Kohler's Week: Chinese money, Commodities, TPP yawn, Gross Bill, Politics, Eureka Interactive

Last Night

Dow Jones, up 0.2%

S&P 500, up 0.08%

Nasdaq, up 0.4%

Aust dollar, US73.2c

Chinese money

The best news items of the week for us (Australian investors) were not the TPP or even the sensational lawsuit launched by Bill Gross against Pimco, but two other things that went unnoticed.

First, on Monday a senior IMF official posted a blog that said China's exchange rate is now “broadly in line with fundamentals” and then on Wednesday the People's Bank of China issued its September foreign exchange reserves report which showed that intervention to prop up the yuan had been much less than it was, and less than anyone expected.

Why are these things important? Because China was at the heart of this year's stock market correction, and the big August crunch was triggered by China's devaluation. As I explained last week another factor, perhaps more important, has been the rising risk of a US downturn, but the trigger was China, and the prospect of a run on the yuan, which would lead to an out-of-control spiral in emerging markets generally and China in particular.

China's purpose in devaluing and widening the management band of the currency so it was more market-based, was to get the IMF to include the yuan in its Special Drawing Rights basket. The SDR is a sort of alternative reserve currency, or more precisely reserve asset, based on a basket of international currencies that is reviewed every five years. The next review is next month, and China is very keen to get into it as an affirmation of its progress. In some ways it would be a bit like China's entry into the World Trade Organisation in 2001, which set the country on its colossal growth path and utterly changed the world. Joining the SDR would be for its financial system what joining the WTO was for its manufacturing industry.

If the IMF gave a tick to China's financial liberalisation program by bringing it into the SDR, that would be a tremendous boost for President Xi's reform push and encourage him and the Communist Party to keep going. China would thus continue to liberalise its exchange rate and resist the temptation to go for a big, disruptive devaluation and pump-priming exercise to boost the economy. So far this year they haven't done either, even though they must have been tempted given the slowdown in the economy and the overvaluation of the currency (the yuan is the only major currency still overvalued against the US dollar).

On Monday, Changyong Rhee, the IMF's director of Asia Pacific Development, gave a big boost to the prospects of the yuan being brought into the SDR with a blog post on the IMF website that said: “The recent change in the exchange rate regime also had large ripple effects, particularly in Asia due to the uncertainty created by the move. However, the change in the exchange regime is consistent with the authorities' intention to move to a more market-determined exchange rate.

“Moreover, following a significant real appreciation over the past year, the renminbi has only depreciated by around 3 per cent since the change. This does not alter the IMF's assessment that the exchange rate is broadly in line with medium-term fundamentals.”

So things look pretty good for the yuan going into the SDR. Then in its World Economic Outlook the IMF took up the theme again on Tuesday, predicting that Chinese growth would slow to 6.3 per cent next year and commented: “further progress in implementing the authorities' structural reforms will be critical for private consumption to pick up some of the slack from slowing investment growth.”

Anatole Kaletsky of GaveKal has been telling clients for a while that the most likely catalyst for a resumption of the bull market would be evidence that Beijing does not want a further devaluation of the yuan and that markets wouldn't be able to force one.

The fact that the PBoC's foreign exchange reserves only fell $US43 billion in September, compared with $US94 billion in August, suggests that the global hedge funds have lost interest in a bear raid on the yuan to test the Government's resolve. A big part of the stock market correction was due to fears that a Lehman-style vicious circle would develop around China, with weak economic data leading to a collapse in confidence and a run on the yuan. That's why the very small 3 per cent devaluation in August caused such consternation.

If those fears truly have now passed, the IMF includes the yuan in the SDR, and the emerging market financial imbalances look like working themselves out without a 2008-style dislocation, then there's no reason markets shouldn't rally strongly into Christmas.

