Kohler's Week: Commodity Crunch, Why is the market falling?, The Banks, Media Laws, A few cracking little interviews

Last Night

Dow Jones, down ~1%

S&P 500, down ~1%

Nasdaq, down ~1.4%

Aust dollar, US71.3c

Commodity Crunch

Brent crude fell below $US45 for the first since 2009 this morning and the US benchmark, West Texas Intermediate, is at $US40.46, threatening to breach $US40 at any moment. Meanwhile copper is below $US5000 a tonne, also for the first time since the GFC, having fallen 2.4 per cent overnight in London. The Bloomberg commodity index also fell to its lowest level since the GFC.

There appear to be two things causing all this: the International Energy Agency put out a new estimate of global oil inventories last night – three billion barrels, the highest on record – on top of this week's economic data from China.

World oil stocks have become inflated by the war for market share between Saudi Arabia, Russia and the US, with Iraq also upping its output. In its World Energy Outlook report, and holding a glass that was half full, the IEA said: “Brimming crude oil stocks” offer “an unprecedented buffer against geopolitical shocks or unexpected supply disruptions.” And with supplies of winter fuels plentiful, “oil-market bears may choose not to hibernate”. “…the prospect of oil prices remaining low for an extended period cannot be ruled out.”

On top of the fact that OPEC members are producing like mad just to get cash in the door and protect their markets, the market is getting more and more worried about Chinese demand.

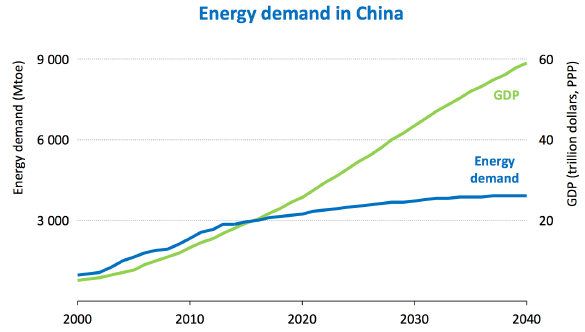

The IEA published this graph last night in its WEO:

I think it's meant to be taken as more indicative than precise, but you get the picture: as China's economy shifts from industrial to services, it becomes less energy intensive.

Meanwhile that shift in the focus of the Chinese economy was emphasised in this week's data out of China: industrial production growth fell to 5.6 per cent and electricity output continued to contract, while retail sales grew 11 per cent, which was more than the month before. Consumer confidence also improved. Earlier in the week there were data on China's trade: exports fell 6.9 per cent year on year – much more than the market had expected.

So while much of the initial reaction to the October data was positive, the commodities markets hated it.

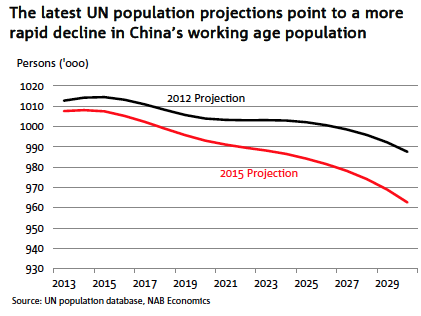

There's also growing focus on China's demographic problems. NAB's economists put out a report this week suggesting that the working age population is about to start shrinking rapidly as a result of the one-child policy.

… and that this will detract about 0.7 per cent a year from GDP growth:

It's all bad news for resources stocks, and the biggest one, of course, has blasted a hole in its foot with the tailings dam disaster in Brazil, which is going to cost an awful lot of money, management focus and reputation.

Why has the market fallen?

On Monday a valued subscriber named Bill wrote to me as follows:

“Can you please inform me (in simple terms) your opinion on why the ASX 500 and 200 are falling. Stocks such as WOW, AGL, WSP, STO, TLS, ANZ, CBA, to name a few, which I have been following for many years.

At present I am 80 per cent invested in the share market. Also, I am on a fixed income etc.

So if you would be able to tell me why, please. I remember that you stated that 2015 would be a rough year, well so far this financial year it is not a roller coaster but a downhill run.

Looking forward to some words of wisdom on the remaining months of the F/Y and where you expect the market to be on the 30th June 2016.

Yours respectfully

Bill”

I replied to him with three points:

“Three reasons:

– The credit cycle has bottomed and bank impairment charges are going to start rising (the market is anticipating that anyway).

– The interest rate cycle has bottomed and rates will start rising – in the US. Probably gradually, but dividends are worth less than before. Affects TLS and the banks.

– Commodities are falling.

It's like 2011 again. Then it was Europe, now it's China. Unless China really falls apart (a small possibility) the market will recover as it did from 2012, but it's unlikely to be a big bull market as it was then because of interest rates.”

