Kohler's Week: Bubble trouble, US payrolls, Greece, Politics, Tabcorp, FlexiGroup

Last Night

Dow Jones, down ~0.5%

S&P 500, down ~0.4%

Nasdaq, down ~0.4%

Aust dollar, US77.9c

Bubble Trouble

The global bond bubble is presenting real difficulties for conservative analysts like me (yes, I'm conservative, I kid you not). This week Doug Turek wrote in Eureka Report about the potential for a “melt up” in share prices because of the big fall in bond yields, even though valuations already look quite stretched and the economy's outlook isn't great.

The hunt for yield has been the main share market trade for a few years now and there could well be a big, final blowout this year because fixed interest yields have fallen even further and look like they are staying down – firstly because of a fresh wave of monetary stimulus already in 2015, and related to that, another strong leg-up in the 30-year-old bond bull market/bubble. As Doug wrote: "World bond prices have reached ridiculously high prices, bought by central bankers with electronically printed money and speculators practising the mantra ‘Don't fight the Fed'”.

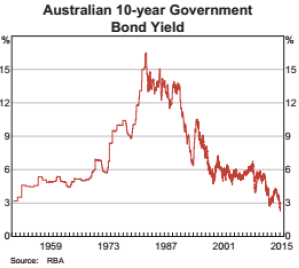

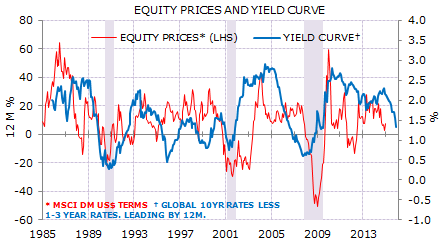

Whether it's a bubble is always impossible to know until afterwards, although I'd say it is. In any case, the yield curve in Australia has inverted even though cash rates are super low. Australian five-year bonds now yield 2% versus cash of 2.25%. Ten year bonds yield 2.4%. This is in line with what's happening elsewhere in the world, as shown by this chart from Gerard Minack:

As Gerard points out, every recession has been preceded by a yield curve inversion, but not every yield curve inversion leads to recession, as we saw in 2012.

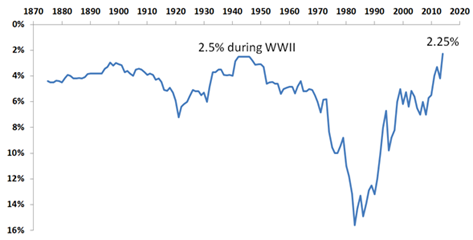

The problem faced by analysts is that not only has the curve gone upside down, but bond yields everywhere are at record lows, which means prices are at record highs, as shown by this chart in Doug's piece this week:

“Price” (yield shown inverted) of 10-year Australian Commonwealth bonds since 1870

And contrary to Doug Turek's point about “don't fight the Fed”, bond markets are betting everything AGAINST the reflation efforts of central banks. Cash rates are being cut not because economic growth is failing, but because inflation is declining and now deflation is a threat. Bond yields are telling us that the efforts of central banks to achieve 2% inflation are not going to work.

The implications of this for investors are enormous. If bond yields stay down and there is no recession, or even an economic slowdown, then analysts will have to adjust their valuations upwards and yield investors will pay more for stocks simply because yields available elsewhere are so low. Share prices could indeed “melt up” and conservative souls like yours truly – worried about high valuations, slow growth and manifold risks – could get seriously caught out. You may remember this happened to me once before – at the end of 2010, when the Australian bond yield halved from 5.6% to 2.8% between early 2011 and mid-2012, because of the decline in inflation expectations – in spite of quantitative easing.

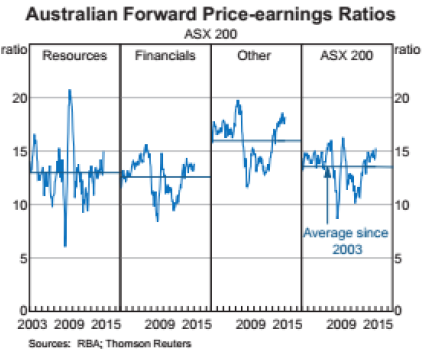

The difficulty now is that although interest rates point to higher share prices, they are not cheap now, as Doug pointed out. Here's the RBA's chart on PE ratios from yesterday's Statement on Monetary Policy:

I've asked our analysts, Simon Dumaresq and James Hannam to explain how the mathematics of valuation works, and how it's being affected by low bond yields, and that should be published on Monday.

