Kohler's Week: Australian economy, The Great Turning Point?, Shanghai shocker, Slater and Gordon, Myer, Enerji

Last Night

Dow Jones, down ~0.09%

S&P500, up ~0.05%

Nasdaq, up ~0.23%

Aust dollar, US71.9c

Australian economy

Three charts tell a rather surprising story.

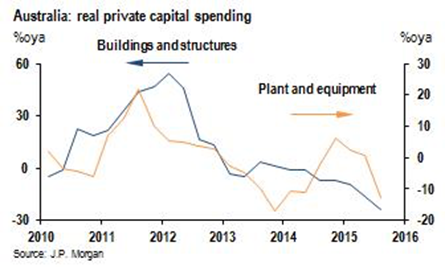

This week there was a shocking drop in capital expenditure, both mining and non-mining, and especially plant and equipment:

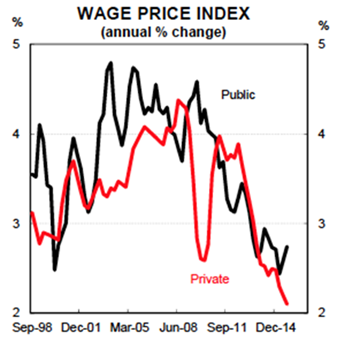

Last week we saw that wages growth is the slowest it has been for decades:

Source: CBA Economics

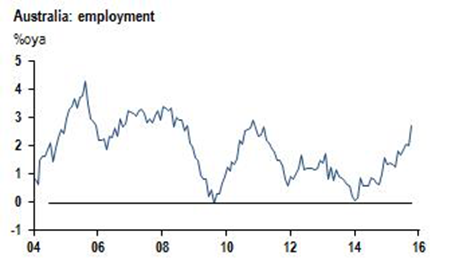

And the week before, we saw that employment had surged in October, leading to a drop in the unemployment rate from 6.2 to 5.9 per cent:

At the risk of over-simplifying some complex data interactions, the much-feared replacement of humans with robots is simply not happening. Firms are hiring people instead of buying machines. For those of us who tend to get gung-ho about the digital revolution, and write excited emails to subscribers headed “Disruption Special” (see last week) this is all rather surprising.

So when is the “race against the machines” and the “robopocalypse” (to quote a couple of scary book titles) going to start? Next year? Never?

Sure, there is plenty of cloud computing going on, as a result of which Amazon's already massive share price more than doubled this year, and that of an Australian cloud tiddler named Bulletproof has also doubled this year. And there are plenty of amazing stories about robots and drones, algorithms and artificial intelligence.

But so far warm-blooded mammals are prevailing, just like in Terminator 2 – Judgement Day, for the simple reason they have brought their price down, or rather not increased it much. Record-low wages growth is leading companies to hire people rather than buy machines.

And by the way, cloud computing is not capex, it's opex – it results in a decline in capex. And it also needs people to manage, so maybe that particular bit of the digital revolution is a key factor in the weak capex statistics this week.

Anyway, don't forget that the sequel to Terminator 2 was Terminator 3 – The Rise of the Machines.

Interest rates

Glenn Stevens did an unusual thing this week: in answer to a question after his speech at the Australian Business Economists dinner the other night, he ruled out a rate cut in December. Central bankers don't normally do that (when asked about a rate cut in February, he said everyone should chill out and wait to see what the data says next year, which I reckon is a ruling out for December).

Will there be a cut in February? I doubt it. Employment is strong and core inflation is not below 2 per cent as it is elsewhere in the world. The RBA doesn't want to cut again – if it did it would have done so already. I can't see any reason for another rate cut in February.