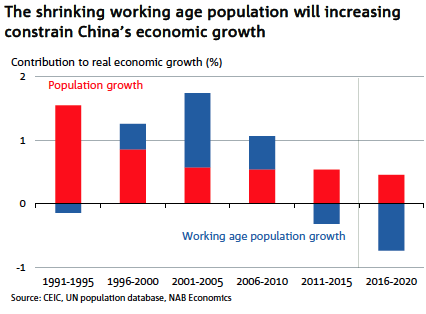

The point I didn't mention was exhaustion: the global sharemarket had rallied 75 per cent from 2011 with absolutely no support from earnings, as this stunning graph from Gerard Minack shows.

Gerard calls it a TINA trade (there is no alternative) – that is, it was driven by falling interest rates. Where there was some earnings support – the US – the market outperformed:

The Australian market rallied 50 per cent from 2011 to 2015:

… And fell 18 per cent in the first half of this year for the reasons mentioned above, plus the lack of earnings support leading to rally exhaustion.

Note that the rally in the banks from 2011 to 2015 was double that of the market (100 per cent versus 50 per cent) so they corrected harder this year (25 per cent peak to trough, versus 18 per cent). The miners' correction was even worse (30 per cent). Industrials on the other hand have rallied, on average, but there have been big variations (e.g. WOW and WES).

Including the 25 per cent correction this year, the banks are still up 110 per cent from September 2011 in total value terms (including dividends), which is a 20 per cent p.a. compound return, so those who have stuck with them can feel well satisfied.

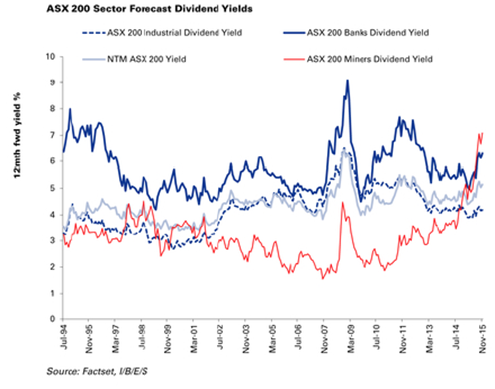

The miners are a different story: the All Resources Accumulation Index is down 35 per cent since 2011, and as a result of that, plus their new-found enthusiasm for dividends, the average mining company yield is now higher than the banks! That is a truly amazing development.

If you had told me even a year ago that the yields of the miners would surpass those of the banks, I would have said you were mad. I think we can confidently say that it has never, ever happened before.

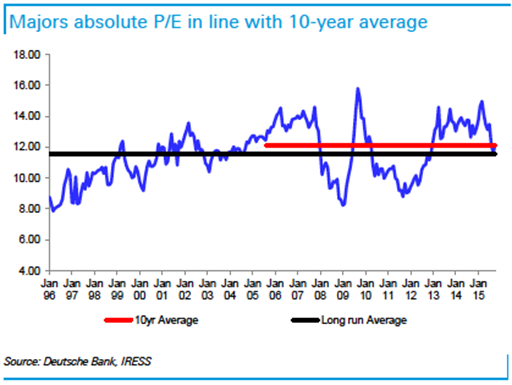

As for what happens from here, clearly there's moderate support from growth in the domestic economy and there's no reason to think an increase in unemployment will impact the banks. However, interest rates are likely to rise, so yields will continue to come under pressure. As for industrials – it depends on the stock. As always, quality earnings is what it's all about.

The main issues are offshore. The trailing PE ratio for the US S&P 500 has shot up to 20.3 from 18.5 a month ago, and with operating earnings per share expected to fall 15.8 per cent for the latest quarter, US share prices look stretched and vulnerable to a correction. On top of that a rate hike in December is clearly on the cards, which will at least make things bumpy.

As for where I expect the market to be on June 30, 2016 … sorry, I don't know. The thing is, I don't really believe in “the market”. I don't invest in it, and don't think you should either. (By which I mean an ASX 200 ETF, or something.)

I doubt very much whether the banks will be higher in seven months, or any yield-only stocks for that matter. That surprisingly includes the big miners, which have become yield stocks. BHP in particular will almost certainly cut its dividend by then – it will never get a better excuse to abandon its silly “progressive policy” than the Brazilian tailings dam disaster, and they'll probably take it.

But I can tell you that whatever the market does, I'm pretty sure my portfolio, and Eureka Report's model portfolios, will be higher in June next year.

The Banks

Let's dig into the banks a little more.

