Kohler's Week: Correction, US Rates, Australia's best investor, This week's interviews

Last Night

Dow Jones, down 3.1%

S&P500, down 3.2%

Nasdaq, down 3.5%

Aust dollar, US73.2c

Correction

The global market correction worsened last night and is turning into a full rout. If you take it from May 19, the 2015 peak, the correction is now 10 per cent on the Dow Jones and 13 per cent on the Australian all ordinaries up to yesterday afternoon. There is clearly more to come in Australia on Monday.

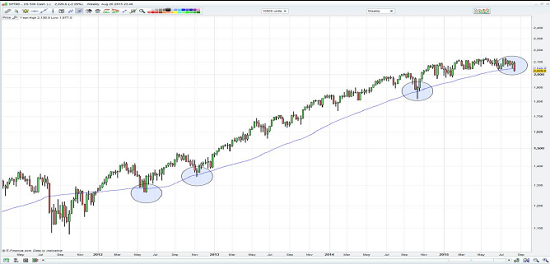

Here's a 12-month chart of the Dow up to this morning:

The Dow Jones dropped 531 points this morning, or 3.1 per cent, the S&P 500 3.2 per cent and the Nasdaq 3.5 per cent. Earlier the German and French markets closed around 3 per cent lower, Shanghai 4.3 per cent, Moscow 4.2 per cent, Tokyo 3 per cent.

There is panic in the air – nameless, irrational panic. Next week could be a time to back up your ute and fill it with bargains – definitely DO NOT set up a stall at the trash and treasure market yourself and try to sell on Monday: this is more likely a time to be greedy when others are fearful, as Warren Buffett would advise.

The world economy is not going into recession and interest rates are not going up. Markets are correcting, which is what they regularly do, and in the process coming back into better value.

The trigger for last night's sell-off appears to have been Chinese PMI yesterday, which fell to its lowest level in six years and sparked that 4.3 per cent fall in the Shanghai Composite yesterday. It's now lost 13 per cent this week.

But unlike with the previous big Chinese correction in June, there are now deeper issues at work that are affecting all markets. Louis-Vincent Gave of GaveKal Dragonomics summed them up neatly earlier this week with a piece entitled “Four Horsemen of the Apocalypse”, and with this very nice opening par:

“In almost every good movie battle scene, the heroes must face attacks on several fronts at once. Invariably, as losses mount, the defensive perimeter shrinks until, with American movies at least, (Saving Private Ryan, Fury…) the cavalry arrives in the nick of time, and our heroes are saved. If the movie is French (La 317eme Section) the position gets overrun and, like in Camerone or Dien Bien Phu, a glorious disaster ensues. Right now, many money managers, especially in emerging markets, must feel like the heroes above; with fights on many fronts, a shrinking defensive perimeter and growing doubts that the cavalry will ever show up.”

Here are his four horsemen:

“1. The commodity downturn: The market is starting to worry that commodity losses will not only be borne by equity holders, but by debt holders and recent earnings releases (Glencore, Noble Group…) have done little to allay concerns on the sector.

2. Emerging market fears: As concerns grow that commodity losses move from equity to debt holders, the fear is simultaneously brewing that the banking systems of Russia, Brazil, South Africa, Middle East etc… could hit the skids. In turn, this is triggering massive redemptions from emerging market debt and equity funds.

3. The tech slowdown: Recent data points (i.e. falling DRAM prices, declining SOX index…) and recent declarations by Fanuc, Samsung, Tokyo Electron… all point towards tech capital spending slowing hard. This further amplifies redemptions from EM and Asian focused funds.

4. Freezing of bond markets: All of the above would be bad enough. But then for good measure throw in the rather poor timing and communication by the PBOC of its recent decision to float the renminbi. This move triggered fears of a massive renminbi devaluation, and the resulting exodus from emerging market and Asian bond and equity funds has turned into a rout. In turn, this redemption cycle has amplified stresses on emerging market bond markets in which investment banks are no longer serving as liquidity providers.”

Louis-Vincent's view then was that this was leading money managers to withdraw to developed markets and out of emerging ones, and he concluded:

“So … the race is on. Either we soon start to see large bankruptcies, and investors get stuck in a French movie where every defender dies to the last man. Or, alternatively, the cavalry appears in the shape of China reassuring markets. Perhaps yesterday's liquidity injection by the PBOC was a first step in this movie having a happy, American, ending?"