US Jobs Boom

Here are a few quotes from economists and investors about the January US payrolls report that came out this morning: “10 out of 10”, “astonishingly strong”, “robust”, “nothing shy of spectacular”.

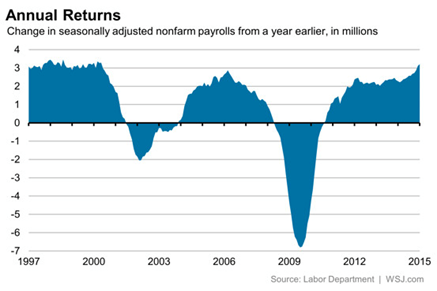

The US economy added 257,000 jobs last month but the unemployment rate rose from 5.6% to 5.7%. Consensus forecasts had been 237,000 and 5.5%. And the increase in the unemployment rate was actually a good thing: it happened because 703,000 people entered the labour force, the biggest gain in seven years, which indicates growing optimism about the economy. As this chart shows, employment growth is now back to what it was before 2000:

Despite the strong jobs growth, the rise in wages remained sluggish at 2.2% and the percentage of long-term unemployed was still high.

The question is whether it all increases the likelihood of a rate hike this year in the US. Even those who base their thinking on the theory of NAIRU (non-accelerating inflation rate of unemployment) will be struggling to push for rate hikes, since the unemployment rate is going up because of rising workforce participation, so far at least. I guess at some point that will change, but no sign yet.

Certainly Wall Street seemed to be taking it as a sign that rates are more likely to start rising this year – the Dow and the S&P 500 both fell after the report. Deutsche Bank's strategist, Alan Ruskin, told the Financial Times: "This is the kind of data that leaves a June Fed tightening in play, against a first hike priced in for October before the data.”

So we'll see. Maybe we're back in the old 'good jobs growth is bad because rates will go up' scenario, which at least had a perverse system about it.

The RBA statement

Yesterday the RBA's Statement on Monetary Policy confirmed there will be another rate cut in quick order, as there usually is: they normally come in pairs, at least.

The last paragraph of the overview says that "informed by a set of forecasts based on an unchanged cash rate, the Board judged at its February meeting that a further 25 basis point reduction in the cash rate was appropriate”. In other words they looked at the forecasts with a 2.5% cash rate, didn't like what they saw and promptly changed the input to 2.25%.

Then later, on page 70, the statement says: "The forecasts are conditioned on the assumption that the cash rate moves broadly in line with market pricing as at the time of writing.” Market pricing right now assumes a 2% cash rate in one month's time, which the RBA knows, so its forecasts therefore assume a 2% cash rate.

And that's why the RBA has been able to hold its 2016 GDP forecast at 3.25%, while lowering the number for 2015 – it knows the cash rate will be cut again, and these forecasts are just what pops out of the mathematical model.

These forecasts should not be taken as any indication of what will actually happen. After all here's the RBA's chart of the terms of trade:

Note that its forecasts are based on the proposition that the terms of trade – therefore commodity prices – will remain flat until 2017. Yeah right.

Greece

The prime candidate for the cause of a ‘melt down' instead of a melt up remains Greece, and the prospect of a eurozone break-up and financial crisis. I still think they will do a deal, but so far the Germans and the ECB seem to be trying hard to muck everything up.

The ECB has suspended the eligibility of Greek sovereign debt in its monetary policy operations, which means Greek banks can't use it as collateral for borrowing money from the central bank. The decision apparently has no impact in the short term, but is designed to put pressure on the new government to come to the table. The ECB has an inglorious history of doing this sort thing – threatening a state with economic collapse if they don't comply with its demands for austerity as a condition of the bailout. Ireland, Spain and Cyprus all got bullied in this way and none of them called the ECB's bluff.

Alexis Tsipras and Finance Minister Yanis Varoufakis seem to be made of sterner stuff, and Varoufakis in particular is some kind of student of game theory, whatever that means. They know that if the ECB buggers up the Greek economy, forcing it to exit the eurozone and thus begin a dominoes collapse of the entire union, history will blame the ECB and Germany, not Greece. The Germans might be right in asserting that the whole thing is the fault of the feckless Greeks and their failure to pay their taxes (German Finance Minister Wolfgang Schäuble this week offered to send 500 German tax collectors to Greece to help out) but in the end the blame won't matter.

