Kohler's Week: Australia, the slide show, US, Dick Smith, Strategic Energy Resources

Last Night

Dow Jones, down 0.29%

S&P 500, down 0.23%

Nasdaq, down 0.04%

Aust dollar, US78.3c

Australia, the slide show

You might wonder a bit these days whether the actual Australian economy is of much relevance to investors.

Most of what happens seems to be governed by commodity prices (resources stocks) and bond yields (banks) and global market sentiment, and those things are all about other economies, their central banks and market responses to them. In fact, bond and equity markets seem to have become monetary policy addicts, not taking much notice of the actual economies that matter, such as the US, Europe and China.

So … the Australian economy? Who cares!

Well, you do! The domestic economy – specifically consumption and investment – will determine the medium-term health of most of the companies you invest in, especially banks and industrials.

It's true that the short-term ups and downs of their share prices are determined by market conditions, namely psychology and liquidity, but over the longer term it's all about our economy.

So this week I am focusing on that – the Saturday email is a bond-free zone!

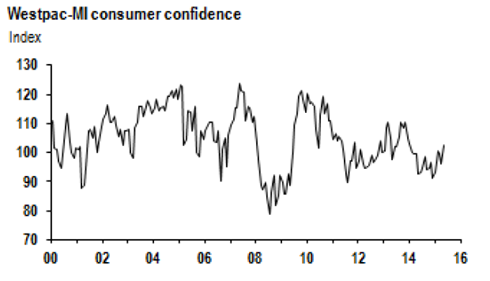

This week's lift in consumer confidence (up 6.4 per cent in May) was the best news about the Australian economy for quite a while. Whether it turns into a lift in employment and waning GDP growth is the question.

The cause of the boost to confidence was the combination of a rate cut and a friendly budget. All the categories improved, especially the 25-44 age group (up 16.3 per cent) and the expectation about economic conditions over the next five years (up 20.2 per cent).

Taken at face value that's pretty good: these are the people you want spending and five-year expectations are what will do it.

Here's a chart of the overall index (note that while confidence has improved it's still subdued):

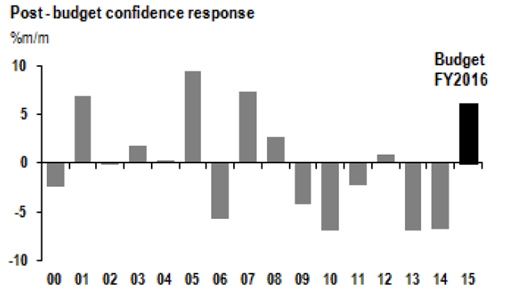

And here are the post-budget responses in the confidence index going back 15 years:

It's quite interesting that responses to the budget are usually negative – this month's bounce is quite unusual.

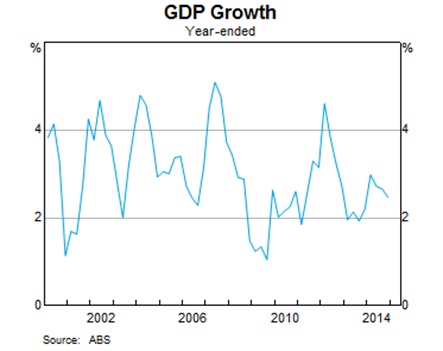

But there's a lot of slack in the Australian economy at present. GDP growth is stuck below trend:

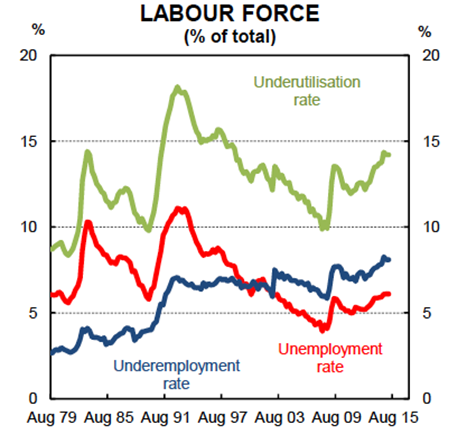

And more importantly, while the rising unemployment rate is still nowhere near what it was during the last recession 24 years ago, the “underemployment rate” is at a record high. This is a measure of employed people who want to work more, but can't (the “underutilisation rate” is a simple addition of unemployment and underemployment).