The coming Great Turning Point

Here is a chart of the US 10-year bond yield for the past 60 years:

The matter at hand is whether the lowest yield in 2012 of 1.3893, touched on July 24th that year, after a 30-year decline from a peak of 15 per cent, was The Bottom – the great turning point for bonds. Here's a closer view of that:

And here, just to be even clearer, is a chart of the price, as opposed to the yield, taken from the occasional newsletter of Paradigm Securities' Barry Dawes, who lives, at his own admission, in “Resourcesland”:

The peak in price (or the bottom in yield) took place in 2012, as discussed. The uptrend broke in 2013 and there was what looks like a “goodbye kiss” at the start of this year when the US bond yield dropped suddenly to a low point of 1.6384, having opened the year at 2.2 per cent. Since then the uptrend in yields (downtrend in prices) has been renewed.

In the middle of 2013 it seemed a bond crash was in the offing and memories of 1994 – when Greenspan unexpectedly hiked the Fed funds rate and the bond market tanked – were being invoked. However a huge bond rally through the whole of calendar 2014 came out of the blue from a collapse in the global inflation rate and Janet Yellen taking over as Federal Reserve chair in February 2014 and taking a pledge not to raise rates without warning.

That 2014 bond rally supported a 30 per cent rise, on average, in Australian bank share prices, which in turn prevented a horrible year for iron ore miners from dragging the ASX 200 negative for the year.

By the way, those two things were closely related: a big reason for the decline in inflation, and therefore bond yields, was the amazing collapse of commodity prices – specifically iron ore and oil, both of which halved in price during 2014 as those and other commodity markets became overwhelmed by supply gluts, as well as the slowing Chinese economy.

Anyway, thanks to that 2014 rally, the end of the 30-year bond bull market is a stop-start affair – it is definitely not a crash, not yet anyway. Maybe bonds won't crash at all, ever, and maybe the turn, if this is truly it, will be sedate (which goes against virtually all market history – major turns are never sedate, always violent).

Part of the reason for the lack of violence this time, it seems to me, is that America and Europe are not in sync. It's perfectly clear that the US economy is very strong, with falling unemployment and record sales in many markets, plus a surge in the housing market, which means interest rates there must rise soon, probably next month. In Europe it's a different story entirely.

Obviously if the US bond market cracks as a result of the first (or second) cash rate increase, then all bets will be off and there will be some violence visited upon our investment portfolios in 2016. In any case, the increase in short-term rates is likely to be the cause of a continued decline in bond prices.

There is close to $US100 trillion invested in the global bond market, about a third of which is in US bonds. As that market turns decisively, money will flow out of bonds into something else, and that something else will rise in price as bonds decline. The big question, obviously, is: what?

What?

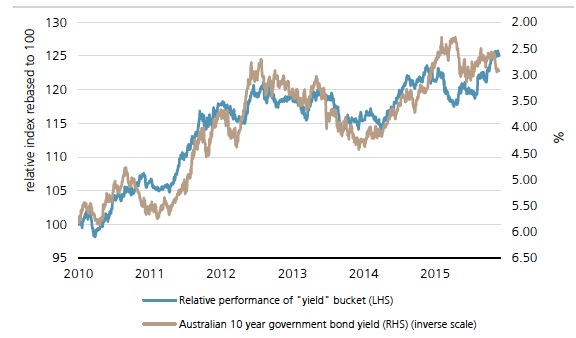

First, yield stocks won't do as well as before, as interest rates rise, so money is likely to flow out of them as well. It's a statement of the obvious, reinforced by this chart of the relative performance of yield stocks and the Australian bond yield:

Source: UBS

There is obviously a new, gathering boom in unlisted venture capital and listed small caps, as discussed in last week's letter, but there's probably a limit to how far that can benefit from an end to the bond bull market. Money in bonds and bank shares is there for a reason – income, safety and conservative mandates. It's unlikely to switch straight into zero-income, risky VC.

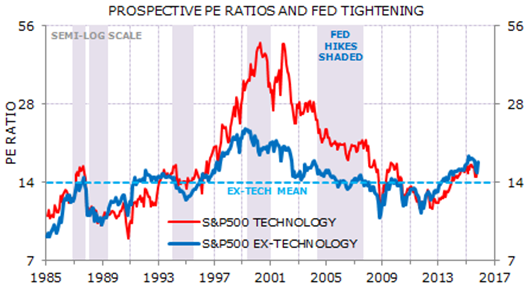

Also, Gerard Minack points out that Fed tightening almost always leads to risk assets de-rating.

