indicators will dominate the headlines while the CommSec State of the States report will also garner significant interest.

In the US the focus will be on Federal Reserve policy meeting and ‘top shelf' data on the housing sector.

In Australia, the week kicks off on Monday when CommSec releases its State of the States report. NSW led the quarterly assessment of economic performance in the July report. The question is whether NSW retained the top spot given the resurgence of the Victorian economy.

On Wednesday, the Bureau of Statistics releases the quarterly inflation data, that is, the Consumer Price Index. In the June quarter the big mover was the price of petrol, which lifted by 14 per cent and dominated the inflation result. However this time around, using our daily national estimates of petrol prices, CommSec has calculated that petrol fell by around 2 per cent in the September quarter, ensuring a much tamer result. Offsetting this to some degree, the slide in the Australian dollar is likely to contribute to a modest lift in imported prices.

Overall the CommBank Group expects that the headline CPI rose by 0.7 per cent in the quarter with annual growth at 1.7 per cent. Stripping out volatile factors like petrol, ‘underlying inflation' probably lifted 0.6 per cent in the quarter or by 2.5 per cent over the year. In other words, inflation remains well within the Reserve Bank's 2-3 per cent target band.

In the September quarter, seasonal changes in electricity, gas, water and council rates affected the CPI while health costs likely eased due to the effects of the Pharmaceutical Benefits Scheme. The cost of ‘new dwelling purchase by owner-occupiers' also likely rose in the quarter reflecting the high demand for home building services.

On Thursday, data on new home sales for September is issued – a useful indicator from the Housing Industry Association on the state of home building.

Also on Thursday, the focus stays on price measures with data on export and import prices for the September quarter. The readings tend to be heavily influenced by changes in the Aussie dollar and oil prices. And the export price index is affected by changes in coal and iron ore prices.

On Friday there are two items of note. The first is the release of data on business inflation, the producer price indexes (PPI). This data was useful in the past when it was released prior to the publication of the Consumer Price Index. Now, the PPI is of less interest, although economists will still dissect the figures to determine if there are some emerging inflationary pressures.

Also on Friday the Reserve Bank releases the “Financial Aggregates” publication for September. Not only does the publication include figures on outstanding loans in the economy (effectively, private sector credit) but it includes data on the money supply, which last dominated consciousness back in the 1980s.

We expect that private sector credit data will show a 0.6 per cent increase in September, with annual growth holding at a 6½-year high of 6.3 per cent. Most interest will be in the measures of housing credit, especially investor home loans.

Plenty to monitor on overseas markets

US data dominates the overseas economic calendar in the coming week with the highlight being the Federal Reserve meeting on Wednesday. And the week kicks off on Monday with data on new home sales while the Dallas Federal Reserve manufacturing survey is released.

On Tuesday, the Case Shiller measure of home prices will be released with a gauge of consumer confidence and figures on orders of durable (or long-lasting) goods with the latter also serving as a proxy for business investment. Also surveys are released by the Richmond and Dallas Federal Reserve districts.

On Tuesday and Wednesday, the Federal Reserve policymaking committee, the Federal Reserve Open Market Committee, meets to decide policy settings (decision Thursday 5am AEDT). The FOMC is widely expected to keep interest rates on hold. However the focus will be on the accompanying statement and any wording that may suggest that a rate rise is still on track for December. Overall, there is a clear risk that the tone of the statement could induce more financial market volatility.

On Thursday the first estimates of economic growth are expected for the September quarter with economists tipping annualised growth rate of 1.7 per cent -- a result that gives the Fed more ammunition to justify the low rate environment.

Also on Thursday is the release of weekly data on claims for unemployment insurance and pending home sales.

And on Friday, data on personal income and spending is issued with the final reading of the consumer sentiment index for October from the University of Michigan.

Sharemarkets, interest rates, commodities & currencies

In the US, the profit-reporting or earnings season picks up pace in the coming week. A total of 94 companies deliver results on Monday including Garmin, Xerox and Whirlpool.

On Tuesday, 253 companies report earnings including, Pfizer, Alibaba, Apple, Coach, Merck & Co, Ralph Lauren, Comcast, Simon Property Group, and United Parcel Service,

On Wednesday, another 279 companies are slated to issue results including, Visa, PayPal, and Starwood Hotels & Resorts,

Thursday is the busiest day in the reporting calendar with 375 listed companies slated to issue profit results including Coca-Cola, ConocoPhillips, Mastercard, Time Warner, Newmont Mining, and Johnson and Johnson.

Closing the week on Friday, ExxonMobil, Iron Mountain, Western Union and Starbucks are amongst the 94 companies scheduled to report.