Commodities

Having said all that, China's slowdown is a disaster for Australia and is far from over. Although demand volumes have not fallen that much, we need to remember that commodities are financial assets these days. For example, what I quote each night on the ABC news is not the actual price of iron ore or copper or oil, but the “front month” of the futures market, which is called “spot”. It is more or less what a producer would get if they tried to sell a load of, say, iron ore on eBay, but there's not an exchange for iron ore, as such.

Futures contracts are traded by speculators as well as producers and buyers, and the speculators are the marginal pricers. And they aren't looking at today's supply and demand, but what they think will happen in a while, which is why it's called the futures market.

Commodity prices have collapsed because of an expectation that demand from China will fall, and that supply will remain elevated by cash-starved producers. That especially applies to oil.

In other words, the price decline up to this point is an event of anticipation, not response. So the question is: have prices now fully discounted the Chinese slowdown. Answer: yes, on what we know so far. If China's economy slows to roughly 6.3 per cent growth next year, as forecast by the IMF, commodities have probably bottomed.

A couple of things about that. First, if that's true don't expect some kind of rapid recovery. It's more likely to have a once-off adjustment because China's growth is unlikely to bounce back to 10 per cent any time soon; in fact the risks are all to the downside.

In some ways, this adjustment to commodity prices was exactly what the world needed. Central banks were getting exhausted trying to prop up the world's economies with monetary policy, and so lower oil and commodity prices have triggered a large drop in relative prices and a transfer of wealth from producers to consumers. Indebted consumers have been saving the gains at first but will soon start spending them. Also, those feeling pain, such as Australia, always tend to react faster than those feeling a gain.

So it's natural that the initial effect of the commodity price collapse has been bad. Later, for the world as a whole at least, it will be good.

As for us, it's really bad so far but thankfully Australia has a more complex economy than all of the emerging markets, so we are in a position to benefit from lower commodity prices and a lower exchange rate, as well as suffer from our reliance on commodities. Tourism is already growing solidly and Australia's healthcare industry is booming. There will be a one-off shock to employment from the closure of the car industry over the next few years, but as long as the currency keeps falling and settles in the 60s, as I expect, I'm confident that other manufacturing industries will emerge to soak up the newly available labour.

TPP yawn

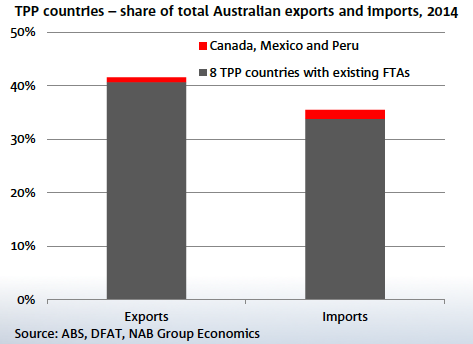

Meanwhile the TPP is a bit of a hyped-up yawn really. Australia already has free trade deals with eight of the 11 others that are in it, and the other three are Canada, Mexico and Peru, and we have a tiny trade deficit with each of those, and not much potential for more exports to them. We haven't heard much about that during all the hype about the TPP this week, have we?

But more trade is always a good thing, and while Australia has already cut most of its trade barriers, which is the main benefit of any free trade deal – to reduce one's own barriers – we might get some better access for food and services exports to some of the markets.

There's a lot of grumbling about Investor State Dispute Settlement (ISDS) procedures, because it supposedly gives US corporations the right to sue the government over any change in laws or regulations that affect it.

But this is massively overstated. It's limited to breaches of rules in the Investment Chapter of the TPP, it will explicitly not protect companies from a loss in profit following a change in government policy or regulation, and there are explicit safeguards to protect the right of governments to make decisions in the public interest, such as in health and the environment. Tobacco measures cannot be challenged, for example.

The benefit of ISDS is that it is supposed to lower risk premiums for foreign investment, but the way it's worded in the TPP seems to be so watered down that it won't even do that.

Are there any opportunities for investors out of the TPP? Not much. If you can find a beef, rice, sugar or seafood business to invest in, that might be worthwhile. There'll be greater access for wine as well, so Treasury Wine Estates might benefit.