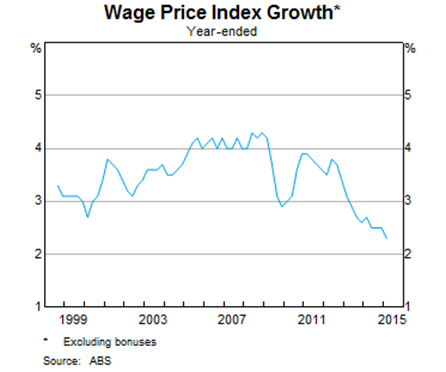

This is why wages growth is very weak indeed…

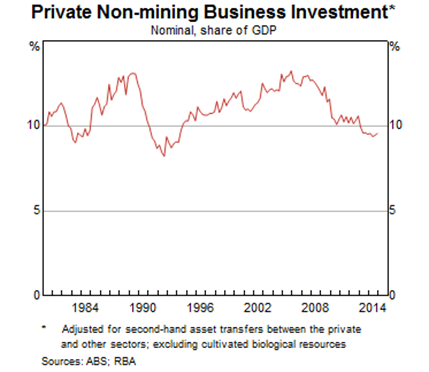

and it's why the RBA cash rate is at a record low of 2 per cent. Despite low interest rates, business investment remains very weak.

In a speech this week, RBA deputy governor Phil Lowe said: “Many businesses tell us that while conditions are okay at the moment, they are not sufficiently strong for them to lift their investment plans. Many feel uncertain about the future and so are waiting until there is a sustained pick-up in demand before committing to new capital expenditure.”

In other words, they'll be looking for more than the one-month spike in confidence that was reported this week – they want something more sustained than that.

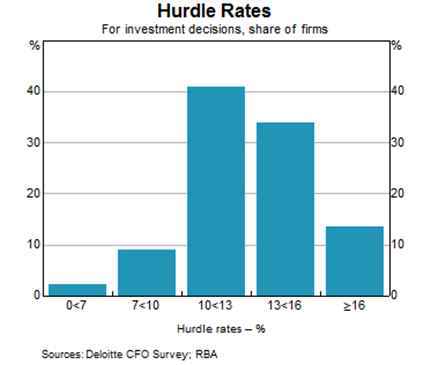

And by the way, Phil Lowe included a really important chart of hurdle rates – the investment returns that companies require before investing:

Companies are simply not catching up to the fact that interest rates are low, both short and long term. Ninety per cent are keeping hurdle rates above 10 per cent before they invest and 50 per cent require 13 per cent or more.

That's very difficult to achieve when the 10-year bond yield – that is, the risk-free rate of return – is 3 per cent. It means that half of all companies expect a risk premium on their investments of 10 per cent or more, which is quite unrealistic.

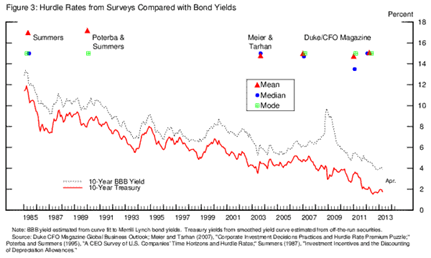

This is not a problem confined to Australia. Here's a chart from a US Federal Reserve presentation on US hurdle rates. The lines are market interest rates; the dots at the top are hurdle rates from various surveys.