In the last couple of days since he wrote that, the panic has spread to developed market equities as well.

But this is mainly an emerging market (EM) problem at this stage. Last night on the ABC news I referred to the 22 per cent devaluation of the Kazakhstan tenge a few days ago as a butterfly effect (the flap of a butterfly's wings in Peru causes a typhoon across the world) because it demonstrated the problems for emerging countries caused by China's devaluation.

Yesterday morning Rupert Murdoch tweeted a couple of tweets that quickly went viral and may have even contributed to what happened last night on Wall Street.

rupertmurdoch All prices dropping not just shares. Timely correction or sign of major global crisis in near future? |

rupertmurdoch If new recession biggest nations have few tools left to fight it. mountains of cash everywhere, but nobody investing. |

Certainly his tweets had an impact at the ABC. They rang soon after to request that I do something special on the News last night and they'd bump me up the bulletin, citing Rupert's tweets (note my previous comments re getting bumped up the ABC bulletin, i.e. when things are really bad).

Recession? Major global crisis in the near future? Disagreeing with the boss is never a great career move, but I doubt that he's right, not that he predicted it – just raised the question. But the boss is definitely right that there aren't many tools left to fight a downturn, if that's what happens. Mountains of cash, but nobody's investing, or rather the speculators have been investing in stocks, bonds and property, but firms haven't been investing much in real production capacity.

The US share market has rolled over and the Australian market has corrected 13 per cent. Some of this is due to the continuing commodities bear market, led by oil, some of it to the manifest problems in China and the prospect (according to some) of more devaluations there, some to the slow-moving machinery of bank regulation demanding extra capital, and some simply to ‘It's Time' – US valuations had become high; it was time to pull back.

Chris Weston of IG Markets points out that the S&P 500 has gone decisively below its 55-week moving average, which doesn't happen too often, and could herald a deeper correction:

How deep could this correction go?

Well, as you can tell from my opening comments I think this is a trash and treasure sale and not another 2008 (although that became one of the all-time great buying opportunities, of course, in March 2009). So yes, corrections are always buying opportunities – it's question of when.

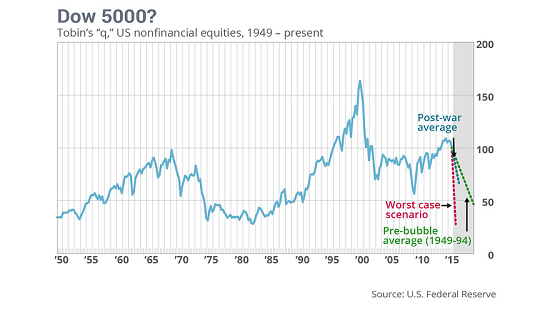

However there is a scenario in which markets keep falling. It was highlighted by a columnist named Brett Arends on MarketWatch this morning, and is based on Tobin's Q – the valuation method that is based on the ratio of the total value of all companies on the stock market and the replacement cost of all the companies. It was developed by a Nobel laureate named James Tobin.

Here's a chart of it, with some scenarios:

As always, charts of any sort are good at telling the past, but not the future, but the should the price of companies' equity on the stock market be 100 per cent of their replacement value, as they are now, or 50 per cent, as they used to? That's the question.

It's a plausible scenario, and corrections are not always instant buying opportunities … as the one that started in October 2007 demonstrated (the market fell 20 per cent in a couple of months, and then recovered 8 per cent, as “bargain hunters flocked into what they thought was a buying opportunity”. (It wasn't.)

US Rates

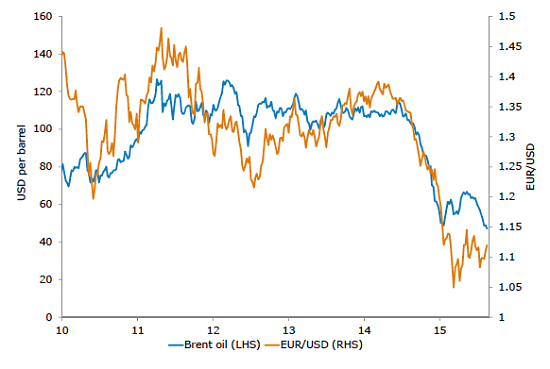

The other big factor at work in global markets is US interest rates, and everyone is catching up with my prediction six months ago that the Federal Reserve's September rate hike will be put off. The main reason is the resumption of the oil price slide (back down to roughly $US40 a barrel, a drop of 30 per cent or so since June) and now the equities market correction.