There was a bit of a kerfuffle yesterday when the Australian Financial Review reported/alleged that ANZ had pre-paid tax in order to preserve its dividend franking.

“Hahaha", went the market; “gulp” went shareholders; “not true”, went ANZ, denying the story in a pre-market press release yesterday morning. “We have consistently stated that we expect to fully frank dividends for the foreseeable future,” adding that “ANZ did not pre-pay tax in order to maintain its fully franked 2015 dividend”. Next year was not mentioned.

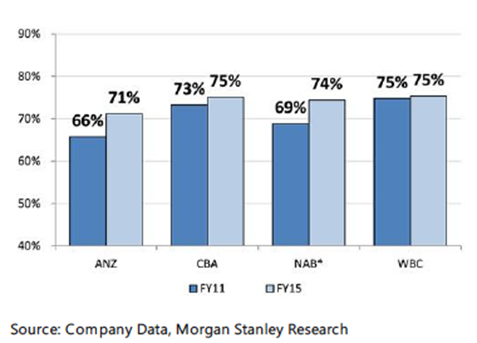

The shares were crunched at the opening, and the whole episode highlighted investors' sensitivity about bank dividends. And why wouldn't they be nervous? Payout ratios are very high …

Bank payout ratios

… and can't go much higher. At an average of 6.2 per cent, the yields are above average and now depend on holding both the payout ratios and earnings.

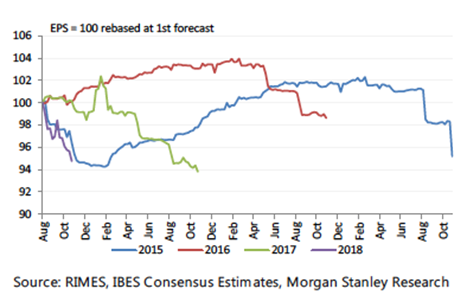

Earnings forecasts have been significantly downgraded by analysts for the next few years:

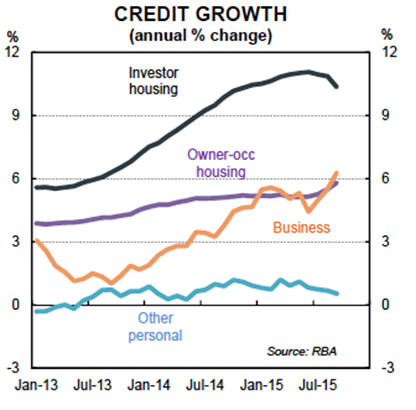

The two key vulnerabilities are credit growth and loan impairment provisions.

As for the first of those, investor home loans are now falling, but that's being offset by owner occupiers upgrading and business lending is also picking up. Personal lending is not. Overall, credit growth is flat, but does not look likely to fall overall.

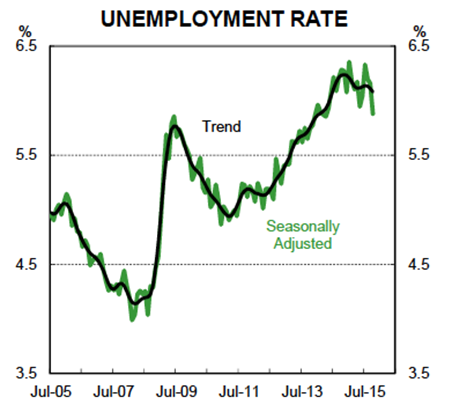

Loan impairments are largely a function of unemployment, which is falling.

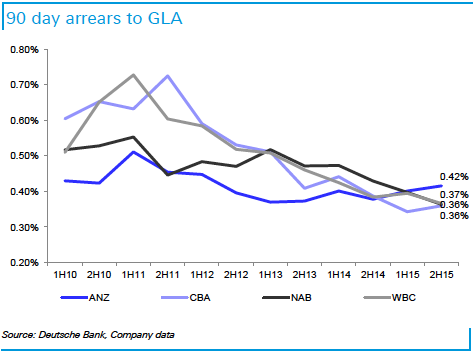

Nevertheless, impairments are likely to be a headwind next year and beyond. Arrears are starting to kick up…

And this forecast from Morgan Stanley suggests they could be a problem in the years ahead:

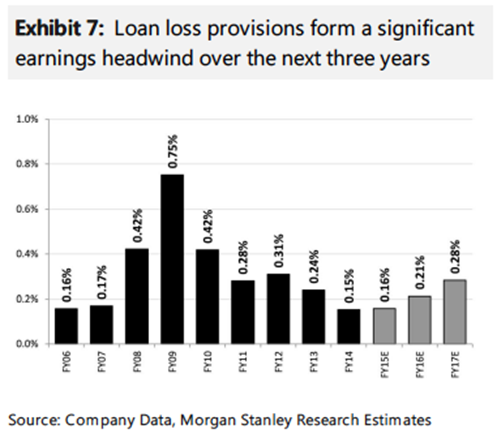

The next question is share price: are their valuations stretched and are they vulnerable to downgrading?

