Intelligent Investor Equity Income Portfolio - August 2019 update

We'll highlight some important results shortly, but first we want to highlight why an active value-investing approach could soon be more rewarding.

The bots

You may have heard of momentum and algorithmic investment strategies that use a pre-determined set of rules to capitalise on short-term price movements instead of fundamental research.

An algorithm might suggest buying a stock based on the number of positive words identified in a chief executive's commentary or the direction and magnitude of key financial metrics, such as revenue growth.

This might explain some large share price increases despite lacklustre earnings results and outlooks. Carsales.com is one of the larger positions across our funds. Within two days after reporting its annual results its share price had increased 13%, with the stock up 18% at the time of writing.

As much as we like the company's long-term prospects, neither the results nor its outlook for 'solid adjusted net profit growth' appeared to justify the increase. Perhaps it was just a relief rally after the market turned particularly bearish as new car sales fell for the fifteenth month in a row in June, the largest fall in 20 years.

ResMed is another example from our Growth and Ethical funds. In January the stock fell 21% after announcing a lacklustre result. The share price has since increased 52% despite a similar full year result.

ResMed is not a microcap flying under the radar. It's a globally dominant $30bn healthcare company followed by scores of sell-side analysts. Did ResMed really add $10bn of value in the past six months, or are momentum strategies adding to market inefficiencies?

We think it's the latter, which is music to the ears of long term, value investors, who can't wait for the next great buying opportunity. Perhaps we won't need to wait too long.

13d

13D Research recently published a bunch of charts showing the herding of passive and 'algo' funds in an article titled 'The risks grow that the passive and algorithmic transformation of equity markets could lead to a crisis.'

'According to estimates released by J.P. Morgan in late June, passive strategies now control 60% of U.S. equity assets while quant funds control 20% - a staggering 80% combined.'

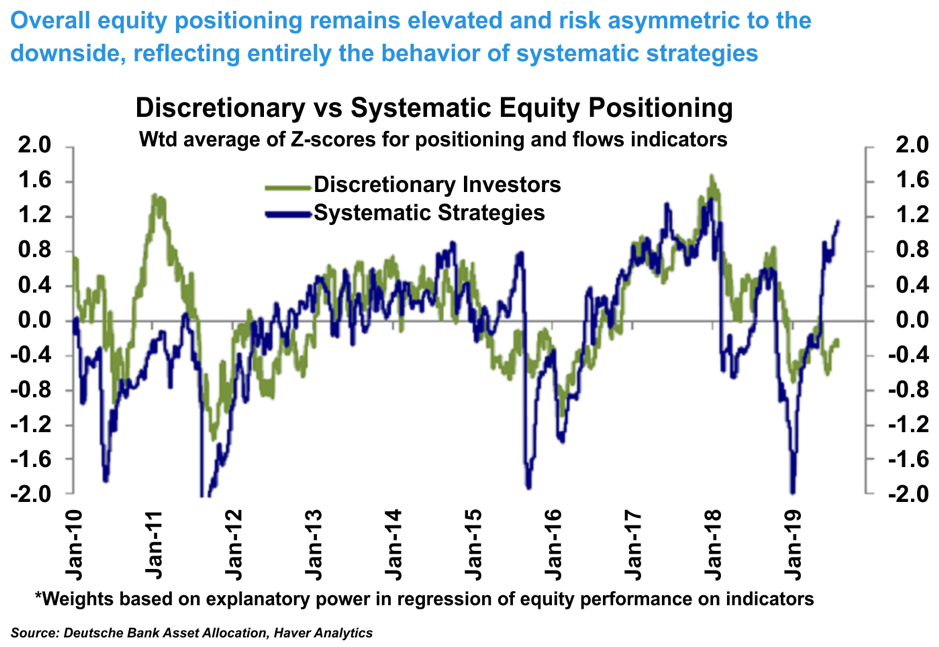

'It's rare markets offer such a vivid depiction of the difference between humans and machines than we've seen in recent weeks. As the S&P 500 hit new highs late last month, the proportion of "mom-and-pop" bears exceeded bulls, according to a survey by the American Association of Individual Investors. Discretionary investor equity exposure remained low, never breaking the decade average. And in recent weeks, traders loaded up on call options on the Cboe Volatility Index, anticipating market turbulence following the FOMC announcement.'