The re-rating in the late 1990s was the exception.

Which brings us to emerging markets and resources. Obviously the resources sector is in the midst of a horrible period and the market leader, BHP Billiton, has had a triple whammy: low commodity prices, the coming cut in the dividend and the Brazilian tailings dam disaster.

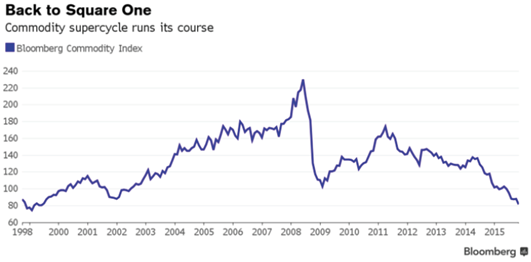

Broadly, the commodity “super cycle” has not only finished, the Bloomberg commodity price index is back to where it was at the beginning of the Chinese boom – back to square one:

As a result the XMM (mining and metals) share of the All Ordinaries has declined from 35 to 15 per cent:

The main bear point for commodities in 2016 is the possibility that the US dollar will keep rising and interest rates go up (mainly because commodities are expressed in US dollars). Two things about that.

First, as discussed here previously, the US dollar doesn't always follow the Fed rate cycle, and in fact more often than not it declines after the first hike; and second, it's still all about China.

It's true that gluts in oil, copper and iron ore have yet to be cleared, but the most likely outcome for China's economy next year is continued growth in the range of 6-7 per cent. Given the size of China now, this is still very decent growth and just because it's not double digit doesn't mean China should be dismissed.

But Warren Buffett's dictum to be greedy when others are fearful and fearful when others are greedy will soon apply to commodities and resources, if it doesn't already.

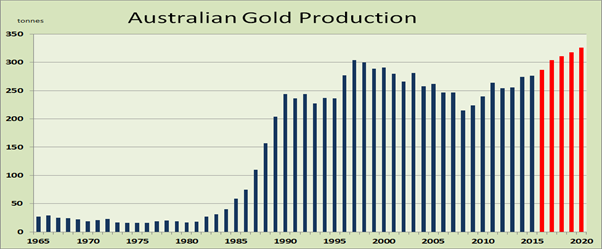

And the first sign of that might be gold. For some diehards, the answer to any question is “gold”, although there are fewer of them these days after the devastating gold bear market of 2012 to now.

However the fact is that although the US dollar gold price has continued to decline this year the Australian dollar price has strengthened as the local currency falls, and production has gone up, leaving local producers awash with cash.

Source: Paradigm Securities

Barry Dawes, a fully paid-up gold diehard, says: “The action in the gold share market here in Australia is strongly suggestive of the bottoming process being mature and the real long-term uptrend in gold and gold stocks is resuming. I actually have my first gold sector IPO sponsorship since 2007 now underway with A$4.2m for Golden Eagle Mining coming soon.”

I only mention all this because you may not have thought about gold or gold stocks for a while (I certainly haven't) and it may be worth thinking about.

The ASX gold index (XGD) is up 44 per cent in the past year, which makes it the best performing sector in the market, by far. It's still down 70 per cent over four years, so this is very unlikely to be the end of its run.

In case you're wondering, these are the stocks that gold/resources bull Barry Dawes owns: DRM, NST,MLX, RSG, TBR, GOR, BLK, MML, TNR, TYX and PNR. Also STO, BHP, DFM, BPT.