Here is the average PE ratio of the big four banks:

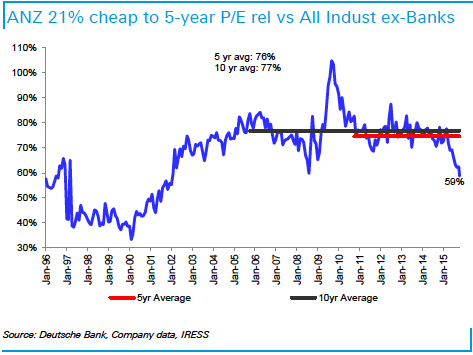

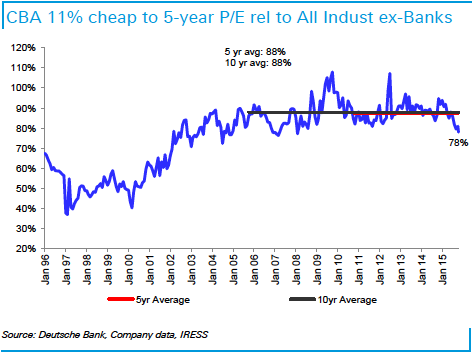

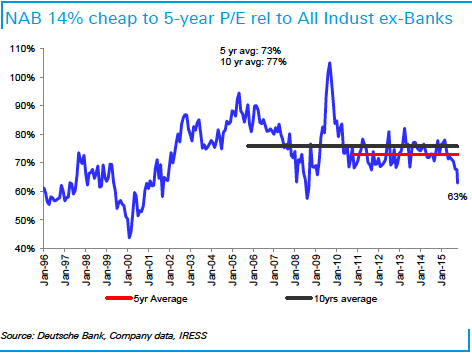

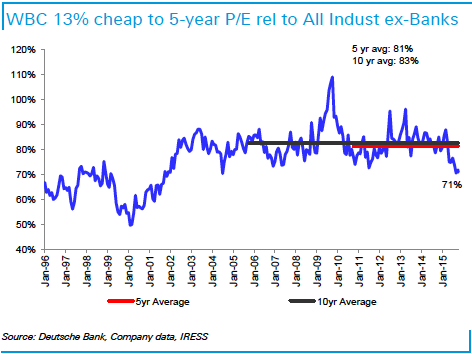

And here is a series of charts from Deutsche Bank of the PE ratios of the big four banks, relative to the all industrials, ex banks:

All of them are relatively cheap on that basis and the cheapest is ANZ, but perhaps for good reason: its riskier Asian exposure. But Deutsche Bank's view is that with the Australian and New Zealand businesses doing well, the risks have been more than discounted in the price.

But whether that means any of them is a buy is another matter entirely. I don't think so.

It's Time

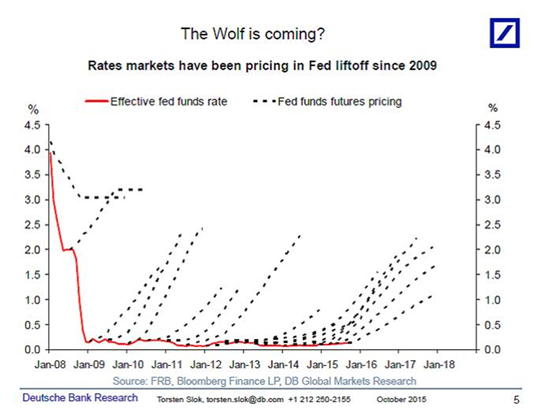

Will the US Federal Reserve actually raise interest rates next month? Probably, I suppose so. But look, the market has been consistently wrong on this subject for seven years. Here's a graph showing market consensus forecasts of the Fed funds rate (dotted lines) with what actually happened (red line).

I have consistently opposed the market pricing and said US rates would be going nowhere. I wrote in January that the Fed would not raise rates in June, which was then the prediction, and I've repeated that consistently since then. Now I'm wobbling on that – not only do I think the Fed will do “lift off" in December, that's what SHOULD happen. It's time.

Media Laws: Titanic Deck Chairs?

There's a lot of talk that the Government is about to reform the media laws, and there's been enough mumbling from ministers that the regulations are out of date to think that the smoke has some fire under it.

So I thought it might be useful to have a quick and dirty primer on what the current laws are and what opportunities might arise for investors.