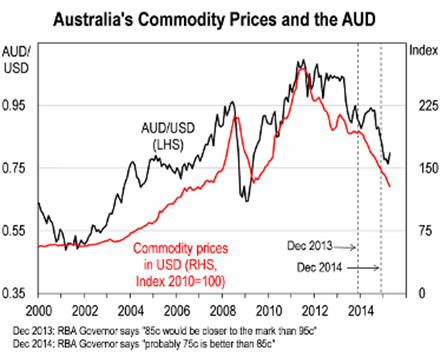

The other problem is that the Australian dollar has started climbing again, having not come down enough in response to falling commodity prices and the lower cash rate.

So is Australia riding for a fall (recession)?

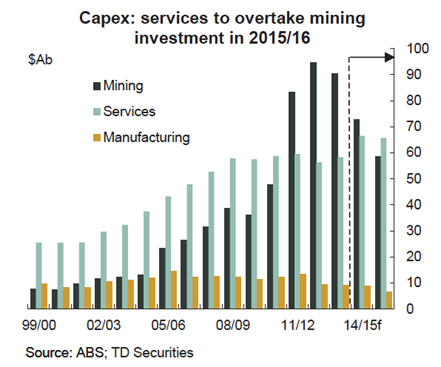

It's all about business investment, and whether non-mining businesses step up to the plate and take over from the waning mining sector.

And since manufacturing is just 5 per cent of the economy these days, it's all about services. Even if manufacturing doubled in size, which it's definitely not going to do, it still wouldn't be enough (by the way manufacturing investment is set to shrink by 20 per cent this year, but that won't matter as long as services grow).

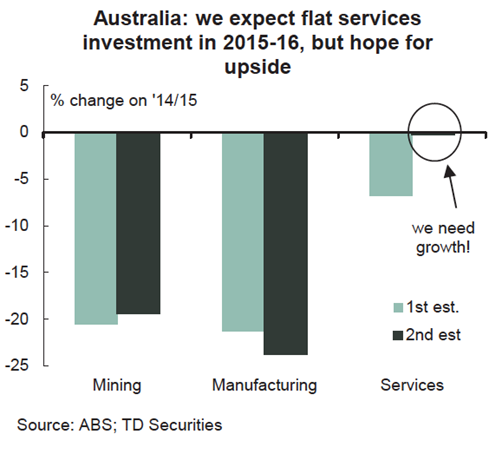

On that subject: so far, so bad. The first estimate for 2015-16, released on February 26, was a shocking minus 7 per cent – that is, services businesses were predicting they would CUT BACK investment this year.

That's when thoughts of a recession in Australia started to emerge, and that survey result in February set expectations for a rate cut in March, which didn't happen. In the end the RBA said more information was needed, and established a clear easing bias, which led to the rate cut in May.

On the subject of rates, the market is pricing in a 60 per cent chance of a 0.25 per cent cut by year end but only a 30 per cent chance of a cut before August.

Anyway, next week's second estimate of capital expenditure for 2015-16 will be crucial. If there isn't a decent uplift in services investment intentions, then the odds of a recession in Australia will rise dramatically – in fact services investment needs to overtake mining this year.

For GDP growth to return to 3 per cent next year, from the current 2.5 per cent, and then get to the 3.25 per cent the government needs in 2016-17 to deliver on its budget strategy, requires faster and better rebalancing of the economy towards non-mining activity.

That's because the mining expansions have already finished and half of the LNG projects in Queensland with be completed this year and half next year. Engineering investment will therefore fall 30 per cent in 2015 and 20 per cent in 2016.

Against that, LNG exports will boom and iron ore exports will continue to grow (notwithstanding Andrew Forrest's ridiculous efforts to the contrary). The problem is that exports themselves don't employ people, and certainly not as many as construction.