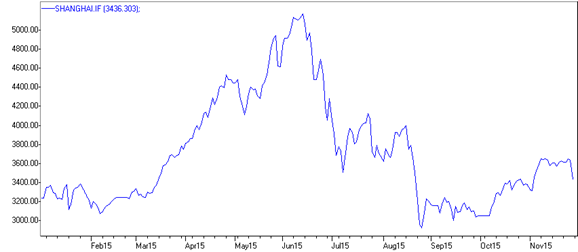

Shanghai shocker

The Shanghai Composite dropped 5.5 per cent yesterday, which is being put down to an intensified probe into the broking industry after the August collapse. I reckon that's a pretty clear confirmation that the brokers are controlling the market, if an investigation into them causes the market to crash.

Alternatively, the brokers were demonstrating their power over the market yesterday to warn the China Securities Regulator to lay off. See what we can do?

But it's also possible that the punters using the brokers named were looking for an excuse to take some profits, after a 25 per cent rally since August 26.

Here's the Shanghai composite index this year:

That 25 per cent rally from late August to the day before yesterday was not based on any fundamentals whatsoever so a correction was definitely due.

But yesterday's fall was led by the brokerage firms under investigation, such as Citic and Guosen, down 10 per cent each (the maximum allowed in a day) and Haitong, down 7.5 per cent. Whether intended or not, it was certainly a demonstration to the Chinese authorities that cleaning up the sharemarket – and the whole economy for that matter – won't be cost free, or easy.

Interestingly, although the firms and individuals being investigated have been named by the official news agency, Xinhua, no one has any clue what they are supposed to have done. It's apparently all about the market crash in August.

Will it affect our market on Monday? Well, it won't help, but it didn't seem to have much impact on Wall Street overnight, where most eyes were on “Black Friday” shopping. The day after Thanksgiving is always the start of Christmas shopping, so how it goes is a big indicator of what Christmas is going to like for the retailers this year. It was a bust. It looks like a lot of people stayed home and let the fingers do the walking … on computer keyboards and smartphones.

Slater & Gordon

Well, the shorts have sure made a killing on this poor stock. Having fallen 70 per cent, it then halved on Thursday and dropped another 25 per cent or so yesterday – from $7 to 70c in the blink of an eye, a reverse 10 bagger. Amusingly, broking analysts across the country scrambled, as one, to replace their “buy” recommendations with “hold”. Management remained deep in the bunker trying to work out what hit them. Shareholders were ringing up Maurice Blackburn for class action advice.

Was it just the short sellers who caused it? Of course not, but the practice of institutions lending stock to hedge funds so they can short sell them certainly played a part. Why has the market been so horrendously savage on Slater & Gordon? I have no idea to be honest, although trust in management has completely evaporated and with it has gone any benefit of the doubt. When the UK Government announced on Wednesday that they would be restricting road accident compensation claims it was the last straw and remaining punters sold first and asked questions later.

The only reason I'm not saying this stock is a screaming buy is Forge Group. You might remember (and it is seared into my memory) that this company's share price collapsed early last year, and many punters climbed in thinking it was cheap. The company then had the bad manners to go broke.

I'm certainly not saying Slater & Gordon is about to go broke. Is it? But I don't think it's a hold. Either it's a buy or a sell. Personally, I'm out – there are happier places for my money.

Enerji

I interviewed the CEO of Enerji, Andrew Vlahov, during the week and it wasn't until afterwards that I twigged that he was the great basketball player for Australia! Damn. I thought he was a pretty big unit, but I didn't put one and one and a half together (he's one and a half). He was very engaging in the interview, I must say.

Anyway Enerji is one of those technology businesses that has been plugging away for years trying to get some traction, and actually during our interview, the company announced to the ASX that it was close to making its first sale – to Northern Star Gold – so maybe it's taking off.

Myer

My other Eureka Interactive interview this week was Richard Umbers of Myer – not a basketball player, and not a particularly large chap, but he is pretty engaging, with an interesting story to tell. I think department stores generally, and Myer in particular, have a hard row to hoe, but at least Richard Umbers has a plan.

Here's the video and transcript of the interview.

International stocks

Unfortunately Clay Carter will be leaving us next week, and as a result we will cease coverage of specific international stocks, at least for the time being. Clay is a wonderful bloke and has been a tremendous addition to our team, both because of his long investment experience and his global stock ideas.