But remember this is not a series of bilateral deals with Australia – every other country in the TPP gets the same improved access, so it will be competitive.

Gross Bill

Oh, and Bill Gross. Gosh. He got a bonus of US$S300 million in 2013 and is now suing his ex-employer, Pimco, for the $US200 million bonus he says remains outstanding for 2014. Now that's what I call a bonus!

Amusingly, in the lawsuit he calls himself “one of the foremost authorities on the bond markets”, the “world-famous investment manager”, the “world-renowned investor” and “a towering reputation”, so not lacking in confidence is his Billness. Actually, the fund he ran for Pimco under-performed the benchmarks in both 2013 and 2014, so I'd say he was fortunate to get his base, let alone that bonus. I think he ought to shut up and keep the $US300 million.

I interviewed him for Inside Business once, and it wasn't my easiest interview that's for sure. Unfortunately the camera and lights team in San Diego were a bit slow setting up and The Great One wasn't happy. “I'm pissed now,” he said, which in Australia would have meant he'd been drinking (which might have been true!). Anyway the interview went downhill from there.

Politics alert

Those who don't want to read my views on politics, please avert your eyes, although this does have some relevance for investing.

Clearly the change of PM from Tony Abbott to Malcolm Turnbull is as much of a change of government as when a different party wins an election. There has been a sea change in the way the Government operates, which is likely to lead to greater stability and consensus, and changes in policy substance are starting to flow as well. The only difference with an election is that this time there are no expensive promises to fulfil.

In my view, it's all good and Malcolm Turnbull could well be Prime Minister and the Coalition the government for a very long time. Bill Shorten now has no hope and will go down with Andrew Peacock, Brendan Nelson and Mark Latham as one of opposition leaders who never became PM (you watch Turnbull steal the infrastructure policy he announced this week). To the extent that dysfunctional politics has depressed consumer and business sentiment, that has finished. To the extent that an ALP government is bad for investors, it won't happen.

The only negative I can think of is superannuation taxes, which are likely to go up, but that's not a party political issue – it's bipartisan, because there are so few other ways to get the budget back to balance.

Eureka Interactive

Four interactive interviews this week, all of them perfect in their own way ;-).

First, Mark Sowerby, the founder of Blue Sky Alternative Investments (BLA:ASX), the alternatives fund group and LIC for small, self-managed super investors, as well as high net worth people and family offices.

He runs about 60 funds, some of them special purpose vehicles owning one business. In some ways the most interesting investment is in water rights, which represent 32 per cent of the assets of the LIC, Blue Sky Alternatives Access Fund (BAF:ASX). Anyway, Mark is articulate and convincing on the subject of investing in illiquid investments, something I've been banging on about for a while. You can watch the interview with Mark, or read the transcript, here.

Second is Stephen Porges, executive chairman of DirectMoney (DMI:ASX) a lender of unsecured personal loans. Stephen used to be CEO of Aussie Home Loans. It's sort of a peer-to-peer lender, except the structure is through a trust, not directly from lenders to borrowers. The fund pays a yield of around 8 per cent, supported by loans that yield about 14-15 per cent interest. The difference is the company fee and costs of 2.5 per cent and a buffer for bad debts of 4 per cent. This is both an income investment (in the fund) and a growth investment -- in the company, which is currently capitalised at $13 million. The interview is worth watching, or reading, because I get Stephen to talk about valuation, and how much the company is likely to make. Here it is.

Third is Frank Wilson of TFS Corporation (TFC:ASX), who I had on in December last year. The stock hasn't done much since then, in fact it hasn't done anything at all, which is slightly miffing to yours truly, since I bought some. But it's definitely a longer-term investment. As Frank explains, the harvest will increase ten-fold next year and then another ten-fold five years later. The stock will be re-rated if that actually happens and the wood and oil is sold without collapsing the price. The interview is here.