There are five basic media ownership regulations:

1. The 75% reach rule. This says a person or company can't control commercial TV licences whose total licence area exceeds 75 per cent of the population. At the moment, Nine reaches 73.55 per cent of the population, Seven 73.81 per cent and Ten 66.7 per cent.

2. One in a market rule. This prevents anyone controlling more than one commercial TV licence in a particular area.

3. Two out of three. This is the old “cross media ownership” rule. It prevents the merger of more than two regulated media platforms – TV, radio and newspapers.

4. 5/4 rule. This stipulates that there must be at least five independent media voices in metro areas and four in regional areas.

5. Two to a market rule. This prevents a person or company owning more than two commercial radio licences in a licence area.

Given the way all the commercial broadcasters are under siege from various manifestations of the internet, it does seem time to recast the media laws. I doubt that all five will be abolished at once, but full deregulation must be seen as possible. The 5/4 rule is clearly redundant, along with “reach” and “two out of three”. The two I'd keep for the moment are “two to a market”, because radio is powerful and so far relatively unchallenged by digital disruption, and “two out of three”, since combining TV, radio and print in one market would still bring a lot of clout.

If I'm right the opportunities for investment gains would be pretty small -- mainly in regional TV, specifically a merger of Southern Cross and Nine Entertainment would make sense and generate synergies. Other potential targets are Prime Media and APN.

Not many opportunities, and anyway it's hard to escape the feeling that it's a matter of deck chairs on the Titanic, after the iceberg has been struck.

Disruption

I received this letter last Saturday, from a subscriber who's getting a bit worried about me:

“Dear Alan,

For some time now, I have been uncomfortable with where your headspace is at in relation to investment opportunities. Disruption is fascinating from an intellectual point of view, but I suggest it is not a good investment theme. When the PC revolution came along, 140 companies had a place at the starting line. Two, maybe three survived and did well – not great odds. Similar things happened in biotech. Yes, traditional companies will get hurt, but the chance of picking winners is not high. Who will be the successful peer-to-peer lender, and what happens in a rising interest rate environment?

I would appreciate some reflective thoughts by you about the difference between an overall business trend and picking the successful disruptor.

Kind Regards

Thomas”

Here's my response:

“Hi Thomas,

I appreciate you writing in with your concerns. I'd point out, though, that two weeks ago I wrote that people ‘shouldn't focus on the new at the expense of the old': ‘success in investing and modern business is not just about digital disruption.'

Having said that, there really are a lot of exciting and lucrative opportunities in the digital world at the moment. I think it's not so much a matter of picking winners as making sure you have some careful and diversified exposure to digital disruption. As I wrote in another Saturday email recently: get on the train, don't lie on the tracks (that is, bet on the disruptors, not the disruptees).

Anyway, I'm glad you wrote and you made some good points. If it's OK with you I'd like to use your letter in my next edition to spark further discussion of the issue.

Warm regards

Alan K”

Would love to hear from you if you disagree with either of us, or want to add your thoughts on the subject of whether, and how, to invest in disruption.

MoneyPlace

In line with my policy of showing you all of the new peer-to-peer lenders as yield investment possibilities (and any other yield ideas I can find) I spoke to the latest P2P entrant this week – Stuart Stoyan of MoneyPlace.

It's an unsecured consumer lender up to $35,000 per person. Stuart's particular angle is that you don't lend to a specific loan – the money is lent in risk tiers and each investment is spread among 10 loans, that is, no more than 1 per cent of each person's investment is exposed to one risk. Interesting model.

Watch him, and read the transcript here.

Melbourne IT

This was Australia's first internet domain name dispenser, and has been going for nearly 20 years. Most of the money is still made from domain name registrations, but it's now a declining legacy business. Martin Mercer is now adding some interesting growth businesses to it. The interview can be found here.

Uscom

My final interview for the week was Rob Phillips of Uscom, a medical device company that sells a non-invasive heart monitor and is about to launch a blood pressure device as well. This is an $18 million market cap business that is still losing money, but Rob says they're about to break even following the acquisition of a medical device company in Hungary. Here's the interview (and interestingly there were some very well-informed questions from the audience.

Dick Smith

Forager Funds has responded to our response to their critique of the private equity ownership of Dick Smith, when they called it "the greatest private equity heist of all time”.

Readings & Viewings

Nice video about farming: “See this? (flicks a wad of money) I got this from selling corn! Comes out of the fucking ground!”

Good interview with Peter Garrett by Andrew West of the ABC's Religion and Ethics Report.

Phenomenal video of the Sun, incredibly detailed and clear – really shows what it looks like, including all the massive explosions. Not bad music with it either…

Islam and the future of tolerance.