Before he goes, Clay will, on Wednesday, review each of the 33 of the companies he has recommended and provide some future guidance for those who have bought any of them, and will be happy to answer any questions you may have about them, or other international investing issues.

Readings & Viewings

Here's a video of Malcolm Turnbull's new chief of staff, Drew Clarke, when he was secretary of the Communications Department, presenting the department's annual report on YouTube. Boy is he boring!

I really like this piece: Saudi Arabia is ISIS that has made it.

Magical thinking about ISIS.

Waleed Aly is wrong in saying that ISIS is a mere nuisance.

Obama is dangerously nonchalant about ISIS. Really? Is he?

Silver lining department: thanks to ISIS, global weapons sales have surged.

An extract of Laura Tingle's Quarterly Essay on Australian politics these days: “I argue that there is a growing loss of institutional memory about how things have come about, and, more importantly perhaps, why they did.” I think she's my favourite political commentator.

The media has no idea how to deal with Donald Trump's constant lying.

A delightfully simple analysis of Sydney house prices: supply and demand will decide what happens next.

HSBC is predicting gains in emerging market bonds next year.

There is far less sympathy than you might think among Muslims for Islamic State.

From the Blackrock blog: what family traditions taught me about investing.

If China killed the commodity super cycle, the Fed is about to bury it.

Bryan Cranston (the guy in Breaking Bad) and his “grown man boy band”. Very amusing.

The head of the CIA apparently blamed Edward Snowden for the attacks in Paris. Long bow.

The strange links between the Barbie doll and the US Federal Reserve.

First dog on the moon: The eggplants from S.P.H.I.N.C.T.R.E.

The best tall building in 2015 is covered in trees.

Does Belgium actually exist? It's held together by little more than a gnawing collective sense that things cannot continue as they have.

How doctors did a full face transplant for a poor bloke who suffered terrible burns.

Want more innovation? Get more diversity.

Epic oil glut sparks tanker traffic jam at sea.

How Turnbull can beat the right on terrorism.

Time to ditch yield for quality.

Nice video of a dolphin rescuing a dog.

US home prices could take 17 years to return to their previous peak.

Cardinal Pell, his lawyers and the Royal Commission.

Xi's China: the illusion of change.

Ian Silk's grand ambition for super.

Marcus Padley: “Anchoring” holds back your investing.

There was a time, back when I looked even younger than the picture below, when I could recite Alice's Restaurant. In this piece, Arlo Guthrie reflects on the 50 years since he wrote that song.

Happy Birthday the marvellous Randy Newman, 72 today. Here he is singing “Losing You”, not very long ago, and explaining why he wrote it.

And here's a BBC documentary about him by a guy who says he's a genius. He might be. It's called "I am, unfortunately, Randy Newman”.

And finally, here he is doing the very silly “Short People”, which I think might have been his biggest hit!

Me, some time ago…

Me, now…

Last Week

By Shane Oliver, AMP

The past week was mixed for shares with Eurozone shares up on good economic data and expectations for further ECB easing, Japanese and US shares basically flat and Chinese and Australian shares down with Australian materials stocks under pressure again. Turkey's downing of a Russian fighter jet caused some angst but it was quickly forgotten about by investors. Bond yields fell but oil and metal prices managed very modest gains and the Australian dollar fell fractionally as the US dollar rose marginally.

The downing by Turkey of a Soviet era Su-24 Russian fighter jet (that may not have even known it had crossed the exact border into Turkey), provides a reminder of the risk of conflict between foreign powers in the seemingly free for all shootout that has become Syria, but it's not going to trigger WW3 or anything close.

Sure, it's something new for investors to worry about, but its best put in the geopolitical furphies basket. Russia will continue with its war of words and may impose some token sanctions on Turkey, but is not going to get into a war with NATO and its options economically are limited because Turkey takes 13 per cent of its gas exports and has the ability to disrupt or stop 35 per cent of its oil exports. Rather the rest of NATO will try and calm Turkey down as it focuses on trying to build a more coordinated attack on it and Russia's common enemy, IS. So far so good, with France and Russia agreeing to coordinate their attacks on IS in Syria.