Last but not least, Warren Ebert of Sentinel Property Group. This is a purely income investment opportunity and Warren pays yields of between 9.5 and 15 per cent. The various commercial funds that he runs (mostly retail) are all geared about 50 per cent and investors simply get the difference between rent and interest paid plus fees, which include performance fees. Warren does pretty well, but so do investors, and he has a happy, loyal following. Here it is.

And by the way, James Samson and Mitchell Sneddon did an excellent video update on Mitch's Listed Investment Company portfolio, which is well worth a look as well.

Readings & Viewings

This is quite long (41 minutes). It's a video of Mark Sowerby of Blue Sky Alternative Investments, who I interviewed this week (see above), swimming the English channel in August for charity. I haven't watched it all yet. Mark says it was a tough day, which I imagine is quite an understatement. I get the impression it wasn't very nice at all, but he seems to be glad he did it. The password to watch the video is “starlight”.

This is a very clever skit involving Jimmy Kimmel and Matt Damon. It's basically a long (11 minutes) and elaborate promo for The Martian, Damon's latest film. But it's really good.

Photos from space highlight the miserable lives of North Koreans (the place is dark).

Stiglitz: the Trans-Pacific free trade charade.

"Is the dot com bubble about to burst (again)?” Of course not! It's totally different this time. Isn't it?

Really interesting piece by Michael Wolff on the long death of New York's Daily News.

Stephen Colbert on the Oregon shootings, Donald Trump and political honesty.

The world beard and moustache championships. Oh what a bunch of weirdos!

Why is Ronald Reagan so idolised by the Republican Party? Because there's no one else really.

Barrie Cassidy: Turnbull's overhaul has Labor on the back foot.

The Shakespearean tragedy of Tony Abbott's prime ministership could only have happened because of the destructive power triangle at the party's apex.

Australia's climate policy is messier than a teenager's bedroom, but is Turnbull the man to tidy it up?

Tim Cook's Apple has forced the whole tech world to realign.

Here's a phone that's just a phone – it does nothing else. “And it's beautiful.”

This interesting piece argues that the TPP is the biggest global threat to the internet.

This is the main purpose of the TPP: to kick-start Abenomics again.

Maybe the key TPP losers – China and Europe – should join forces.

John Menadue: the Government just does not get it on free trade agreements.

China's first Nobel prize laureate in science.

Why Facebook's “real names” policy is dangerous.

Very clever analysis of what's going wrong with investing now.

Peter Singer: Volkswagen and the future of honesty.

Investing by thematics rather than indexes.

Paul Krugman briefly discusses Ben Bernanke's book, and asks: did the Fed really save the world?

When the invisible hand goes wrong, free markets and competition can cause serious problems.

Happy Birthday Giuseppe Verdi. Here is Le Fosche Notturne Spotigle from Il Trovatore, with electric bass and guitar. It's great!

It's also Thelonious Monk's birthday (1917-1982). Here he is in 1966 doing Round Midnight.

And finally Happy Birthday Midge Ure, 62 today. Here he is at the front of Ultravox at Live Aid in 1985 doing their most dramatic song – Vienna. What a fantastic voice!

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

The past week has seen the rebound in share markets and other growth related assets gather pace led by US shares which have closed above the range they have been in since their sharp fall in August. The major driver has been diminishing concerns regarding both China and the Fed. The rebound in share markets has been reinforced by stronger commodity prices, which has helped energy and mining shares. Commodity currencies such as the Australian dollar have also bounced up. Reflecting the “risk on” trade bond yields have generally increased.

While global economic data releases over the past week were pretty mixed, a number of developments have come together to drive the rebound in growth assets like shares and commodities:

- At their late September lows shares had become ripe for a rebound as valuations had improved significantly, shares were technically oversold and investor sentiment had become so negative that it only needed a bit of good or less bad news to spark buying;

- The Minutes from the last Fed meeting have reinforced the impression that the Fed is waiting to get comfortable regarding global growth and US inflation and that with September payrolls disappointing the first hike is likely to be delayed into 2016.