But the survey estimates for both mining and manufacturing investment in 2015-16 are for contractions of 20 per cent and more in both cases. That means we need services investment to NOT contract by 7 per cent, as in the first estimate, and to not even be flat – but to grow:

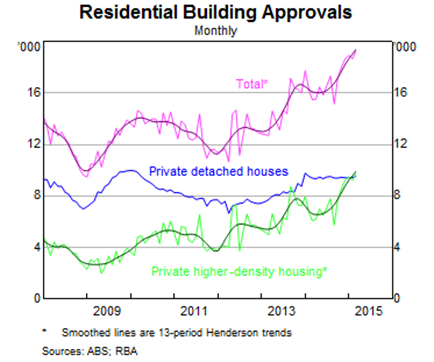

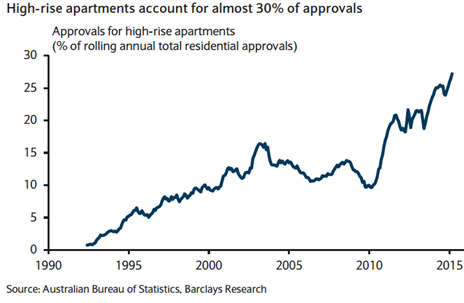

Offsetting the weakness in business investment is housing construction, which is undergoing a boom – mainly in investment-related housing, and mainly high-rise. In fact approvals for detached houses are only back to where they were six years ago.

The increasing proportion of high-rise living has a lot to do with the lack of infrastructure spending by state and federal governments over a long period. People are being forced to cluster around transport hubs, especially in Melbourne and Sydney.

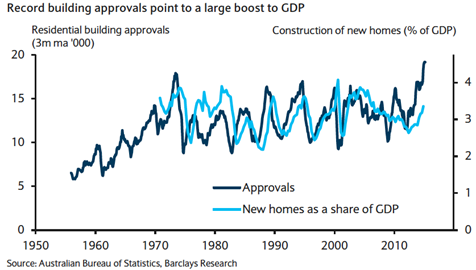

The construction is having a material impact on GDP: housing construction has already increased from 2.6 per cent to 3.4 per cent of GDP and Barclays Research expects it to peak at 4.5 per cent next financial year.

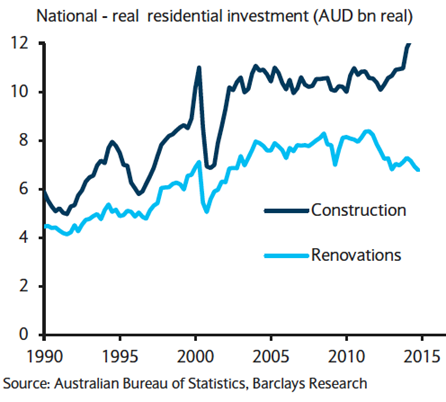

Offsetting that to some extent is a decline in renovation activity.

But most importantly the boom in house prices and new construction is leading to a lift in consumption and that should continue – through both a wealth effect and the need to furnish the new homes.

There are potential Government responses that could rein in the boom: a crackdown on negative gearing, which did not eventuate in the Federal Budget and has now been ruled out entirely, and “macroprudential policies” that could limit bank lending.

APRA announced in December that new investment property lending would have to be restricted to 10 per cent growth in future and that lenders would be required to test whether new borrowers could service a 7 per cent mortgage rate.

That doesn't seem to have worked yet, and in a speech this month the chairman of APRA, Wayne Byres, said he has further measures available, including capital requirements and limiting certain lending.

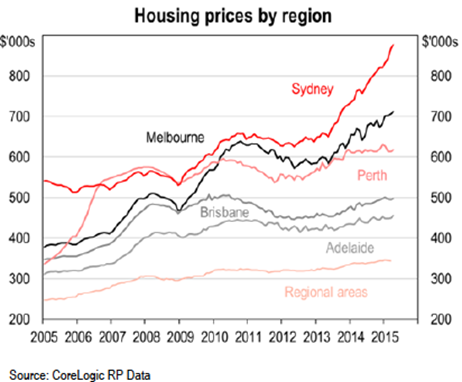

Even before this month's rate cut, Sydney house prices had gone up another 14 per cent year-on-year and investors' share of housing loans had jumped back to record levels. There are also growing risks in the commercial property market.

