Is the market too expensive?

John Addis

Is the market too expensive?

In December 2001, Fortune magazine revealed the details of a speech given by Warren Buffett to a bunch of corporate executives. At the time Buffett called the ratio of market capitalisation to Gross National Product “probably the best single measure of where valuations stand at any given moment.”

He may have been right about that. Had investors been paying attention to it they may have avoided the tech wreck in 1999-2000 and the global financial crisis seven years later. Those with strong stomachs may have even bought a few bargains in the ensuing crashes.

The ratio has a degree of predictive power, not in terms of timing of course, but in signifying generally cheap and expensive stocks. With the US S&P 500 within scratching distance of its all-time highs in early March, the measure is enjoying something of a resurgence. So, what's it saying right now?

The beauty of the Buffett Indicator, as it became known, is its simplicity. On the top sits the numerator, or so Google tells me – the combined market value of all publicly traded shares. On the bottom is the denominator – I worked that out myself – GNP. Divide the top by the bottom and you're done.

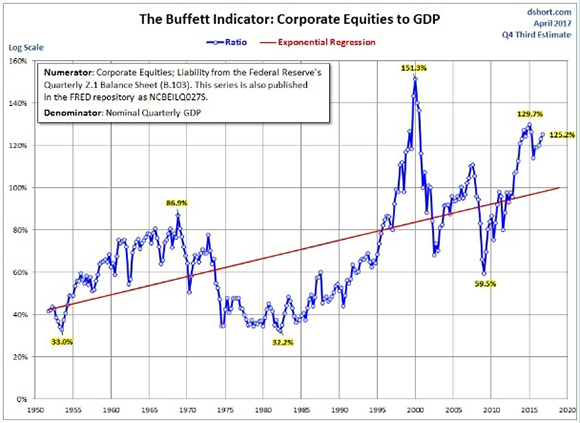

More recent versions of the chart use GDP instead of GNP but the picture's pretty much the same either way. Here's how it looks for the US, via Advisor Perspectives:

The Nifty 50 peak in the late 1960s and the more recent booms and busts are self-evident, as is the long-term increase in total market capitalisation since the early 1980s (the rising red line) related to the growing share of corporate profits as a share of US GDP, which have pushed market capitalisations up.

So, are US stocks expensive? Not according to Buffett. In an interview with CNBC in February, he said “we're not in bubble territory” and that US stocks prices were “on the cheap side”. That's not what the chart seems to suggest, though. It's generally accepted that a ratio above 100 per cent departs from fair value, and it's well above that level right now. Buffett explains the discrepancy via historically low interest rates. “If interest rates were 7 or 8 per cent then these [stock] prices would look exceptionally high.”

Then again, Berkshire Hathaway is sitting on $US86 billion in cash and equivalents, its highest ever. If bargains abounded, you'd think Wazza would be finding more opportunities to put it to work.

With the S&P 500 very close to its all-time high of 2396 set on March 1, plenty of high-profile fundies are, in effect, saying that Buffett got it right 17 years ago and is now departing from the script. He's even buying into airlines, something he vowed never to do.

This week, reclusive hedge fund manager Paul Tudor Jones lined up behind that view, saying that a variation of the above chart should “terrify” central bankers. Zerohedge reported that Guggenheim Partners' Scott Minerd expected a “significant correction” this summer, while Philip Yang of Willowbridge Associates expected falls of 20-40 per cent. Gulp! And the famed Seth Klarman recently told clients that corporate insiders offloading stock was an indicator of “full or excessive valuations.”

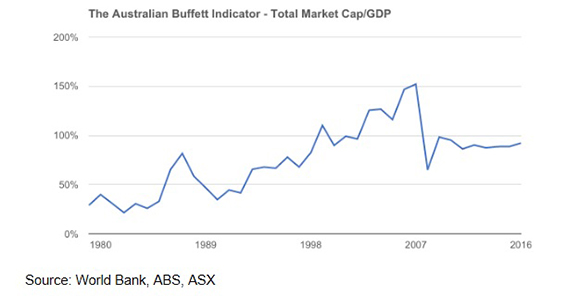

Should we be worried? If you're largely invested in US stocks, perhaps. But if your portfolio is chock-full of ASX-listed businesses, probably not. Whilst a Buffett Indicator of 125 per cent suggests US valuations are stretched, in Australia it's 96 per cent as of this week. Moreover, this ratio has been surprisingly stable since the GFC.

There's another reason not to panic, aside from the fact that panicking is always a bad idea. Just because a market is generally expensive does not mean cheap stocks cease to exist, although they may be harder to find.