There are two ways to measure this view: one is the US dollar versus the euro and the other is simply the market odds of a September hike.

Here is a graph of the (rising) USDEUR rate versus the oil price:

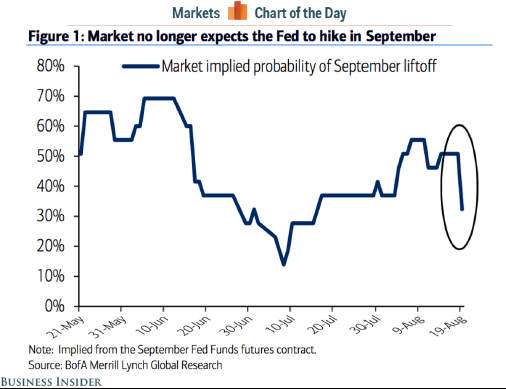

And here is a chart of the market probability of a September liftoff, initially from Bank of America Merrill Lynch and published yesterday by Business Insider:

It was clear from the minutes of the Fed's July meeting that came out this week that it's all about inflation. The minutes said: "Some participants cited downside risks to inflation, pointing to the absence of any noticeable response of inflation to the reduction in resource slack over the past several years, risks of further declines in oil and commodity prices, and the possibility of further appreciation in the dollar.”

When the meeting was held on July 29 the oil price was already slip-sliding away and it has kept going in the past two weeks. I'd say most of the 'participants' badly want to get the cash rate off the floor to remove the distortion from the yield curve. As Kerr Neilson said in a recent adviser lunch: “If we don't have rates going up, we are going to have pandemonium in markets at some stage. We are already seeing distortions in the use of cash now. The longer we leave this, the greater the risks of misallocation become.”

And as David Kotok of Cumberland Advisors put it this week: “The issue is simple. The entire yield curve is impacted by the zero side. We are not getting full and complete price discovery at the intermediate-term and long-term levels because rates are anchored at the distorting zero-bound. Economies, markets, mortgages, building, rebuilding, refinance, growth – all require price discovery. Price discovery requires a system that allows some price to be set by supply and demand. That is why the Fed has to get away from zero.”

But it's hard to justify when inflation is 0.3 per cent p.a. and likely fall further when the latest drop in energy prices flows through. In a recent op-ed in the Wall Street Journal, the President of the Federal Reserve Bank of Minneapolis, Narayana Kocherlakota wrote:

“If the Fed raises interest rates when inflation is so far below target, market participants and other members of the public could well conclude that the FOMC has implicitly lowered its inflation goal. That, in turn, poses two serious risks to the economy.

The first risk is near-term. Financial decisions depend on real – that is, net-of-inflation – interest rates. If the public believes the Fed has lowered its inflation goal, all real interest rates in the US will be higher.

This will discourage people from borrowing money for homes and autos. It would likely raise the dollar's value relative to foreign currencies, making US goods and services less attractive to households and firms here and abroad. Prices of homes and other assets would also feel downward pressure under higher interest rates. All of these changes would likely discourage spending and create a drag on US economic activity and employment growth.

The second risk is longer-term. In late 2014 the FOMC ended its asset purchase program, even as the outlook for inflation was sliding further below the 2 per cent goal. Financial markets logically interpreted this step as meaning that the FOMC had tacitly lowered its longer-term inflation objectives from the 2 per cent goal established in January 2012. If the committee were to tighten monetary policy again by raising the federal-funds rate in 2015, when the inflation outlook has changed little since late 2014, markets would likely respond similarly.”

And in a way, the rise in the US dollar in response to the anticipation of a rate hike is self-defeating in the context of other things getting cheaper, such as oil and technology. As the Fed started talking about a September liftoff, the US dollar index appreciated 5 per cent between May and July, putting downward pressure on inflation and, in effect, cancelling the liftoff.

But the main thing is the falling prices of energy and technology. The Fed is stuck. It is desperate to get the cash rate off zero for reasons spelt out by David Kotok and Kerr Neilson, but it can't.

But BNP Paribas' economists spelt out the problem, saying that this week's minutes “severely damaged the chances of rate liftoff in September” and added: “It is unlikely that upcoming data would be sufficient to deliver the requisite degree of confidence in the inflation outlook in time for a hike in September -- there's just not enough runway. A mammoth payrolls, a sharp fall in unemployment and a spike in average hourly earnings could yet resurrect lingering hopes of September, but we see this as unlikely."