If Greece, Spain and Italy leave the union, the euro will do a Swiss franc and appreciate massively, since it would basically become the German currency, and German manufacturers like Volkswagen, BMW and Mercedes would have to exit their factories as well, or become uncompetitive. It won't be allowed to happen.

Politics

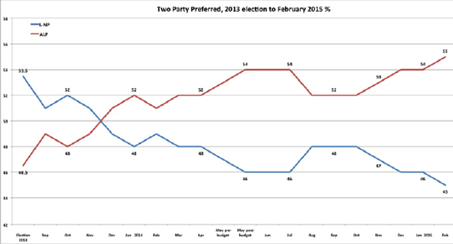

The above graph is the main reason Tony Abbott is facing a spill motion on Tuesday. It does seem like he's been having a touch of the Kevin Rudds – arrogant, isolated, autocratic etc. None of those things would matter if he remained popular and the Coalition's vote had stayed up, but in fact, the Coalition and the ALP have flipped their positions since the election. It was 54/46 on a two-party-preferred basis and now it's 46/54.

The Coalition is headed for defeat in Canberra as well as Victoria and Queensland, and there doesn't seem to be a lot of confidence in Tony Abbott's ability to turn things around. Wiser heads than mine on politics think the Libs will go for Turnbull, either on Tuesday or soon after, and that seems right to me.

More broadly, and at the risk of oversimplifying a tangled tale of human frailty, vanity, ambition, and numbers (see graph above), the Coalition government has had to shift to populism far earlier than usual, no matter who's in charge. The errors started with the May budget's surprises and were crowned by the Medicare debacle over Christmas and January, and the amazing knighting of Prince Philip was the cherry on top. The fact that Abbott stopped the boats and axed the carbon tax didn't turn out to matter much.

It's true that the Howard government's only truly tough budget was its first, but it didn't go all the way to populism until 2006 – after the WorkChoices debacle, when it became clear it was heading for defeat in 2007. The ALP never even got one tough budget in because of the global financial crisis. The 2013 budget did start to reverse the expansions of the previous five, but not enough to offset the impact of the economy on the deficit.

An embattled Tony Abbott has made it clear that the hair shirt is off already and they have moved into populist spending mode. Specifically there will be a new family package to replace Abbott's mistaken “captain's call” of paid parental leave, which will subsidise childcare in some way, and there will be a tax cut of 1.5% for small companies (under $5 million in turnover) but not for the 3000 or so companies turning over more than that. In any case there is almost nothing that can be done about the deficit now, so they might as well as lie back and enjoy it.

Needless to say this is not policy or reform. The reason for cutting company tax is that we are in a competitive world where companies get to choose their taxable location. Nations that charge too much company tax will see their collections decline, not rise, so they have to be sensible and pragmatic about it. But the firms that are least able to shift geographies are the small ones, and they are the ones getting a tax cut.

Treasurer Joe Hockey says any spending or tax cuts will still have to matched with spending cuts, but with the Coalition now trailing the ALP by 8 percentage points 18 months from an election, that will need to be seen to be believed – whoever ends up leader after Tuesday's Coalition party room.

Tabcorp

Tabcorp shareholders will be quite a bit richer next week after the special dividend and rights issue wheeze announced on Thursday. Basically it's a very clever tax scheme: the 30c dividend is fully franked and the rights issue is a decent discount to the market. It means that you can either rebuild your shareholding by taking up your rights and still walk away with a pocketful of cash – the amount depends on whether your fund is in retirement mode or not – or you can sell your rights and retain the same number of shares, and walk away with even more cash. And of course, when the shares come back on next week, they will undoubtedly be a lot higher.

But why not let CEO David Attenborough explain to you how it works – I knocked off a quick interview with him after the announcement on Thursday, and also asked him how the business is going – which is, after all, what should inform your decision on whether to take up your rights, or indeed buy some more. Short answer: the business is going great. But they always say that, don't they? You can watch the interview here.

FlexiGroup

My other CEO interview this week is with Tarek Robbiati, CEO of FlexiGroup, the consumer financier. Needless to say, this business is going great too! – according to Tarek.

