Kohler's Week: Bonds/banks, Kiwi rate cut, Sydney property, Aconex

Last Night

Dow Jones, down 0.78%

S&P 500, down 0.7%

Nasdaq, down 0.62%

Aust dollar, US77.3c

Bonds/banks

The end of the 34-year-old global bond bull market has been confirmed with a second round of the German bund sell-off, taking the 10-year bund yield to the giddy height of 1 per cent this week and the 10-year US Treasury to 2.5 per cent, a seven-month high.

With the benefit of hindsight, the structural bond bull market ended in mid-2012 when the US yield briefly touched 1.4 per cent.

The 2014 bond rally, that saw CBA's share rise another 16 per cent over that year and then produce a final $10 spurt between January and March 20, can be seen as the great secular bond bull market's death throes. The latest rout actually began a month AFTER CBA peaked, when a German bund auction went badly and yields suddenly spiked. I started telling you about what was happening as soon as I got back from Greece in early May. Then, of course, CBA and the other banks stabilised in May because the US and German yields also stabilised and it looked like I was getting over-concerned (as usual).

But in June bank share prices and bonds have resumed their declines. In the first 10 days of June the banks' share prices fell by an average of 5 per cent as the US 10-year yield rose from 2.12 to 2.49 per cent, German bund yields popped above 1 per cent, from a low, would you believe, of 0.05 per cent and the Australian 10-year bond yield rose from 2.7 to 3.14 per cent. By the way, just to show how unusual, and unusually stretched, the sub-1 per cent bund yield had been, Deutsche Bank's data goes back to 1807 and it says bund yields have been above 1 per cent for 99.6 per cent of the monthly observations.

Anyway, I doubt that you're investing in German bunds. The question is: have the Aussie banks got further to fall. As usual the answer is: that depends – on Aussie unemployment. Global bond yields will definitely keep rising now; they may even “melt up” at some point. Against that, Australian unemployment fell from 6.2 to 6 per cent in May and the feared employment recession seems to be receding. If so, that could offset the effect of rising long-term interest rates. On balance I'd say that the offset, even if it happens, won't be enough and the 14 per cent (so far) fall in the bank share index (21 per cent for Westpac) is the beginning of a bear market in banks that could see a decade of dividends lost in capital.

But as we have said many times at Eureka Report, if you're only in it for income and you bought the banks a while ago, DON'T (necessarily) SELL unless you have a really good alternative, and I mean really good – because capital gains tax has to be made up. The dividends look pretty secure. If you hold the banks “to maturity” you'll eventually get your capital back.

Kiwi rate cut

Arguing against the message from bond markets was the symbolism this week of the New Zealand Reserve Bank's sudden decision to cut its cash rate. The NZRB confirmed its “easing bias” with the words: "We expect further easing may be appropriate.” Yesterday Gerard Minack called it the “final surrender”: "Every OECD economy that has tightened monetary policy since the Great Recession has now reversed course.”

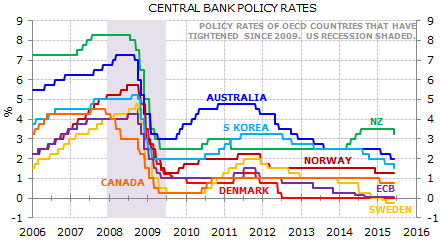

Gerard included this graph with his note (the NZRB was the last to hike and the last to capitulate and cut – Australia was first to do both):

He says Morgan Stanley's economists put it well: "Central bankers are cycling in a low rate peloton. Any bank that breaks away from the pack faces intense headwinds. None seems able to cope, so the pressure on rates – in year 6 of recovery – remains down.”

Downward pressure on short rates; upward pressure on long rates. It is an unresolved contradiction that is like a fork in the road: one fork leads to a continuing US recovery, with the global economy returning to normal – that is, selling stuff to American consumers, with the US current account deteriorating nicely; the other fork leads to another US slowdown, and possibly deflationary bust, which would be exported to the rest of the world. And as Yogi Berra said: if you see a fork in the road, take it! (quoted by GaveKal).