Greece

Alexis Tsipras, he of the grand gesture, has resigned as PM of Greece, forcing the President, Prokopis Pavlopoulos, to see if anyone else can form a government (that is, survive a no confidence vote) and failing that, which is most likely, appoint the head of the Supreme Court as interim PM and organise an election, probably at the end of September.

Is this a problem (European stocks were whacked on Thursday, including a 3.5 per cent fall in Athens)? Definitely not. I suspect Tsipras is trying to jettison the far left that brought him to power in January but has been a stone in his, and the country's, shoe ever since. He got the best bailout deal possible and is very popular as a result. The new election could slow down the bailout process and delay the passage of the necessary legislation, such as pension reform, the €50 billion of privatisations and new product market regulations, but unless the extreme left manages an unlikely victory, the legislation will pass and the bailout will proceed.

Markets are stretched, jumping at shadows at the moment.

Australia's best investor

The Mercer fund manager tables for July came out this week and there was one that stood out above all the rest – not for July, which was won by a relative newcomer called Devon Australian Fund (7.7 per cent), but for the more meaningful three and five-year time periods.

Smallco Broadcap Fund has achieved a 35.8 per cent p.a. return over three years and 27.6 per cent over five years. The next best, Bennelong Concentrated Equities, returned 24.8 and 17.7 per cent respectively over three and five years. In other words, Smallco Broadcap is doing roughly 10 per cent per annum better than the next best fund and obviously shooting the lights out versus the index (total return, 15 per cent and 16 per cent respectively).

So I went and visited them in Pitt Street Sydney this week. It was an office about the size of my lounge room (which isn't very big) containing six desks and a little meeting room. It was rather messy, or perhaps lived in.

The place is led by Rob Hopkins, a stockbroking analyst formerly with ANZ Securities and Macquarie, who started Smallco with his friend Bill Ryan 15 years ago. With them are portfolio managers Andrew Hokin, Craig Miller and Paul Graham, and financial controller Lisa Xu. That's the team.

They run two funds: the Smallco Investment Fund ($220 million) and the Smallco Broadcap Fund ($110 million). They're as they sound – concentrated small company funds, with SBF holding some larger companies as well. They hold between 20 and 35 stocks, but Rob would only tell me the top five in each, which are, for SIV, Cover-More Group, Isentia Group, oOhMedia, Seek, Sirtex Medical, and for SBF, Commonwealth Bank, Westpac, Cover-More Group, Isentia and Sirtex.

Andrew Hokin runs the Broadcap fund, which has done so well, and in his previous life he was a bank analyst, which explains why there are a couple of banks in the fund (note they're still in there).

The fees are, for SIF, 1.65 per cent base plus a performance fee of 18.64 per cent (which is 20 per cent minus input tax credits) for performance above the previous high water mark, and for SBF 1.2 per cent plus 15 per cent of outperformance above ASX200 total return. Both funds have returned in the mid-30s over three years, so Rob and Bill are doing OK.

They say their “sweet spot” for investing is companies between $100 million and $500 million in capitalisation – below that there are major liquidity issues and above that they've usually been discovered by the big guys and are no longer cheap.

The funds are going to be limited to $300m each, so total funds under management will be no more than about $600m.

They do all their own modelling (not using broker research except to check their work) and to focus on predicting the next earnings surprise.

Says Rob: “It's pretty simple. If earnings go up, the share price will go up; if earnings go down, the share price will go down.” As a result, they get their best outperformance in February and August (earnings season).

They don't do discounted cash flow modelling: “Anyone's ability to forecast one year's cash is not very good, two years is worse and three years is hopeless”.

They have a system of quality rating, scoring companies out of 10 because low-quality stocks get badly hurt in a downturn. The score is based on earnings cyclicality, long-term performance and pricing power. They sell a stock if there's a change in their view on earnings or the industry is getting competitive and pricing power is lost.

Needless to say I was impressed, although there's nothing particularly unique about them – a team of five fund managers in a pokey office poring over models and talking to companies every day is a scene repeated dozens of times in Melbourne and Sydney.

It's just that on performance, which is all that matters, these guys are the best at it in Australia, the runaway champions.

Politics

I don't like writing about politics because it usually pisses off at least some of you, and you write in tartly telling me to stick to finance. But occasionally it's unavoidable.