But actually this is a very interesting business – earning, as it does, a consistent return on equity of 22%.

As you will learn if you watch the interview, FlexiGroup has five different businesses and the main one, by a fair way, is “no interest ever” lending at point of sale. It simply means the customer doesn't pay interest on the loan – the merchant pays an equivalent fee which he recovers from the price of the product ... or not, depending on how he's going and the competition.

The business works as follows: effective average yield (that is the interest rate, except that it's not interest) across the business is 21.8%; cost of funds is 5.8%; loan loss ratio is 3%. Therefore net loan margin is 13%. I don't know of any other finance business getting that sort of margin.

Nevertheless the share price declined from $4.80 in October 2013 to $2.70 in mid-January this year, from when it started to come in for sustained and apparently well-informed buying, rising to $3 before the half-yearly result on Thursday, before whacking on another 50c after the company reported an 11% lift in profit and an increase in the dividend. The company is guiding to a $90 million full-year profit and market cap is $1 billion, so forward PE is a pretty juicy 11 times and assuming another increase in the final dividend, it's yielding more than 5%, fully franked, at the current price of $3.44.

You can watch the interview here.

Readings & Viewings

Excellent piece by Laura Tingle explaining where the Liberal leadership thing is at (The Liberal Party has moved from thinking "we may have to get rid of him but we aren't quite ready to contemplate Malcolm Turnbull", to "how do we move to Malcolm Turnbull but also put in place a structure that appeases the party's Right and protects Julie Bishop?”)

Abbott faces a leadership challenge - Wall Street Journal.

Michelle Grattan: Abbott should quit for Turnbull.

Tony Abbott bricks himself into the PM's office (satire).

“Greece is no longer the miserable partner who listens to lectures to do its homework.” – Alexis Tsipras, Greek PM.

A chart of how much Greece owes, and to whom. (It's Europe).

The problem is not Greece's debt, it's the eurozone's bailout conditions.

How Greece is using game theory to increase its chances.

This article examines 91 episodes of fiscal consolidation (aka austerity) in advanced and developing economies between 1945 and 2012.

The way to get reform is to talk, and talk, to people. The problem is not the 24 hour news cycle, because Abraham Lincoln had the same challenges.

Gloomy old Nouriel Roubini – we're in for continued slow growth, secular stagnation, disinflation, and even deflation.

GMO is selling its good US stocks and buying the bad and ugly. Here's why.

“Don't Do It, Harper Lee” – an alternative view to the joy about a new book from the author of To Kill a Mockingbird.

Argentina's insane political scandal, explained.

ISIS is losing in Iraq, but what happens next?

China's central bank is fighting just to keep up.

Interesting Background Briefing on Radio National last Sunday about the conflict between native title and the plan in Queensland to allow freehold title for aboriginals.

Burning alive a single human being offends al-Qa'eda - what about 9/11?

Apparently some idiots are tattooing their eyeballs!

Subscription services like Netflix are training people to watch TV without ads. Oh my God, what's going to happen?

The 10 best ads at this year's Super Bowl.

And on the subject of the Super Bowl, here's a long piece from the New York Times about how the winning quarterback, Tom Brady, keeps going.

Phillip Adams did a fascinating interview during the week with Johann Hari, who campaigns against the “war on drugs”. He says that addiction is not what we think it is. I thought he made a lot of sense.

This is the best hole-in-one (on a par 4) you're ever likely to see, unless there was someone in the bunker throwing it out. Even then…

Last Week

By Shane Oliver, AMP

Investment markets and key developments over the past week

Global shares generally rose over the past week with gains helped by better US earnings reports, a stabilisation in the oil price, better Eurozone data and some optimism regarding Greece. However, Chinese shares remained in correction mode. Oil and metals rose from oversold levels helped by a softer US dollar and a further reduction in the US oil rig count. The iron ore price is still drifting down though. Bond yields generally reversed some of the previous week's sharp falls. The Australian dollar rose slightly as the US dollar gave up some of its recent gains.

Australian shares have been a star performer, having surpassed my (too optimistic) target for last year and my target for this year to now be up 7.5% year to date, which is up there with European shares. Clearly the combination of lower interest rates boosting yield plays, the lower Australian dollar boosting earnings and a stabilisation in oil and commodity prices helping resources stocks are having a big impact. While Australian shares are now looking a bit overbought in the short term (with the forward PE pushing above 15 times compared to a long term average around 14 times) and could see a correction or consolidation, the broad trend is likely to remain up.