The current surge in US stock prices makes the point. Since the Nasdaq breached 5500 towards the end of January, almost half the increase since then is down to Apple, Facebook, Microsoft, Amazon and Alphabet, owner of Google. The group accounts for about a third of the S&P 500's increase this year, too. Plenty of stocks have gone nowhere or retreated. Such are the problems of general indicators.

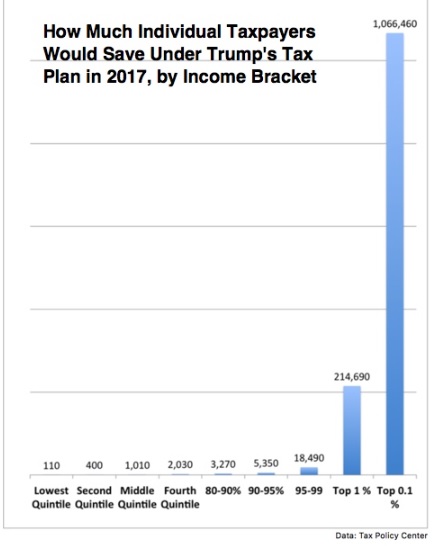

Still, it's a nice way to land on another mystifying market curio. The Trump bump is turning into a long, steady climb because investors are terrifically excited by the prospect of massive corporate and personal tax cuts, with little regard to how to pay for them. And yet the stocks primarily responsible for the market's rise – some of the most profitable on Earth – barely pay any taxes anyway. Go figure.

David Einhorn of Greenlight Capital had the best alternative take on this, telling clients this week that “the bulls explain that traditional valuation metrics no longer apply to certain stocks. Perhaps as the prospects for tax reform have dimmed, the market has regained enthusiasm for profitless companies that aren't at risk of paying taxes.” Einhorn reportedly drives a Honda Odyssey, not a Tesla.

It's hard to see how this sketchy tax plan will be enacted in anything like its current form, and not just because of the chart below. I love white space as much as the next person – it's why my fridge is empty – but even Ayn Rand might find it a little self-serving, let alone moderate Republicans. John McCain's response may well be a Galtian shrug, after which nothing much happens until Trump rents out Mar-a-Lago to Kim Jong-un.

Source: The Atlantic.com, using data from the Tax Policy Sector

The best thing about the plan, for me at least, was what wasn't in it. Despite talk of a territorial tax system, there was no mention of import taxes or duties. The pre-election trade war bluster could be a Hitchcock Macguffin, a plot device to get elected but unimportant to the presidency itself. I hope so, because global trade is showing signs of picking up.

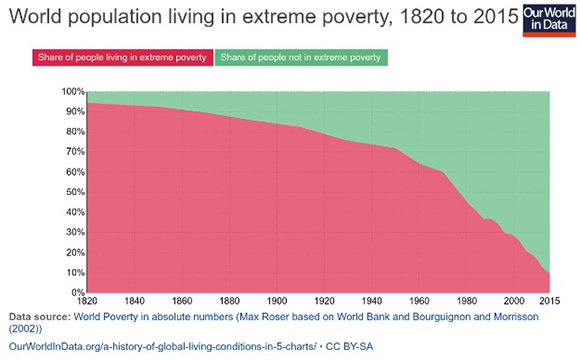

On Tuesday the World Trade Monitor announced that from July last year to January this year, world trade had increased 4.3 per cent, the index's biggest six-month gain since 2010. As Bloomberg's headline reporting the news said, OK, maybe globalization isn't dead. That would be a good thing because, despite all its problems, global trade has been wonderful for the world's poorest as well as its richest.

Prior to the industrial revolution economics was a zero-sum game. Without economic growth, a person could not get richer without another person becoming poorer. Industrialisation began to change that but the post-war period, when globalisation took hold, took it to a whole new level. The percentage of the world's population living in extreme poverty has declined dramatically since then. It's quite the achievement.

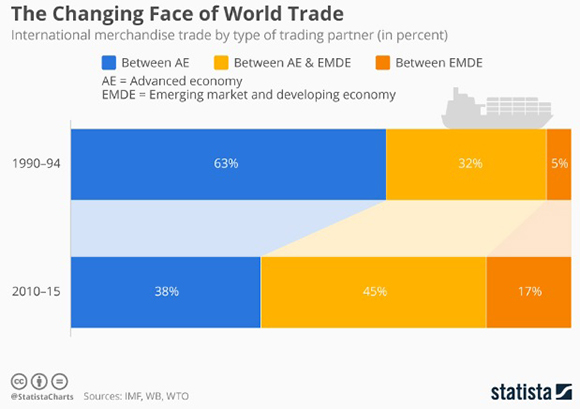

Still, the chart does mask one of the great economic themes of recent decades, which has been the growth of emerging markets, especially in Asia. The chart below from Statista shows how the proportion of trade between advanced economies has fallen in recent decades, offset by increased trade between emerging and developing economies and with advanced economies.