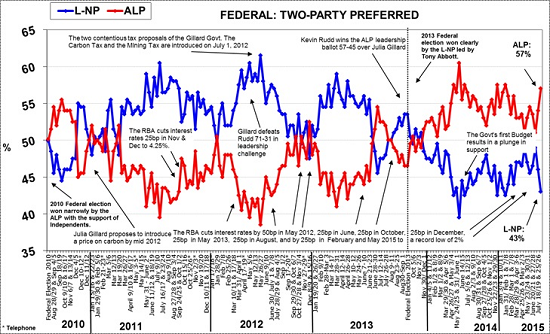

This graph has been poisonous for Australian investors:

Note that for five years, the government has been less popular than the Opposition.

Unpopular governments are bad for confidence, both consumer and business, and popular Oppositions indicate that negativism, which is the currency of opposition, is holding sway. We've now had two unpopular governments in five years: Gillard and Abbott. (Even though Kevin Rudd was sacked twice – once by his party and then again by the voters – and arguably for good reason, he was more popular than both Julia Gillard and Tony Abbott.)

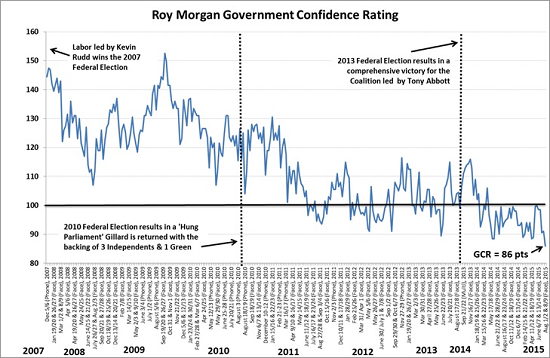

Confidence in government has been declining since 2009:

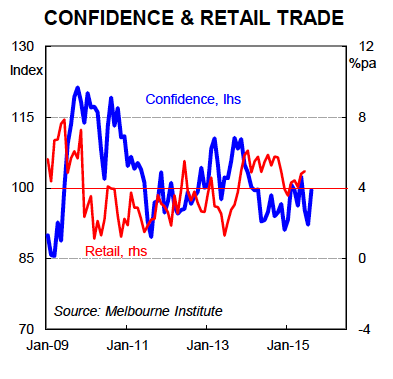

Consumer confidence has been weak since 2010, basically from the moment Julia Gillard knocked off Kevin Rudd:

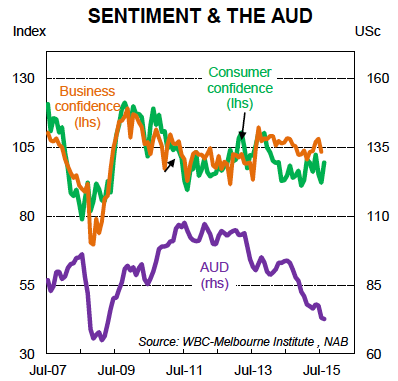

And business confidence likewise, although that has also had a lot to do with the horrible rise of the Australian dollar to above parity between 2010 and 2012, thanks in large part to the Reserve Bank's mad decision in late 2009 to raise rates.

Business confidence should be much higher given the currency devaluation back to just below the post-float average, but is being held back by politics.

The problem? My take is that there is a competence deficit. The current Prime Minister and his office are inexperienced and lacking in confidence, and don't understand that if you focus on good policies and careful leadership, re-election will take care of itself. They don't seem to believe it, and are constantly focused on gaining political points. Policy ideas and implementation are taking a back seat, which is plain for all to see and self-defeating.

Minack on Currencies

My friend Gerard Minack wrote to me this week to rebut the item on currencies last week quoting Paul Donovan of UBS, in which Donovan proposed that devaluations don't work in boosting economies.

Here's what Gerard wrote:

As Charlie Munger says: “invert, always invert.”

It's easier to think about the impact of currencies by considering what would happen if they do not adjust. There's lots of examples of unsustainable currency pegs, the resultant macro stress and, ultimately, the market almost always forcing a currency adjustment.

So the point is not that currency movements shape relative prices, export market shares, or export growth. It's the reverse: these factors force currencies to move.

Put another way, the right way to think about this is to invert Donovan's quote: "Currency fluctuations are helpless victims of competitiveness and economic activity.”

That, by the way, explains why currencies over time tend to follow a country's terms of trade or relative competitiveness. For currencies to not adjust that way would create unsustainable macro forces that ultimately force the currency adjustment.