- A slowing fall in China's foreign exchange reserves in September (down $US44bn on an adjusted basis from down $US129bn in August) suggests that capital outflows from China have slowed as fears of a sharp depreciation in the Renminbi have subsided (thanks partly to its stability of late and assurances from the Chinese Government that a sharp depreciation is not on the cards). This in turn provides scope for the PBOC to undertake further monetary easing in the months ahead.

- More broadly, the ongoing flow of easing measures in China is adding to confidence that the risks from China's share market and economy are coming under control.

With US shares breaking out of the range they have been in since their August falls and this dragging other markets (including the Australian share market) higher, more upside is likely ahead as we come into traditional seasonal strength into year end, albeit with a few bumps along the way. The cyclical bull market in shares looks to be resuming.

The latest downwards revisions to the IMF's global growth forecasts - to 3.1 per cent for 2015 (from 3.3 per cent) and to 3.6 per cent for 2016 (from 3.8 per cent) – is nothing new or alarming. For the last five years or so, the IMF's global growth forecasts for the year ahead have started near 4 per cent only to end nearer 3 per cent. So, nothing new. On the one hand it highlights the ongoing constraints on global growth post the GFC. On the other hand if growth did really take off it would only usher in worries about overheating, inflation and monetary tightening. So maybe uneven and constrained global growth is the best outcome.

News that 13 Asia-Pacific nations including the US, Japan and Australia have finally agreed the Trans Pacific Partnership free trade deal is to be welcomed, but don't get too excited. Free trade is great but watching for the impact of new trade deals on overall economic growth or share markets is like watching grass grow. And of course, the TPP has to be passed into law in each country and there are some uncertainties on this front in the US. I won't be changing any economic growth forecasts or investment market expectations as a result of it!

Major global economic events and implications

It was a quiet week on the data front in the US. Services conditions PMIs fell in September but remain solid suggesting no problems in terms of growth on this front and jobless claims remain low. However, the trade deficit increased in August and points to trade detracting around 0.5 per cent from September quarter GDP growth. This, plus a detraction from inventories, is likely to knock September quarter growth back to around 1.5-2 per cent annualised after 3.9 per cent in the June quarter. While final demand will be strong, the continuing hot and cold nature of US growth around a 2 per cent or so trend is another reason why they Fed shouldn't be rushing into a rate hike.

German factory orders fell in August raising fears about an impact from slower emerging world growth. With the German manufacturing PMI holding up reasonably well though in September it's probably too early to get too concerned but is worth keeping an eye on.

The Bank of Japan left is quantitative easing program unchanged but with growth and inflation remaining too low – with weak machinery orders providing a reminder of the former – further BoJ easing likely remains on the cards for some time in the next six months.

Australian economic events and implications

In Australia, the RBA provided no surprises in leaving interest rates on hold, making very little change to its post meeting statement. However, it has acknowledged that APRA's measures to slow investor lending seem to be working which arguably provides it with more flexibility on interest rates. At this point the RBA still seems pretty comfortable with current interest rate settings but my view remains that the economy will still need a bit more help from lower RBA interest rates and a lower $A. Economic data over the last week was somewhat upbeat. Sure the trade deficit blew out again on falling export values, but imports of consumer goods are very strong, housing finance rose strongly in August, the ANZ job ads index rose again last month and while the AIG's services conditions PMI fell in September it remained ok at 52.

Housing finance data shows a continuing decline in lending to investors versus owner occupiers but the strength in lending to owner occupiers is likely to have been exaggerated by the reclassification of some loans from “investor” to “owner occupier”. I suspect that the reclassification relates to old loans that started as investor loans and then remained investor loans even though the borrower moved into the property. This did not matter pre the interest rate hikes on investor loans because the rate to the borrower was the same, but this is no longer the case so some borrowers would have wanted to be reclassified. From the ABS' view point this would be seen as a new owner occupier loan hence distorting lending to owner occupiers upwards. No doubt APRA will be keeping a close eye on this.

Meanwhile, the TD Securities Inflation Gauge showed continuing very low inflation in September leaving plenty of scope for another RBA rate cut.