China's demand for cars has slowed, but overcapacity is the new normal.

A flash report from Bloomberg called “What you need to know about the world economy in 2016.”

The arrival of Facebook and Twitter appeared to threaten the advertising industry's very existence. So what happened next?

The coal industry is in crisis.

Malcolm Turnbull promised a faster and cheaper broadband network, but it's already slower and more expensive than the old one.

The new Trudeau's new Canada.

Norway's worried about its “unprecedented” housing splurge. Welcome to the club!

A very nice video about teaching a pelican how to fish.

Can BHP and Vale be the leaders they need to be after their dam failed in Brazil?

In Syria, Assad is a dead end.

The robot revolution and other great transformations in the nature of work.

I interviewed Glyn Davis, the vice chancellor of Melbourne Uni this week, the week after the PM had a go at him for something to do with university research. This blogger reckons it's all Malcolm's fault. (Glyn was too polite to say that.)

Does one piece of bacon really equal one cigarette?

This is a dense, technical report, but it has a wonderful chart in it: inflation from 1628 to 1973.

The tourism industry in North Korea is taking off, would you believe.

Microsoft is putting servers in Germany to get them away from US intelligence agencies.

Sea level data (just sayin).

The Economist on Myanmar's new era.

Yanis Varoufakis is on a quest to save Europe from itself.

Elegiac, melancholic – Spectre would be a fitting, if strange, end to James Bond. (Until the next time the studio needs some cash, of course.)

Another bubble bursts – ultra luxury London home prices tumble.

Ten economic facts that power the Bernie Sanders insurgency.

Mal Dunning sent this in – it's Carole King, Celine Dion, Gloria Estefan and Shania Twain doing “You've Got a Friend”. Very, very nice.

And Georgine sent in this wonderful video of a mature Joni Mitchell doing Both Sides Now in 2000, to a long, standing ovation.

Happy Birthday Claude Monet, 175 today.

Financial Planning explained by an Irishman.

Paddy bought a donkey from a farmer for $100.

The farmer agreed to deliver the donkey the next day.

In the morning he drove up and said,

‘Sorry son, but I have some bad news. The donkey's died.'

Paddy replied, ‘Well just give me my money back then.'

The farmer said, ‘Can't do that. I've already spent it..'

Paddy said, ‘OK then, just bring me the dead donkey'

The farmer asked, ‘What are you going to do with him?'

Paddy said, ‘I'm going to raffle him off.'

The farmer said, ‘You can't raffle a dead donkey!'

Paddy said, ‘Sure I can. Watch me. I just won't tell anybody he's dead.'

A month later, the farmer met up with Paddy and asked,

‘What happened with that dead donkey?'

Paddy said, ‘I raffled him off. I sold 500 tickets at $2 each and made a profit of $898′

The farmer said, ‘Didn't anyone complain?'

Paddy said, ‘Just the guy who won. So I gave him his $2 back.'

Paddy now works for the Commonwealth Bank of Australia.

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

The past week has seen shares under pressure again as worries about a Fed rate hike next month driving the $US up, putting downwards pressure on commodity prices and reigniting worries about the emerging world returned. Resources shares led the way down as oil and iron ore prices head back towards their recent lows. This in turn has seen Australian shares fall almost back to their September lows, even though global shares remain well above them. While US, Eurozone, Asian, emerging market and Australian shares fell over the week Japanese and Chinese shares rose. Despite the fall in commodity prices the $A actually rose helped by stronger than expected Australian jobs data. Bond yields rose in Australia on the back of the jobs data but fell in the US, Japan and particularly Europe where talk of ECB easing is weighing.

Back to worries about a rising $US and its impact on US growth, commodities and the emerging world. With heightened expectations the Fed will now raise interest rates in December we are seeing a return to the worries of August and September that a stronger $US will weigh on commodities and accentuate the risk of a crisis in the emerging world and that this will all blow back and harm the US. If the Fed is not careful this could see a re-run of September where the Fed is forced yet again to back down from its plans to raise US rates. To minimise the risk of such a re-run, key Fed officials are trying to sound a bit more dovish, emphasising that the pace of hikes will be very gradual. This was particularly evident in a speech by NY Fed President Dudley, and is all aimed at damping down upwards pressure on the value of the $US. As the path of least resistance of the $US is up (as the Fed moves to hike and other central banks like the ECB and BoJ continue to ease), expect more dovish talk of a gradual approach from the Fed and also bear in mind that the $US will be a big brake on how much the Fed will be able to tighten. So it's worth keeping an eye on.

