Is this the gold boom?

Summary: Global political events are pushing the price of gold, and the share price of gold miners, higher. |

Key take-out: Unlike other minerals, movements in gold are very difficult to predict as investors flock to the metal as a hedge against other events that damage market confidence. |

Key beneficiaries: General investors. Category: Commodities. |

Gold's rush is distorting the pecking order in Australian mining and has become a challenge for fund managers caught short – with the best example being the shock discovery that on Monday, Newcrest passed Rio Tinto in the top 20 on the ASX.

There is a trick in that comment, but it also highlights the point that many Australian funds, especially those focussed on the top 100 stocks, have minimal exposure to gold – a situation they might have to correct, compounding the problem by driving goldminers higher.

The driver behind the Monday changeover, which saw Newcrest displace Rio Tinto as the 16th biggest ASX-listed company, was the stronger gold price after the Britain's “Brexit” vote, and the distorting effect of the ASX only valuing the Rio Tinto shares on its Australian share register.

The official view of the ASX is that it provides a platform for 424.2 million Rio Tinto shares, overlooking the 1.37 billion on the company's London share register. When the British shares are added, Rio Tinto's market capitalisation is around $78 billion, making it four times bigger than Newcrest.

Once you look past the problem of Rio Tinto's dual share registers, the point about gold stocks rising rapidly on the ASX remains valid, especially the question of whether fund managers have sufficient exposure to a metal with a price that is notoriously difficult to forecast.

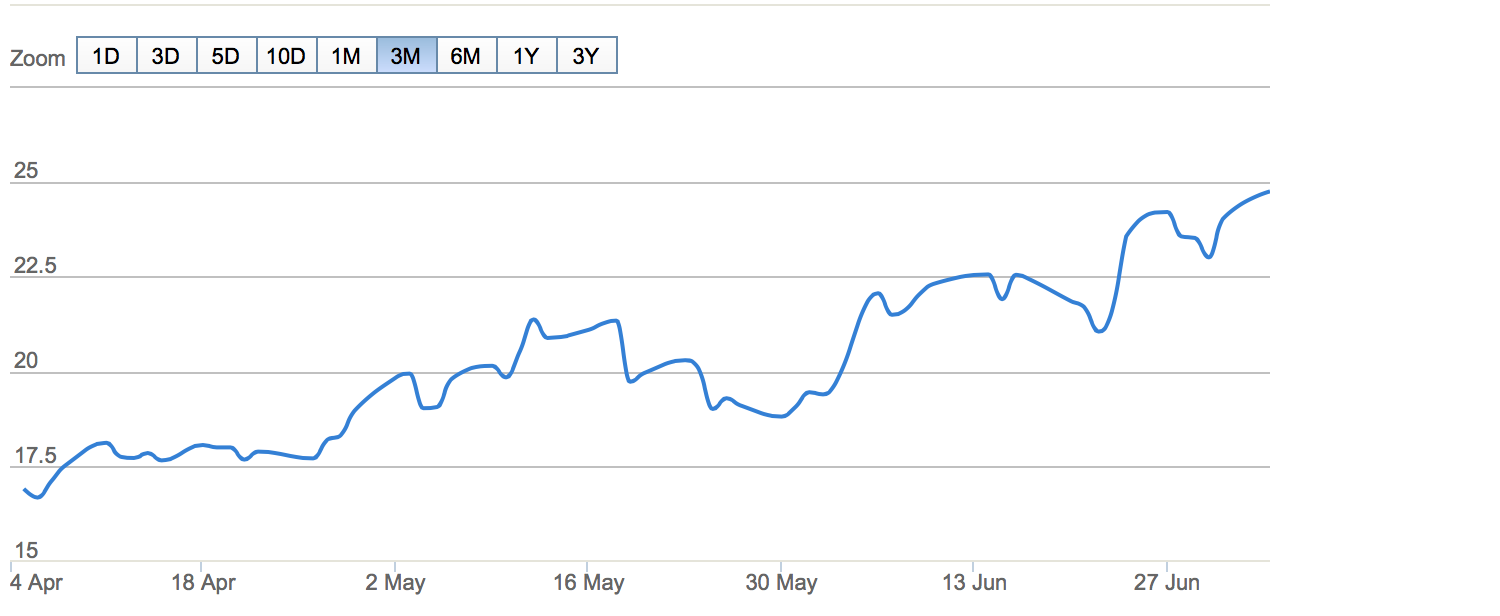

Newcrest, for example, has enjoyed a 125 per cent share price rise over the past 11 months, lifting its market capitalisation from $8bn to $18bn, whereas Rio Tinto's ASX-listed shares have risen by 20.6 per cent from a low point value of $15.5bn to $18.7bn – with that latest value putting it back ahead of Newcrest, just.