Personally, I have some money invested in a Japan fund and a bit more in dedicated international fund managers. But it always surprises me how few Australian investors, despite being regular visitors to Asia, bother to think of it as an investment opportunity.

That's a theme I'll return to in a fortnight. We all have a tendency to let the US dominate our thoughts – witness the preceding 1200 words – despite widespread recognition that the axis of global economic and political power is shifting our way.

It's going to be a fascinating decade but for now, enjoy the weekend.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

The past week saw “risk on” following the outcome of the first round of the French election and in anticipation of President Trump's tax plan. Mostly good economic and earnings news helped too. This saw most share markets rise led by Europe, but Chinese shares dipped on news of tighter financial regulation. Australian shares had another push towards the 6000 level. Reflecting the risk on tone bond yields rose in core countries (but fell sharply in France), but commodity prices were mixed and the $A fell.

There has been a lot of action on the policy front in the US over the last week – most of which has been positive:

President Trump's much anticipated tax plan provided few surprises: a reduction in the corporate tax rate to 15 per cent (from 35 per cent); a one-off tax on repatriated cash earnings (of 10 per cent); no border adjustment tax (it's just too hard); collapsing the personal tax brackets from seven to just three of 12 per cent, 25 per cent and 33 per cent (with the current top bracket being 39.6 per cent); doubling the tax free threshold to $US24,000; and cutting itemised deductions. While it was short on details this is to be expected as it is really just an opening statement of principles with agreement to be reached with Republicans in Congress who have their own plans that head in the same direction, i.e. lower rates. So compromise is likely - probably resulting in a corporate tax rate of 20 per cent rather than 15 per cent. If the package is “revenue neutral” after 10 years - helped by savings from Obamacare reform, less deductions and "dynamic scoring" which takes account of a possible growth dividend then it should pass Congress with just a simple majority in the Senate (which the Republicans' have). But if it's not revenue neutral 8 Democrat senators will be needed to support it and that's a big ask - so expect it to be "revenue neutral", although that still means a boost to growth. There is a long way to go yet and getting Obamacare reformed is back at the head of the queue so tax reform may not make it into law until early next year. But what the plan shows is that tax reform remains high on the President's agenda and this is all that matters for markets.

Trade got back in headlines over the last week with the US imposing countervailing tariffs on Canadian softwood, investigating imports in relation to the steel and aluminium industries and talk of withdrawing from NAFTA. However, tariffs were deployed under Bush and Obama at times and Trump denied a withdrawal from NAFTA in favour of renegotiation. All of which sounds like bargaining noise. But we remain a long way from the trade war many fear.

A US Government shutdown looks unlikely – with Congress close to a short-term funding agreement.

Of course, risks remain high around conflict with North Korea, although President Trump has indicated he prefers a diplomatic solution.

The first round of the French election saw a good result for markets (and France) with the centrist Macron wining 24 per cent of the vote and the far right anti Euro Le Pen on 21.3 per cent to now face each other in the run-off election on May 7. Macron's relatively complacent post-election speech and team dinner in an up-market restaurant did not get his round two campaign off to a strong start with Le Pen's side playing up his establishment credentials. A portion of those who voted for centre right Fillon and far left Melenchon may also transfer their support to Le Pen and some 20-30 per cent of voters may abstain. More terrorist attacks may also boost support for Le Pen. So a Le Pen victory is still possible. If this were to occur French citizens and investors would fear she will find a way out of the Euro even though there are immense barriers to such a move and this would likely see runs on French banks (remember Greece in 2015), a surge in French bond yields relative to German yields and a renewed bout of Eurozone break up fears weighing particularly on the Euro and Eurozone shares but also on global shares as was the case at the height of the Eurozone crisis in 2011-13. However, against this Macron has a solid poll lead of around 20 per cent against Le Pen which is far wider than the 4 per cent poll error seen in the Brexit vote and the 2 per cent poll error seen in the US election. This could well narrow – which may be a good thing in order to stop complacency sinking in - but our base case is that with the majority of the French wanting to stay in the Euro and negative towards the far right National Front that Le Pen represents Macron will ultimately win on May 7. Expect some nervousness along the way though.