So there is a fair chance APRA will do something more, and there are obviously discussions taking place with the Reserve Bank – the RBA clearly wants to cut rates again to do more to get the dollar down and to get businesses investing, but it's afraid of the Sydney and Melbourne housing booms. APRA needs to pull its weight.

In general the immediate future of the Australian economy comes down to a tussle between the housing boom and the mining and energy slump, with services as the swing factor. It would be nice, perhaps, if the swing factor was manufacturing, but it's simply not material.

In my view, investment in services will eventually follow consumption, which in turn will follow housing – as long as there isn't a housing crash.

Is it a bubble? Maybe in Sydney.

The chairman of ASIC, Greg Medcraft, who is more spectator than player in this game, recently declared that he's worried about Sydney and Melbourne, and added: “History shows that people don't know when they are in a bubble till it's over.”

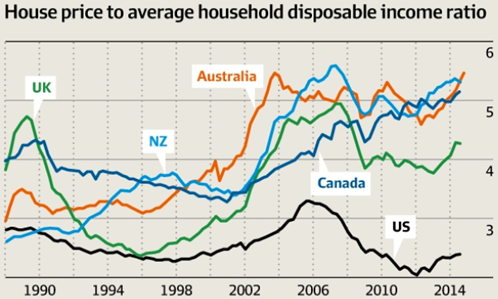

He was mainly talking house price to income ratios and this graph accompanied the article about his warning (it was in an interview, not a speech):

If APRA does actually manage to limit lending for investment property, and therefore put a cap on the price boom, then the RBA will feel freer to cut rates again.

Whether it does, of course, will depend on the data, and that data, as discussed, is weak apart from the housing sector.

So there are three things to watch: next week's capital expenditure data, and whether services investment expectations reverse the February decline of 7 per cent, employment and whether the unemployment rate can start to head down, and all the housing data – prices and approvals.

US CPI, Yellen speech

American inflation for April came out last night – core inflation (CPI minus food and energy) was 0.3 per cent and 1.8 per cent for the year. More significantly the three-month annualised rate of core inflation has risen to a four-year high of 2.6 per cent – well over the Fed's stated target of 2 per cent.

Also, that target was reiterated last night by Fed chair Janet Yellen is a speech in Providence Rhode Island. The key paragraph was: "if the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy. To support taking this step, however, I will need to see continued improvement in labor market conditions, and I will need to be reasonably confident that inflation will move back to 2 per cent over the medium term.”

The markets reacted, but not excessively. The US dollar index jumped (see chart) the AUDUSD rate fell to 78.2 and the S&P 500 fell about five points. No big deal.

Dick Smith

What a story this company has been. Started by a young bloke named Richard Smith, tinkering with car radios in 1968, sold to Woolworths for $20 million, which failed miserably to run it properly, sold after 30 years to the Anchorage private equity firm for $22 million, and then Anchorage turned around and floated it less than two years later for $510 million!!

Good grief. And the fact that Anchorage cut the costs so effectively and then floated it at such an amazing price has made life a bit difficult for CEO Nick Abboud.

Costs are mostly gone – he has to go for growth, which he's doing pretty well so far, although the share price is basically where it was at the float in late 2013.

What I (sort of) got out of Nick in our interview is that in addition to opening more Dick Smith stores, he's planning a big expansion of the airport duty free shops, including overseas.

The company announced the move into Sydney Airport in September last year, in partnership with the world's fifth biggest duty free operator, the German firm, Heinemann, and according to Nick Abboud it's been a ripper. So he's going to keep doing more.

Dick Smith is one of the winners from the budget, and we currently have it as a but, with a projected price of $2.70. Here's James Hannam's most recent note.

You can watch and read my interview with Nick Abboud here.

Strategic Energy Resources

Here is my last (for the moment anyway) look at graphene.

This company was, and still is, a copper explorer that had some graphite in South Australia, which it has demerged into a company called Valence Industries (formerly Tarcoola).