Cheers, GM

IPIF

Interview No.1 this week was with Nicole Connolly, majority owner and CEO of Infrastructure Partners Investment Fund. I'm interested in this fund, and wanted to show it to you again, as it looks a good way for retail investors to get some exposure to unlisted infrastructure. IPIF invests only in Utilities Trust of Australia, a fund operated by Hastings, a subsidiary of Westpac (started by Mike Fitzpatrick). Nicole charges 75 basis points and UTA charges 67bps – total MER of about 1.4 per cent. UTA's 20-year performance is 11.6 per cent, about half distribution and half capital. Watch the interview here.

Invigor Group

Next interview was with Gary Munitz, CEO of Invigor. Its business consists of a web crawler that inspects every online retailer's products and prices and then sells that data in a few ways – to retailers, manufacturers and shoppers. Interesting business. You can watch or read the interview here.

YPB Group

John Houston owns half of this business, which consists of a patented “tracer” that is applied to products to authenticate them – to prevent counterfeiting. The company's main operation is China, where 70 per cent of the world's counterfeiting takes place, apparently. YPB's tiny tracers can be put in ink or plastic, and a little scanner can read the emissions and verify that the product is genuine. All these interesting little businesses! Learn more about the business by watching or reading the interview.

Qube

This one is a bit better known – the ports and logistics business born out of the port assets of P&O Steam Navigation Company, managed by the old Patrick Stevedores team led by Chris Corrigan and listed in 2011. Here's its share price since listing:

… So a 5-bagger at one stage but back to $2.20 because of some unpleasantness with iron ore bulk transport.

But as I put to CEO Maurice James in this interview, Qube is almost a start-up these days, such is the importance of its Moorebank development in western Sydney. Find out more by watching or reading the interview.

By the way, please don't expect four interviews every week – it's exhausting!

Readings & Viewings

Video of the Week: the artist formerly known as Prince stalks a herd of jockeys in the wild. Very funny.

Laura Tingle: Bible in one hand, shovel in the other: Tony Abbott is for coal.

Myths about the Adani mine busted.

Anne Summers: Is same sex marriage killing gay culture?

It's their right to join, but it's sad gays want to be members.

Naval shipbuilding in SA is a waste of money.

Tianjin warehouse operator flouted safety rules. Really?

Why China's big currency devaluation is bad for it, for America, and for the world.

China's crisis: the price of change.

Three reasons why oil will surge past $70 by the end of the year. Or maybe not.

Bitcoin is on the verge of a constitutional crisis.

'Weird hotel' in Japan run by robots who handle guest relations, transport luggage and clean rooms

Editing wars on Wikipedia.

Helen Razer on Nick Kyrgios: don't look for moral guidance to sports stars, or sports writers.

What should a super fund return?

Are driverless cars safer cars?

Researchers are storing data in DNA. It works.

Norman Swan's Health Report on Radio National was terrific this week – 1. The importance of grip strength in telling if you're at risk of dying in the next few years; 2. The benefits of fish oil for mental illness; 3. Reflux, Barrett's oesophagus and cancer.

Goldman Sachs says its clients are asking a surprising question – will there be a recession in 2016.

Animal Farm was published 70 years ago this week. Here is George Orwell on the freedom of the press.

The Japanese Prime Minister's long-anticipated statement of commemoration is a radically different take on the Asia-Pacific War.

Stockmarkets reflect all information. Really???

Inside Amazon: wrestling big ideas in a bruising workplace. This was a big story this week.

And here's Jeff Bezos' reply.

Greece may not need a debt haircut.

A must read by Bryan Appleyard on robots.

Mohamed El-Erian: oil's new normal.

Interest rate hike coming? The economy says no. Does it even matter?

Last Week

By Shane Oliver, AMP Capital

Investment markets and key developments over the past week

The global share market correction continued over the last week as worries intensified regarding emerging countries, their currency rout and the impact on global growth along with the ongoing fall in commodity prices. Messy profit results also didn't help Australian shares. From their highs earlier this year global shares have fallen 6 per cent but this masks a big range with US shares only down 4.5 per cent whereas Eurozone shares have had a fall of around 12 per cent. Asian shares have had a fall of 18 per cent, emerging market shares are down 17 per cent and Australian shares are down around 13 per cent. Reflecting investor nervousness commodity prices remained under pressure over the last week and bonds benefitted from safe haven demand. Emerging market currencies fell further and weak Chinese economic data put renewed pressure on the Australian dollar.