Rising bond yields point to the first scenario, ongoing monetary stimulus points to the second. In September the US Fed will start trying to tighten, according to the messages coming out now. The IMF says there is no reason for the US to start tightening because falling unemployment is not causing inflation to rise. This is something I have been discussing for a while: that the non-accelerating inflation rate of unemployment (the NAIRU) is not what it used to be. Thanks to the deflationary impact of technology, unemployment can be lower without causing inflation to accelerate.

Anatole Kaletsky of GaveKal Research puts it this way: “Today's 10-year Treasury yield of around 2.4 per cent may seem unreasonably low in relation to the real growth of 2.5-3 per cent that is implied by 200,000 monthly payrolls, but with inflation showing no signs of accelerating, the Federal Reserve's inflation target remains well out of reach (the last figure for the core personal consumption price index was 1.2 per cent)."

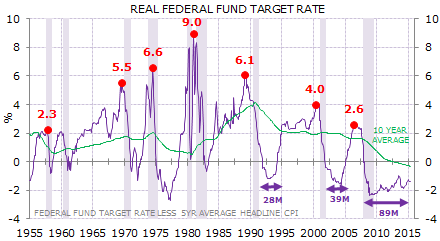

Actually, there's a 30-year pattern of the “neutral interest rate” being lower than the previous cycle, as shown by this graph from Gerard:

If the Fed can achieve lift-off this year, as it expects, and manages to avoid having to go into reverse again as the NZRB did this week, then that suggests the positive scenario will unfold and that bond yields will keep rising. The negative scenario would lead to another collapse in yields and a return in full to the hunt for yield and the Aussie bank bull market.

Sydney property

A further complicating factor to the prospects for banks is all the talk that the Sydney property market and parts of Melbourne are in a bubble.

Glenn Stevens' comments on Wednesday to the effect that “some of what's happening” with Sydney house prices is crazy, and that he's “acutely concerned” about it got a lot of attention, rightly so. It was attention-grabbing stuff. You don't often hear a central banker talking like that, and it comes soon after the Secretary of the Treasury, John Fraser, said much the same thing, although whereas Glenn Stevens used the “C” word, Fraser used the “B” word (bubble). Crazy/bubble – it's all the same.

The argument has become quite heated, with those who say it is not a bubble – including yours truly – accused of being idiots at best. But I give up. If the Reserve Bank Governor and Secretary to the Treasury both think it's a bubble, then it's a bubble, and I'm an idiot.

So is Mike Smith. The ANZ Bank CEO said on Wednesday that he thought house prices weren't a bubble yet, but could become one, which seems to have been widely taken as confirmation that it's already a bubble. Our own Adam Carr (not an idiot) wrote in Business Spectator this week that not only is it not a bubble, but Sydney real estate is not even unaffordable. (I reckon they're too expensive, but affordability is in the eye of the buyer). On Tuesday Joe Hockey said it's not a bubble and that all you need is a good job paying good money, for which he became the focus of a rollicking blocking, and everyone had a lovely time crucifying him. Carolyn Whitzman, professor of urban planning at the University of Melbourne among many others, begged to differ, describing it as “our affordable housing crisis”.

There are only two issues of real consequence to you as an investor: should you invest in a house or flat and should you be worried about the banks? I think the answers are: no, and a little bit.

Probably best to stay away from Sydney and parts of Melbourne (which John Fraser described as being unequivocally in a bubble). Whether he's right or not, two things are true: bubbles and booms always go longer than you think possible, so there may be some distance for Sydney prices to go yet. In any case, medium to long-term returns from assets bought in a hot market are rarely very good. And the market is definitely hot, bubble or not.

A final word on bubble trouble: there is rarely an argument about it when we're in the middle of one. The very definition of a bubble is that the bears have capitulated and everyone is in one, and that is patently not the case at the moment. The bears are vociferous, victoriously so now that the two umpires, Stevens and Fraser, have delivered their verdict, and getting more so by the day.

