iSentia: A good business struggling with challenging trends

By James Greenhalgh

It's been quite a ride since iSentia listed a couple of years ago. The shares were initially offered at $2.04, but began trading around $2.40 and quickly moved above $3. In December 2015 they almost reached $5, but expectations got a bit ahead of reality and they've since tumbled almost a third to $3.50.

So, is this the opportunity we've been waiting for, or is it a sign of further trouble to come?

At this stage we think it may be more of the latter, although iSentia is a very good business and it's certainly worthy of a place on your watchlist – even if its private equity packaging has helped disguise some worrying trends.

iSentia is no pig but that didn’t stop Quadrant, its former private equity owner, from applying a generous smear of lipstick at the time of the float. Quadrant could hardly wait to sell its remaining 19% stake in August 2015 – as soon as it was able. Managing director John Croll then sold 1.4m iSentia shares in September (representing around a fifth of his holding). Both sales were made at prices below the current share price – which is hardly an endorsement of the value in the stock.

The lack of value – more on that later – isn’t the only thing precluding an upgrade to Buy. Also concerning is that the company’s main Australia and New Zealand (or ‘ANZ’) division is more mature than it looks. And an important risk highlighted in the 2014 prospectus might – just might – soon cause the company problems.

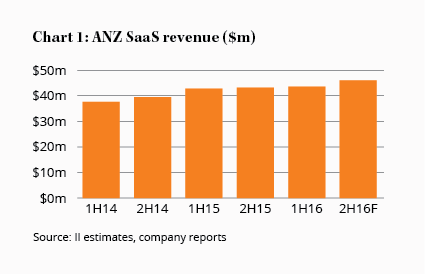

Chart 1 shows estimated revenues from iSentia’s ANZ ‘Software as a Service’ (or SaaS) business over the past six half-yearly periods (including the current half). The generally flat revenue profile is concerning enough, but things may even be worse than they look.

First, iSentia acquired its smaller competitor, AAP, in the second half of 2014. This boosted annual revenue by about $6m. Second, iSentia aims to push through an annual 5% price rise and did so in March 2014 and then again in March 2015. Without these two tailwinds, there’s little in the way of underlying growth.

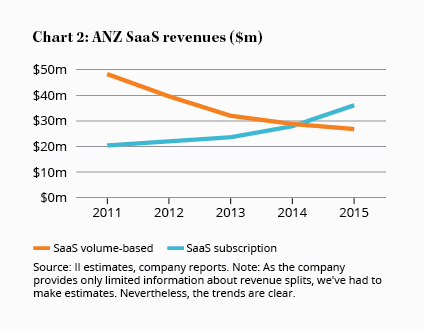

So what’s behind the weak underlying business performance? The answer might lie in Chart 2.

It clearly shows iSentia is a business in transition. The company’s origins as a media monitoring service mean revenue was once wholly based on the volume of press clippings cut for clients. As Chart 2 shows, a large chunk of revenue is still volume-based.

The problem is laid out on page 85 of the 2014 prospectus: ‘The volume of content from print news sources in ANZ has declined in recent years’; and ‘If the volume of content continues to decline (eg because of further reductions in journalist numbers by print media publishers) … iSentia’s future financial performance could be adversely affected’.

So iSentia shareholders should be a tad nervous about Fairfax Media’s recent announcement that it will cut 120 editorial jobs from its Sydney and Melbourne newsrooms. News Corporation has also flagged staff cuts in Australia this year.

No wonder iSentia has been encouraging clients to switch from volume-based fees to subscription-only. Chart 2 shows it is having some success. But volume-based revenues remain substantial at around 25% of the Australia and New Zealand total, and switching these clients to subscription-only will become progressively more difficult.

We may just be jumping at shadows. Despite the changing revenue mix in the core business, other areas are growing nicely.

iSentia is generating reasonable growth from ‘value-added services’ such as social media monitoring, with Australia and New Zealand revenue forecast to rise 57% between 2014 and 2016. Total revenues from Asia are also expected to grow by 41% over the same period. This is good quality growth.

Growth by acquisition is of greater concern. Take last year’s $48m acquisition of King Content, a company providing marketing content that’s useful to consumers (now there’s an idea). iSentia paid a big price – 10 times forecast 2017 earnings before interest, tax, depreciation and amortisation (EBITDA). King Content forms the company’s new ‘Content marketing’ arm.

But King Content is a less attractive business than iSentia’s monopoly-like media monitoring operation. King Content’s market share is 15%, compared with iSentia’s media monitoring market share of around 90%.

Lower EBITDA margins are the result, with King Content’s at around 18% compared with the 45% generated by iSentia’s Australia and New Zealand business. Then there’s the fact iSentia’s largest client accounts for 1.5% of revenue; King Content’s top ten clients account for around 50% of revenue.

Acquisitions such as King Content might fit with iSentia’s existing business but we’re having trouble seeing how. Whatever the case, it looks like the company is travelling down the road towards ‘marketing services’. This road involves lower margins, greater competition and, quite possibly, a few hairpin bends.

US company Experian paid 20 times historical EBITDA for Veda Group, perhaps the highest quality ex-private equity business of recent years. Should you pay the current 18 times 2015 EBITDA for iSentia?

We think not. While iSentia forecasts EBITDA will grow by about 20% in 2016, bringing the prospective multiple down to 15, there’s no margin of safety here.

We’d like more evidence that cash flow isn’t under pressure too, particularly because free cash flow in the first half was only $9.4m. Management attributed this to the acquisition of King Content but that isn’t exactly reassuring.

iSentia enjoys an extremely strong market position, high margins and the potential growth from Asia mean it deserves – and currently has – a premium price.

No one knows whether the company’s recent share price decline since the peak in mid-December is the beginning or the end. What we do know is that this is a business in transition, the decline in print media is continuing, the stock trades at a premium price, and company insiders have been selling.

None of that provides a reason to buy and, if anything, there is an argument for the opposite course of action.