Major global economic events and implications

US data was mostly good with a gradual rising trend in capital goods spending orders, solid home sales, continuing gains in home prices and still high consumer confidence. Meanwhile, March quarter profits continue to surprise on the upside. We have now seen 54 per cent of companies report with 81 per cent beating on earnings and 65 per cent beating on sales. Earnings are up 12 per cent year on year and on track for the fourth quarterly gain to new record highs.

As expected the ECB made no changes to monetary policy with President Draghi more upbeat on growth but remaining relatively dovish on the back to still weak core inflation. Meanwhile April confidence readings in the Eurozone pushed up to the highest levels since before the GFC.

The Bank of Japan also remained on hold as expected consistent with its commitment last September to continue quantitative easing and zero bond yields until inflation exceeds 2 per cent. Given core inflation fell to -0.1 per cent yoy in March this looks like being the case for a long time. Labour market conditions remain strong (partly due to a falling labour force) but household spending remains weak and industrial production dipped in March albeit this looks temporary.

Australian economic events and implications

In Australia, headline inflation rose to 2.1 per cent yoy in the March quarter putting it back in the RBA's 2-3 per cent target range. This is good news to the extent it signals that the risk of deflation has receded. But it's too early to get excited. The cost of living is now rising faster than wages and this will act as a drag on household spending. And abstracting from higher petrol prices and increases in prices for government influenced items like utilities, health and education underlying inflation in the market sector of the economy remains too low at just 1 per cent yoy.

In other data, producer price inflation remains soft, skilled vacancies fell for the second month in a row which is a bit of a concern, credit growth remained weak with lending to property investors slowing again but a surge in export prices in the March quarter points to another rise in Australia's terms of trade and national income.

Meanwhile, with the Federal Budget close two things are worth highlighting. First, the Government is playing down what it can deliver on housing affordability – maybe a few fiddles to encourage downsizing but since the big issue is supply and that is a state issue there is not really much it can do. Second, its new found focus on distinguishing between “good” debt (where debt is used to finance investment in assets like infrastructure that have a long-term payoff) and “bad” debt (where debt is used to finance current spending) makes some sense. There is logic in using debt mainly for assets as it spreads the cost of paying for them to future generations who will benefit from them and such an approach may help reinvigorate the focus on getting current spending under control. The danger though is that it just results in a smoke and mirrors trick that allows a further ramp up in debt with no real slowing in recurrent spending. Ratings agencies would just see through that and such an approach did not help the WA Government. That said, it does look like there will be a ramp up in debt financed infrastructure spending in the coming budget.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Savanth Sebastian, CommSec

Reserve Bank in focus

-

The Reserve Bank and home prices dominate attention in Australia over the week. The Reserve Bank Board meets on Tuesday; Governor Lowe delivers a speech on Thursday and the Bank will release latest economic growth and inflation forecasts on Friday.

-

The week kicks off on Monday with the release of the CoreLogic measure of home prices as well as the Performance of Manufacturing index. Manufacturing is currently in good shape, while home prices continue to lift across most capital cities. Across the nation, home prices rose by a substantial 1.4 per cent in March, matching similar gains in February and December 2016. In fact over the four months to March home prices have accelerated by 4.9 per cent – the strongest four-month period in 18 months. But data currently points to only a modest 0.2 per cent rise in prices in April.

-

On Tuesday data on consumer confidence is issued at 9.30am AEST. While the Reserve Bank hands down the rates decision at 2.30pm.

-

If the Reserve Bank was looking to move rates in any direction it would certainly have the opportunity to do so on Tuesday given that it would be able to flesh out its reasoning in the Statement of Monetary Policy released on Friday. However it is a safe to assume that the cash rate is unlikely to move.

-

Firstly the Reserve Bank is relatively comfortable about how the economy is evolving and secondly the Federal Budget is released on May 9. The Reserve Bank Board would want to see latest fiscal policy measures.

-

On Wednesday the Federal Chamber of Automotive Industries releases industry data on new vehicle sales while the Performance of Services index is also expected.

-

On Thursday the Reserve Bank Governor delivers a speech at the Economic Society (QLD) Business Lunch. And the Bureau of Statistics releases international trade figures (exports and imports) for March. In February the trade surplus lifted from $1,503 million to $3,574 million, powered by a surge in exports. In fact annual growth of exports was the fastest in eight years with exports especially lifting to China, Hong Kong and India.

-

And on Friday, the Reserve Bank releases the quarterly Statement on Monetary Policy which includes the latest economic forecasts. Investors will focus on any commentary on the Australian dollar and the state of the housing market. In addition on Friday, the Housing Industry Association releases data on new home sales.