As for whether you should be worried about your bank shares because there might be a real estate crash around the corner, well the time to worry was three months ago. Bank share prices have fallen 15 per cent for two reasons: bond yields are rising and so is the risk of higher unemployment, and possibly recession. Investors are paying less for the banks' dividends and profits are under threat from rising bad debt provisions.

Aconex

This week's CEO interview – Leigh Jasper of Aconex – is a ripper. This company was started 15 years ago by Leigh, who had been working for McKinsey & Co and his mate from boarding school, Rob Phillpot, a project manager at Multiplex. They were both 26 at the time.

Aconex is now the world leader in web collaboration services for construction projects. Instead of using paper, builders can use the Aconex platform to share and record documents and Aconex gets paid around 0.1 per cent of the project cost. Aconex has 70 per cent of the Australian market for this and close to 50 per cent of the global market. The fascinating thing is that it's early days for this transition from analogue to digital. Leigh says about 25 per cent of Australian projects have so far moved to cloud-based collaboration services, and only about 5-6 per cent of global projects. In particular, China has barely started, and as far as Leigh can tell, Aconex is the only one firmly there at the moment.

As always, I haven't researched this company at all and only know what Leigh Jasper told me in the interview but it looks a very interesting business and I liked the cut of Leigh's jib. By the way, the stock jumped 5 per cent yesterday and has gone up 20 per cent in June. I wish I'd done this interview in May! You can watch, and read, the interview here.

Eulogy

Dad died last Sunday morning and the funeral was held yesterday. You didn't know him: he wasn't famous, or even a high achiever, but he was a wonderful man and a great father. I'll miss him a lot.

Here's the eulogy that I delivered at the funeral:

We're gathered to celebrate the life of Ern Kohler, a really wonderful bloke.

Ern was born in Minyip on June 26th 1926, minutes after his brother Arno (here today).

Their parents Paul and Minna came out from Germany in the 1920s, got married in Melbourne and took a journey to the end of the earth – the Wimmera.

Nations are built on the lives of people brave enough to make such journeys. In their case, Ern's family was built on it.

In Murtoa Paul and Minna brought up four kids. They spoke German in a house on the edge of the lake that smelled of home-made pork sausage and German yeast cakes.

Dad seems to have been a mixture of zero confidence at school and total confidence everywhere else. He'd tackle anything, ride anywhere on his bike, traits that would characterise him all his life. He spent his early teenage years building crystal sets (an early radio for you kids out there).He left school at 14 with a sigh of relief for a job as an apprentice butcher, but didn't really take to it.

At 18, he joined the navy but the next year the war was over and the family moved to Melbourne – to Warrigal Road, South Oakleigh, where for a while they all lived in a huge tent. There's a treasured clipping from the Melbourne Herald testifying to that.

And then, his remarkable father embarked on his fourth or fifth career, this time building houses. Ern did a six-month carpentry course at a local tech and joined his dad.

Ern was always a man of many parts, taught himself photography then and later leadlighting, building ponds, wood turning, vegetable gardening. In Oakleigh he spent every spare hour taking pictures and then developing them in his dark room. He met a professional photographer named Lester Howard whose girlfriend worked with a girl named Mildred Henshaw and introductions were made. Ern and Mill fell in love and last Sunday morning, 66 years after they met, and four days after their 64th wedding anniversary, Mill said goodbye to Ern for the last time.

Over the last few months when I was with him he would become teary whenever he mentioned Mum – not from sadness, I think, but from emotion close to the surface. He said a few weeks ago that they never argued, never raised their voices against each other. Surely not. I checked with mum. She says it's true.

Ern approached love and partnership in the same way he approached everything – like a bull at a gate. 100 per cent -- all in.

Ern and Mill bought a block of land. Dad built the garage and they lived in that while he built the house. I was born 10 months after they were married, the first of four children – Vicki, Jan and Sue-ellen.