Business friendly Mauricio Macri's election as Argentina's President is a positive sign potentially signalling that the tide may be turning against populist policies that have helped put it and some other emerging countries into a mess. But it's not a green light (yet) to invest in Argentina/EMs: sensible economic reforms will likely see Argentina's economy and peso worsen before they get better, populists still control the Senate and are likely to slow or stall reformist legislation and other EMs like Brazil are a long way behind Argentina. So a good sign, but too early to get too excited.

It's almost certain that on Monday the IMF will include the Renminbi in its basket of Special Drawing Right currencies. While its inclusion as an SDR currency won't have a major direct impact on global financial markets or Chinese economic prospects it will provide a huge symbolic boost for the Renminbi – encouraging its use as a reserve currency and as currency for use in trade.

Looks like the Australian Treasury is now following the RBA in revising its estimate of Australia's potential growth rate to around 2.75 per cent, largely on the back of slower population growth. This is an old story really as we have been using lower potential growth in Australia for the last few years. It will have the effect of further slowing the projected return to a budget surplus though with some estimates putting the hit to the budget from each 0.25 per cent reduction in growth at $5bn pa.

Political momentum appears to be building to look at limiting some tax concessions, including in relation to superannuation. Putting aside the specific merit of such changes, it is very important that they be considered in the context of the whole tax system.

Even with the various tax concessions the Australian income tax system is highly progressive compared to other comparable countries (see The Australian Government's Tax Discussion Paper, page 30). Our marginal tax rates are relatively high (eg the top MTR is 49 per cent versus 33 per cent in NZ and 20 per cent in Singapore) and despite the tax concessions this is leading to just 17 per cent of tax payers paying a high 63 per cent of income tax revenue raised by Canberra (based on 2011-12 data).

Limiting tax concessions without reducing marginal tax rates and/or increasing the income thresholds will only see this burden increased further, which in turn will reduce work incentive and reduce the size of the economic pie making it even harder to sustain government services and social safety nets. Fortunately the Government appears to recognise this.

With a Super Saturday on the way for Sydney and Melbourne auction listings this weekend, the recent fall in clearance rates suggests there could be disappointment in Sydney where clearances have plunged to 2011-12 cycle lows. Melbourne is a bit stronger.

Major global economic events and implications

US data was mostly solid with strong durable goods orders, trade data, new home sales and service sector conditions, falling unemployment claims, rising home prices and an upwards revision to September quarter GDP growth. But it's not universally so with weakness in existing home sales, manufacturing conditions, consumer confidence and consumer spending and the core private consumption deflator remaining stuck well below the Fed's target at 1.3 per cent year on year.

The overall flow of data supports the case for a December Fed rate hike but the moderate nature of growth along with continued sub-target inflation suggests that the Fed will continue to stress that future rate hikes will be gradual.

Eurozone business conditions PMIs rose further in November and October money supply and lending accelerated pointing to an improvement in growth ahead.

In Japan, household spending remains weak and core inflation fell back to 0.7 per cent year on year, but some indicators are looking quite good with a further rise in the manufacturing PMI, the job to applicant ratio remaining at its highest since 1992 and the unemployment rate falling to its lowest since 1995. PM Abe's plan to increase minimum wages by 3 per cent pa for several years could further help end deflation expectations.

Australian economic events and implications

Australian construction and capital spending data for the September quarter were very weak as mining investment continues to fall back to earth and non-mining investment remains poor. Capex plans remain over 20 per cent down on expectations from a year ago, with this mainly due to slumping mining investment but the outlook for non-mining investment also remains soft.

So while the economy has been successfully rebalancing away from reliance on mining for growth, we are still waiting for the final piece of the puzzle, ie a pickup in non-mining investment, to fall into place. As such, the economy looks like it might still need a bit more help in the form of lower interest rates and a further fall in the value of the Australian dollar.