Is this 1997-98 all over again? The past week has seen a further intensification of concerns regarding the emerging world with a range of general and country specific factors coming together including the ongoing plunge in commodity prices, more falls in emerging market currencies (with Vietnam devaluing and Kazakhstan abandoning its currency fix) as China's 3 per cent devaluation continues to reverberate, the bombing in Thailand, a reference by the Fed to global weakness presumably mainly in emerging countries and worries about China with the explosion in Tianjin not helping.

Fears of a re-run of the 1997-98 Asian-emerging market crisis are building again. Such fears are of course not new - we saw similar worries early last year with talk of the fragile five - and emerging market (EM) currencies have been plunging since 2011 (now down 36 per cent on average) and their share markets underperforming over the same period. The EM world is arguably much stronger than it was is 1997-98 with stronger current account balances, higher foreign exchange reserves and mostly floating as opposed to fixed exchange rates (which mean they don't have to be defended from speculative attacks).

However, some of the emerging world is suffering from a return to populist policies and a reversal of economic reforms so the EM crisis could go on for a while yet. What may be needed to end the negative feedback feeding through global currency and share markets at the moment though is a policy easing. This came in 1998 with Fed monetary easing. While it's now looking unlikely the Fed will tighten in September, a circuit breaker policy easing this time around ideally needs to come from China – so keep an eye out for further Chinese stimulus measures. Expect China to cut its benchmark interest rate to below 4 per cent by year end, from currently 4.85 per cent, and to step up fiscal stimulus.

Greece worries back again, but maybe not really. With Greece's third bailout program now in place, Greek PM Tsipras has called a new election, likely for September 20. Such a move was expected. With the bailout locked in Tsipras wants to take advantage of his popularity and purge Syriza of far left MPs who didn't support the bailout. Most recent polls indicate he remains popular and that Syriza would be the first placed party with a comfortable margin. While it would likely need to form a coalition with other centre left parties it would be committed to the bailout. Alternatively the main opposition party, New Democracy, is committed to the bailout anyway. So expect some more noise regarding Greece, but it's unlikely to be a major threat.

The Australian June half profit reporting season is now almost two thirds done and overall the results have been a little disappointing. 43 per cent of results have beaten expectations and 60 per cent have seen their profits rise from a year ago which is okay, but it's well down on what we have been seeing in the last few reporting seasons. Resources companies have remained under pressure, industrial profit margins have been weaker than expected and the banks have been mixed and guidance for the current financial year has been a bit downbeat. As a result profits now look to have fallen by around 2 per cent over the last financial year and expectations for the current financial year have been downgraded to around 2 per cent. However, it's not all doom and gloom. Profits are still growing outside the resources sector by around 7 per cent with companies exposed to housing and NSW and Victoria generally doing well, the lower $A should provide and dividends are continuing to rise solidly. So there is a bit of light at the end of the tunnel.

Major global economic events and implications

US economic data was mostly okay. While the New York manufacturing conditions index fell in August, the NAHB home builder's conditions index, housing starts, existing home sales and the Philadelphia Fed manufacturing index all rose. Against this, CPI inflation in July was weaker than expected.

Fed backing away from a September hike. While the minutes from the Fed's last meeting recognised progress in terms of the labour market and economic activity there was a degree of wariness regarding downside risks to inflation and global economic weakness. In fact since the July meeting the downside risks to inflation have increased with further falls in commodity prices, still weak wages growth and increasing risks regarding China and emerging countries. I think the probability of a September hike is now less than 40 per cent and it will likely slide further if the emerging market related turmoil intensifies.

Japanese June quarter GDP contracted but growth is likely to return in the current quarter. A further improvement in the August manufacturing conditions PMI to 51.9 also points up.

Chinese economic data was contradictory. While property prices rose again in July and the MNI business sentiment survey rose strongly in August, the closely watched Caixin manufacturing PMI fell to its lowest since March 2009. The latter likely reflects the difficult conditions in small and medium businesses and the need for further monetary easing.

Australian economic events and implications

The minutes from the RBA's last meeting provided nothing new. Citing more positive economic data of late and lower unemployment than forecast the RBA looks to be in no hurry to ease. However, since then commodity prices have weakened further & uncertainty about the emerging world has increased. My view remains that the RBA will still have to cut again.