Expect further easing from the RBA. The RBA did what it should and cut rates to a new record low of 2.25%. This was justified by sub-par growth, low confidence readings, benign inflation and a still too high Australian dollar. The main risk flowing from the latest rate cut is the additional boost it will provide to the property market, but the RBA clearly believes that this is an issue for APRA. Downwards revisions to the RBA's growth forecasts and to its inflation forecasts in its quarterly Statement on Monetary Policy, along with the need to maintain downwards pressure on the value of the Australian dollar in the face of ongoing global monetary easing, are consistent with another 0.25% rate cut in the months ahead. In fact, the RBA's downwardly revised growth and inflation forecasts have already baked in further monetary easing as they are built on the assumption that the cash rate moves down in line with current market pricing. So if the RBA does not cut again at least in line with market expectations, then the implication is that it will take even longer to return the economy to decent economic growth. So we expect the cash rate to soon fall to 2%, with the risks skewed to a dip below this later this year.

China also eased monetary policy with the People's Bank of China cutting the required reserve ratio of banks by 0.5% to 19.5%, freeing up RMB600bn for lending. Coming after a rate cut last November, the Chinese authorities are clearly moving to support growth and with China no longer accumulating foreign exchange reserves it can afford to lower the banks' required reserves. More rate cuts and reserve ratio reductions are likely, with the bench mark lending rate likely to fall to around 4.5% (from 5.6% currently).

In Europe, the argy bargy is now well underway regarding Greece, with the ECB upping the pressure on the Greek Government to reach an interim agreement on its funding program by ending the ability of Greek banks to access cheap ECB funding using junk debt as collateral. This means that it will be harder for the Greek Government to fund itself once the current EU/IMF/ECB funding program ends at the end of the month by issuing short term debt to Greek banks which the latter would purchase using funding from the ECB. Greek banks can still get funding from the Greek central bank but this is a more expensive and the ECB has the power to turn this access off too. So the pressure on the Greek Government to reach a deal has increased immensely as no deal could mean no funding from the end of February and potentially a run on the banks (which may come sooner). There has been a welcome softening in the Greek stance with Syriza dropping demands for a debt write down in favour of lower rates and longer maturities, but the two sides are still a long way apart. However, the ECB move could trigger a resolution quicker than previously thought. Our base case remains that a deal will be reached (although I must admit it's a difficult call) but that even if Greece doesn't agree and heads for a Grexit, the risk to the rest of the Eurozone is manageable as the peripheral countries are now in better shape and defence mechanisms are stronger. In terms of the latter it's noteworthy that Italian and Spanish bond yields remain at record lows.

Major global economic events and implications

US data was mixed with a softer manufacturing conditions ISM index for January and weaker than expected construction and personal spending data and a wider trade deficit, but a solid services conditions ISM and employment readings. The US story remains the same. Growth is solid but not taking off.

The tone to US December quarter earnings results has continued to improve over the last week. We are now two thirds done and 77% of companies have beaten on earnings, 56% have beaten on sales and earnings growth for the quarter has picked up to 4.3% from a low of 1.3% in mid-December.

Eurozone data continued the somewhat better tone seen lately with the services conditions PMI for January revised up resulting in solid gains in the overall composite PMI, retail sales growth at 2.8% year on year (or 3.4% in real terms given falling prices) running at its fastest since 2007 and stronger than expected German factory orders. Eurozone growth looks to be picking up and this was reflected in upwards revisions to European Commission's growth forecasts for this year and next.

Chinese manufacturing and services conditions PMIs were all a bit softer in January, suggesting soft growth momentum at the start of the year. Fortunately, the PBOC is responding with further monetary easing.

Australian economic events and implications

Australian data was mixed with a fall in new home sales and building approvals, although both remain at solid levels, gains in business conditions PMIs, although only to softish levels, strong growth in retail sales volumes in the December quarter and a further narrowing in the trade deficit. Consumer spending and net exports are now likely to make solid contributions to December quarter GDP growth. Meanwhile, home prices saw solid gains in January according to RP Data. While APRA's toughened stance towards home lending was announced in December, it's too early to expect much impact.