Next Week

By Savanth Sebastian, CommSec

A big week

Arguably this is the last big week of economic data with economic growth and a Reserve Bank Board meeting in Australia and pivotal jobs data in the US.

In Australia, each change of season is ushered in by a barrage of economic data. So next week investors need to brace for the ‘Summer tsunami', with almost a dozen indicators expected together with the Reserve Bank Board meeting.

The week kicks off on Monday with the Business Indicators publication from the Bureau of Statistics, including data on sales, profits and inventories.

Also on Monday, TD Securities and Melbourne Institute release the inflation gauge while the Reserve Bank issues data on private sector credit (effectively, loans outstanding).

On Tuesday the Reserve Bank Board meets. But while an 'easing bias' exists, this is more of an insurance policy -- there is no need for further interest rate stimulus at present. In fact economic momentum seems to be lifting, courtesy of home building.

Also on Tuesday there is a raft of indicators due for release including building approvals, home prices, the balance of payments, government finance and a gauge on the manufacturing sector.

On Wednesday, the ABS releases the economic growth figures for the September quarter with the national accounts publication. The economy may have lifted 0.9 per cent in the quarter after the scant growth of 0.2 per cent in the June quarter. Annual economic growth is below average near 2.00-2.25 per cent, but oddly the unemployment rate has been falling, not rising.

Also on Wednesday, the Reserve Bank governor delivers a breakfast speech in Perth. The title for the talk – Economic Conditions & Prospects – gives Glenn Stevens a broad canvas on which to paint.

On Thursday the ABS releases the trade (exports and imports) data for October ($2.8 billion deficit expected). In addition the Federal Chamber of Automotive Industries issues November data on new vehicle sales. In the year to October, vehicle sales were at record highs. The Performance of Services index is also released.

On Friday the ABS issues the October data on retail spending. Spending is recording healthy growth at present, growing broadly in line with longer-term averages. Retail trade may have risen 0.2 per cent in October.

Also on Friday the ABS releases October tourism data. In September, greater China (mainland China plus Hong Kong) passed New Zealand with the highest number of tourist arrivals in Australia.

US jobs data pivotal to rate expectations

There is plenty of data to watch in the US, and normally investors would only have eyes for the non-farm payrolls (employment) data on Friday. But the Federal Reserve Chair, Janet Yellen, has a number of appearances that will be closely monitored.

In the US, the week begins on Monday with the release of the Chicago Purchasing manager's index, pending home sales index and the Dallas Federal Reserve manufacturing index.

On Tuesday, purchasing manager surveys for the manufacturing sector are released across the globe. In the US, it takes the form of the ISM manufacturing gauge. While in China the National Bureau of Statistics issues its survey results for manufacturing but also publishes the services sector survey the same day.

Also on Tuesday, data on new vehicle sales is issued together with construction spending data and the weekly data on chain store sales.

On Wednesday, the Federal Reserve Chair, Janet Yellen, speaks before the Economic Club of Washington. At present, no topic is set down for the speech.

Also on Wednesday, the ADP National Employment index is released, an influential survey of private sector jobs. While the data doesn't always line up with the “official” figures, it is still closely watched by investors. Revised data on labour costs and productivity is also issued on Wednesday together with the ISM New York index and weekly mortgage finance figures.

On Thursday, Federal Reserve chair Janet Yellen testifies before the congressional Joint Economic Committee. The appearance -- a day before the important monthly job figures -- will likely be 'make or break' for those expecting a rate hike in December.

Also on Thursday, the ISM gauge for the services sector is issued in the US together with factory orders and the weekly data on claims for unemployment insurance.

And on Friday the non-farm payrolls report is released. In October, 271,000 jobs were created, above expectations with the jobless rate falling to 5 per cent. In November it is expected that 190,000 jobs were created with the jobless rate unchanged. If the employment results are in line with the forecasts, this will set the scene for a rate hike in December.