Newcrest Mining (NCM) share price:

Look a little further down the list of ASX stocks and the gold challenge for fund managers becomes clearer because whereas there was once only Newcrest to consider, the latest rush has lifted three more goldminers into the top 100.

Evolution Mining (EVN), OceanaGold (OGC) and Northern Star (NST) have all joined the top 100 list with rankings at 85, 92 and 95 respectively.

Whether the goldminers stay in the top 100 for long is the first question for fund managers, but if they hang around for a while then managers with a mandate to invest in top 100 stocks will have to rethink what has been a generally negative view of gold.

A second question is what to do about the other gold stocks knocking on the door of the top 100, including Regis Resources (137th) and St Barbara (160th).

The easiest explanation for the light exposure of fund managers is that they are refusing to believe what's happening with gold. This also extends explaining the under-valuation of gold stocks by big name investment banks, which prefer easier-to-understand minerals like iron ore, copper and coal.

The latest crop of research papers on Newcrest reveals an expectation that the stock will be trading at $15.39 in 12 months, a price which is 34 per cent below its latest $23.55.

It is possible that investment bank such as Credit Suisse, with its 12 month price forecast of $16.05 for Newcrest, published last week, will be proved correct, but given the mercurial nature of gold it's equally possible that it will be proven wrong.

That's the problem with gold when it comes to logical, spread-sheet based, modelling of mining stocks and the assumptions required about future supply, demand and price of a particular commodity.

The uncertainty factor, on full display after the Brexit vote and the threat it represents to the future of the European Union, does not fit into a financial model.

Australia's biggest mining companies, BHP Billiton and Rio Tinto, have also subscribed to the financial-model view when it comes to investment decisions, preferring what they believe to be the relative certainty of forecasts about conventional industrial minerals.

Unfortunately for millions of investors, those views of sticking with something that can be modelled has been a disaster over the past three years, as a glut of minerals (and oil) has been dropped onto saturated markets. The result has been lower profits, reduced dividends and falling share prices.

Gold, which was once included in the portfolios of BHP Billiton and Rio Tinto, has been dumped for what seemed the safer option of selling industrial minerals to rapidly industrialising markets such as China.

The result is that the commodity in short supply today is not iron ore, copper, or coal, it's the metal the big boys of mining abandoned: Gold.

Will it stay that way?

Probably not because gold, like all commodities, is subjected to cyclical swings of supply and demand, plus the considerable unknown of a large portion of its market being classified as “investment”.

The question investors ought to be asking is: “what's the outlook for industrial metals v gold?” and that's when you get a few interesting thoughts, such as this one last week from the chief executive of BHP Billiton, Andrew Mackenzie.

In response to a question asked at a New York investment conference about the future of industrial minerals he said: “We've had such a long boom that to work that through, in my view, it may take another 10 years”.

In other words, the sort of industrial minerals produced by BHP Billiton face another 10 years of over-supply, a forecast implying flat profits and flat dividends until the year 2026.

Gold, however, could be at the start of a boom given recent turbulent events in world financial markets, the Brexit vote, the prospect of “Nexit and Frexit” – snappy ways of describing the potential for EU exit referendums in the Netherlands and France, or the ultimate exit acronym “Exit”, for the collapse of the common currency, the euro.

Gold is doing precisely what it's designed to do in times like these, creating an investment class of its own which is beyond the reach of government, a place more people are finding attractive every day.

Does any of that mean that the gold price will rise further than its current $US1,315/ounce?

“Perhaps” is the only safe answer, but one thing is certain, because gold is a currency more than a commodity. It has been a portfolio-saver for some British investors who have just watched their currency, the pound, trashed, while the gold price in pounds has risen by 20 per cent in a matter for days to be nudging the £1000/oz mark.

Ignoring gold is an option for all investors and certainly one applied by management at BHP Billiton and Rio Tinto – and that's why Newcrest is snapping at the heels of Rio Tinto on the ASX and why three once-small gold stocks have barged their way into the top 100.