…..So that's the general round-up of Dad's life, now I want to speak more personally about my father.

Growing up, the largest, most powerful things in the world were Dad's hands. They were indestructible. I remember him coming home with chunks out of them, black fingernails, pulling splinters out with pliers. I thought those hands could build the world, that Dad could build the world.

I loved being with him, whether it was labouring on his building jobs, fishing or rabbitting, or mushrooming with us all, or picking blackberries, life was full and rich and Dad made it reliable and solid always.

He really was a pretty solitary bloke. Didn't smoke, hardly drank, never talked about football or cricket or racehorses, just wasn't interested. His greatest pleasure was fishing – alone – and for the family that involved an unseen transaction; he wanted to go to distant fishing spots so therefore we got to have adventures in distant holiday spots every year!

I learned from him, even though Dad wasn't really the teaching type, least not with words. For example when I was 13 or 14, mum dispatched him to my room to talk to me about the birds and the bees. He sidled in, obviously uncomfortable, and soon blurted: “You know how to do it, don't you?” “Of course I do, dad,” I replied swiftly and the discussion came to an end, both of us relieved. It was a lie of course. I had no idea.

He was always amazed and maybe even disbelieving, that I was able to make a living with my brains instead of my hands. He was so encouraging. ‘Marvellous!' He'd say about anything I told him. “You're a winner”.

Before he died I was able to tell him why he was a hero to me.

It was for two very important things that he taught me, that I've always tried to live by, not always successfully, I must admit.

The two things he taught me are: integrity and possibility.

He never lied, which could be uncomfortable. He was straight but always kind and giving to others. More than that, he was honourable, almost naively so. If he encountered dishonesty or shiftiness, he was shocked and uncomfortable.

Journalists learn not to be shocked by dishonesty but he did teach me how to be straight myself. Well not teach – he showed me just by how he lived.

He also showed me about confidence; that anything is possible if you just get stuck into it.

I can't say that I've graduated from the School of Ern yet. Maybe I never will. I feel like he's still the master and I'm the student, striving to match his integrity, his kindness and his confidence.

When I was 21 and just emerging from some youthful difficulties, I wanted to get away and I asked Dad to drop me at the edge of Melbourne, over to the west. I planned to hitchhike to the other side of Australia and in the end I did get a long way and was gone for years. But on that day, Dad took me in the car, I think it was the old Valiant, and just peacefully let me out where I wanted and I took my stuff and he waved and I remember watching him drive away and I loved that he was able to let me go. No arguments. He just backed me. He always did that.

Readings & Viewings

Video of the Week: a mate of mine tweeted this yesterday and I thought I'd share it. It is one and a half hours of baroque counter tenor from Philippe Jaroussky. Absolutely beautiful.

While on music, a subscriber (Chris) wrote in to say that yes, Steve Vai is fine, but you should check Gary Moore and BB King doing The Thrill is Gone. So I did. It's pretty good, but not as explosive as Mr Vai. Here they are (thanks Chris). By the way, if you keep watching it turns into a video stream of BB King's funeral service.

This is really interesting – a tour of a space station by someone floating around. The stuff about the toilet is gruesomely fascinating (the stuff tends to go everywhere in zero gravity)

Top 10 movie sets of all time. This is pretty cool if you're in to movies.

Australians are reluctant renters, but it doesn't have to be that way.

Chris Sacca, one of the original investors in Twitter, predicts some tough times for tech start-ups. “There's nobody normal left in Silicon Valley anymore,” he says.

Greece's woes go beyond debt. The problem is it's a closed economy (video).

Europe to Greece: get real.

Joseph Stiglitz argues that forcing Greece out of the euro would make the next financial crisis far worse.

It's not just Greece in trouble: Ukraine has warned of a debt moratorium.

According to a Perth-based financial planner, the debate about advice remuneration is really about value: many financial planners aren't really sure about the value they bring to clients. It's good to see someone admit it.