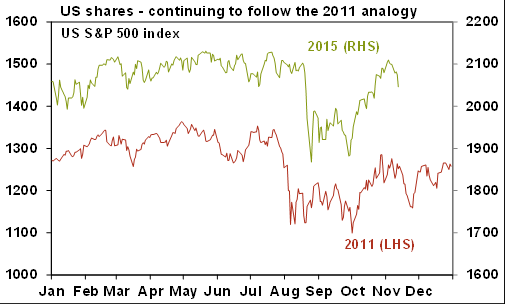

US shares still following the 2011 analogy. After a strong gain through October, the 2011 analogy now points to a pull back through November. Fed worries are likely to be a key driver of this. But once the Fed is out of the way expect a decent rally into year-end as investors get more comfortable that the Fed is not going to be aggressive and is allowing for the impact on the $US and global growth. Global share markets generally are likely to follow a similar pattern, but with Australian shares remaining a relative underperformer as commodity price weakness continues to weigh.

Source: Bloomberg, AMP Capital

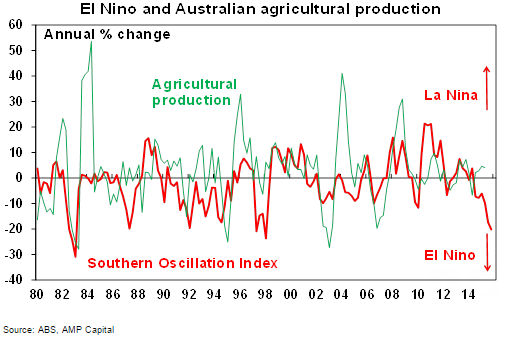

El Nino and the Australian economy – should we be worried? Indicators of the risk of a serious El Nino weather phenomenon have been getting more concerning. An El Nino sees trade winds that normally blow across the Pacific to the west (La Nina) weaken or reverse causing more rain in the east Pacific and less rain/drought in the west. It is commonly measured by the Southern Oscillation Index which measures sea surface pressures across the Pacific and it is nearing levels seen around the last major El Nino of 1997-98 and so warning of drought in Asia and the east coast of Australia, pointing to lower farm production and higher food prices. For Australia, the link from El Nino to farm production varies, eg farm production was little effected by the severe 1997-98 El Nino but was more affected by weaker El Nino's last decade. See the next chart.

Source: ABS, AMP Capital

And swings in farm production don't have the impact they used to on the economy as it is now only just above 2% of GDP. That said a severe El Nino drought induced slump in Australian farm production at a time when growth is sub-par would not be good. For example a 20% slump in farm production (as occurred in the 1982-83 severe El Nino) would knock around 0.45 percentage points off GDP growth. While food prices may see some upwards pressure, the hit to growth would likely dominate the RBA's thinking supporting the case for lower rather than higher interest rates.

Major global economic events and implications

US data was a bit light on with no major economic releases and mixed signals. Jobs data remains solid with ultra-low jobless claims and strong job openings supporting the case for a Fed rate hike. Against this though, small business optimism held steady at a moderate level, wholesale stockpiles rose more than expected and import prices fell more than expected in October. Rising US interest rates at time when Europe and Japan are still easing will only mean a rising US dollar which in turn will mean downwards pressure on US import prices and hence inflation making it harder for the Fed in meeting its objective to get core inflation back to 2%.

In Europe, there was more talk of ECB easing in December and industrial production fell again in September.

Japanese economic data was a bit better with a rise in current conditions according to the Eco Watchers survey and a decent rise in machinery orders in September. The underlying improvement in the Japanese economy is evident in a collapse in Tokyo's office vacancy rate to 4.5% from 9.4% in 2012.

Chinese economic data was a mixed bag consistent with a stabilisation in growth, but no improvement. Export and import data fell more than expected in October and industrial production slowed a bit further but retail sales, car sales and investment picked up. Sales tax cuts for small vehicles are clearly helping and fiscal stimulus is evident in a 36% rise in fiscal expenditures over the 12 months to October. Credit data was weaker than expected but after adjusting for local government bond issuance still showed an acceleration in terms of annual growth rate. More stimulus is needed though and with non-food inflation of just 0.9%yoy and producer prices falling 5.9%yoy, there is plenty of scope for the PBOC to provide more monetary easing next month (on its easing every two months cycle). Finally a surprise rise in China's foreign exchange reserves suggests the capital outflows that had been triggered by August's RMB devaluation have come to an end.

Australian economic events and implications

The past week has seen a run of mostly better Australian economic data, culminating in a blowout jobs report. Business conditions held above average levels according to the latest NAB survey (although confidence is subdued), consumer confidence recovered to long term average levels presumably helped again by the “Turnbull factor” and jobs growth was unbelievably strong.