Overseas: US employment data and FOMC meeting to dominate headlines

- It is a busy week in the US in terms of economic events The US jobs data will garner the most interest given it is considered the most important of the monthly statistics. Also the Federal Reserve meet to decide rates.

-

The week begins on Sunday when China's National Bureau of Statistics releases the results of purchasing manager surveys for manufacturing and services. Australia and New Zealand will be the first markets to react to the data on Monday.

-

On Monday the US version of the purchasing managers manufacturing survey is released together with data on construction spending.

-

On Tuesday the April data on new vehicle and truck sales is released together with the usual weekly figures on chain store sales. New vehicle sales are expected to have lifted by 4 per cent to a 17.2 million annual rate in April.

-

In China on Tuesday, the private sector Caixin manufacturing survey is released with the equivalent services gauge to be issued on Wednesday.

-

On Tuesday, the US Federal Reserve begins a two-day meeting (decision 4am in Sydney on Thursday morning). If there was any doubt about the likelihood of a rate hike, it was resolved with the weak jobs data for March. In short the Fed should do nothing on rates this month. But updated economic forecasts may provide some guidance on the timing of future rate changes.

-

On Wednesday, the usual weekly data on mortgage applications is released together with purchasing manager surveys for services, and the ADP national employment index of private-sector jobs.

-

On Thursday, factory orders, the trade balance and the final reading on durable goods orders for March are released. For the record factory orders are expected to lift by 0.4 per cent, while a trade deficit of $44.4 billion is expected for March.

-

Also on Thursday, the usual weekly data on claims for unemployment insurance is issued together with the Challenger job layoffs series.

-

On Friday, the US jobs report – non-farm payrolls – is released. And the focus will be on all the key measures – job growth, unemployment and wages. If jobs rise by 193,000 in April as expected with hourly earnings up 0.3 per cent, then the Federal Reserve should remain on track to lift interest rates twice in the second half of the year. Consumer credit data is also released on Friday.

-

There will also be five speeches by US Federal Reserve officials to watch on Friday.

Financial Markets

-

The US profit reporting (earnings) season remains in full swing in the coming week.

-

Amongst stocks reporting on Monday are Ferrari and Tenneco.

-

On Tuesday, reporting firms include Apple, Archer Daniels, BP, ConocoPhillips, Gilead Sciences, Merck & Co, MasterCard, and Pfizer.

-

On Wednesday, profit results include those from Carlyle Group, Facebook, Fitbit, Garmin, Groupon, Tesla, Time Warner, Transocean, and Yum! Brands.

-

On Thursday, earnings will come from Alibaba, Peabody Energy, Paramount Group, and Zynga.

-

And on Friday, financial updates will come from Berkshire Hathaway, and Cognisant.

Savanth Sebastian is Senior Economist at CommSec.

Readings & Viewings

Our own federal budget is only just over a fortnight away, and the leaks have been coming thick and fast, from likely increases in government borrowings, to infrastructure spending, and even more changes to the superannuation and retirement savings system. And the pressure is on for corporate tax cuts here.

US Presidential Donald Trump finally unveiled his tax agenda this week, and it has left more questions than answers. As one observer exclaimed to The New York Times, “Who doesn't love a tax cut, especially if no one has to pay for it?”

The Washington Post has seven tax questions on the Trump tax plan that must be answered.

Meanwhile, US Republicans have told Trump to hold off on unravelling NAFTA.

Now, there has been a lot of local noise about the arrival of Amazon in Australia. Should our retailers really be worried? Yes. The online retailer has just recorded some staggering performance numbers, despite its best money-making machine slowing down.

And the company is investing heavily outside of Australia as well. In the UK, Amazon is opening a mega warehouse and creating more jobs.

But those wanting to spend a fiver will need to act quickly.

Others, who are more well-heeled, might fancy this news coming out of London.

Don't worry, if the “retail apocalypse” spirals into a widespread apocalypse, the recently launched Atlas for the end of the world has us sorted.

The trade spat between Canada and the US has claimed another high-profile victim. Americans might be waving their Guinness World Records goodbye.

Is this the day the music died? Check out this snapshot into where America's largest radio group, now led by the inventor of MTV, went wrong. They should have known video would keep killing the radio star.

This is a great upside of technology: A Fitbit contradicts a murder story.

Want to become highly connected? Take these tips from a Silicon Valley super-connector. Or do you want to learn faster and better than everyone else? Follow super-human Elon Musk's lead.