An interesting contribution to the housing affordability debate: the best way to increase supply is to liberalise land release regulations (it's the IPA, by the way – they want to liberalise everything).

And speaking of libertarianism, this guy says the best way to be more humanitarian to refugees would to be to create a market for them.

The importance of knowledge capital.

Thomas Piketty reviews a new book on inequality.

China's central bank lowers growth and inflation forecasts.

The next battle between Apple and Google is all about context.

A review of Apple's new operating system, iOS9.

Apple, having already transformed the music business once, wants to do it again.

Trying to make sense of North Korea's leader Kim Jong-un.

A 3D-printed car. Enough said!

The death of ageing. Will we soon be living forever?

I found this interview on Andrew West's Religion and Ethics Report on Radio National this week very interesting. It's with Christina Lamb, foreign affairs correspondent for the Sunday Times, who has just written a book called "Farewell Kabul: From Afghanistan to a More Dangerous World”. She's talking about the Taliban.

This is a beautiful piece by a man who is caring for his mother, who has Alzheimer's. He says it gave him the best birthday ever.

The biggest intelligence reform in 40 years.

This is a critical moment for the future of the internet.

A list of the dumbest things Presidential campaigns have spent money on.

This is funny, especially for someone, like me, who loves graphs. It's a website of spurious correlations.

We are entering an age of wilful ignorance.

Machines are learning how to understand the way we speak.

Happy Birthday WB Yeats, Ireland's greatest poet. Here's his “When You Are Old”.

WHEN you are old and grey and full of sleep,

And nodding by the fire, take down this book,

And slowly read, and dream of the soft look

Your eyes had once, and of their shadows deep;

How many loved your moments of glad grace,

And loved your beauty with love false or true,

But one man loved the pilgrim Soul in you,

And loved the sorrows of your changing face;

And bending down beside the glowing bars,

Murmur, a little sadly, how Love fled

And paced upon the mountains overhead

And hid his face amid a crowd of stars.

Last week

Shane Oliver, AMP

Shares had a mixed week with mostly good economic data, but ongoing uncertainty regarding Greece and worries about a MERS outbreak in Korea weighing on some Asian markets. While US, Australian and Chinese shares rose, European shares fell slightly as did Japanese shares and some other Asian markets. Bond yields fell late in the week. Despite stronger US economic data, the US dollar fell slightly and this helped some commodities and the Australian dollar.

Chinese shares' inclusion in MSCI benchmark indices on hold but inevitable. While some may have been disappointed by MSCI's decision not to include China A (or mainland) shares in its benchmark indices the logic was understandable as gaining exposure to Chinese shares for foreign investors is still a bit convoluted. That said it's just a matter of time as China is steadily making foreign access easier. When it does occur it will boost global demand for Chinese shares from global “benchmark huggers” and more importantly will inject a more significant and much needed foreign institutional element into the Chinese share market helping to balance out speculative retail investors and making for a more stable market.

Its back -- the RBA's clear easing bias that is. If there was any doubt that the RBA retains an easing bias it was laid to rest by Governor Steven's comment that "we remain open to the possibility of further easing" and that "the economy could do with some more demand growth". Of course there were numerous qualifications around this - in particular the risks around low interest rates - but the clear message is that another rate cut is under serious consideration. I think it's now more about narrowing the interest rate gap between us and the zero rates in the US, Europe and Japan to make sure the $A continues to come down helping globally exposed sectors like tourism, higher education, manufacturing and agriculture combine with home construction and consumer spending to help fill the gap left by the end of the mining boom. The Australian dollar probably needs to fall into the $US0.60s.

Whether there is another cut or not, the Governor pointed out "it will be quite some time before we can think about interest rates going back up" so get used to low rates for a long time yet. (Sorry Mum!)

RBNZ back peddling on rates

It now looks like NZ jumped the gun a bit on rate hikes and is now having to fall back into line by cutting rates as NZ export prices are falling. More RBNZ cuts are likely. So while the Australian dollar is likely to head lower over time against the US dollar, the Australian dollar/ NZ dollar rate is on the way back up again.