'Meanwhile, systematic strategies flooded into equities:'

Source: Deutsche Bank

'The distilled reason for this divergence appears clear: The humans saw increased risk of human unpredictability - a trade war one Trump tweet away from escalation and a Fed facing contradictory evidence for a rate cut. The machines saw a number: historically low volatility.'

'When the humans proved prescient and volatility spiked last week to its highest since January, the flat-footed machines unloaded swiftly. According to Wells Fargo estimates, volatility-targeting strategies sold roughly $50 billion in U.S. equities from Monday through Wednesday.'

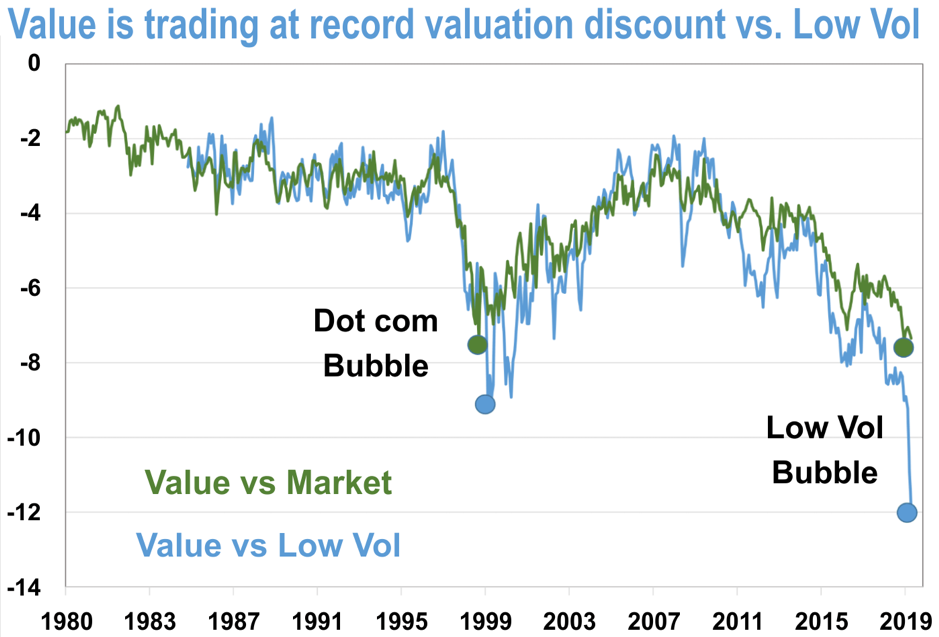

Investors have deserted underperforming value investors in droves to the benefit of low volatility funds. 'As a result of this crowding: "Low-volatility stocks are trading at almost three standard deviations above the mean. That means low-vol is more expensive than it has been nearly 99% of the time, relative to the mean, since 1990," according to the Leuthold Group.'

'J.P. Morgan's quant guru Marko Kolanovic has identified this crowding as an opportunity. An extreme divergence has opened up between the defensive stocks held by low volatility funds and value stocks. Kolanovic believes this offers, "a once in a decade opportunity to position for convergence"':