Because it had the graphite, according to CEO Mark Muzzin, and Monash University's Dr Mainak Majumder, who was doing research into graphene, needed graphite, he gave exclusive global rights to his research in return for material plus royalties.

Next month the graphene research business, called Ionic Industries, is also to be hived off into a separate listed company, with an IPO to raise $10 million to fund the research. Mark Muzzin will go with Ionic and someone else will run SER.

I think graphene is interesting and certainly hot at the moment, but I wouldn't want you to think I'm a fanatic on the subject. Having now done two interviews I haven't yet invested any of my own money in it, although I'm thinking about Talga.

Anyway, here's my interview with Mark Muzzin, who definitely is a fanatic, and good luck to him. At least he's focusing on the business end, which is the products that can be made from graphene.

Readings & Viewings

John Oliver, hilariously, on the saga of Johnny Depp's dogs, in case you missed it.

Compelling, but difficult to watch, interview with Alan Cumming on ABC's 7.30, talking about his dreadful childhood.

Hugh Jackman shows Jimmy Fallon how to eat vegemite.

"The world economy is like an ocean liner without lifeboats.”

Antidote: How to make French onion soup.

Low interest rates: a retiree survival guide from Morningstar.

Anyway, retirees are into sex, drugs and rock n roll – the statistics prove it!

Dave Letterman's best DIY bits from when it was a low-budget TV show.

An absolutely brilliant comment on modern politics (published in 2012). The “other side” must not win…

Fascinating inside story about how Comcast lost its bid for Time Warner.

In a budget marked by confusion, the government's hunt for ‘unfairness' has made enemies of key constituents.

Grattan Institute's analysis of the budget: future taxpayers will pay the price.

My view: the budget was just a piece of spin, as usual.

This guy has compared budget forecasts with budget realities. Not pretty.

Stephen Colbert's funny, earnest graduation address at his old college.

Chris Bowen reckons he will go to an election over super. Give me a break.

Greece is not the only country facing economic challenges.

A quick video on the $5.6 billion in fines that US banks were whacked with this week.

Matt Taibbi on the same thing: banks admit to crimes, pay $5 billion of their shareholders' money, and no one goes to jail.

Why robots will always needs us.

Interesting piece arguing that the American declaration of independence was actually a revolt against austerity.

Why did God invent economists? To make weathermen feel good about themselves. At least they know what happened yesterday.

The backlash against Facebook's Internet.org project is growing.

Why today's "trade" agreements are about much more than free trade.

The great beta hoax: it's not an accurate measure of risk at all.

Grand bargain emerging on Europe as Germany gets used to Cameron's victory.

Declining newspaper circulation: the digital age is not so different to analogue.

Why do we make the search for happiness so much more complicated than it needs to be?

Happy birthday Iva Davies of Icehouse, 60 yesterday. Here he is doing “Great South Land” line in 2005.

Last Week

By Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Global share markets mostly rose over the last week as mixed US economic data was seen delaying Fed hikes, an ECB official talked about front loading QE and talk of further Chinese easing continued. Australian shares slipped though as banks remained under pressure. Bond yields rose slightly but remained below recent highs with the bond sell-off looking like its lost momentum. The US dollar rose slightly and this weighed a bit on commodity prices and saw the Australian dollar fall slightly.

Global growth continuing but remains sub-par. The story of the last few years has been optimism regarding global growth at the start of the year and then a bit of disappointment as global growth remains uneven and below trend. This year looks the same. While “flash” manufacturing conditions PMIs rose in May (up in Japan, China and Europe but down slightly in the US), their level remains consistent with okay but still sub-trend global growth. See the next chart.

Source: Bloomberg, AMP Capital

Against this backdrop, global monetary conditions are likely to remain very easy (with pressure for further easing in China) and it's hard to get too bearish on bonds. In fact, there is a good chance that the bond sell off has run its course (at least for now).