Bank of Korea is cutting rates too, largely in response to the threat that an outbreak of Middle East Respiratory Syndrome (MERS) is posing to consumer spending there. It seems we regularly have fears of new pandemic lately. Since 2003 there has been fears regarding SARS, bird flu, swine flu, Ebola and now MERS.

The latter appears to have originated in Saudi Arabia from camels with the first reported cases in 2012, with cases being reported in over 20 countries with the Korean outbreak being the largest outside of Saudi Arabia. At this stage it's hard to know how big a threat it is, but fear and the resultant reduction in travel and consumer spending could have a short term effect on economic activity like occurred in some Asian countries with SARS in 2003. But just bear in mind, we have seen all this before with SARS and Ebola last year. The panic around the outbreak could fade just as quickly as it has arisen as authorities swing into action and human behaviour changes.

After all, MERS seems to have been reasonably well contained in other countries.

Greece nearing the end game

While there have been some positive signs of progress with Angela Merkel saying “where there's a will there's a way” and that “the goal is to keep Greece in the euro area”, with the IMF leaving Brussels and indicating there are still major differences the ball is now clearly in Greece's court to accept what is on offer or face the consequences. To avoid defaulting at end June a deal needs to be agreed soon so it can pass various country parliaments in time. The June 18 eurozone finance ministers' meeting may be the next deadline to watch. The pressure on Greece is now immense as recent turmoil has helped plunge it back into recession, which has hit tax revenue and likely eliminated its primary (ie ex interest payments) budget surplus. So even if it were to repudiate all its debts it will still have to undertake aggressive austerity. The problem for PM Tsipras is trying to get support for an agreement which is acceptable to both Greece's creditors and to the rest of Syriza. Our base case remains that a deal will be agreed but the risks are high. So Greece is likely to remain a source of volatility. But even if Greece does end up leaving the euro, the threat of contagion to other peripheral countries is low compared to the 2010-12 period as they are now in better shape and the ECB is now providing stronger support.

Major global economic events and implications

US economic data provided further evidence that growth is picking up with retail sales up strongly in May and previous months revised up, small business optimism up, jobless claims remaining low, job openings up strongly in April even though the hiring and quits rate was down fractionally and mortgage applications to purchase up strongly. Japanese economic data was good with March quarter GDP growth revised up to a strong 1 per cent quarter on quarter driven by strong investment, strong machinery orders in April indicating that the strength in investment may be continuing and further falls in bankruptcies and Tokyo office vacancy rates. Chinese economic data for May provided signs of a stabilisation in growth after the soft patch early this year.

Imports and fixed asset investment were weaker than expected, but growth in industrial production, consumer spending, exports, property sales and money supply improved and credit came in stronger than expected. At the same time though inflation was weaker than expected and producer prices are continuing to fall highlighting that monetary policy still remains way too tight, so further PBOC easing is still likely.

Australian economic events and implications

Australian economic data mostly surprised on the upside with a nice lift in business confidence, continued gains in housing finance and much stronger than expected jobs growth in May. However, against this consumer sentiment gave back all of its post Budget boost and the official jobs numbers look a bit too good to be true, particularly with employment growth accelerating even though GDP growth has been slowing.

The bottom line seems to be that while growth is not great, we aren't seeing the collapse many doomsters keep talking about either. What we are seeing is the reversal of the two speed economy with last decades laggards (including Victoria and NSW) coming back to life. I just saw a report from JLL on “record leasing activity in the Melbourne CBD office market” - not exactly the sort of thing you would see in a recession.

On my ranking of the current performance of Australian states, Victoria and NSW rank number 1 and number 2.

Next Week

By Craig James, Commsec

Reserve Bank dominates the week

If it wasn't for the Reserve Bank, investors would be faced with a pretty dull week on the economic front in the week ahead. Overseas, the US Federal Reserve meets on Tuesday and Wednesday.

