Investor Signposts: January 26, 2018

A raft of important price measures will be published in Australia this coming week.

Australia: Inflation data in focus

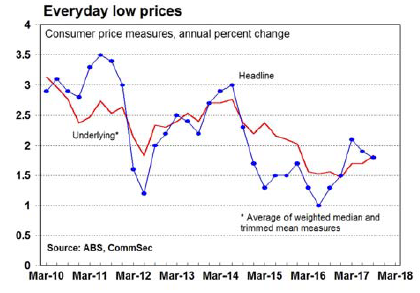

- Various price measures (measures of inflation) feature in Australia in the coming week. The highlight is the release of the Consumer Price Index on Wednesday.

- The week begins on Monday with the release of the quarterly State of the States report from CommSec. The report tracks the economic performance of the states and territories.

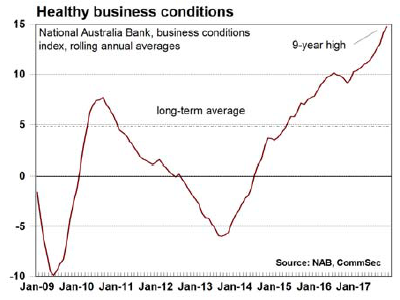

- On Tuesday the monthly NAB business survey weekly is released with the weekly ANZ-Roy Morgan Consumer Confidence survey. Both businesses and consumers are in good spirits and business activity is near the best in nine years.

- On Wednesday, the Australian Bureau of Statistics (ABS) releases the December quarter Consumer Price Index (CPI) – the main inflation measure in Australia.

- Overall we expect that the CPI rose by 0.7 per cent in the quarter, lifting the annual rate of inflation from 1.8 per cent to 1.9 per cent. However a key reason behind the lift in the annual growth rate is a sharp 10 per cent rise in the price of petrol.

- On the other side of the equation, food deflation likely extended into the December quarter according to stock analysts.

- However, stripping out volatile elements, underlying inflation probably rose by 0.5 per cent in the quarter and 1.9 per cent over the year.

- Also on Wednesday the Reserve Bank releases private sector credit figures.

- On Thursday a raft of indicators are scheduled for release. The ABS releases data on dwelling approvals and export & import prices. There are manufacturing surveys from CommBank and AiGroup. And CoreLogic releases data on January home prices. Capital city prices may have fallen by 0.3 per cent.

- And on Friday the ABS releases yet another set of price measures – this time the Producer Price Indexes or measures of business inflation.

Overseas: The US Federal Reserve meets

- A busy week lies ahead on the international economic calendar. In China, the purchasing manager's index is issued. While in the US, the US Federal Reserve meets and the monthly jobs report dominates attention.

- The week kicks off in the US on Monday with the release of the personal income & spending data. Incomes may have lifted 0.3 per cent in December with spending up 0.4 per cent. But investors will also be keen to see the result of the personal consumption price deflator (inflation measure). The core index (excludes food and energy) may have lifted 1.6 per cent over the year, still below the Federal Reserve's preferred target of 2 per cent.

- On Tuesday the Conference Board consumer confidence index is released with the S&P/Case Shiller measure of home prices. The usual weekly measure of chain store sales is also issued.

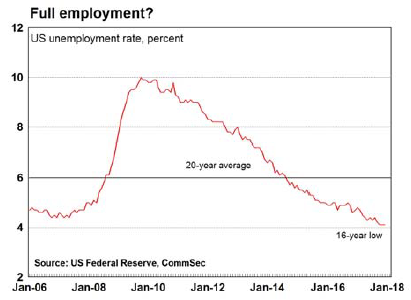

- The US Federal Reserve also starts a two-day meeting on Tuesday (announcement at 6am Sydney time on Thursday morning). No change in rates is expected but investors will dissect the wording of the statement.

- On Wednesday the ADP report on private sector payrolls is released with the employment cost index, Chicago purchasing managers survey and the pending home sales data. Private payrolls probably rose by 180,000 while employment costs may have lifted 0.6 per cent in the December quarter. Results in line with the forecasts will keep the Federal Reserve on track to lift rates in March. The usual weekly data on mortgage finance is also released on Wednesday.

- The ISM manufacturing survey is released in the US on Thursday together with auto sales, construction spending, the Challenger survey of job layoffs and the labour cost/productivity estimates. The ISM index may have eased from 59.7 to around 59.0 in January but this is still well above a reading of 50.0 signifying expansion of the manufacturing sector. Weekly data on new claims for unemployment insurance is also issued on Thursday.

- On Friday the January data on non-farm payrolls (employment) is issued in the US. Economists tip a 175,000 lift in jobs after the 148,000 increase in December. The jobless rate may have remained steady at 4.1 per cent. But the big question is whether the tight job market is leading to wage and price pressures. Average earnings are tipped to have risen by 0.3 per cent in January, lifting annual wage growth from 2.5 per cent to 2.6 per cent.

- Data on factory orders and consumer sentiment are also released on Friday.

- In China, the National Bureau of Statistics releases the purchasing manager survey results for manufacturing and services sectors on Wednesday. The private sector Caixin purchasing manager results for manufacturing are released on Thursday.

Financial markets

- The US corporate reporting season continues in the coming week. Amongst companies reporting on Tuesday are McDonalds, Advanced Micro Devices and Pfizer.

- On Wednesday, Boeing, Microsoft, Facebook and AT&T are listed to release results.

- On Thursday, Amazon, Apple, Alphabet, ConocoPhillips, and Time Warner are listed to report.

- And on Friday earnings from Exxon Mobil, Chevron and Merck are due.

Share this article and show your support