Falling emerging world exports are worth keeping an eye on. A range of emerging and Asian countries, including Korea and Taiwan, have reported falling exports over the last few months. Part of this may reflect earlier strength in the US dollar, weakness in China and falling commodity prices. However, it may also be a sign of softer global growth generally. It's too early to get too excited about, particularly as Europe and Japan have picked up a bit and the US is having just another soft start to the year, but it's worth watching.

Still no Greek deal yet. It's now close to crunch time for Greece which will need agreement on a funding release in the next week or so or else face a probable default event in June as it runs out of funds. Such a default or “Graccident” won't necessarily mean that a Grexit (Greek exit from the euro) is inevitable and by highlighting the difficult situation Greece is in could force it to agree to the necessary reforms. However, the political uncertainty - ie, whether there will be a deal? how long it will take to be approved by the Greek Parliament? whether it will have a referendum on it? what will happen if there is no deal? etc - has the potential to cause increased volatility in investment markets. Our base case remains that a deal will be reached as it's in the interests of both sides, but whichever way it goes the rest of Europe is in far better shape now than was the case in 2010-2012 so contagion from Greece to other peripherals is likely to be kept to a minimum.

Major global economic events and implications

US data remains pretty mixed. While housing starts and permits rose strongly April and jobless claims remained low, a range of data was softer than expected including the NAHB home builders conditions index, existing home sales, the Markit manufacturing conditions PMI and regional manufacturing conditions indexes. The strong US dollar and the lower oil prices (via energy producers) has clearly weighed on the US growth. It will likely pick up in the months ahead but it's another year where US growth is failing to meet expectations set at the start of the year. And that includes the Fed's own forecasts. The minutes from the last Fed meeting offered little that was new with the Fed largely dismissing recent economic weakness as transitory, but seeing little support for a June rate hike with September looking more likely. The generally weak tone to US economic data since the last meeting make the minutes a bit dated though so it may be even more dovish now.

Eurozone data disappointed a bit, highlighting that any talk of an early end to the ECB's quantitative easing program is way too premature. Although the manufacturing conditions PMI rose in May, services conditions fell and this dragged the composite PMI lower. While the overall PMI is still at a reasonable level, based on past relationships its pointing to growth remaining around 0.3/0.4 per cent quarter on quarter for now. Consumer confidence also disappointed in May, albeit from a relatively solid level.

Japanese data provided a bit of confidence that its latest economic recovery is continuing. March quarter GDP growth was stronger than expected (albeit much of this was due to inventory accumulation), machine orders rose more than expected and the manufacturing PMI for May improved more than expected. As expected the Bank of Japan made no changes to monetary policy.

Chinese economic data was a bit more positive with the flash HSBC manufacturing conditions PMI improving in May (albeit by less than expected) and property prices coming in roughly flat for April (in contrast to falls averaging around 1 per cent a month in mid last year) adding to signs that the property market may be stabilising. People's Bank of China monetary easing has also resulted in a collapse in money market interest rates, with the overnight rate falling to around 1 per cent.

Australian economic events and implications

A 6 per cent bounce in consumer confidence has confirmed that the Budget has gone down far more positively than last year's Budget did (when confidence fell 7 per cent). This is very welcome, as confidence has been lacking for some time now. However, with confidence still only just above long term average levels a further improvement is required to get confident that the growth outlook is on the mend. Meanwhile, the minutes from the RBA's last Board meeting and comments by Deputy Governor Lowe to the effect that there is still scope to lower the cash rate if needed support the interpretation that the RBA retains a mild easing bias. Our base case remains that 2 per cent is the low for the cash rate, but that the risks are on the downside particularly if the Australian dollar fails to behave. However, going by the recent experience another cut in rates is unlikely to occur before August as the RBA would probably prefer to get a look at its next set of economic forecasts (which won't be available till August).

Next Week

By Craig James, CommSec

Business spending dominates attention

In Australia in the coming week, the key survey of business spending – or private sector capital expenditure – is released. In the US, another solid week of economic data releases is scheduled.