Next Week

By Craig James, Commsec

Reserve Bank remains in the spotlight

Another big week of economic events is in prospect in Australia over the coming week, including key data on the labour market. In addition you could be forgiven for thinking that the Reserve Bank would take a step back given the prominence it held over the past week with an interest rate decision and also with the release of the Statement of Monetary Policy. But with a couple of speeches and the Governor fronting the House of Representatives Economics Committee on Friday, the Reserve Bank will dominate investor attention. In China, trade and inflation figures are in focus. And in the US, retail sales and industrial production data are due.

In Australia, the week kicks off on Monday when ANZ releases data on job advertisements. In the past, budding employers would advertise positions in newspapers or on job websites. Now positions are more likely to be found on individual company websites, social media or sent directly to smartphones. So while the data on job ads is less instructive, figures show that the have still risen for the past seven months. Also on Monday the Reserve Bank Governor delivers a speech at the Bank of China Renminbi Clearing Bank launch.

On Tuesday the NAB business survey and indexes of residential property prices from the Bureau of Statistics (ABS) are released.

Investors will be looking for improvement in the NAB business survey after the December results suggested that business conditions has slipped further from 3-year highs. There will be less interest in the ABS home price measure as more complete and timely figures have already been released.

On Wednesday, the Westpac/Melbourne Institute monthly measure of consumer sentiment is released – a survey that provides a useful check on the similar and timelier Roy Morgan weekly survey (released Tuesday). On the same day home loans (housing finance) for December are released.

The home loan data may prove a concern to the Reserve Bank in coming months (in light of the recent rate cut) with data from the Bankers Association suggesting the number of owner-occupier home loans may have lifted by 4% in December while the value of all loans jumped 8%.

On Thursday, the ABS releases the latest job data for January. The statement following the Reserve Bank decision to cut interest rates also highlighted concerns of a further lift in unemployment due to the sluggish below trend growth. Interestingly jobs growth was solid over the latter part of 2014 with unemployment falling for the past two months.

After rising by 37,400 in December, we think employment eased by around 5,000 people in January. With a mild fall in workers looking for work (participation rate – expectation 64.7%) the unemployment rate was probably steady at 6.1%.

If employment surpassed our forecast and followed the recent improvement and unemployment fell towards 6%, then questions would arise if the Reserve Bank February rate cut was validated. Clearly it would take more than one month's worth of data to signify a trend but there has been a solid lift in jobs growth. The key question is if the pace of hiring is strong enough to offset those exiting jobs?

And on Friday, the Reserve Bank Governor faces a grilling by politicians. And providing that they can abstain from playing politics and ask questions of real interest, then real value can come from the session – such as the Governor's view of the ideal level of the Australian dollar and the likely triggers for another interest rate cut.

China trade and US retail sales dominate attention

Turning attention overseas and China will be the focus in the early part of the week. On Sunday China releases trade data for January. In December, China recorded a healthy surplus of US$49.6 billion with exports up 9.7% on a year ago and imports down 2.4%. It is likely that exports continued to record a healthy lift in January with the trade surplus holding around $48 billion.

On Tuesday, China issues January data on inflation – producer and consumer prices. Producer deflation is still being recorded while consumer prices are tame, up 1.5% over the year. Also in China, data on money supply and lending are expected over the week.

Shifting to the US, the week kicks off on Tuesday with the release of wholesale trade and inventories alongside the usual weekly data on home purchase and refinancing.

But the key focus will be the retail sales data released on Thursday alongside business inventories and the regular US weekly data on new claims for unemployment insurance (jobless claims). Forecasts centre on retail sales easing by 0.3% in January after a 0.9% fall in December. A modest 0.2% lift in business inventories is expected.

On Friday, the University of Michigan releases a preliminary reading on US consumer sentiment. The lift in share markets, and cheaper gasoline are likely to be offset by the colder weather.

Sharemarket, interest rates, currencies & commodities

The Australian profit reporting season cranks up a notch in the coming week as the US earnings season starts to wind down.

On Tuesday earnings announcements are expected from Cochlear and Bradken. On Wednesday, AGL Energy, CSL, Domino's Pizza, Stockland and Suncorp are scheduled to issue results. On Thursday, ASX and Telstra are amongst companies reporting. On Friday resource companies Rio Tinto and Newcrest Mining are listed to report.