Source: J.P. Morgan

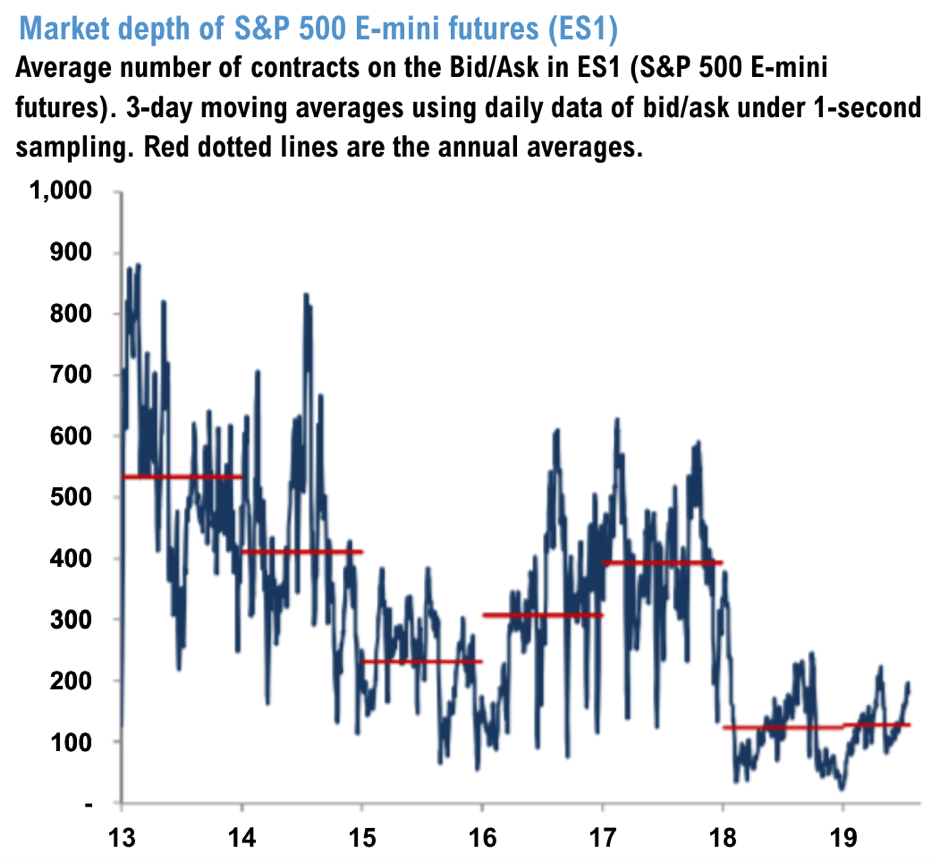

'Due to post-GFC regulations, big banks have dramatically pared back their market-making capabilities. Instead, they now act like brokers, employing high-frequency algorithmic techniques to match supply to demand. Along with authorized participants - the liquidity providers for ETFs (see WILTW December 6, 2018) - it's unclear whether modern market makers will provide the liquidity necessary to stabilize markets in the event of a crisis. The abundant liquidity provided by QE has delayed a test of this system for almost a decade.'

'If volatility continues to escalate, that test may soon come. Market depth appears to be sitting near historic lows - as measured by the volume of orders on the bid and ask sides for the S&P 500 E-mini futures contract (see chart below). The market is already walking a liquidity tightrope. And as The Daily Dirtnap's Jared Dillian has pointed out: "There is an axiom in markets: volatility and liquidity are inversely correlated."'

Source: J.P. Morgan

While virtually all our underperformance in the past year can be traced back to our lack of exposure to Australia's largest 20 stocks, these charts suggest our contrarian approach will eventually be rewarded.

What we don't know is whether the great unwinding of momentum and algorithmic funds will be like a volcanic reaction, likely the result of a recession or higher interest rate expectations. Or, alternatively, an elongated period of underperformance as price-to-earnings ratios slowly deflate in spite of solid operating results.

This would be synonymous with the experience of tech titans like Microsoft, whose share price took 17 years to regain its high from March 2000 despite earnings per share increasing four-fold over the same period.

Key results

Link Administration's share price had fallen 40% from a peak of nearly $8 in May due to regulatory changes, problems associated with its $1.5bn UK acquisition two years ago and increasing scepticism about the time it's taken to resign key Australian superannuation clients.

Costs to deal with Australian regulatory issues have remained stubbornly high, but they should subside in a year or so when the company should've also upgraded old IT systems in the UK. The company also finally agreed terms with REST superannuation recently, which means it has resigned two of its four major Australian superannuation clients that produced half the company's profits when it listed in 2015. The proportion has roughly halved since the large UK acquisition, but the contracts are still very important to Link's profitability.

Pricing power in Link's financial administration businesses, such as share registry management, is constantly falling and growth is slow. That means management must continue making tuck-in acquisitions to keep lowering costs.

Link will suffer when corporate and market activity slows. But longer term, Link should benefit from increased outsourcing and opportunities such as the UK pension system switching to Australia's system or favouring defined contribution schemes over defined benefit schemes.

Link currently trades on a forecast price-to-earnings ratio of just 11 after adjusting for its 44% stake in property settlement company PEXA. That leaves plenty of room for a higher valuation should management return the business to growth in 2021 and beyond.

Smartgroup

The recent increase in Smartgroup's share price suggests it reported a scintillating annual result. More truthfully, it reflects fading fears of a large fall in earnings due to lower new car sales.

Smartgroup chief executive Deven Billimoria has made an art form out of acquisitions, but his large anchor of past success will drag on future returns. Still, with the stock trading on a forecast PER of 18 and a 4% fully franked dividend yield, and with a chief that still has skin in the game despite selling a quarter of his shareholding last year, we hope to be long-term shareholders.

See here for more information on the Intelligent Investor Equity Income Portfolio, or you can invest directly on the ASX using the code INIF.