Next Week

By Craig James, Commsec

Business investment in focus

Domestic economic data remains in short supply. The highlight in the coming week is business investment data on Thursday. But it is another big week for corporate earnings with commentaries on profit results and the outlook statements from major companies of interest to get a better handle on the economy.

The week kicks off on Tuesday with an eclectic spattering of statistics. The Bureau of Statistics (ABS) issues preliminary quarterly readings on goods and services trade – an input to forthcoming Balance of Payments figures. The ABS also issues additional data on producer prices and detailed data on household income and wealth for the 2013/14 financial year.

Also on Tuesday usual weekly consumer confidence survey is issued by ANZ and Roy Morgan.

On Wednesday, the ABS issues preliminary Construction work Done figures. The data covers residential, commercial and engineering construction, but it is the residential building figures which act as an input to the national accounts – assists in calculation of economic growth figures.

On Thursday, the ABS releases its survey of business investment – Private Capital Expenditure. The survey effectively has two parts – the measures of actual spending and the estimates of future spending for the 2015/16 year.

After falling by 4.4 per cent in the March quarter, we expect that spending on new equipment and buildings may have eased a further 6 per cent in the June quarter, reflecting the wind back of mining investment.

It's important to note that this is just one aspect of business spending, it may not fully pick up the post- Budget spending by small business or general day-to-day spending of Australia's 2.1 million businesses.

In terms of the expectations component of the ABS business survey, the third estimate for spending in 2015/16 is usually revised higher from the second estimate – in fact the upward revisions have been anything from 3.4 per cent to 17.8 per cent over the last decade.

If expected business investment for the 2015/16 year is revised up by around 5 per cent to $110 billion, it would be regarded as a “good” result in current circumstances.

Another busy week of US economic data releases

A bevy of US economic indicators is scheduled over the coming week with revised economic growth data (Thursday) one of the highlights.

The week kicks off in the US on Monday with the release of the National Activity index. Further, in China the Caixin “flash” manufacturing index is released – an early gauge on manufacturing production activity in August.

On Tuesday, there is raft of economic indicators in the US. Both the CaseShiller and Federal Housing Finance Agency surveys on home prices are released with consumer confidence, new home sales and the influential Richmond Federal Reserve survey. The usual weekly chain store sales figures are also issued.

US home prices are around 5-6 per cent higher than a year ago. Economists tip a rise in consumer confidence from 90.9 to 93.2. And new home sales may have rebounded by near 8 per cent after falling 6.8 per cent in June.

On Wednesday, the July data on durable goods orders is released – goods designed to last three years or more. Economists tip a flat result with orders down 0.5 per cent and non-transport goods up 0.2 per cent. The weekly reading of housing finance is also issued on Wednesday.

On Thursday the second reading (preliminary) of June quarter economic growth is released in the US together with pending home sales and the Kansas City Federal Reserve manufacturing survey. Economists now expect that the US economy rebounded in the June quarter, posting annualised growth around 3.1 per cent. The regular weekly data on claims for unemployment insurance is also issued.

And on Friday, data on personal income and spending is released together with the final estimate of August consumer sentiment, reported by the University of Michigan. Economists expect that income and spending both rose by 0.4 per cent in July.

Sharemarket, interest rates, currencies & commodities

The Australian profit-reporting season moves into the final week. Overall it is clear that the economy was in something of a “holding pattern” over the past year. Both revenue and expenses of Australia's largest companies grew by around 3 per cent with profits flat. Companies have still been keen to lift dividends, cutting high cash levels to do so. In aggregate, dividends rose around 8 per cent with a number of special dividends being paid.

On Monday, earnings results include Lend Lease, UGL, Beach Energy, Spark Infrastructure, nib Holdings, AWE Limited, Fortescue, APN Property and BlueScope Steel.

On Tuesday, earnings are scheduled from BHP Billiton, Amcor, Oil Search, Ingenia, Independence Group, Scentre Group and Healthscope.

On Wednesday, amongst those scheduled to issue their profit results are BC Iron, Drillsearch Energy, Charter Hall, NEXTDC, APA Group, WorleyParsons and Prime Media.

On Thursday, earnings are expected from Horizon Oil, Flight Centre, Perpetual, Ramsay Health Care, Nine Entertainment, Southern Cross Media, Evolution Mining, Boral, Westfield, Cromwell Property and Kingsgate Consolidated.

On Friday, scheduled earnings results include those from Northern Star Resources, Woolworths, Sandfire Resources and Harvey Norman.