Isaac Newton: great scientist, terrible investor

To his chagrin, Isaac Newton discovered that the laws of gravity also apply to bubbles.

Physicist and mathematician Sir Isaac Newton was one of the greatest scientists to have ever lived.

Born in 1643, Newton's book ‘Principia' introduced his laws of gravity and motion and is arguably the most important scientific book ever written. Newton's list of achievements also include the discovery that white light is actually comprised of colours, the invention of the reflecting telescope and, to the irritation of high-school maths students everywhere, the co-invention of calculus.

What is less well known is that Newton also lost a substantial proportion of his wealth (about $4m in today's money) in the South Sea Bubble.

The South Sea Company

As a result of the War of Spanish Succession and years of war with France, the British government's debt had ballooned by the early 18th century. Its solution was to create the South Sea Company in 1711, which reduced its debt burden by requiring investors to exchange their government debt holdings for South Sea stock. To sweeten the deal, the government granted the company a monopoly on trade with Spain's South American colonies.

The South Sea company's directors talked up the stock with ‘the most extravagant rumours', and investors believed that the South American colonies would soon be trading their silver and gold for England's fleeces and fine wool.

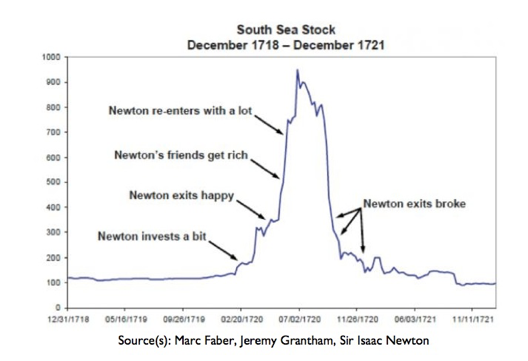

In early 1720, Isaac Newton made his first small investment which, to his delight, doubled in just a few months and allowed him to sell out for a 100% profit.

However, like most value investors have at some stage in their careers, he sold too soon and South Sea stock continue to rise. No longer in the market, Newton was forced to watch enviously as his friends and colleagues who still held stock basked in their newfound wealth.

Unable to endure it any more, Newton decided to buy back into the stock but this time he committed a much more substantial proportion of his wealth.

You can guess what happened next.

Despite the hype and promises of untold riches, the South Sea Company achieved very little and in September 1720, the bubble finally burst (see chart).

The South Sea Company's collapse meant thousands of individuals were declared bankrupt and the British economy went into reverse. Showing the more things change, the more they stay the same, a number of politicians and directors involved in fraud, bribery and insider trading were disgraced and had their estates forfeited.

For his part, Newton's wealth dropped like an...er...apple in an orchard and he ultimately lost most of his money. For the rest of his life he forbade anyone from speaking the words ‘South Sea' in his presence.

The big question is why?

Although it occurred 300 years ago, Newton's experience offers a number of good lessons for today's investors.

Despite being a genius, Newton still succumbed to a number of common human biases. With seemingly everyone else buying South Sea stock and making money (at least on paper), the temptation for Newton to join in was clearly too strong. In the jargon, this was a classic case of herding behaviour or simply following the crowd.

Newton may have also fallen for the ‘deprival super reaction syndrome'. In plain English, this is the feeling you get when something you like and own (or almost own) is taken away from you. The feeling of loss and missing out that Newton probably experienced after he sold his first lot of shares then watched them keep rising may have contributed to him buying in again.

The lure of making money quickly is strong: when your friends and colleagues are getting rich, you don't want to miss out, something many readers may have felt during the internet boom of the late 1990s. So simple greed and envy would also have contributed to Newton's mistake.

Newton co-invented calculus so should have been able to see that the numbers simply didn't stack up at the height of the boom. Yet perhaps the lure of riches was so great that he chose to simply tune out this part of his thinking ('psychological denial' in the lingo).

Finally, given Newton's amazing list of lifetime achievements, he may simply have felt overconfident and that he could do no wrong.

A better finish

Unfortunately, Newton realised too late that the laws that govern physics and mathematics are more ordered and predictable than the chaos that surrounded the South Sea Company. ‘I can calculate the motion of heavily bodies but not the madness of men,' he complained.

Though Newton lost a small fortune, he continued as the well-paid Master of the Royal Mint until his death in 1727. And despite his investment in South Sea stock being a dud, he did well investing in the East India Company and died leaving an estate of around $6m (in today's money).

Newton's South Sea bubble experience shows the power of emotions and biases, and how they can override even the most brilliant of minds. If you can maintain your temperament and, unlike Newton, not succumb to emotions and biases, you'll go a long way to becoming a better investor.