In Australia, the week kicks off on Tuesday with preliminary estimates of goods and services exports and imports issued for the March quarter. The figures are more for data aficionados as are the supplementary figures on producer prices (business inflation).

However the first measure of relevance for economists and investors alike is the construction work done figures from the Bureau of Statistics (ABS) on Wednesday. Certainly the data is more of an historical record, showing residential, commercial and engineering construction activity in the quarter. But the data on residential building is a direct input to the GDP (economic growth) equation. The economic growth data will be released on June 3.

Also on Wednesday the Reserve Bank Deputy Governor Philip Lowe delivers yet another speech, this time at Thomson Reuters' 3rd Australian Regulatory Summit in Sydney. Whenever Reserve Bank officials front the lectern, they have the opportunity of sending messages to the wider community. In a recent speech, Philip Lowe confirmed that the Reserve Bank still had scope to cut interest rates should it become necessary.

The highlight over the week is the business spending figures on Thursday. The Reserve Bank's fervent wish is that businesses start to embrace the amazing opportunities presented by the low interest rate environment. In fact Reserve Bank Deputy Governor Philip Lowe has highlighted a recent global survey from Deloitte that shows businesses still require that new business investment initiatives achieve returns of above 10 per cent despite the super-low interest rate settings.

We expect that business spending fell by around 5 per cent in the March quarter, keeping downward pressure on interest rates.

Apart from actual business spending, the other point of interest from the investment survey is the expectations component. Respondents to the survey reveal expectations for spending over the remainder of 2014/15 as well as early expectations for 2015/16. Expected spending of around $154 billion for 2014/15 will be well regarded as would be spending near $115 billion for 2015/16.

On Friday the Housing Industry Association issues data on new home sales for April, while the Reserve Bank also releases the Financial Aggregates publication. Not only does the publication contain the data on private sector credit or loans outstanding but also the monetary aggregates. Private sector credit probably grew by 0.4-0.5 per cent in April or around 6.2 per cent over the year. Investment housing probably led growth, but the focus will be on business borrowing.

Bevy of US data releases

There are no Chinese economic indicators of note over the week, so the spotlight will clearly be on the US economic data releases.

The week kicks off on Tuesday with no fewer than half dozen economic events scheduled. Data on durable goods orders is released – a key measure of business investment. Durable goods are generally regarded as goods that last longer than three years such as aircraft, fridges and computers. Orders may have fallen by 1.2 per cent in April after lifting by 4.7 per cent in March.

Also on Tuesday, two data releases on home prices are released with consumer confidence, new home sales, the Richmond Federal Reserve survey and weekly data on chain store sales. Home prices may have risen by 0.8 per cent in March to stand almost 5 per cent higher than a year ago. And new home sales may have rebounded by 7.1 per cent in April after slumping by 11.4 per cent in March.

On Wednesday, the “flash” Markit purchasing managers survey for the services sector is released together with both the Dallas and Texas surveys on the services sector and weekly survey of housing finance.

On Thursday, data on pending home sales is issued together with the usual weekly figures on claims for unemployment insurance.

And on Friday in the US, the preliminary estimates of economic growth are released for the March quarter. The “flash” or advance reading showed the economy growing at a scant 0.2 per cent annual rate. But following weak trade data, economists now expect that the economy went backwards by 0.6 per cent. Clearly the figures will make it more difficult for the Federal Reserve to lift interest rates in coming months.

Also out on Friday is the final estimate of consumer sentiment for May together with a speech by the Federal Reserve chair Janet Yellen and the Chicago purchasing manager's survey.

Sharemarket, interest rates, currencies & commodities

Volatility trailed off for the Australian sharemarket last year but it has edged higher in recent months. Using a measure tracking the number of days in the month that the ASX 200 rose or fell by more than 1 per cent, volatility hit 8-year lows over August and September last year.

But the rolling annual total of ‘volatile' days has lifted from 32 days to 43 days on uncertainty about the outlook for the resources sector and about the timing of US interest rate hikes. And the uncertainty looks set to linger a little longer.