In Australia, the week begins on Monday when Christopher Kent, Assistant Governor (Economic) at the Reserve Bank delivers a speech at the Australian National University in Canberra. No topic has been set for the speech as yet.

On Tuesday, the weekly ANZ Roy Morgan consumer confidence is released. The Reserve Bank Governor has described the current mood as “determined pessimism”.

Also on Tuesday, the Reserve Bank releases minutes of the Board meeting held on June 2. The Board hasn't provided any guidance on future interest rate moves, so investors will be screening the minutes for clues.

On Tuesday, Guy Debelle, Assistant Governor (Financial Markets) at the Reserve Bank will deliver a speech and participate in a panel discussion at the launch of Financial Integration in the Asia Pacific: Future of Australian Financial Services in Sydney.

And to cap off a big day on Tuesday, the Bureau of Statistics (ABS) issues May data on new vehicle sales. The industry body – the Federal Chamber of Automotive

Industries – has already released the detailed vehicle sales data. The ABS will just recast the ‘top level' data in seasonally adjusted and trend terms. Sales of sports utility vehicles (SUVs) are at record highs, largely at the expense of weaker passenger car sales.

On Thursday, the Reserve Bank releases its quarterly Bulletin publication, containing articles of relevance to the economic and financial environment.

Also on Thursday the ABS releases data on imports of goods as well as detailed job market figures.

The imports data is one of the timeliest indicators available of spending although figures can get distorted by exchange rate and price changes.

And the detailed job market figures will contain details of employment by industry as well as demographic and regional dissections of the job market data.

Investors only have eyes for the US Federal Reserve

The stand-out event for investors in the coming week is the meeting of US Federal Reserve policymakers over Tuesday and Wednesday. But there will also be a healthy supply of economic data to monitor.

The week kicks off on Monday in the US with data on industrial production to be released together with figures on capital flows, the New York Federal Reserve manufacturing index and the National Association of Home Builders sentiment gauge. Economists tip only a modest 0.2 per cent lift in production in May after the 0.3 per cent fall in April.

On Tuesday, the US Federal Reserve begins its two day meeting while data on housing starts (commencements) is released together with the weekly survey of chain store sales. Housing starts may have eased 3 per cent in May after a huge 20.2 per cent lift in April.

On Wednesday the Federal Reserve hands down its interest rate decision (decision at 4am Sydney time on Thursday). No one expects the interest rate “normalisation” process (rate hikes) to begin just yet, but investors will be hoping for future guidance.

Also on Wednesday the usual weekly data on housing finance activity is released.

On Thursday the weekly data on jobless claims is issued together with consumer prices (inflation), the current account, the leading index and the influential Philadelphia Federal Reserve survey.

The consumer price index (CPI) data should show that underlying (core) inflationary pressures are still restrained.

The core measure of prices (excludes food and energy) may have lifted 0.2 per cent after a 0.3 per cent rise in May. But the headline CPI may have lifted 0.5 per cent in May, underpinned by higher gasoline prices, after a 0.1 per cent increase in April.

And the leading index may have posted a 0.4 per cent gain in May after a 0.7 per cent rise in April, suggesting stronger economic growth – and higher interest rates – lies ahead.

In China, there is just one indicator to watch – the measure of house prices, to be released on Thursday.

Sharemarket, interest rates, currencies & commodities

The first half of the 2015 calendar year has almost been completed. So it is an opportune time to look at how the Aussie dollar has been travelling – especially given the Reserve Bank's view that it should currently be lower, providing greater assistance to our economy.

The Aussie dollar started the year near US82 cents, hitting highs of US82.95c on January 15. However it spent little time at the highs, falling to just over US76c in February, US75.58c in March and the low for 2015, on April 2, at US75.3c. After lifting again to US81.62c on May 14, the Aussie has held US76-78c over June.

The Aussie has tracked over an US7.65c range in 2015, making it the least volatile start to a year in a decade.