Next Week

By Craig James, CommSec

Employment data dominates focus

A full schedule of domestic economic data awaits, with key indicators scheduled on each day in the coming week. Overseas, there are top-shelf indicators for release in both China and the US over the week.

The week kicks off on Monday when the Australian Bureau of Statistics releases lending finance data. The figures cover the full gamut – housing, personal, lease and commercial loans. Also on Monday the Reserve Bank releases data on credit and debit card lending.

On Tuesday National Australia Bank releases the September business survey. As the Reserve Bank Governor is fond of stressing, business conditions and confidence levels are actually close to normal, in contrast to the media-driven perception that sentiment and activity are soft.

Also on Tuesday, ANZ and Roy Morgan release the weekly consumer confidence rating. And Reserve Bank deputy governor, Philip Lowe, delivers a speech.

On Wednesday, Westpac and the Melbourne Institute release the monthly survey of consumer confidence. This is more of a check on the more frequent weekly survey. However it will be the first monthly reading since the Federal Government leadership changes.

Also on Wednesday the ABS releases the June quarter Building Activity publication – noteworthy because it includes the latest estimate of dwelling starts or commencements. We estimate that dwelling starts rose by 5.5 per cent to fresh all-time highs.

On Thursday the ABS releases the monthly job figures. Despite seemingly soft economic growth rates, the job market has been quite resilient. We expect that employment may have lifted by just 5,000 in September after strong gains in previous months while the jobless rate may have held steady at 6.2 per cent.

Also on Thursday the ABS will confirm that car sales were at record highs in September.

And on Friday, the Reserve Bank will hand down the bi-annual Financial Stability Review with most interest in comments on the housing sector.

Overseas: ‘Top-shelf' inflation and activity data to watch

‘Top-shelf' economic indicators will be in focus over the coming week in both China and the US.

However, the week doesn't kick off until Tuesday. In the US, the National Federation of Independent Business, a leading small business association, releases its September survey. On the same day the monthly Federal Budget report is released together with the usual weekly chain store sales data.

Also on Tuesday in China, September trade data is released. In August the trade surplus stood at a lofty level of just over $US60 billion.

On Wednesday inflation data dominates in both China and the US. In China both producer and consumer price figures are released. And in the US, the data is confined to just the producer price index (PPI) although alongside another ‘top shelf' indicator in the monthly retail sales data. The core PPI is tipped to have lifted 0.1 per cent in September while retail sales likely posted a modest 0.3 per cent increase.

The usual weekly report on mortgage transactions – purchases and refinancing – is also scheduled.

On Thursday in the US, weekly data on claims for unemployment insurance is issued together with the consumer price index (CPI) and influential business surveys from the New York and Philadelphia Federal Reserve district banks. The core CPI may have lifted just 0.1 per cent in September and by 1.8 per cent over the year.

And on Friday in the US, industrial production data is scheduled together with the consumer sentiment survey, the JOLTS job openings survey and data on longer-term capital slows. Economists estimate that production lifted by 0.2 per cent in September after falling 0.4 per cent in the previous month.

Sharemarkets, interest rates, commodities & currencies

The US earnings season has begun – that is, the time when US listed companies release their latest revenue and profit figures. And yet again analysts are telling investors to brace for weakness. For the first time in five years, S&P 500 companies are expected to report lower earnings than the previous year with estimates centred on a decline of around 5 per cent.

FactSet senior earnings analyst, John Butters, has been quoted by MarketWatch as tipping a 5.1 per cent fall in earnings. Encouragingly, Butters says that only 76 companies in the S&P 500 have so far issued profit warnings – the lowest number for just over three years.

Among those companies reporting on Monday is Infosys, while on Tuesday, Johnson & Johnson, CSX and Intel issue profit results.

On Wednesday, Bank of America, Blackrock, Wells Fargo, and Netflix issue earnings results.

On Thursday, US Bancorp and Advanced Micro are slated to report their earnings results. And on Friday, General Electric and Honeywell are amongst those to report.