While the October jobs report ( 60,000 jobs in one month and unemployment back to 5.9%) was too good to be true, with a payback likely at some point, the underlying trend in jobs growth suggests that the economy is holding up reasonably well helped by a rebalancing away from WA to the population rich states of NSW and Victoria. As a result a December rate cut is now looking very unlikely and we will need to see a run of softer data to get a rate cut early next year now. Meanwhile, housing finance data for September showed a further fall in lending to investors only partly offset by increased lending to owner occupiers.

Next Week

By Craig James, CommSec

Reserve Bank Board minutes and wage data in focus

After a busy fortnight, there are only a few economic or financial events to watch in Australia in the coming week.

The week kicks off in Australia on Monday with the October data on new vehicle sales from the Australian Bureau of Statistics. The original sales data has already been issued by the Federal Chamber of Automotive Industries. The ABS merely republishes the data in seasonally adjusted and trend terms. The data will confirm that new vehicle sales were at record highs in the year to October.

On Tuesday, the Reserve Bank issues minutes of the Board meeting held on November 3. No doubt there was keen discussion on interest rate settings in the wake of rate hikes by Australian banks. While the Reserve Bank Governor has already talked about the issue and it has been covered by the Statement on Monetary Policy, investors are always on the look-out for further insights.

Also on Tuesday the weekly ANZ/Roy Morgan consumer confidence survey is released.

On Wednesday the ABS issues the wage cost index -- the main measure of wages in Australia. We expect that wages rose by 0.6 per cent in the September quarter with the annual rate unchanged at 2.3 per cent, the slowest pace of growth since the series began in 1997.

Also released on Wednesday is data on imports of goods, a timely measure of spending in the economy, and the leading index. And Reserve Bank assistant governor (Financial Markets) Guy Debelle, speaks at the Bloomberg Summit.

On Thursday, detailed employment data is published, including geographic and demographic details on indicators like jobless rates.

And on Friday, the ABS will issue the State Accounts for 2014/15, an historical record of the economic performances of state and territory economies last financial year.

Mixed offerings in the US

There is a mix of ‘top shelf' and ‘second tier' indicators in the US over the coming week.

The week kicks off in the US on Monday with the Empire State manufacturing survey.

On Tuesday the focus in the US will be on monthly inflation data (consumer prices) as well as industrial production. The Federal Reserve is closely watching all the economic indicators to determine if rates should be lifted in December.

But if inflation remains well contained, it reduces the urgency for a move next month. Economists tip a 0.2 per cent lift in the core measure (excludes food and energy), keeping annual inflation near 1.9-2.0 per cent. A modest 0.1 per cent lift in production is also expected.

Also on Tuesday, data on capital flows is expected in the US together with the usual weekly data on chain store sales.

On Wednesday in China, the October figures on house prices are released. In the year to September house prices were down 0.9 per cent.

On Wednesday in the US, the Federal Reserve releases minutes from the last policymaking meeting held on October 28. Analysts will be going through the report with a fine-toothed comb for assurance that rates are set to rise at the December meeting.

Also on Wednesday, the October data on housing starts is released together with the usual weekly report on mortgage transactions -- purchases and refinancing. Economists are tipping a 3.4 per cent retracement in housing starts after the hefty 6.5 per cent increase in September.

On Thursday the leading index is released together with the influential Philadelphia Federal Reserve survey and the usual weekly data on claims for unemployment insurance. Economists tip an encouraging 0.4 per cent lift in the leading index while the Philly Fed index is expected to improve from -4.5 points to 0.5 points.

On Friday, the only data of note is the Kansas City Federal Reserve manufacturing index.

Sharemarkets, interest rates, commodities & currencies

At face value, it hasn't been a great year for Australian shares with the ASX 200 index down by around 5 per cent over 2015. But while the broader market is down, a number of industries and sectors of the market have actually performed well.

It has been the larger resource stocks that have done badly, reflecting lower commodity prices. But the Small Ordinaries index is up around 2 per cent with the MidCap50 up 6 per cent.

Across 20 industry sub-sectors, 12 of the sectors are currently up on the year. Leading the way is the autos & components sector (up 30 per cent) with transportation up 28 per cent, diversified financials up 27 per cent and utilities up 15 per cent.

Leading the declines is energy, down 25 per cent, food & staples retailing, down 15 per cent, with both the banks and materials down around 12.5 per cent. media and telecom sectors are also amongst the losers over 2015.

Interestingly, despite the ASX200 being down 5 per cent over 2015 and the All Ordinaries down 4 per cent, market capitalisation is flat, reflecting capital raisings.